Economy

Ottawa should scrap its oil and gas emissions cap plan

From the Fraser Institute

By Elmira Aliakbari and Julio Mejía

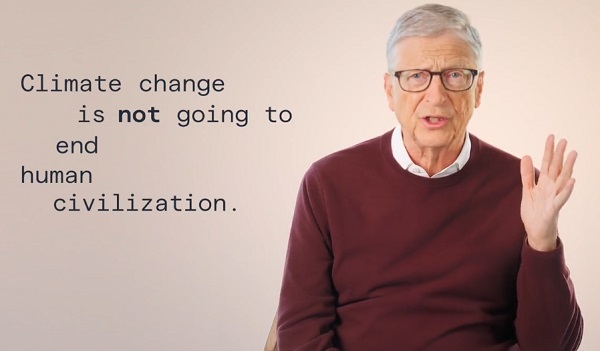

Ottawa’s proposed GHG cap, which solely targets the oil and gas industry while exempting the remaining 73.4 per cent of the country’s GHG emissions, lacks a scientific rationale.

Once again, Alberta is at odds with the federal government, this time over proposed regulations, which would impose a cap on greenhouse gas (GHG) emissions in the oil and gas sector, with the goal of reducing emissions by 35 to 38 per cent by 2030 (relative to 2019 levels).

The Smith government fiercely opposes these regulations and recently submitted formal feedback to Ottawa. While the federal government says these regulations are necessary to combat climate change, in the reality they will impose significant costs on Canadians without yielding detectable environmental benefits.

Firstly, it’s a universally accepted fact that a unit of carbon dioxide has the same atmospheric effect regardless of its source, be it from an oilsands mine in Alberta, a manufacturer in Quebec or a steel mill in Ontario. CO2 is CO2 is CO2. Therefore, Ottawa’s proposed GHG cap, which solely targets the oil and gas industry while exempting the remaining 73.4 per cent of the country’s GHG emissions, lacks a scientific rationale.

Moreover, Canada already has a national carbon tax aimed at reducing GHG emissions. Stacking a GHG cap on top of the carbon tax contradicts the rationale for a carbon tax and would likely result in emissions reduction at a very high cost. According to a recent economic analysis by the Conference Board of Canada, the cap could reduce Canada’s economy (i.e. GDP) by up to $1 trillion between 2030 and 2040, eliminate up to 151,000 jobs by 2030, reduce federal government revenue by up to $151 billion between 2030 and 2040, and reduce Alberta government revenue by up to $127 billion over the same period.

These new findings echo earlier studies, which show the proposed cap’s large costs and little benefits. For instance, a recent study found that an emissions cap on the oil and gas sector would inevitably reduce production and exports, leading to at least $45 billion in lost economic activity in 2030 alone, accompanied by a substantial drop in government revenue.

Again, these large economic costs come with almost no discernible environmental benefit. Even if Canada were to entirely shut down its oil and gas sector by 2030, thus eliminating all GHG emissions from the sector, the resulting reduction in global GHG emissions would amount to a mere four-tenths of one per cent (i.e. 0.004 per cent) with virtually no impact on the climate or any detectable environmental, health or safety benefits.

Meanwhile, every credible forecast of world energy consumption indicates that oil and gas will continue to dominate the global energy supply mix for decades. Given the sustained demand for fossil fuels, constraining oil and gas production and exports in Canada would merely shift production to other regions, potentially to countries with lower environmental and human rights standards such as Iran, Russia and Venezuela.

Clearly, this is an opportunity for Canada, which possesses abundant reserves of natural gas (a cleaner alternative to coal), to play a pivotal role in reducing global GHG emissions. Countries such as China, which is grappling with rising energy demands, are eager to reduce their heavy reliance on coal. And several countries including Germany want to diversify away from Russian gas for geopolitical and energy security reasons. By expanding our natural gas resources, Canada could unleash significant economic activity (jobs, revenue, etc.) while reducing global GHG emissions and improving global energy security.

The Trudeau government will likely publish a draft version of the regulations, which will include the cap, sometime in the next few months. The cap plan lacks any scientific, economic or environmental rationale so the government should scrap the cap for the benefit of Canadians and the world.

