Alberta

High costs, low returns – Canada’s wildly expensive emissions cap

In this new commentary, Director of Energy, Natural Resources, and Environment Heather Exner-Pirot reveals why the Canadian government’s oil and gas emissions cap isn’t just expensive – it’s economic insanity.

Canada is the world’s third-largest exporter of oil, fourth-largest producer, and top source of imports to the United States. Much of Canada’s oil wealth is concentrated in the oil sands in northern Alberta, which hosts 99 percent of the country’s enormous oil endowment: about 160 billion barrels of proven reserves, of a total resource of approximately 1.8 trillion barrels. This is the major source of oil to the United States refinery complex, a large part of which is optimized for the oil sands’ heavy oil.

Reliability of energy supply has remerged as a major geopolitical issue. Canadian oil and gas is an essential component of North American energy security. Yet a proposed cap on emissions from the sectors promises to cut Canadian production and exports in the years ahead. It would be hard to provide less environmental benefit for a higher economic and security cost. There are far better ways to reduce emissions while maintaining North America’s security of energy supply.

The high cost of the cap

In 1994 a Liberal federal government, Alberta provincial conservative government and representatives from the oil and gas industry, working together through the national oil sands task force, developed A New Energy Vision for Canada. Their efforts turned what was then a middling resource into a trillion dollar nation-building project. Production has increased tenfold since the report came out.

The task force acknowledged the need for industry to “put its best efforts toward … reducing greenhouse gas emissions.” However, it also expected governments to “understand” that there “is no benefit to Canada or to the environment to have production and value-added processing done outside of the country in less efficient jurisdictions … policies set by regulator must not result in discouraging oil sands production.”

As part of its efforts to meet its climate goals under the Paris Accord, the Canadian government proposed a regulatory framework for an emissions cap on the oil and gas sector in December 2023. It set a legally binding limit on greenhouse gas emissions, targeting a 35 to 38 percent reduction from 2019 levels by 2030 for upstream operations, through regulations to be made under the Canadian Environmental Protection Act, 1999 (CEPA).

The federal government has not yet finalized its proposed regulations. However, industry experts and economists have criticized the current iteration as logistically unworkable, overly expensive, and likely to be challenged as unconstitutional. In effect, this policy layers a cap-and-trade system for just one sector (oil and gas) on top of a competing carbon pricing mechanism (the large-emitter trading systems, often referred to as the industrial carbon price), a discriminatory practice that also undermines the entire economic rationale of a carbon pricing system.

While the Canadian government has maintained that it is focused on reducing emissions rather than production – the latter of which would put it at odds with provincial jurisdiction over non-renewable resources – a series of third party analyses as well as the Parliamentary Budget Office’s own impact assessment find it would indeed constrain Canadian oil and gas production. The economic cost of the emissions cap far exceeds any corresponding benefit in reduced emissions.

How much will the emissions cap cost in terms of dollar per tonne of carbon in avoided emissions, both domestically and globally? Based solely on the cost to the Canadian economy, we estimate the emission cap is equivalent to a C$2,887/tonne carbon price by 2032.

Assuming no impact on global demand and full substitution by non-Canadian crudes, it finds that the cost of each tonne of carbon displaced globally is between C$96,000 to C$289,000 for oil sands bitumen production. For displaced Canadian conventional and natural gas, the cost is infinite, i.e. global emissions would actually be higher for every barrel or unit of Canadian oil and gas displaced with competitor products as a result of the emissions cap.

Canadian oil and gas emissions reduction efforts

The oil and gas sector is the highest emitting economic sector in Canada. However, it has made substantial efforts to reduce emissions over the past two decades and is succeeding. Absolute emissions in the sector peaked in 2014, despite production growing by over a million barrels of oil equivalent since (see Figure 1).

Figure 1 Indexed greenhouse gas (GHG) emissions (and gross domestic product (GDP) at basic prices, for the oil and gas extraction industry, 2009 to 2022 (2009 = 100). Source: Statistics Canada 2024.

Figure 1 Indexed greenhouse gas (GHG) emissions (and gross domestic product (GDP) at basic prices, for the oil and gas extraction industry, 2009 to 2022 (2009 = 100). Source: Statistics Canada 2024.

