Business

North Carolina-headquartered Barings named in Climate Action 100+ probe

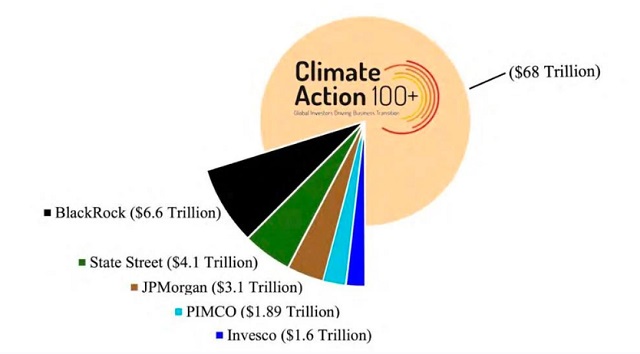

The Judiciary Committee of the U.S. House of Representatives, in a report, says its probe has led to a loss of $17 trillion worth of assets under management by the Climate Action 100+. That includes $6.6 trillion from BlackRock, $4.1 trillion by State Street, $3.1 trillion by JPMorgan, $1.89 trillion by PIMCO, and $1.6 trillion by Invesco.

From The Center Square

By Alan Wooten

An interim report by the Judiciary – Climate Control: Exposing the Decarbonization Collusion in Environmental, Social and Governance (ESG) Investing – labels the initiative a “climate cartel,” one which is involved in collusion and has not been investigated by the Biden administration.

One North Carolina company is among more than 130 in the United States being asked by a congressional committee about involvement with environmental, social and governance initiative Climate Action 100+.

U.S. Reps. Deborah Ross and Dan Bishop, a Democrat and Republican respectively from North Carolina, are among the 42 members of the Judiciary Committee in the House of Representatives seeking answers. In addition to the letter sent to Charlotte-headquartered Barings, the probe also seeks answers on involvement by retirement systems and government pension programs.

The probe and letters dated last Tuesday to Climate Action 100+ is trying to find answers to how the companies are operating with tactics, requests and actions; and garner documentations. A noon Aug. 13 deadline is set for responses.

Antitrust law, and the possible breach of it, is cited in each letter. Antitrust laws, the Department of Justice says, “prohibit anticompetitive conduct and mergers that deprive American consumers, taxpayers, and workers of the benefits of competition.”

An interim report by the Judiciary – Climate Control: Exposing the Decarbonization Collusion in Environmental, Social and Governance (ESG) Investing – labels the initiative a “climate cartel,” one which is involved in collusion and has not been investigated by the Biden administration.

“The climate cartel has declared war on our way of life, escalating its attacks on free markets and demanding that companies slash output of the critical products and services that allow Americans to drive, fly, and eat,” the report says. “The Biden administration has failed to act upon the climate cartel’s apparent violations of longstanding U.S. antitrust law. The committee, in contrast, is actively investigating their anticompetitive behavior.”

The report says with launch of the probe came withdrawals from the effort by BlackRock, State Street and JPAM, “three of the world’s largest asset managers.” Asset managers BlackRock, State Street and Vanguard own 21.9% of shares, and vote 24.9% of the shares, within the Standard and Poor’s (S&P) 500.

More than 272,000 documents and 2.5 million pages of nonpublic information were reviewed, the Judiciary says.

Most of the letters went to addresses in New York, Massachusetts and California.

Barings, according to its website, “is a global asset management firm which seeks to deliver excess returns across public and private markets in fixed income, real assets and capital solutions.”

In general, ESG investing – an acronym used in conjunction with environmental, social, and governance policies in investments – measures company policy. These policies typically align with progressive, or left, thoughts when it comes to politics.

Other names of description are sustainability, such as treatment of natural resources, gas emissions and climate regulations. A company’s policies for profits shared in the community, and how health and safety are impacted, relates to the social aspect. Governance usually aligns not only with integrity of accountability toward shareholders, but also diversity in leadership.

