Business

Major projects in Western Canada are essential, but they require broad and genuine coalitions.

Nation-building takes hard work and goodwill

A couple of weeks ago, I was feeling a little despondent about the chances that the present federal government would take seriously its constitutional role in facilitating nation-building infrastructure across provinces, particularly something as ambitious (and contentious) as an oil pipeline.

This week, I’m feeling a little more upbeat. On July 6, Reuters reported Prime Minister Carney saying this:

“Given the scale of the economic opportunity, the resources we have, the expertise we have,” Carney said, “it is highly, highly likely that we will have an oil pipeline proposed as a project of national interest.”

In my adult life, I don’t think we’ve seen a true nation-building project. I was still a kid when the St. Lawrence Seaway and the Trans-Canada Highway opened.

One project I’ve been marginally involved in might qualify as nationally significant: the building of a container terminal at the Port of Prince Rupert (opened in 1914) in the early 2000s. It wasn’t a nation-building effort, but it took a crisis to set it in motion.

The situation in the early 2000s was not as intense as it is today, but it did involve major trade disruption. The emergence of China as a global manufacturing hub was upending shipping patterns. Every container terminal on the West Coast was operating over capacity, severely compromising supply chains. Not acting would have been a regretful missed opportunity.

What made the Prince Rupert proposal viable was geography and infrastructure. It sat at the Pacific terminus of the most underutilized section of a transcontinental railway in North America, an asset that had waited nearly a century to be put to good use, except during World War II.

Fairview Container Terminal was an economic lifesaver for Prince Rupert and the Indigenous communities surrounding the Port of Prince Rupert. Consultations with First Nations were anything but smooth. However, the terminal laid the groundwork for a significant improvement in the relationship between the Prince Rupert Port Authority (PRPA) and local Indigenous governments.

Today, Peter Lantin, a member of the Haida Nation, chairs the PRPA’s Board. Local Indigenous companies are investing in housing projects, owning and operating key hospitality and retail businesses, making up a significant portion of light industrial capacity, holding equity in heavy industry, and spearheading major projects, such as the South Kaien Import Logistics Park.

While the project carried national significance, it didn’t meet the threshold of a genuine nation-building effort. However, it still necessitated a broad coalition, stretching from Prince Rupert, through the Rockies, across the Prairies, and into the manufacturing heartlands of Ontario, Quebec, and the American Midwest, to rally support and address the concerns of others along the way.

The campaign, led by the Prince Rupert Port Authority and the City of Prince Rupert, had to reach beyond politicians, regulators, economic development agencies, and direct beneficiaries. The proposed port facility would be a key asset, but without a railway, it would not be.

The Canadian National Railway formed the backbone of the project, stretching across Canada and deep into the United States, with spur lines reaching thousands of communities, farms, and factories.

The subjective, business, social, and environmental concerns, especially those raised by people along the line, rested with CN Rail.

Some steamship lines and North American logistics providers were skeptical that a container terminal without a large adjacent market could succeed. A few also questioned whether CN Rail would commit the resources needed to support the terminal at scale. Meanwhile, some of CN’s existing customers worried they’d face delays, as containers were prioritized.

The issues became local as traffic volumes increased, resulting in a host of impacts on communities along the line. Container trains are generally longer than other trains, which compounds the impacts: more noise and vibration, longer waits at level crossings, and expanded rail yards in villages, towns, and cities. Safety concerns grow, especially at unregulated crossings and within rail yards.

Traffic growth also brings environmental consequences: twin tracking, new bridges, and overpasses. These changes often occur in remote areas, where they can disrupt wildlife and sensitive habitats.

The more difficult challenges were political. Addressing the legacy issues between the railroad and the First Nations whose land the railway crosses remains an ongoing and often complex process. But there has been real progress.

In this case, CN Rail determined that acquiring the government-owned BC Rail was critical to its participation. Like transmission lines, railways require a degree of redundancy. CN believed that if the line between Prince George and Prince Rupert were ever unavailable, it needed a secondary route to Vancouver that it controlled directly. The concern was that if the shared tracks with Canadian Pacific Kansas City Limited (CPKC) in the Fraser-Thompson Canyon became inaccessible, CN would have no fallback.

The BC government of the day agreed to the sale of BC Rail to CN, despite strong objections from the BC NDP.