Much of this success can be attributed to methane capture, particularly in the natural gas and conventional oil sectors, where absolute emissions peaked in 2007 and 2014 respectively.

Since 2014, the oil sands have dramatically increased production by over a million barrels per day, but at the same time have reduced the emissions per barrel every year, leaving the absolute emissions of the oil and gas sector relatively flat. The oil sands are performing well vis-à-vis their international peers, seeing their emissions per barrel decline by 30 percent since 2013, compared to 21 percent for global majors and 34 percent for US E&Ps (exploration and production companies) (see Figure 2).

Figure 2 Indexed Oil Sands GHG relative intensity trend (2013=100). Source: BMO Capital Markets, “I Want What You Got: Canada’s Oil Resource Advantage,” April 2025

Figure 2 Indexed Oil Sands GHG relative intensity trend (2013=100). Source: BMO Capital Markets, “I Want What You Got: Canada’s Oil Resource Advantage,” April 2025

On an emissions intensity absolute basis, the oil sands have significantly outperformed their peers, shaving off 25kg/barrel of emissions since 2013 (see Figure 3) and more than 65kg/barrel since the oil sands task force wrote their report in 1994.

As emissions improvements from methane reductions plateau, the oil sands are likely to outperform their conventional peers in emissions per barrel reductions going forward. The sector is working on strategies such as solvent extraction and carbon capture and storage that, if implemented, would reduce the life-cycle emissions per barrel of oil sands to levels at or below the global crude average.

Figure 3 Emissions intensity absolute change (kg CO2e/bbl) (2013–24E) Source: BMO Capital Markets, 2025

Figure 3 Emissions intensity absolute change (kg CO2e/bbl) (2013–24E) Source: BMO Capital Markets, 2025

The high cost of the cap

Several parties have analyzed the proposed emissions cap to determine its economic and production impact. The results of the assessments vary widely. For the purposes of this commentary we rely on the federal Office of the Parliamentary Budget Officer (PBO), which published its analysis of the proposed emissions cap in March 2025. Helpfully, the PBO provided a table summarizing the main findings of the various analyses (see Table 1).

The PBO found that the required reduction in upstream oil and gas sector production levels under an emissions cap would lower real gross domestic product (GDP) in Canada by 0.33 percent in 2030 and 0.39 percent in 2032, and reduce nominal GDP by C$20.5 billion by 2032. The PBO further estimated that achieving the legal upper bound would reduce economy-wide employment in Canada by 40,300 jobs and full-time equivalents by 54,400 in 2032.

Table 2 Comparison of estimated impacts of the proposed emissions cap in 2030. Source: PBO 2025

Table 2 Comparison of estimated impacts of the proposed emissions cap in 2030. Source: PBO 2025

However, the PBO does not estimate the carbon price per tonne of emissions reduced. This is a useful metric as Canadians have become broadly familiar with the real-world impacts of a price on carbon. The federal government quashed the consumer carbon price at $80/tonne in March 2025, ahead of the federal election, due to its unpopularity and perceived impacts on affordability. The federal carbon pricing benchmark is scheduled to hit C$170 in 2030. ECCC has quantified the damages of a tonne of carbon dioxide – referred to as the “Social Cost of Carbon” – as C$294/tonne.

Based on PBO assumptions that the emissions cap will reduce emissions by 7.1MT and reduce GDP by $20.5 billion in 2032, the implied carbon price is C$2,887/tonne.

Emissions cap impact in a global context

Even this eye-popping figure does not tell the full story. The Canadian oil and gas production that must be withdrawn to meet the requirements of the emissions cap will be replaced in global markets from other producers; there is no reason to assume the emissions cap will affect global demand.

Based on life-cycle GHG emissions of the sample of crudes used in the US refinery complex, Canadian oil sands produce only 1 to 3 percent higher emissions than a global average[1] (see Figure 4), with some facilities producing lower emissions than the average barrel.

Figure 4 Life Cycle GHG emissions of crude oils (kg CO2e/bbl). Source: BMO Capital Markets 2025

Figure 4 Life Cycle GHG emissions of crude oils (kg CO2e/bbl). Source: BMO Capital Markets 2025

As such, the emissions cap, if applied just to oil sands production, would only displace global emissions of 71,000 to 213,000 tonnes (1 to 3 percent of 7.1MT). At a cost of C$20.5 billion for those global emissions reductions, the price of carbon is equivalent to C$96,000 to C$289,000 per tonne (see Figure 5).

