Business

Next federal government has to unravel mess created by 10 years of Trudeau policies

From the Fraser Institute

It’s no exaggeration to describe the Trudeau years as almost a “lost decade” for Canadian prosperity.

The Justin Trudeau era is ending, after nine-and-a-half years as prime minister. His exit coincides with the onset of a trade crisis with the United States. Trudeau leaves behind a stagnant Canadian economy crippled by dwindling productivity, a long stretch of weak business investment, and waning global competitiveness. These are problems Trudeau chose to ignore throughout his tenure. His successors will not have that luxury.

It’s no exaggeration to describe the Trudeau years as almost a “lost decade” for Canadian prosperity. Measured on a per-person basis, national income today is barely higher than it was in 2015, after stripping out the effects of inflation. On this core metric of citizen wellbeing, Canada has one of the worst records among all advanced economies. We have fallen far behind the U.S., where average real income has grown by 15 per cent over the same period, and most of Europe and Japan, where growth has been in the range of 5-6 per cent.

Meanwhile, Ottawa’s debt has doubled on Trudeau’s watch, and both federal government spending and the size of the public service have ballooned, even as service levels have generally deteriorated. Housing in Canada has never been more expensive relative to average household incomes, and health care has never been harder to access. The statistics on crime point to a decline in public safety in the last decade.

Reviving prosperity will be the most critical task facing Trudeau’s successor. It won’t be easy, due in part to a brewing trade war with the U.S. and the retreat from open markets and free trade in much of the world. But a difficult external environment is no reason for Canada to avoid tackling the domestic impediments that discourage economic growth, business innovation and entrepreneurial wealth creation.

In a recent study, a group of economists and policy advisors outlined an agenda for renewed Canadian prosperity. Several of their main recommendations are briefly summarized below.

Return to the balanced budget policies embraced by the Chretien/Martin and Harper governments from 1995 to 2015. Absent a recession, the federal government should not run deficits. And the next government should eliminate ineffective spending programs and poor-performing federally-funded agencies.

Reform and reduce both personal and business income taxes. Canada’s overall income tax system is increasingly out of line with global best practise and has become a major barrier to attracting private-sector investment, top talent and world-class companies. A significant overhaul of the country’s tax policies is urgently needed.

Retool Ottawa’s existing suite of climate and energy policies to reduce the economic damage done by the long list of regulations, taxes, subsidies and other measures adopted Trudeau. Canada should establish realistic goals for lowering greenhouse gas emissions, not politically manufactured “targets” that are manifestly out of reach. Our climate policy should reflect the fact that Canada’s primary global comparative advantage is as a producer and exporter of energy and energy-intensive goods, agri-food products, minerals and other industrial raw materials which collectively supply more than half of the country’s exports.

Finally, take a knife to interprovincial barriers to trade, investment and labour mobility. These long-standing internal restrictions on commerce increase prices for consumers, inhibit the growth of Canadian-based companies, and result in tens of billions of dollars in lost economic output. The next federal government should lead a national effort to strengthen the Canadian “common market” by eliminating such barriers.

Business

Energy leaders send this letter urging Prime Minister Mark Carney to unlock Canada’s resources

An Open Letter to the Prime Minister of Canada

The CEOs of Canada’s largest energy companies, including Canadian Natural Resources, Cenovus, Suncor, Imperial Oil and many more, have issued a new “Build Canada Now” letter to Prime Minister Carney. They are calling for Ottawa to repeal the production cap, scrap the tanker ban, simplify regulations and shorten project approvals so Alberta’s energy sector can create jobs, attract investment and help Canada become a true global energy superpower.

September 15, 2025

The Rt. Hon. Mark Carney, PC, MP

Prime Minister of Canada

Dear Prime Minister Carney,

Six months have passed since the first “Build Canada Now” letter was sent to you and the leaders of Canada’s other political parties outlining an action plan to unlock Canada’s world class oil and natural gas resources to strengthen Canada’s economic sovereignty, resilience and prosperity. After the election, we followed up with a second letter expressing our support for our shared vision of Canada becoming an energy superpower, one that harnesses both conventional and clean energy resources. Since then, we have seen progress but it is insufficient to stimulate the investment and growth required to make this vision a reality.

Thank you for leading the positive change in tone from the Federal Government in terms of the importance of economic development, including expanded investments in conventional energy. The launch of the new Major Projects Office, Indigenous Advisory Council, the initial list of projects of national significance, and the announcement that it will begin work in support of Pathways Plus are critical steps in the right direction. We appreciate the progress the Federal Government has made in these areas.

However, Canada still lacks the clear, competitive and durable fiscal and regulatory policies required to achieve the so-called “Grand Bargain”. That bargain being significant emissions reductions, expanded market access and material upstream production growth. Achieving these three inter-related outcomes goes beyond progressing select major projects but rather includes a multitude of other projects and related investments. Consequently, we reiterate our call to work together to make the policy changes required for this to happen.