All of this is a long way of saying that even a utility, stretching through countless communities, across rugged terrain, and multiple jurisdictions, requires a broad coalition to succeed, especially if it is controversial and undertaken in the national interest. Too often, both right- and left-wing ideologues, if not kept at room temperature, lose sight of the national interest.

I’m confused by Premier Eby’s comment that there should be no federal funding for an expected proposal for an oil pipeline to the North Coast, an infrastructure project deemed to be of nation-building scale. There’s no opposition to the pipeline itself, only to federal funding.

We haven’t heard any provincial premier complain about the billions in federal investment in port and airport authorities in Metro Vancouver, Victoria, Nanaimo, and Prince Rupert. The federally funded ports and airports now represent the single largest industrial sector in urban British Columbia.

While the benefits of those facilities are felt across the country, the direct gains, jobs, municipal infrastructure, and local economic activity, are concentrated in BC. Would oil piped to the North Coast not provide the same kind of broadly shared benefit, not limited to Alberta?

Hopefully, Premier Eby, and the NDP more broadly, will reach the position they now hold on the Site C Dam, LNG, and TMX (which they rightly support dredging to bring to full production).

These points are not criticisms. I’m impressed by his flexibility when considering natural resource projects in the context of provincial and national interests, and from a workers’ perspective.

We shouldn’t be so hesitant to supply democratically produced, cleaner-than-average oil to Asia. It creates leverage to secure many other export opportunities across the Pacific.

Jim Rushton is a 46-year veteran of BC’s resource and transportation sectors, with experience in union representation, economic development, and terminal management.

Photo credit to THE CANADIAN PRESS/Spencer Colby

Business

Poilievre: “Carney More Irresponsible Than Trudeau” as Housing, Jobs, and Energy Failures Mount

50,000 lost manufacturing jobs, 86,000 more unemployed, soaring housing costs, and blocking every LNG project while vowing to end the TFW program

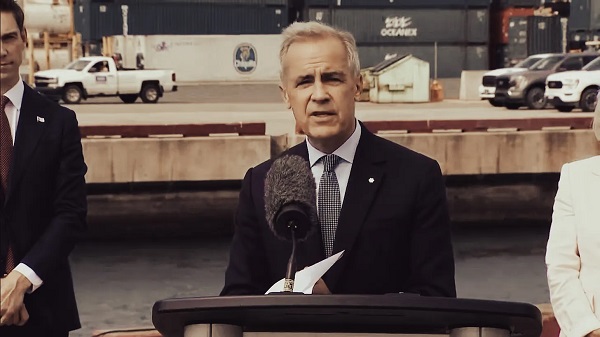

Pierre Poilievre opened his press conference with a direct attack on Mark Carney and the Liberal record on housing, framing the crisis as the product of government mismanagement rather than market forces.

He began by pointing to Conservative MP Scott Aitchison, a former mayor, as an example of what can be done when local leaders “cut the taxes and the development charges and the wait times so that building can happen.” Then came the pivot: “What a contrast with Justin Trudeau — excuse me, with Mark Carney,” he said, before slamming Carney’s choice of Gregor Robertson as housing minister. Robertson, he reminded the crowd, presided over a 149% increase in Vancouver housing costs and more than doubled homebuilding taxes. Carney, Poilievre said, rewarded that record by handing him the national housing file.

The setting itself — Deco Homes, a family-run builder founded by Italian immigrants — was chosen deliberately. Poilievre praised the Gasper family for their role in building Canada’s homes and businesses, but then asked whether such families could do the same today. His answer was no. “After a decade of Liberal taxes, Liberal spending, out-of-control Liberal immigration, reckless crime policies… the Canadian promise is really broken.”

From there, he broadened the attack. He spoke of an entire generation priced out of homeownership, of immigration growing “three times faster than housing and jobs,” of crime rising, and of what he called “the worst economy in the G7.” And then he turned squarely on Carney: “Mr. Carney is actually more irresponsible than even Justin Trudeau was,” citing an 8% increase in government spending, 37% more for consultants, and 62 billion dollars in lost investment — the largest outflow in Canadian history, according to the National Bank.

The message was simple: Liberals talk, Conservatives build. Poilievre painted Carney as a man of speeches and promises, not results. “The mistake the media is making is they’re judging him by his words rather than his deeds,” he said.

It was an opening statement designed less to introduce policy — those details came later — and more to frame the battle. For Poilievre, Carney isn’t just Trudeau’s replacement. He’s Trudeau’s sequel, and in some ways worse.