Figure 5 Cost per tonne of emissions cap behind domestic carbon all (left) and post-global crude substitution (right)

Figure 5 Cost per tonne of emissions cap behind domestic carbon all (left) and post-global crude substitution (right)

For any displaced conventional Canadian crude oil or natural gas, the situation becomes absurd. Because Canadian conventional oil and natural gas have a lower emissions intensity than global averages, global product substitutions resulting from the emissions cap would actually serve to increase global emissions, resulting in an infinite price per tonne of carbon.

The C$100k/tonne carbon price estimate is probably low

We believe our assessment of the effective carbon price of the emissions cap at C$96,000+/tonne to be conservative for the following reasons.

First, it assumes Canadian heavy oil will be displaced in global markets by an average, archetypal crude. In fact, it would be displaced by other heavy crudes from places like Venezuela, Mexico, and Iraq (see Figure 4), which have higher average emissions per barrel than Canadian oil sands crudes. In such a circumstance, global emissions would actually rise and the price per carbon tonne from an emissions cap on oil sands production would also effectively be infinite.

Secondly, emissions cap impact assumptions by the PBO are likely conservative. Those by ECCC, based on a particular scenario outlook, are already outdated. ECCC assumed a production loss of only 0.7 percent by 2030, with oil sands production hitting approximately 3.7 million barrels (MMbbls) per day of bitumen production in 2030. According to S&P Global analysis, that level is likely to be hit this year.[2]

S&P further forecasts oil sands production to reach 4.0 MMbbls by 2030, or about 300,000 barrels more than it produces today. This would represent a far lower production growth rate than the oil sands have experienced in the past five years. But assuming the S&P forecast is correct, production would need to decline in the oil sands by 8 percent to meet the emissions cap requirements. PBO assumed only a 5.4 percent overall oil and gas production loss and ECCC assumed only 0.7 percent, while Conference Board of Canada assumed an 11.1 percent loss and Deloitte assumed 11.5 percent (see Table 1). Production numbers to date more closely align with Conference Board of Canada and Deloitte projections.

Let’s make the Canadian oil and gas sector better, not smaller

The Canadian oil and gas sector, and in particular the oil sands, has a responsibility to do their part to reduce emissions while maintaining competitive businesses that can support good Canadian jobs, provide government revenues and diversify exports. The oil sands sector has re-invested for decades in continuous improvements to drive down production costs while improving its emissions per barrel.

It is hard to conceive of a more expensive and divisive way to reduce emissions from the sector and from the Canadian economy than the proposed emissions cap. Other expensive programs, such as Norway’s EV subsidies, the United Kingdom’s offshore wind contracts-for-difference, Germany’s Energiewende feed-in-tariffs and surcharges, and US Inflation Reduction Act investment tax credits, don’t come close to the high costs of the emissions cap on a price-per-tonne of carbon abated basis.

The emissions cap, as currently proposed, will make Canada’s oil and gas sector significantly less competitive, harm investment, and undermine Canada’s vision to be an energy superpower. This policy will also reduce the oil and gas sector’s capacity to invest in technologies that drive additional emission reductions, such as solvents and carbon capture, especially in our current lower price environment. As such it is more likely to undermine climate action than support it.

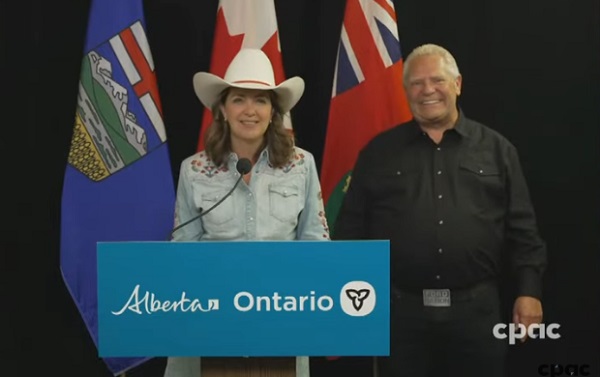

The federal and provincial governments have come together to advance a vision for Canadian energy in the past. In this moment, they have the opportunity once again to find real solutions to the climate challenge while harnessing the energy sector to advance Canada’s economic well-being, productivity, and global energy security.

