Energy

Ottawa’s emissions cap—all pain, no gain

From the Fraser Institute

By: Julio Mejía, Elmira Aliakbari and Tegan Hill

According to a recent analysis by the Conference Board of Canada think-tank, the cap could reduce Canada’s GDP by up to $1 trillion between 2030 and 2040, eliminate up to 151,000 jobs by 2030, reduce federal government revenue by up to $151 billion between 2030 and 2040, and reduce Alberta government revenue by up to $127 billion over the same period.

According to an announcements last week by Premier Danielle Smith, the Alberta government will use the Alberta Sovereignty within a United Canada Act to challenge Ottawa’s proposal to cap greenhouse gas emissions from the oil and gas sector at 35 per cent below 2019 levels by 2030.

Premier Smith, who said the cap will harm the economy and represents an overstep of federal authority, also plans to prevent emissions data from individual oil and gas companies from being shared with Ottawa. While the federal government said the cap is necessary to fight climate change, several studies suggest the cap will impose significant costs on Canadians without yielding detectable environmental benefits.

According to a recent report by Deloitte, a leading audit and consulting firm, the cap will force Canadian firms to curtail oil production by 626,000 barrels per day by 2030 or by approximately 10.0 per cent of the expected production—and curtail gas production by approximately 12.0 per cent.

Deloitte estimates that Alberta will be hit hardest, with 3.6 per cent less investment, almost 70,000 fewer jobs, and a 4.5 per cent decrease in the province’s economic output (i.e. GDP) by 2040. Ontario will lose 15,000 jobs and $2.3 billion from its economy by 2040. And Quebec will lose more than 3,000 jobs and $0.4 billion from its economy during the same period.

Overall, the country will experience an economic loss equivalent to 1.0 per cent of the value of the entire economy (GDP), translating into lower wages, the loss of nearly 113,000 jobs and a 1.3 per cent reduction in government tax revenues. Canada’s inflation-adjusted GDP growth in 2023 was a paltry 1.3 per cent, so a 1 per cent reduction would be a significant economic loss.

Deloitte’s findings echo previous studies. According to a recent analysis by the Conference Board of Canada think-tank, the cap could reduce Canada’s GDP by up to $1 trillion between 2030 and 2040, eliminate up to 151,000 jobs by 2030, reduce federal government revenue by up to $151 billion between 2030 and 2040, and reduce Alberta government revenue by up to $127 billion over the same period.

Similarly, another recent study published by the Fraser Institute found that the cap would reduce production and exports, leading to at least $45 billion in lost economic activity in 2030 alone, accompanied by a substantial drop in government revenue.

Crucially, these huge economic costs to Canadians will come without any discernable environmental benefits. Even if Canada entirely shut down its oil and gas industry by 2030, eliminating all GHG emissions from the sector, the resulting reduction in global GHG emissions would amount to a mere four-tenths of one per cent with virtually no impact on the climate or any detectable environmental, health or safety benefits.

Given the demand for fossil fuels, constraining oil and gas production and exports in Canada would likely merely shift production to other countries with lower environmental and human rights standards such as Iran, Russia and Venezuela. Consequently, global GHG emissions would increase, not decrease. No other major oil and gas-producing country has imposed a similar cap on its leading export sector.

The Trudeau government’s proposed cap, which still must pass the House and Senate, would further strain an already struggling Canadian economy, and to make matters worse, do virtually nothing to improve the environment. The government should cancel the cap plan given the economic costs and nonexistent environmental benefits.

Julio Mejía

Policy Analyst

Elmira Aliakbari

Director, Natural Resource Studies, Fraser Institute

Tegan Hill

Director, Alberta Policy, Fraser Institute

Automotive

Politicians should be honest about environmental pros and cons of electric vehicles

From the Fraser Institute

By Annika Segelhorst and Elmira Aliakbari

According to Steven Guilbeault, former environment minister under Justin Trudeau and former member of Prime Minister Carney’s cabinet, “Switching to an electric vehicle is one of the most impactful things Canadians can do to help fight climate change.”

And the Carney government has only paused Trudeau’s electric vehicle (EV) sales mandate to conduct a “review” of the policy, despite industry pressure to scrap the policy altogether.

So clearly, according to policymakers in Ottawa, EVs are essentially “zero emission” and thus good for environment.

But is that true?

