National

Moving election means tens of millions in extra pensions

From the Canadian Taxpayers Federation

Author: Franco Terrazzano

“If even half of these MPs lose, moving back the election one week would cost taxpayers tens of millions of dollars”

The Canadian Taxpayers Federation released estimates showing how much it could cost to delay the next election by a week and trigger the pension eligibility for members of Parliament elected in 2019.

“This looks like the government is pushing back the election so more MPs can take a very lucrative, taxpayer-funded pension,” said Franco Terrazzano, CTF Federal Director. “If politicians don’t want to look shady, then they should stop doing shady stuff like this.”

MPs are eligible for a pension after six years of service. MPs first elected in the 2019 election are not eligible for the pension until Oct. 21, 2025.

The federal government introduced legislation that would move the next scheduled election from Oct. 20 to Oct. 27, 2025.

This would mean 80 additional MPs would be eligible to collect a pension. The additional pensions total $120 million. That is the estimated lifetime pension if all 80 MPs lose their seats.

The annual starting pension ranges from $32,000 to $49,000.

“If even half of these MPs lose, moving back the election one week would cost taxpayers tens of millions of dollars,” Terrazzano said. “When MPs tweak the system to pad their pockets, it sends a signal to thousands of bureaucrats that they should dig deeper into the trough too.

“Leadership starts at the top and MPs are going the wrong way.”

The CTF is calling for reforms to the MP pension plan, ending severance and the transition allowance, and cancelling the April 1 MP pay raise.

The estimated pension calculations for the 80 MPs can be found HERE.

Business

Ottawa Is Still Dodging The China Interference Threat

From the Frontier Centre for Public Policy

By Lee Harding

Alarming claims out of P.E.I. point to deep foreign interference, and the federal government keeps stalling. Why?

Explosive new allegations of Chinese interference in Prince Edward Island show Canada’s institutions may already be compromised and Ottawa has been slow to respond.

The revelations came out in August in a book entitled “Canada Under Siege: How PEI Became a Forward Operating Base for the Chinese Communist Party.” It was co-authored by former national director of the RCMP’s proceeds of crime program Garry Clement, who conducted an investigation with CSIS intelligence officer Michel Juneau-Katsuya.

In a press conference in Ottawa on Oct. 8, Clement referred to millions of dollars in cash transactions, suspicious land transfers and a network of corporations that resembled organized crime structures. Taken together, these details point to a vulnerability in Canada’s immigration and financial systems that appears far deeper than most Canadians have been told.

P.E.I.’s Provincial Nominee Program allows provinces to recommend immigrants for permanent residence based on local economic needs. It seems the program was exploited by wealthy applicants linked to Beijing to gain permanent residence in exchange for investments that often never materialized. It was all part of “money laundering, corruption, and elite capture at the highest levels.”

Hundreds of thousands of dollars came in crisp hundred-dollar bills on given weekends, amounting to millions over time. A monastery called Blessed Wisdom had set up a network of “corporations, land transfers, land flips, and citizens being paid under the table, cash for residences and property,” as was often done by organized crime.

Clement even called the Chinese government “the largest transnational organized crime group in the history of the world.” If true, the allegation raises an obvious question: how much of this activity has gone unnoticed or unchallenged by Canadian authorities, and why?

Dean Baxendale, CEO of the China Democracy Fund and Optimum Publishing International, published the book after five years of investigations.

“We followed the money, we followed the networks, and we followed the silence,” Baxendale said. “What we found were clear signs of elite capture, failed oversight and infiltration of Canadian institutions and political parties at the municipal, provincial and federal levels by actors aligned with the Chinese Communist Party’s United Front Work Department, the Ministry of State Security. In some cases, political donations have come from members of organized crime groups in our country and have certainly influenced political decision making over the years.”

For readers unfamiliar with them, the United Front Work Department is a Chinese Communist Party organization responsible for influence operations abroad, while the Ministry of State Security is China’s main civilian intelligence agency. Their involvement underscores the gravity of the allegations.