About the author

Heather Exner-Pirot is Director of Energy, Natural Resources, and Environment at the Macdonald-Laurier Institute.

Alberta

Alberta’s E3 Lithium delivers first battery-grade lithium carbonate

E3 Lithium employees walk through the company’s lithium pilot plant near Olds

From the Canadian Energy Centre

E3 Lithium milestone advances critical mineral for batteries and electrification

A new Alberta facility has produced its first battery-grade lithium carbonate, showcasing a technology that could unlock Canada’s largest resources of a critical mineral powering the evolving energy landscape.

In an unassuming quonset hut in a field near Olds, Calgary-based E3 Lithium’s demonstration plant uses technology to extract lithium from an ocean of “brine water” that has sat under Alberta’s landscape along with oil and gas for millions of years.

Lithium is one of six critical minerals the Government of Canada has prioritized for their potential to spur economic growth and their necessity as inputs for important products.

“The use for lithium is now mainly in batteries,” said E3 Lithium CEO Chris Doornbos.

“Everything we use in our daily lives that has a battery is now lithium ion: computers, phones, scooters, cars, battery storage, power walls in your house.”

Doornbos sees E3 as a new frontier in energy and mineral exploration in Alberta, using a resource that has long been there, sharing the geologic space with oil and gas.

“[Historically], oil and water came out together, and they separated the oil from the water,” he said.

“We don’t have oil. We take the lithium out of the water and put the water back.”

Lithium adds to Canada’s natural resource strength — the country’s reserves rank sixth in the world, according to Natural Resources Canada.

About 40 per cent of these reserves are in Alberta’s Bashaw District, home to the historic Leduc oilfield, where E3 built its new demonstration facility.

“It’s all in our Devonian rocks,” Doonbos said. “The Devonian Stack is a carbonate reef complex that would have looked like the Great Barrier Reef 400 million years ago. That’s where the lithium is.”

Funded in part by the Government of Canada and the Government of Alberta via Alberta Innovates and Emissions Reduction Alberta (ERA), the project aims to demonstrate that the Alberta reserve of lithium can be extracted and commercialized for battery production around the world.

E3 announced it had produced battery-grade lithium carbonate just over two weeks after commissioning began in early September.

In a statement, ERA celebrated the milestone of the opening of the facility as Alberta and Canada seek to find their place in the global race for more lithium as demand for the mineral increases.

“By supporting the first extraction facility in Olds, we’re helping reduce innovation risk, generate critical data, and pave the way for a commercial-scale lithium production right here in Alberta,” ERA said.

“The success from this significant project helps position Alberta as a global player in the critical minerals supply chain, driving the global electrification revolution with locally sourced lithium.”

With the first phase of the demonstration facility up and running, E3 has received regulatory permits to proceed with a second phase that involves drilling a production and injection well to confirm brine flow rates and reservoir characteristics. This will support designs for a full-scale commercial facility.

Lithium has been highlighted by the Alberta Energy Regulator (AER) as an emerging resource in the province.

The AER projects Alberta’s lithium output will grow from zero in 2024 to 12,300 tonnes by 2030 and nearly 15,000 tonnes by 2034. E3 believes it will beat these timeframes with the right access to project financing.

E3 has been able to leverage Alberta’s regulatory framework around the drilling of wells to expand into extraction of lithium brine.

“The regulator understands intimately what we are doing,” Doornbos said.

“They permit these types of wells and this type of operation every day. That’s a huge advantage to Alberta.”

Alberta

In Federal vs Provincial Battles, Ontario In No Longer A Great Ally For Alberta

Alberta Could Make A Deal With Bill Davis’ Ontario. Just One Problem.

Last month my friend Steve Paikin and I did a public appearance at the lovely Oshawa Town Square, recalling the highlights of our careers and the stories behind the stories. One of Steve’s stories was the subject of one of his 847 books, Bill Davis, the former premier of Ontario from 1971-1985.

He came to power the year our family moved to Ontario, so we watched his arc in power, from centrist Conservative to key figure in the interminable constitutional wrangles of the time. He typified a no-drama approach long before Barack Obama adopted it. His most controversial move was granting equal funding to Catholic schools. And smoking a pipe.