Issues in a company’s industry and the principles of ESG often shape policy.

Bishop is a member of the Subcommittee on the Administrative State, Regulatory Reform, and Antitrust within the Judiciary Committee. The 26-member subcommittee is chaired by Rep. Thomas Massie, R-Ky.

Managing Editor

Artificial Intelligence

Lawsuit Claims Google Secretly Used Gemini AI to Scan Private Gmail and Chat Data

Whether the claims are true or not, privacy in Google’s universe has long been less a right than a nostalgic illusion.

|

When Google flipped a digital switch in October 2025, few users noticed anything unusual.

Gmail loaded as usual, Chat messages zipped across screens, and Meet calls continued without interruption.

Yet, according to a new class action lawsuit, something significant had changed beneath the surface.

We obtained a copy of the lawsuit for you here.

Plaintiffs claim that Google silently activated its artificial intelligence system, Gemini, across its communication platforms, turning private conversations into raw material for machine analysis.

The lawsuit, filed by Thomas Thele and Melo Porter, describes a scenario that reads like a breach of trust.

It accuses Google of enabling Gemini to “access and exploit the entire recorded history of its users’ private communications, including literally every email and attachment sent and received.”

The filing argues that the company’s conduct “violates its users’ reasonable expectations of privacy.”

Until early October, Gemini’s data processing was supposedly available only to those who opted in.

Then, the plaintiffs claim, Google “turned it on for everyone by default,” allowing the system to mine the contents of emails, attachments, and conversations across Gmail, Chat, and Meet.

The complaint points to a particular line in Google’s settings, “When you turn this setting on, you agree,” as misleading, since the feature “had already been switched on.”

This, according to the filing, represents a deliberate misdirection designed to create the illusion of consent where none existed.

There is a certain irony woven through the outrage. For all the noise about privacy, most users long ago accepted the quiet trade that powers Google’s empire.

They search, share, and store their digital lives inside Google’s ecosystem, knowing the company thrives on data.

The lawsuit may sound shocking, but for many, it simply exposes what has been implicit all along: if you live in Google’s world, privacy has already been priced into the convenience.

Thele warns that Gemini’s access could expose “financial information and records, employment information and records, religious affiliations and activities, political affiliations and activities, medical care and records, the identities of his family, friends, and other contacts, social habits and activities, eating habits, shopping habits, exercise habits, [and] the extent to which he is involved in the activities of his children.”

In other words, the system’s reach, if the allegations prove true, could extend into nearly every aspect of a user’s personal life.

The plaintiffs argue that Gemini’s analytical capabilities allow Google to “cross-reference and conduct unlimited analysis toward unmerited, improper, and monetizable insights” about users’ private relationships and behaviors.

The complaint brands the company’s actions as “deceptive and unethical,” claiming Google “surreptitiously turned on this AI tracking ‘feature’ without informing or obtaining the consent of Plaintiffs and Class Members.” Such conduct, it says, is “highly offensive” and “defies social norms.”

The case invokes a formidable set of statutes, including the California Invasion of Privacy Act, the California Computer Data Access and Fraud Act, the Stored Communications Act, and California’s constitutional right to privacy.

Google is yet to comment on the filing.

|

|

|

|

Reclaim The Net is reader-supported. Consider becoming a paid subscriber.

|

|

|

|

Business

Nearly One-Quarter of Consumer-Goods Firms Preparing to Exit Canada, Industry CEO Warns Parliament

Standing Committee on Industry and Technology hears stark testimony that rising costs and stalled investment are pushing companies out of the Canadian market.

There’s a number that should stop this country cold: twenty-three percent. That is the share of companies in one of Canada’s essential manufacturing and consumer-goods sectors now preparing to withdraw products from the Canadian market or exit entirely within the next two years. And this wasn’t whispered at a business luncheon or buried in a consultancy memo. It was delivered straight to Parliament, at the House of Commons Standing Committee on Industry and Technology, during its study on Canada’s underlying productivity gaps and capital outflow.