Authors:

Business

Trump’s Tariffs Have Not Caused Economy To Collapse

From the Daily Caller News Foundation

By Mark Simon

The APEC Summit in Korea last week marked a pivotal moment for U.S. trade policy, delivering tangible wins for American interests. Solid deals were struck with South Korea, while the U.S. and China de-escalated their long-simmering trade war—a clear positive for President Trump. In the chaotic world of Donald Trump, such normalcy disappointed the news media and foreign policy pundits, who grumbled that the event lacked the drama of a disaster.

Yet, as Trump departed Busan, a deeper transformation unfolded, largely overlooked by observers. In just two days, President Trump orchestrated the most significant shift in U.S. trade strategy since China’s 2001 entry into the World Trade Organization (WTO).

The real triumph? Widespread acceptance by Asian trading partners of U.S. tariffs as a cornerstone of a reimagined American economic model. This acceptance dismantles nearly a century of unwavering belief in low tariffs as the unassailable path to global prosperity.

Trump’s tariff approach disrupts the post-World War II global trading system, particularly the U.S.-championed free-trade orthodoxy embraced by both parties for over 50 years. By wielding tariffs effectively, Trump challenges the free-market gospel enshrined in the WTO and echoed by World Economic Forum elites and corporate-sponsored Washington think tanks like AEI and CATO, which decry tariffs as heresy.

At APEC, there was no fiery backlash—only quiet nods to moderate tariffs as fixtures in the evolving economic order. Leaders from across the Asia-Pacific assessed the tariffs’ impacts and moved forward without spectacle, signaling a pragmatic pivot toward Trump’s view of international commerce.

Historically, tariff reductions in Asia stemmed from U.S. pressure to open markets. Mercantilist instincts run deep in most Asian governments—except in freewheeling Hong Kong and Singapore. These nations, built on exports inside protected markets, grasp how tariffs can revitalize U.S. manufacturing and bolster federal revenue. Unlike America’s one-sided openness to Asian imports, Trump’s reciprocity feels like overdue fairness.

As a former free-market purist who once decried tariffs, I initially missed their nuance in Trump’s arsenal. Tariffs impose costs, but the genius lies in offsetting them strategically. Trump’s aggressive deregulation, sweeping tax reforms, and drive for rock-bottom domestic energy prices mitigate burdens and generate a net economic surge—one that Asian leaders implicitly endorsed.

This “internal free-market trio” forms the bedrock of the new U.S. paradigm: moderate tariffs generate revenue and incentivize factory repatriation; deregulation slashes red tape; tax cuts keep capital flowing competitively; and abundant, cheap energy undercuts foreign advantages.

Together, they magnetize global investment, upending a century of free-trade dogma. Energy dominance is key. Through promotion of domestic oil, gas, and renewables, Trump has driven U.S. energy costs 30–50% below those in Europe or much of Asia. For capital-intensive sectors like steel, semiconductors, and electric vehicles, this is structural superiority, not subsidy. Layer on the 2017 Tax Cuts and Jobs Act—slashing the corporate rate to 21% and allowing immediate capital expensing—and the math tilts toward U.S. production. Tariffs may raise import prices by 20–30%, but deregulation accelerates cost-cutting, while energy savings absorb part of the hit.

Critics claim tariffs ravaged the economy post-2018, but COVID-19, not tariffs, triggered the downturn. Trump’s initial round was a successful pilot, extended by Biden—yet without Trump’s deregulation and energy surge, the tariffs became un-offset weight. Blanket cost hikes under Biden stifled growth; Trump’s selective offsets ensure expansion.

America’s edge sharpens as rivals falter. Europe, shackled by leftist policies, environmental mandates, and the Ukraine quagmire, hemorrhages capital to the U.S. In North Asia—China, Korea, Japan, Taiwan—demographic headwinds make investments unappealing compared to North America’s burgeoning market. Aging populations and shrinking workforces amplify this disparity.

APEC underscored America as a vibrant, tariff-protected haven primed for onshoring. Amid Asia’s labor crunch, nations view the U.S. as an investment beacon, mirroring Japan’s model: a high-value exporter offloading low-end manufacturing while retaining competitiveness. Summit chatter revealed minimal tariff gripes. China voiced tepid concerns over escalations, but these seemed rhetorical—testing boundaries rather than igniting conflict.