Clearly, EVs have some environmental advantages over traditional gasoline-powered vehicles. Unlike cars with engines that directly burn fossil fuels, EVs do not produce tailpipe emissions of pollutants such as nitrogen dioxide and carbon monoxide, and do not release greenhouse gases (GHGs) such as carbon dioxide. These benefits are real. But when you consider the entire lifecycle of an EV, the picture becomes much more complicated.

Unlike traditional gasoline-powered vehicles, battery-powered EVs and plug-in hybrids generate most of their GHG emissions before the vehicles roll off the assembly line. Compared with conventional gas-powered cars, EVs typically require more fossil fuel energy to manufacture, largely because to produce EVs batteries, producers require a variety of mined materials including cobalt, graphite, lithium, manganese and nickel, which all take lots of energy to extract and process. Once these raw materials are mined, processed and transported across often vast distances to manufacturing sites, they must be assembled into battery packs. Consequently, the manufacturing process of an EV—from the initial mining of materials to final assembly—produces twice the quantity of GHGs (on average) as the manufacturing process for a comparable gas-powered car.

Once an EV is on the road, its carbon footprint depends on how the electricity used to charge its battery is generated. According to a report from the Canada Energy Regulator (the federal agency responsible for overseeing oil, gas and electric utilities), in British Columbia, Manitoba, Quebec and Ontario, electricity is largely produced from low- or even zero-carbon sources such as hydro, so EVs in these provinces have a low level of “indirect” emissions.

However, in other provinces—particularly Alberta, Saskatchewan and Nova Scotia—electricity generation is more heavily reliant on fossil fuels such as coal and natural gas, so EVs produce much higher indirect emissions. And according to research from the University of Toronto, in coal-dependent U.S. states such as West Virginia, an EV can emit about 6 per cent more GHG emissions over its entire lifetime—from initial mining, manufacturing and charging to eventual disposal—than a gas-powered vehicle of the same size. This means that in regions with especially coal-dependent energy grids, EVs could impose more climate costs than benefits. Put simply, for an EV to help meaningfully reduce emissions while on the road, its electricity must come from low-carbon electricity sources—something that does not happen in certain areas of Canada and the United States.

Finally, even after an EV is off the road, it continues to produce emissions, mainly because of the battery. EV batteries contain components that are energy-intensive to extract but also notoriously challenging to recycle. While EV battery recycling technologies are still emerging, approximately 5 per cent of lithium-ion batteries, which are commonly used in EVs, are actually recycled worldwide. This means that most new EVs feature batteries with no recycled components—further weakening the environmental benefit of EVs.

So what’s the final analysis? The technology continues to evolve and therefore the calculations will continue to change. But right now, while electric vehicles clearly help reduce tailpipe emissions, they’re not necessarily “zero emission” vehicles. And after you consider the full lifecycle—manufacturing, charging, scrapping—a more accurate picture of their environmental impact comes into view.

Alberta

The case for expanding Canada’s energy exports

From the Canadian Energy Centre

For Canada, the path to a stronger economy — and stronger global influence — runs through energy.

That’s the view of David Detomasi, a professor at the Smith School of Business at Queen’s University.

Detomasi, author of Profits and Power: Navigating the Politics and Geopolitics of Oil, argues that there is a moral case for developing Canada’s energy, both for Canadians and the world.

CEC: What does being an energy superpower mean to you?

DD: It means Canada is strong enough to affect the system as a whole by its choices.

There is something really valuable about Canada’s — and Alberta’s — way of producing carbon energy that goes beyond just the monetary rewards.

CEC: You talk about the moral case for developing Canada’s energy. What do you mean?

DD: I think the default assumption in public rhetoric is that the environmental movement is the only voice speaking for the moral betterment of the world. That needs to be challenged.

That public rhetoric is that the act of cultivating a powerful, effective economic engine is somehow wrong or bad, and that efforts to create wealth are somehow morally tainted.

I think that’s dead wrong. Economic growth is morally good, and we should foster it.

Economic growth generates money, and you can’t do anything you want to do in social expenditures without that engine.

Economic growth is critical to doing all the other things we want to do as Canadians, like having a publicly funded health care system or providing transfer payments to less well-off provinces.

Over the last 10 years, many people in Canada came to equate moral leadership with getting off of oil and gas as quickly as possible. I think that is a mistake, and far too narrow.

Instead, I think moral leadership means you play that game, you play it well, and you do it in our interest, in the Canadian way.

We need a solid base of economic prosperity in this country first, and then we can help others.