Michael Graydon, the CEO of Food, Health & Consumer Products of Canada, didn’t hedge or soften the message. He told MPs, “23% of our members expect to exit products from the Canadian marketplace within the next two years, because the cost of doing business here has just become unsustainable.”

Unsustainable. That’s the word he used. And when the people who actually make things in this country start using that word, you should pay attention. These aren’t fringe players or hypothetical startups. These are firms that supply the goods Canadians buy every single day, and they’re looking at their balance sheets, their regulatory burdens, the delays in getting anything approved or built, and concluding that Canada simply doesn’t work for them anymore.

What makes this more troubling is the timing. Canada’s investment levels have been falling for years, even as the United States and other competitors race ahead. Businesses aren’t reinvesting in machinery or technology at the rate they once did. They’re not modernizing their operations here. They’re putting expansion plans on hold or shifting them to jurisdictions that move faster, cost less and offer clearer rules. That’s not ideology; it’s arithmetic. If it costs more to operate here, if it takes longer to get a permit, and if supply chains back up because ports and rail lines are jammed, investors will choose the place that doesn’t make growth a bureaucratic mountain climb.

Graydon raised another point that ought to concern anyone who cares about domestic production. Canada’s agrifood sector recorded a sixty-billion-dollar trade surplus last year, one of the brightest spots in the national economy, but according to him that potential is being “diluted by fragmented interprovincial trade and logistics bottlenecks.” The ports, the rail corridors, the entire transport network—choke points everywhere. And you can’t build a productive economy on choke points. Companies can’t scale, can’t guarantee delivery, can’t justify the costs. So they leave.

This twenty-three percent figure is the clearest evidence yet that the problem isn’t theoretical. It’s not something for think-tank panels or academic papers. It is happening at the level that matters most: the decision whether to continue doing business in Canada or move operations somewhere more predictable. And once those decisions are made, they’re very hard to reverse. Capital doesn’t boomerang back out of patriotism. It goes where it can earn a return.

For years, Canadian policymakers have talked about productivity as if it were a moral failing of workers or a mystical national characteristic. It’s neither. Productivity comes from investment—real money poured into equipment, technology, training and expansion. When investment stalls, productivity collapses. And when a quarter of firms in a major sector are already planning their exit, you are not looking at a temporary dip. You are looking at a structural rejection of the business environment itself.

The fact that executives are now openly warning Parliament that they cannot afford to stay is a moment of clarity. It is also a test. Either this country becomes a place where people can build things again—quickly, affordably, competitively—or it continues down the path that leads to empty factories, hollowed-out supply chains and consumers who wonder why the shelves look thinner every year.

Twenty-three percent is not just a statistic. It’s the sound of a warning bell ringing at full volume. The only question now is whether anyone in charge hears it.

-

Carbon Tax2 days ago

Carbon Tax2 days agoCarney fails to undo Trudeau’s devastating energy policies

-

Daily Caller2 days ago

Daily Caller2 days ago‘Holy Sh*t!’: Podcaster Aghast As Charlie Kirk’s Security Leader Reads Texts He Allegedly Sent University Police

-

Alberta1 day ago

Alberta1 day agoAlbertans choose new licence plate design with the “Strong and Free” motto

-

Business2 days ago

Business2 days agoThe UN Pushing Carbon Taxes, Punishing Prosperity, And Promoting Poverty

-

Agriculture2 days ago

Agriculture2 days agoFederal cabinet calls for Canadian bank used primarily by white farmers to be more diverse

-

Alberta1 day ago

Alberta1 day agoEdmonton and Red Deer to Host 2027 IIHF World Junior Hockey Championship

-

Great Reset2 days ago

Great Reset2 days agoCanadian government forcing doctors to promote euthanasia to patients: report

-

Health1 day ago

Health1 day agoNEW STUDY: Infant Vaccine “Intensity” Strongly Predicts Autism Rates Worldwide