To free-trade zealots, Trump’s heresy is demolishing sacred economic theory. Past protectionists erred by isolating tariffs without cost-lowering measures. Trump integrates them: selective duties paired with deregulation, technological leaps, and economic decentralization beyond urban centers.

In equilibrium, tariffs harvest revenue and reclaim jobs, capitalizing on America’s fiscal and regulatory advantages. Trump’s blueprint restores balance to free trade, honoring national sovereignty while exposing borderless markets’ perils. It proves moderated protectionism can ignite growth, spur innovation, and draw capital—heralding a bolder, self-reliant American century.

Mark Simon is former group director for Next Digital, parent company for Apple Daily, the leading pro-democracy newspaper in Hong Kong until it was forced to close in 2021.

Business

Carney government should retire misleading ‘G7’ talking point on economic growth

From the Fraser Institute

By Ben Eisen and Milagros Palacios

If you use the more appropriate measure for measuring economic wellbeing and living standards—growth in per-person GDP—the happy narrative about Canada’s performance simply falls apart.

Tuesday, Nov. 4, the Carney government will table its long-awaited first budget. Don’t be surprised if it mentions Canada’s economic performance relative to peer countries in the G7.

In the past, this talking point was frequently used by prime ministers Stephen Harper and Justin Trudeau and their senior cabinet officials. And it’s apparently survived the transition to the Carney government, as the finance minister earlier this year triumphantly tweeted that Canada’s economic growth was “among the strongest in the G7.”

But here’s the problem. Canada’s rate of economic growth relative to the rest of the G7 is almost completely irrelevant as an indicator of economic strength because it’s heavily influenced by Canada’s much faster rate of population growth. In other words, Canada’s faster pace of overall economic growth (measured by GDP) compared to most other developed countries has not been due to Canadians becoming more productive and generating more income for their families, but rather primarily because there are more people in Canada working and producing things.

In reality, if you use the more appropriate measure for measuring economic wellbeing and living standards—growth in per-person GDP—the happy narrative about Canada’s performance simply falls apart.

According to a recent study published by the Fraser Institute, if you simply look at total economic growth in the G7 in recent years (2020-24) without reference to population, Canada does indeed look good. Canada’s economy has had the second-most total economic growth in the G7 behind only the United States.

However, if you make a simple adjustment for differences in population change over this same time, a completely different picture emerges. Canada’s per-person GDP actually declined by 2 per cent from 2020 to 2024. This is the worst five-year decline since the Great Depression nearly a century ago. And on this much more important measure of wellbeing, Canada goes from second in the G7 to dead last.

Due to Canada’s rapid population growth in recent years, fuelled by record-high levels of immigration, aggregate GDP growth is quite simply a misleading economic indicator for comparing our performance to other countries that aren’t experiencing similar increases in the size of their labour markets. As such, it’s long past time for politicians to retire misleading talking points about Canada’s “strong” growth performance in the G7.

After making a simple adjustment to account for Canada’s rapidly growing population, it becomes clear that the government has nothing to brag about. In fact, Canada is a growth laggard and has been for a long time, with living standards that have actually declined appreciably over the last half-decade.

-

Business2 days ago

Business2 days agoTrans Mountain executive says it’s time to fix the system, expand access, and think like a nation builder

