Fraser Institute

Ottawa touts wait lists for dysfunctional child-care program

From the Fraser Institute

By Matthew Lau

Ahead of its April 16 budget release, the Trudeau government effectively admitted its national child-care program, which it began implementing in 2021, has created widespread shortages. “We’re seeing wait lists increase across the country,” said Jenna Sudds, federal minister in charge of child care.

The government has tried to cast the shortages as the result of skyrocketing demand for a popular federal program. But when government makes billions of dollars in subsidies available, of course there will be massive demand among people wanting to get their hands on the cash. That doesn’t mean the program is a success; it means the government is wrecking a market by throwing supply and demand out of whack.

Vancouver has a shortfall of about 15,000 child-care spaces for children up to age 12. In Niagara Region, the wait list for toddlers and preschoolers has expanded by 227 per cent in just the past two years. Clearly, the child-care sector has been thrown into disorder.

But if shortages illustrate a government program’s benefits, then the average 44-week wait time to get orthopedic surgery in Canada is evidence of the success of government health care. Our health-care system must be great—look how many people are lining up for it!

To try to mitigate the shortages, the Trudeau government announced $1 billion in low-interest loans and $60 million in non-repayable grants to expand and renovate child-care spaces. Additional money will be spent in the form of student loan forgiveness and training for workers in the sector. Both the shortages and new spending confirm what skeptics of national government daycare predicted from the outset—the original budget of $30 billion over five years, then $9.2 billion annually after that, underestimated what taxpayers would eventually shell out.

The new spending also exacerbates two government-created problems in child care. The first is that the $1 billion in loans and $60 million in grants are available only to public and non-profit providers. So excluded from the program are parents who want to take care of children at home, children who are cared for by grandparents or other relatives, and private for-profit providers. Instead of getting child-care help, they’ll foot the tax bill to pay for the government-preferred forms of child care.

The discrimination against private for-profit providers is a clear problem with the existing federal child-care strategy. “Frankly, Canada’s national daycare system excludes many more Canadians than it includes,” Cardus researcher Andrea Mrozek wrote last year. In Nova Scotia, where the federal government wants to move “to a fully not-for-profit and publicly managed system,” even provincial Liberal Leader Zach Churchill has lamented the exclusion of the private sector.

The second problem made worse is the spending is done increasingly through different streams and programs, diverting money towards administrative and bureaucratic bloat instead of actual child care. Based on a municipal memo back in 2022, it’s already estimated Peel Region in Ontario needs 40 additional bureaucrats to deal with child care. In British Columbia, the City of Cranbrook recently issued a 26-page request for proposals for consultants to prepare grant applications to the provincial government for child-care funds.

The ever-increasing government budget for child care, apparently, is great for the government sector and consultants hired to help move government money around. It’s a disaster, however, for parents who cannot find child care and taxpayers who pay billions for shortages—a reality unchanged by the Trudeau government’s latest announcement.

Author:

Business

Here’s what pundits and analysts get wrong about the Carney government’s first budget

From the Fraser Institute

By Jason Clemens and Jake Fuss

Under the new budget plan, this wedge between what the government collects in revenues versus what is actually spent on programs will rise to 13.0 per cent by 2029/30. Put differently, slightly more than one in every eight dollars sent to Ottawa will be used to pay interest on debt for past spending.

The Carney government’s much-anticipated first budget landed on Nov. 4. There’s been much discussion by pundits and analysts on the increase in the deficit and borrowing, the emphasis on infrastructure spending (broadly defined), and the continued activist approach of Ottawa. There are, however, several critically important aspects of the budget that are consistently being misstated or misinterpreted, which makes it harder for average Canadians to fully appreciate the consequences and costs of the budget.