During the Q and A portion of the presser; Pierre Poilievre was pressed on immigration today, and what he said was blunt. Canada, he argued, once had the “envy of the world” system: immigrants came in at numbers the country could absorb. There were jobs, housing, health care. Everyone integrated. Ten years later? He says the Liberals have destroyed that.

The facts he used were stark. According to Poilievre, Canada is bringing in people three times faster than homes and jobs are being created. He accused the government of allowing “massive abuses” of the international student program, the Temporary Foreign Worker program, and asylum claims, with what he called “rampant fraud” right under Ottawa’s nose.

He tied this directly to the economy: youth unemployment, he said, is the worst in three decades. At the same time, employers are importing more temporary foreign workers than ever, this year at a record high and using them for cheap labor under poor conditions. His line: “While our young people can’t find jobs, employers are able to exploit temporary foreign workers by giving them lower wages and terrible working conditions.”

But here’s the part that stands out politically. Poilievre said, “Immigrants are not to blame.” He put the responsibility squarely on Liberal governments, calling their immigration numbers “reckless and irresponsible.”

His fix? End the Temporary Foreign Worker program. Cut immigration levels back to “the right numbers and the right people” to fill jobs Canadians can’t do. Tighten border standards to keep criminals out. And, in his words, “always and everywhere put Canada first.”

Pierre Poilievre didn’t hold back when asked about Mark Carney’s record. His words: “Mr. Carney is actually more irresponsible than even Justin Trudeau was.” That’s not a throwaway line, he backed it with numbers.

According to Poilievre, Carney inherited what he called a “morbidly obese government” from Trudeau and made it worse: 8% bigger overall, 37% more for consultants, and 6% more bureaucracy. He says Carney’s deficit is set to be even larger than Trudeau’s.

Then the jobs number: 86,000 more unemployed people under Carney than under Trudeau. That, Poilievre argued, is the real measure, not the polished speeches Carney gives. His line: “The mistake the media is making is they’re judging him by his words rather than his deeds.”

He also went after Carney for what hasn’t happened: “He has not approved a single major national project.” Meanwhile, Poilievre says food price inflation is even worse today, crime policy hasn’t changed the same “catch and release” approach and every big promise Carney made has already been broken.

Pierre Poilievre was asked about Ukraine, and his answer wasn’t about speeches or handshakes in Brussels. It was about pipelines.

“The best way to put Canada first while helping Ukraine is to sell our oil and gas in Europe.” His argument: Vladimir Putin bankrolls his war because Europe still buys his fuel. Poilievre said if Canada had built the Energy East pipeline, we’d be shipping a million barrels of oil a day to Europe right now.

He went further: approve LNG plants immediately, liquefy tens of billions of dollars of Canadian gas, and ship it overseas to “fully displace” Russian sales. His line: “Instead of the money going to Putin’s war machine, it will go to the trades workers in this country.”

And then the indictment of the Liberals: “Mark Carney and the Liberals have blocked every single LNG project that has been put before them. As a result, we only have one plant and it was approved by Stephen Harper.”

So the contrast is stark. Carney talks about climate virtue. Poilievre says: build pipelines, sell fuel, kill Putin’s war economy, and pay Canadian workers. His closer: “That is how you put Canada first.”

Final Thoughts

So let’s just be honest. Under Mark Carney’s leadership, the numbers aren’t just bad they’re devastating. In a matter of months, Canada has lost 50,000 manufacturing jobs. These are not low-skill jobs; they are the backbone of the economy, the kind of work that built the middle class in this country. Add to that another 86,000 unemployed overall compared to when he took office. This is what Carney calls stability.

Now, if you’re a Temporary Foreign Worker, life looks pretty good. Ottawa has built an entire system around you cheap wages, little recourse, and companies happy to import you as disposable labor. If you’re a Carney insider, it looks even better. The government is 8% bigger than when Trudeau left, consultants are raking in 37% more, the bureaucracy is swelling. It’s one of the greatest insider rackets in modern Canadian politics.

But if you’re part of Canada’s middle class, if you’re a young person trying to buy a home, if you’re a worker trying to hold onto a job in a plant, a mill, or a construction site you are being hollowed out. You’re watching your wages stagnate, your housing costs explode, your jobs disappear overseas or into government-mandated “green transitions.” And when you ask for answers, what do you get? You get Patty Hajdu telling you not to be afraid of robots. You get Mark Carney telling you his deficits are “investments.” You get speeches about “climate virtue” and “AI literacy” while your livelihood collapses.