Our call to action is urgent, with persistent indicators that the Canadian economy is moving in the wrong direction. The need to improve productivity and create jobs requires swift and decisive action. Canada is blessed with an enviable abundance of oil and natural gas resources and has the expertise to develop them in a manner consistent with environmental responsibility, social values, and working with Indigenous groups for the benefit of Canada and Canadians. As leaders of this sector, we have consistently advocated for the changes required to unwind the past decade of increasing policy complexity and uncertainty that led to delayed investments, lost opportunities and a competitive disadvantage on the global energy stage.

Given your background, you understand that the private sector and public markets require clarity and certainty to make the long-term investments necessary to realizing this sector’s potential, in turn creating thousands of high-paying jobs and significantly strengthening Canada’s economy.

Making the changes expressed in the earlier Build Canada Now letters are necessary to send clear signals that Canada is open for business. To reiterate, we believe that your government must focus on the following:

- Significantly simplify regulations. The Federal Impact Assessment Act and West Coast tanker ban are impeding development and need to be overhauled and repealed, respectively. Existing processes are complex, unpredictable, subjective, and excessively long. Processes need to be clarified and simplified, and decisions must withstand judicial review.

- Shorten timelines for project approvals. The Federal Government needs to dramatically reduce regulatory timelines to approve all projects within months, not years, of application. This is required to restore investor confidence and once again attract capital to Canada. Clarity on provincial versus federal jurisdiction related to project approvals is also required and needs to be respected.

- Commit to grow production, not limit it. The Federal Government’s unlegislated cap on emissions must be eliminated to allow the sector to grow and achieve its potential for the benefit of Canada and Canadians. The “production cap” creates uncertainty, is redundant, will result in production cuts, and stifles investment.

- Fiscal framework that attracts investment. The Federal carbon levy on large emitters is not globally cost competitive and should be repealed allowing provinces to set regulations. The Federal Government can lead cooperation across jurisdictions, protecting domestic and international competitiveness. Industry needs clear, competitive, and durable fiscal frameworks, including associated with carbon and overall taxation, to secure capital and incentivize investment.

- Incent Indigenous investment opportunities. The Federal Government needs to provide Indigenous loan guarantees at scale so industry can create ownership opportunities to increase prosperity and ensure Indigenous communities benefit from resource development.

As you have clearly stated, our country needs to move from “uncertainty to prosperity”. There needs to be tangible change to make this happen, and without clear and urgent action we risk missing a generational opportunity to capture the potential before Canada now.

As Parliament resumes for the Fall sitting, the energy industry remains committed to working with you, your cabinet, and the provinces on an urgent basis to achieve the energy sector’s potential for the good of Canada. Together, Canada can become the global energy superpower we all envision. We look forward to your response.

Sincerely,

Original signatories

Brandon Anderson

President & CEO

NorthRiver Midstream Inc

Doug Bartole

President & CEO

InPlay Oil Corp.

Robert Broen

President & CEO

Athabasca Oil Corporation

Scott Burrows

President and Chief Executive Officer

Pembina Pipeline Corp.

Chris Carlsen

President & COO

Birchcliff Energy Ltd.

Brad W. Corson

Chairman, President and Chief Executive Officer

Imperial Oil Ltd.

N. Murray Edwards

Executive Chairman

Canadian Natural Resources Limited

Darlene Gates

President and Chief Executive Officer

MEG Energy Corp.

Paul Hawksworth

President and Chief Executive Officer

Inter Pipeline Ltd.

Tyson Huska

President & CEO

Longshore Resources Ltd.

Mike Lawford

President & CEO

NuVista Energy Ltd.

Chris Mazerolle

President

Chevron Canada Resources

Nicholas McKenna

President

ConocoPhillips Canada

Paul Myers

President

Pacific Canbriam Energy Limited

François Poirier

President and Chief Executive Officer

TC Energy Corp.

Susan Riddell Rose

President & CEO

Rubellite Energy Corp.

Don Simmons

President & CEO

Hemisphere Energy Corporation

Adam Waterous

Executive Chairman, Board of Directors

Strathcona Resources Ltd.

Richard Wyman

President

Chance Oil and Gas Limited

Terry Anderson

President and Chief Executive Officer

ARC Resources Ltd.

Michael Binnion

President & CEO

Questerre Energy Corporation

Craig Bryksa

President and Chief Executive Officer

Veren Inc.

David J. Burton

President & CEO

Lycos Energy Inc.

Paul Colborne

President & CEO

Surge Energy Inc.

Greg Ebel

President and Chief Executive Officer

Enbridge Inc.