CEC: Why is it important to expand Canada’s energy trade?

DD: Canada is, and has always been, a trading nation, because we’ve got a lot of geography and not that many people.

If we don’t trade what we have with the outside world, we aren’t going to be able to develop economically, because we don’t have the internal size and capacity.

Historically, most of that trade has been with the United States. Geography and history mean it will always be our primary trade partner.

But the United States clearly can be an unreliable partner. Free and open trade matters more to Canada than it does to the U.S. Indeed, a big chunk of the American people is skeptical of participating in a global trading system.

As the United States perhaps withdraws from the international trading and investment system, there’s room for Canada to reinforce it in places where we can use our resource advantages to build new, stronger relationships.

One of these is Europe, which still imports a lot of gas. We can also build positive relationships with the enormous emerging markets of China and India, both of whom want and will need enormous supplies of energy for many decades.

I would like to be able to offer partners the alternative option of buying Canadian energy so that they are less reliant on, say, Iranian or Russian energy.

Canada can also maybe eventually help the two billion people in the world currently without energy access.

CEC: What benefits could Canadians gain by becoming an energy superpower?

DD: The first and primary responsibility of our federal government is to look after Canada. At the end of the day, the goal is to improve Canada’s welfare and enhance its sovereignty.

More carbon energy development helps Canada. We have massive debt, an investment crisis and productivity problems that we’ve been talking about forever. Economic and job growth are weak.

Solving these will require profitable and productive industries. We don’t have so many economic strengths in this country that we can voluntarily ignore or constrain one of our biggest industries.

The economic benefits pay for things that make you stronger as a country.

They make you more resilient on the social welfare front and make increasing defence expenditures, which we sorely need, more affordable. It allows us to manage the debt that we’re running up, and supports deals for Canada’s Indigenous peoples.

CEC: Are there specific projects that you advocate for to make Canada an energy superpower?

DD: Canada’s energy needs egress, and getting it out to places other than the United States. That means more transport and port facilities to Canada’s coasts.

We also need domestic energy transport networks. People don’t know this, but a big chunk of Ontario’s oil supply runs through Michigan, posing a latent security risk to Ontario’s energy security.

We need to change the perception that pipelines are evil. There’s a spiderweb of them across the globe, and more are being built.

Building pipelines here, with Canadian technology and know-how, builds our competitiveness and enhances our sovereignty.

Economic growth enhances sovereignty and provides the resources to do other things. We should applaud and encourage it, and the carbon energy sector can lead the way.

-

espionage2 days ago

espionage2 days agoWestern Campuses Help Build China’s Digital Dragnet With U.S. Tax Funds, Study Warns

-

Focal Points2 days ago

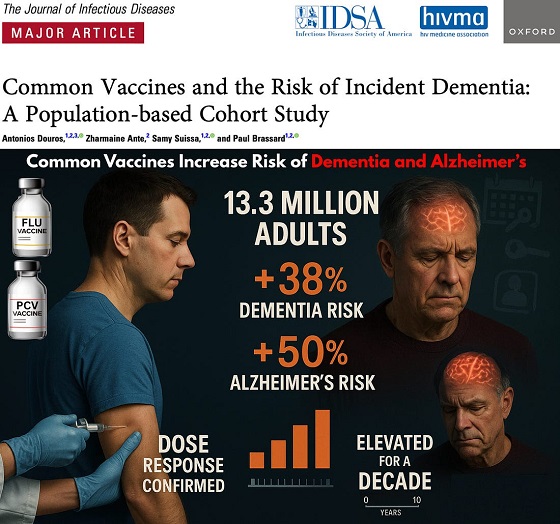

Focal Points2 days agoCommon Vaccines Linked to 38-50% Increased Risk of Dementia and Alzheimer’s

-

Automotive1 day ago

Automotive1 day agoThe $50 Billion Question: EVs Never Delivered What Ottawa Promised

-

Business2 days ago

Business2 days agoCanada invests $34 million in Chinese drones now considered to be ‘high security risks’

-

Alberta13 hours ago

Alberta13 hours agoAlberta introducing three “all-season resort areas” to provide more summer activities in Alberta’s mountain parks

-

Economy2 days ago

Economy2 days agoAffordable housing out of reach everywhere in Canada

-

Business22 hours ago

Business22 hours agoStorm clouds of uncertainty as BC courts deal another blow to industry and investment

-

Health1 day ago

Health1 day agoThe Data That Doesn’t Exist