That’s the contrast Poilievre is trying to draw. On immigration, he says: let’s end the Temporary Foreign Worker scam, bring people in at a pace we can actually house and employ, and put Canadian workers first. On energy, he says: build the pipelines, approve the LNG projects, and stop funding Putin’s war by leaving Europe dependent on Russian fuel. On the economy, he says: stop measuring success by the size of government or the smoothness of a prime minister’s speeches, and start measuring it by the number of Canadians who can work, buy homes, and raise families in their own country.

So the choice is simple. Carney offers more of the same consultants, insiders, deficits, slogans, and the slow managed decline of a once-prosperous nation. Poilievre is offering something completely different: a chance to reverse the hollowing out of the middle class and to put Canadian jobs, Canadian energy, and Canadian sovereignty first.

If you’re an insider, Carney’s Canada works just fine. If you’re a middle-class Canadian, it’s a disaster. And that, in the end, is the dividing line in this country.

Business

Health-care costs for typical Canadian family will reach over $19,000 this year

From the Fraser Institute

By Nadeem Esmail, Nathaniel Li and Milagros Palacios

A typical Canadian family of four will pay an estimated $19,060 for public health-care insurance this year, finds a new study released today by the Fraser Institute, an independent, non-partisan Canadian public policy think-tank.

“Canadians pay a substantial amount of money for health care through a variety of taxes—even if we don’t pay directly for medical services,” said Nadeem Esmail, director of health policy studies at the Fraser Institute and co-author of The Price of Public Health Care Insurance, 2025.

Most Canadians are unaware of the true cost of health care because they never see a bill for medical services, may only be aware of partial costs collected via employer health taxes and contributions (in provinces that impose them), and because general government revenue—not a dedicated tax—funds Canada’s public health-care system.

The study estimates that a typical Canadian family consisting of two parents and two children with an average household income of $188,691 will pay $19,060 for public health care this year. Couples without dependent children will pay an estimated $17,338. Single Canadians will pay $5,703 for health care insurance, and single parents with one child will pay $5,934.

Since 1997, the first year for which data is available, the cost of healthcare for the average Canadian family has increased substantially, and has risen more quickly than its income. In fact, the cost of public health care insurance for the average Canadian family increased 2.2 times as fast as the cost of food, 1.6 times as fast as the cost of housing, and 1.6 times as fast as the average income.

“Understanding how much Canadians actually pay for health care, and how much that amount has increased over time, is an important first step for taxpayers to assess the value and performance of the health-care system, and whether it’s financially sustainable,” Esmail said.

The Price of Public Health Care Insurance, 2025

- Canadians often misunderstand the true cost of our public health care system. This occurs partly because Canadians do not incur direct expenses for their use of health care, and partly because Canadians cannot readily determine the value of their contribution to public health care insurance.

- In 2025, preliminary estimates suggest the average payment for public health care insurance ranges from $5,213 to $19,060 for six common Canadian family types, depending on the type of family.

- Between 1997 and 2025, the cost of public health care insurance for the average Canadian family increased 2.2 times as fast as the cost of food, 1.6 times as fast as the average income, and 1.6 times as fast as the cost of shelter. It also increased much more rapidly than the average cost of clothing, which has fallen in recent years.

- The 10 percent of Canadian families with the lowest incomes will pay an average of about $702 for public health care insurance in 2025. The 10 percent of Canadian families who earn an average income of $88,725 will pay an average of $8,292 for public health care insurance, and the families among the top 10 percent of income earners in Canada will pay $58,853.

-

Business2 days ago

Business2 days agoMark Carney’s Climate Competitiveness Pitch Falls Flat

-

Business2 days ago

Business2 days agoCanada Post is broken beyond repair

-

Alberta2 days ago

Alberta2 days agoMaritime provinces can enact policies to reduce reliance on Alberta… ehem.. Ottawa

-

Business2 days ago

Business2 days agoCanada can’t allow so many people to say ‘no’ to energy projects

-

International2 days ago

International2 days agoNepal Tried To Censor The Internet. Young People Set Parliament on Fire.

-

Crime2 days ago

Crime2 days agoCharlotte train killer hit with federal murder charge, faces max penalty

-

Alberta2 days ago

Alberta2 days agoYes Alberta has a spending problem. But it has solutions too

-

Business1 day ago

Business1 day agoHealth-care costs for typical Canadian family will reach over $19,000 this year