It is a troubling picture. Perhaps the reason Canada seems less and less like a democracy is that it has been compromised by foreign actors. And that same compromise appears to be hindering concrete actions in response.

One example Baxendale highlighted involved a PEI hotel. “We explore how a PEI hotel housed over 500 Chinese nationals, all allegedly trying to reclaim their $25,000 residency deposits, but who used a single hotel as their home address. The owner was charged by the CBSA, only to have the trial shut down by the federal government itself,” he said. The case became a key test of whether Canadian authorities were willing to pursue foreign interference through the courts.

The press conference came 476 days after Bill C-70 was passed to address foreign interference. The bill included the creation of Canada’s first foreign agent registry. Former MP Kevin Vuong rightly asked why the registry had not been authorized by cabinet. The delay raises doubts about Ottawa’s willingness to confront the problem directly.

“Why? What’s the reason for the delay?” Vuong asked.

Macdonald-Laurier Institute foreign policy director Christopher Coates called the revelations “beyond concerning” and warned, “The failures to adequately address our national security challenges threaten Canada’s relations with allies, impacting economic security and national prosperity.”

Former solicitor general of Canada and Prince Edward Island MP Wayne Easter called for a national inquiry into Beijing’s interference operations.

“There’s only one real way to get to the bottom of what is happening, and that would be a federal public inquiry,” Easter said. “We need a federal public inquiry that can subpoena witnesses, can trace bank accounts, can bring in people internationally, to get to the bottom of this issue.”

Baxendale called for “transparency, national scrutiny, and most of all for Canadians to wake up to the subtle siege under way.” This includes implementing a foreign influence transparency commissioner and a federal registry of beneficial owners.

If corruption runs as deeply as alleged, who will have the political will to properly respond? It will take more whistleblowers, changes in government and an insistent public to bring accountability. Without sustained pressure, the system that allowed these failures may also prevent their correction.

Lee Harding is a research fellow for the Frontier Centre for Public Policy.

Business

Canada needs serious tax cuts in 2026

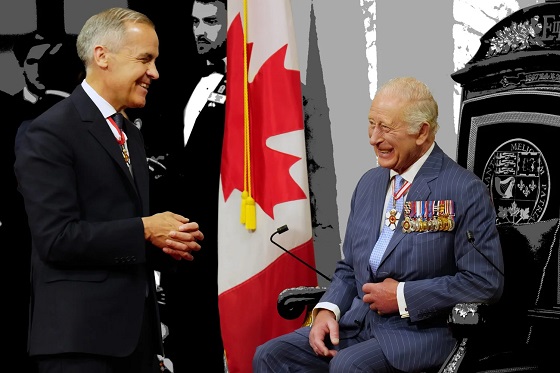

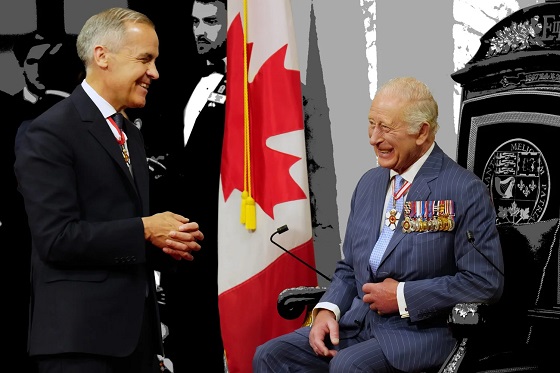

What Prime Minister Mark Carney gives with his left hand, he takes away with his right hand.

Canadians are already overtaxed and need serious tax cuts to make life more affordable and make our economy more competitive. But at best, the New Year will bring a mixed bag for Canadian taxpayers.

The federal government is cutting income taxes, but it’s hiking payroll taxes. The government cancelled the consumer carbon tax, but it’s hammering Canadian businesses with a higher industrial carbon tax.