-

International2 days ago

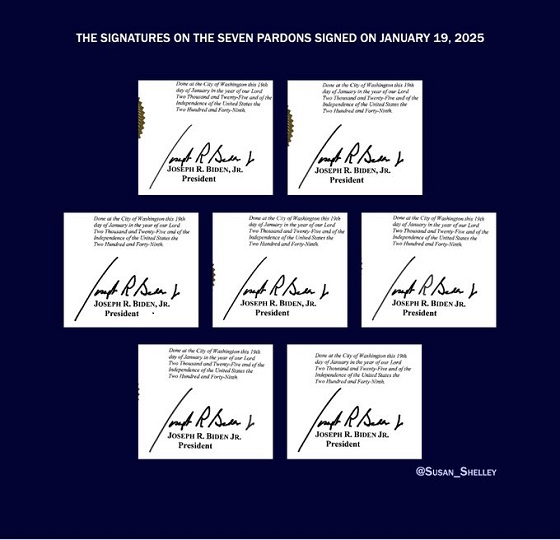

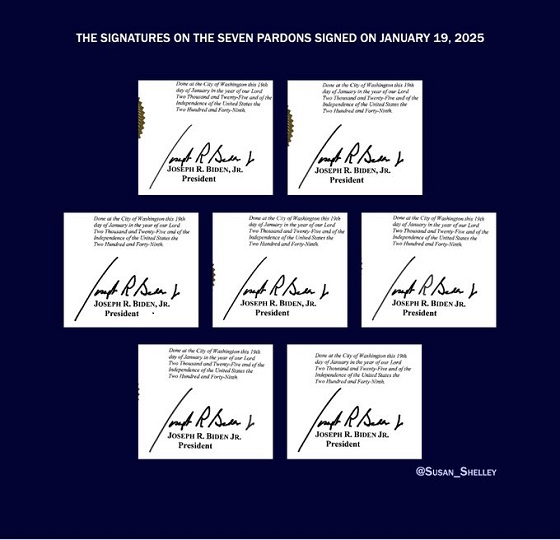

International2 days agoBiden’s Autopen Orders declared “null and void”

-

MAiD2 days ago

MAiD2 days agoStudy promotes liver transplants from Canadian euthanasia victims

-

Business2 days ago

Business2 days agoCanada’s combative trade tactics are backfiring

-

Business2 days ago

Business2 days agoCanada has given $109 million to Communist China for ‘sustainable development’ since 2015

-

Business2 days ago

Business2 days agoYou Won’t Believe What Canada’s Embassy in Brazil Has Been Up To

-

Crime1 day ago

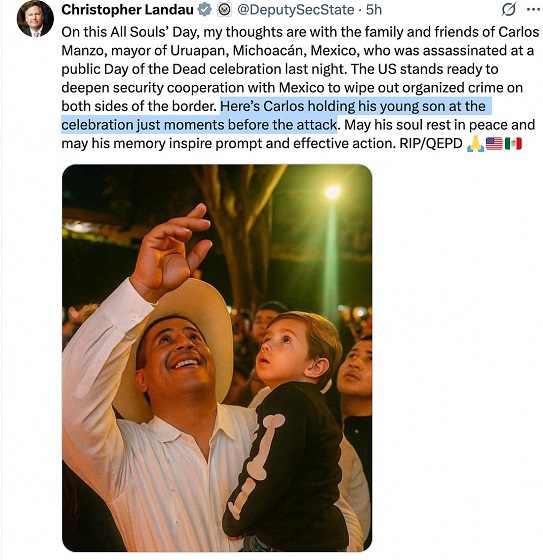

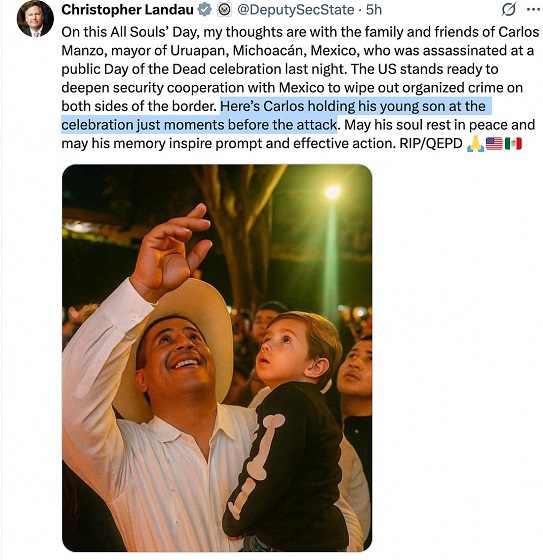

Crime1 day agoPublic Execution of Anti-Cartel Mayor in Michoacán Prompts U.S. Offer to Intervene Against Cartels

-

Automotive2 days ago

Automotive2 days agoCarney’s Budget Risks Another Costly EV Bet