One issue in need of greater clarity is the cost of Canada’s indebtedness. Like regular Canadians and businesses, the government must pay interest on federal debt. According to the budget plan, total federal debt will reach an expected $2.9 trillion in 2029/30. For reference, total federal debt stood at $1.0 trillion when the Trudeau government took office in 2015. The interest costs on that debt will rise from $53.4 billion last year to an expected $76.1 billion by 2029/30. Several analyses have noted this means federal interest costs will rise from 1.7 per cent of GDP to 2.1 per cent.

These are all worrying statistics about the indebtedness of the federal government. However, they ignore a key statistic—interest costs as a share of revenues. When the Trudeau government took office, interest costs consumed 7.5 per cent of revenues. This means taxpayers were foregoing 7.5 per cent of the resources they sent to Ottawa (in terms of spending on actual programs) because these monies were used to pay interest on debt accumulated from previous spending.

Under the new budget plan, this wedge between what the government collects in revenues versus what is actually spent on programs will rise to 13.0 per cent by 2029/30. Put differently, slightly more than one in every eight dollars sent to Ottawa will be used to pay interest on debt for past spending. This is one way governments get into financial problems, even crises, by continually increasing the share of revenues consumed by interest payments.

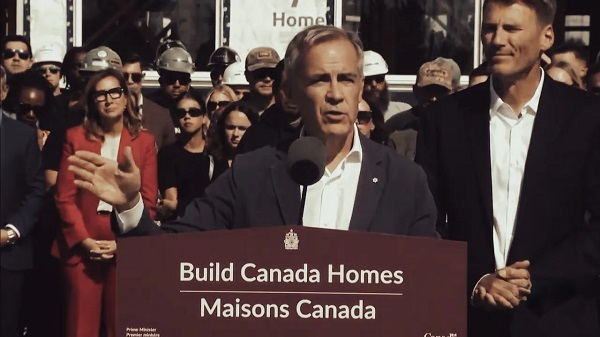

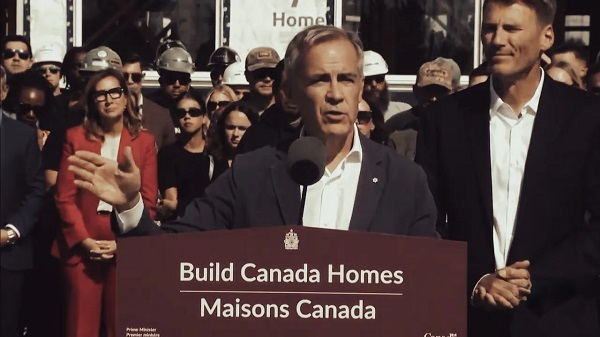

A second and fairly consistently misrepresented aspect of the budget pertains to large spending initiatives such as Build Canada Homes and Build Communities Strong Fund. The former is meant to increase the number of new homes, particularly affordable homes, being built annually and the latter is intended to provide funding to provincial governments (and through them, municipalities) for infrastructure spending. But few analysts question whether or not these programs will produce actual new spending for homebuilding or simply replace or “crowd-out” existing spending by the private sector.

Let’s first explore the homebuilding initiative. At any point in time, there are a limited number of skilled workers, raw materials, land, etc. available for homebuilding. When the federal government, or any government, initiates its own homebuilding program, it directly competes with private companies for that skilled labour (carpenters, electricians, etc.), raw materials (timber, concrete, etc.) and the land needed for development. Put simply, government homebuilding crowds out private-sector activity.

Moreover, there’s a strong argument that the crowding out by government results in less homebuilding than would otherwise be the case, because the incentives for private-sector homebuilding are dramatically different than government incentives. For example, private firms risk their own wealth and wellbeing (and the wellbeing of their employees) so they have very strong incentives to deliver homes demanded by people on time and at a reasonable price. Government bureaucrats and politicians, on the other hand, face no such incentives. They pay no price, in terms of personal wealth or wellbeing if homes, are late, not what consumers demand, or even produce less than expected. Put simply, homebuilding by Ottawa could easily result in less homes being built than if government had stayed out of the way of entrepreneurs, businessowners and developers.