The federal government cut the lowest income tax bracket from 15 to 14 per cent. That will save the average taxpayer $190 in 2026, according to the Parliamentary Budget Officer.

But the government is taking more money from Canadians’ paycheques with higher payroll taxes.

Workers earning $85,000 or more will pay $5,770 in federal payroll taxes in 2026. That’s a $262 payroll tax hike. Their employers will also be forced to pay $6,219.

So Canadians will save a couple hundred bucks from the income tax cut in the new year, but many Canadians will pay a couple hundred bucks more in payroll taxes.

It’s the same story with carbon taxes.

After massive backlash from ordinary Canadians, the federal government dropped its consumer carbon tax that cost average families hundreds of dollars every year and increased the price of gas by about 18 cents per litre.

But Carney’s first budget shows he wants higher carbon taxes on Canadian businesses. Carney still hasn’t provided Canadians a clear answer on how much his business carbon tax will cost. He did, however, provide a hint during a press conference he held after signing a memorandum of understanding with the Alberta government.

“It means more than a six times increase in the industrial price on carbon,” Carney said.

Carney previously said that by “changing the carbon tax … We are making the large companies pay for everybody.”

Carney’s problem is that Canadians aren’t buying what he’s selling on carbon taxes.

Just 12 per cent of Canadians believe Carney that businesses will pay most of the cost of his carbon tax, according to a Leger poll. Nearly 70 per cent of Canadians say businesses will pass most or some of the cost to consumers.

Canadians understand that it doesn’t matter what type of lipstick politicians put on their carbon tax pig, all carbon taxes make life more expensive.

Carney is also continuing his predecessor’s tradition of automatically increasing booze taxes.

Ottawa will once again hike taxes on beer, wine and spirits in 2026 through its undemocratic alcohol tax escalator.

First passed in the 2017 federal budget, the alcohol escalator tax automatically increases federal taxes on beer, wine and spirits every year without a vote in Parliament.

Federal alcohol taxes are expected to increase by two per cent on April 1, and cost taxpayers $41 million in 2026. Since being imposed, the alcohol escalator tax has cost taxpayers about $1.6 billion, according to industry estimates.

Canadians are overtaxed and need the federal government to seriously lighten the load.

The biggest expense for the average Canadian family isn’t the home they live in, the food they eat or the clothes they buy. It’s the taxes they pay to all levels of government. More than 40 per cent of the average family’s budget goes to paying taxes, according to the Fraser Institute.

Politicians are taking too much money from Canadians. And their high taxes are driving away investment and jobs.

Canada ranks a dismal 27th out of 38 industrialized countries on individual tax competitiveness, according to the Tax Foundation. Canada ranks 22nd on business tax competitiveness. Canada is behind the United States on both measures.

A little bit of tax relief here and there isn’t going to cut it. Carney’s New Year’s resolution needs to be to embark on a massive tax cutting campaign.

-

Business14 hours ago

Business14 hours agoICYMI: Largest fraud in US history? Independent Journalist visits numerous daycare centres with no children, revealing massive scam

-

Daily Caller2 days ago

Daily Caller2 days agoUS Halts Construction of Five Offshore Wind Projects Due To National Security

-

Daily Caller2 days ago

Daily Caller2 days agoWhile Western Nations Cling to Energy Transition, Pragmatic Nations Produce Energy and Wealth

-

Alberta2 days ago

Alberta2 days agoAlberta Next Panel calls for less Ottawa—and it could pay off

-

Bruce Dowbiggin2 days ago

Bruce Dowbiggin2 days agoBe Careful What You Wish For In 2026: Mark Carney With A Majority

-

Business2 days ago

Business2 days agoMainstream media missing in action as YouTuber blows lid off massive taxpayer fraud

-

Energy2 days ago

Energy2 days agoRulings could affect energy prices everywhere: Climate activists v. the energy industry in 2026

-

International2 days ago

International2 days agoChina Stages Massive Live-Fire Encirclement Drill Around Taiwan as Washington and Japan Fortify