Grant Fagerheim

President and Chief Executive Officer

Whitecap Resources Inc.

Bryan Gould

Founder & CEO

Aspenleaf Energy Limited

Philip B. Hodge

President & CEO

Pine Cliff Energy Ltd.

Rich Kruger

President and Chief Executive Officer

Suncor Energy Inc.

Byron Lutes

President

Mancal Energy Inc.

Brendan McCracken

President & CEO

Ovintiv Canada ULC

Jon McKenzie

President and Chief Executive Officer

Cenovus Energy Inc.

Curtis Philippon

President & CEO

Gibson Energy

Mike Rose

President and Chief Executive Officer

Tourmaline Oil Corp.

Brian Schmidt

President & CEO

Tamarack Valley Energy Ltd.

David Spyker

President & CEO

Freehold Royalties Ltd.

Bevin Wirzba

President and Chief Executive Officer

South Bow Corp.

Vern Yu

President & Chief Executive Officer

AltaGas

Additional signatories

Business

Attrition doesn’t go far enough, taxpayers need real cuts

The Canadian Taxpayers Federation is calling on Prime Minister Mark Carney to actively shrink the bureaucracy rather than relying on attrition.

“After adding about 100,000 bureaucrats in a decade, attrition doesn’t go nearly far enough,” said Franco Terrazzano, CTF Federal Director. “Carney needs to get serious about fixing the budget and making government more affordable for taxpayers.

“Carney needs to significantly shrink the bureaucracy immediately.”

Carney recently stated that any reduction of the size of the federal bureaucracy will “happen naturally through attrition.”

The federal bureaucracy cost taxpayers $71.1 billion in 2024-25, according to the Parliamentary Budget Officer. The bureaucracy cost taxpayers $40.2 billion in 2016-17. That means the cost of the federal bureaucracy increased 77 per cent since 2016.

The federal government added 99,000 bureaucrats since 2016.

Carney said he would “balance the operating budget by Budget 2028” during the election. The bureaucracy consumes about 55 per cent of the operating budget.

“Canadians pay too much for an expensive bureaucracy that underdelivers,” Terrazzano said. “Carney needs to get serious about fixing the budget, making government more affordable and shrinking the federal bureaucracy.”

Half of Canadians say federal services have gotten worse since 2016, according to a recent Leger poll commissioned by the CTF. That’s despite the cost of the federal bureaucracy growing 77 per cent. The poll also found that 54 per cent of Canadians want the government to cut the size and cost of the federal bureaucracy.

-

Business10 hours ago

Business10 hours agoCarney Admits Deficit Will Top $61.9 Billion, Unveils New Housing Bureaucracy

-

Alberta7 hours ago

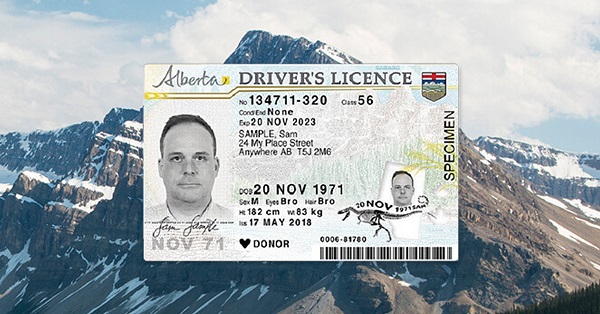

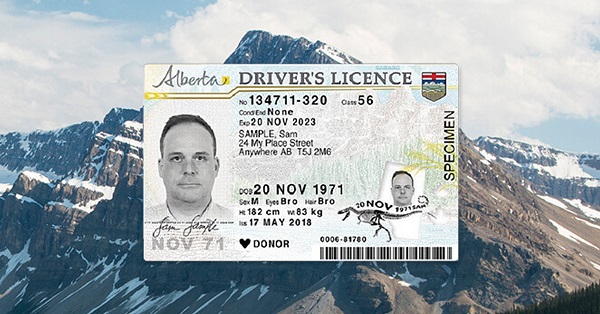

Alberta7 hours agoAlberta first to add citizenship to licenses

-

Business9 hours ago

Business9 hours agoCarney’s Ethics Test: Opposition MP’s To Challenge Prime Minister’s Financial Ties to China

-

Business8 hours ago

Business8 hours agoAttrition doesn’t go far enough, taxpayers need real cuts

-

Addictions2 days ago

Addictions2 days agoNo, Addicts Shouldn’t Make Drug Policy

-

Alberta2 days ago

Alberta2 days agoEducation negotiations update: Minister Horner

-

Business2 days ago

Business2 days agoThe Real Reason Tuition Keeps Going Up at Canada’s Universities

-

COVID-192 days ago

COVID-192 days agoNew Study Obliterates the “Millions Saved” COVID Shot Myth