Similarly, it’s debatable that infrastructure spending by Ottawa—specifically, providing funds to the provinces and municipalities—results in an actual increase in total infrastructure spending. There are numerous historical examples, including reports by the auditor general, detailing how similar infrastructure spending initiatives by the federal government were plagued by mismanagement. And in many circumstances, the provinces simply reduced their own infrastructure spending to save money, such that the actual incremental increase in overall infrastructure spending was negligible.

In reality, some of the major and large spending initiatives announced or expanded in the Carney government’s first budget, which will accelerate the deterioration of federal finances, may not deliver anything close to what the government suggests. Canadians should understand the real risks and challenges in these federal spending initiatives, along with the debt being accumulated, and the limited potential benefits.

Business

Carney budget continues misguided ‘Build Canada Homes’ approach

From the Fraser Institute

By Jake Fuss and Austin Thompson

The Carney government’s first budget tabled on Tuesday promises to “supercharge” homebuilding across the country. But Ottawa’s flagship housing initiative—a new federal agency, Build Canada Homes (BCH)—risks “supercharging” federal debt instead while doing little to boost construction.

The budget accurately diagnoses the root cause of Canada’s housing shortage—costly red tape on housing projects, sky-high taxes on homebuilders, and weak productivity growth in the construction sector. But the proposed cure, BCH, does nothing to fix these problems despite receiving a five-year budget of $13 billion.

BCH’s core mandate is to build and finance affordable housing projects. But this mission is muddled by competing political priorities to preference Canadian building materials and prioritize “sustainable” construction materials. Any product that needs a government preference to be used is clearly not the most cost-effective option. The result—BCH’s “affordable” homes will cost more than they needed to, meaning more tax dollars wasted.

Ottawa claims BCH will improve construction productivity by “generating demand” (read: splashing out tax dollars) for factory-built housing. This logic is faulty—where factory-built housing is a cost-effective and desirable option, private developers are already building it. “Prioritizing” factory-built homes amounts to Ottawa trying to pick winners and losers—a strategy that reliably wastes taxpayer dollars. The civil servants running BCH lack the market knowledge and cost-cutting incentives of private homebuilders, who are far better positioned to identify which technologies will deliver the affordable homes Canadians need.

The government also insists BCH projects will attract more private investment for housing. The opposite is more likely—BCH projects will compete with private developers for limited investment dollars and construction labour. Ottawa’s intrusion into housing development could ultimately mean fewer private-sector housing projects—those driven by the real needs of homebuyers and renters, not the Carney government’s political priorities.

Despite its huge budget and broad mandate, BCH still lacks clear goals. Its only commitment so far is to “build affordable housing at scale,” with no concrete targets for how many new homes or how affordable they’ll be. Without measurable outcomes, neither Ottawa nor taxpayers will know whether BCH delivers value for money.

You can’t solve Canada’s housing crisis with yet another federal program. Ottawa should resist the temptation to act as a housing developer and instead create fiscal and economic conditions that allow the private sector to build more homes.

-

COVID-192 days ago

COVID-192 days agoFreedom Convoy leader Tamara Lich to appeal her recent conviction

-

Justice2 days ago

Justice2 days agoCarney government lets Supreme Court decision stand despite outrage over child porn ruling

-

espionage1 day ago

espionage1 day agoU.S. Charges Three More Chinese Scholars in Wuhan Bio-Smuggling Case, Citing Pattern of Foreign Exploitation in American Research Labs

-

Business2 days ago

Business2 days agoCarney’s budget spares tax status of Canadian churches, pro-life groups after backlash

-

Daily Caller2 days ago

Daily Caller2 days agoUN Chief Rages Against Dying Of Climate Alarm Light

-

Business23 hours ago

Business23 hours agoCarney budget doubles down on Trudeau-era policies

-

COVID-1923 hours ago

COVID-1923 hours agoCrown still working to put Lich and Barber in jail

-

Business23 hours ago

Business23 hours agoCarney budget continues misguided ‘Build Canada Homes’ approach