Which led me to ask Steve, the Most Ontario Man In The World, if it was still the same “place to stand, place to grow” province that Davis ruled. If anyone should know, the former TV Ontario stalwart was likely that person. Steve said that, generally, he felt that it was similar to what existed in the 70s and 80s. Obviously there were changes, but the mood was similar. After all, they’d elected Conservative Doug Ford three times.

My response? That would make Alberta very happy. Alberta could make a deal with Bill Davis’ Ontario. Why? A Bill Davis Ontario would never tell another province to keep its oil in the ground, to hobble its economy to suit climate obsessions in his own province. A Bill Davis Ontario would support nation-building projects like trans-Canada pipelines not forcing Alberta to sell their oil at a discount to the U.S. A Bill Davis Ontario would never support gun seizures from law-abiding owners.

With respect, Steve, the Bill Davis Ontario is no more. There is no deal to be made at the moment. It is a place captured by the globalist fevers of Great Thunberg climate. It is a province in the thrall of liberal indigenous guilt marinated by its teachers and media. It is a province whose real-estate bubble is poisoning the national economy.

It is a province where politicians and leaders struggle to define a woman. Worst of all, Ontario returned an incompetent trust fund flibberty-gibbet not once, but three times as prime minister. The damage to the nation has been incalculable. Now they’ve elected his economic advisor.

And yet many of our Eastern friends believe that we are the ones who’ve have changed. They tell us we have drunk the cowboy Kool-aid and are now irredeemable. What they mean is, you’re become a traitor to your class. “Down the rabbit hole”. Cast out for being a Bill Davis centrist.

But we have not changed. Much of Alberta’s culture has not changed significantly, despite an NDP episode in government from 2012-15. Bill Davis, who died in 2021, would not find much change outside of the immigrants dropped on it by Justin Trudeau were he to visit today.

But eastern Canada? The whiplash changes might best be summed up by Vince Gasparro, the Liberal MP for a midtown Toronto riding, claiming that Canada’s economy is swell compared to other nations. To which the interim parliamentary budget officer Jason Jacques said just because someone else is 450 pounds and sick doesn’t mean an obese 350-pound person is healthy.

Forecasting a conservative $68.5 billion deficit, Jacques called the economy “unsustainable” and said the nation is at the precipice. “We’re at a point where, based upon our numbers, things cannot continue as they are, and I think everybody knows that,” Jacques said, He was immediately attacked by Liberal bot-world claiming he’s angling for a job with the Conservatives.

The closing of the Laurentian mind reflects what happened to the NDP, the party of Tommy Douglas. Once a national lean-left collection of union workers, farmers, culture figures and academics, it took its lead from the avuncular Ed Broadbent, Audrey McLaughlin and even Jack Layton. Socialist with a friendly face. The leaders calmed the Marxist fevers of their radical fringe.

Then, in the aftermath of Layton’s death, the party convulsed. The union workers and farmers were pushed out by radicals drunk on virtue. Under the DEI hire Jagmeet Singh they purged common sense, leaving Liberals to scoop up their less unhinged members. The survivors of Jagmeet wore keffiyehs in Parliament and predicted environmental doom. The party became irrelevant in 95 percent of the nation.

Their reward was a descent from 103 seats in the 2011 election to non-party status with just seven seats and six percent of the vote this year. While they make noises of relevance, they are now like the Monty Python “Bring out yer’ dead” skit in Search For The Holy Grail.

Which is gravy for the Carney Liberals who can now talk centre but govern as far left as it wishes. Which the Toronto Star says may soon include criminalizing residential school “denialism.” The author Michelle Good says that questioning the unsupported tales of murdered babies is just like “holocaust denial”.

The NDP collapse mirrors what is happening to the Democratic Party in the U.S. By design or by accident Donald Trump has bludgeoned them into assuming most of the policies that are now putting a torpedo into the NDP. Defending crime, endorsing unfettered illegal immigration, patronizing Hamas and other bad actors on the world stage, Balkan economics. Hollywood preening.

While the reviled Trump remains unrepentant, Democrats continue to sink in the polls. Married to California values they’re at 28 percent approval in the polls, and none of their potential 2028 presidential hopefuls is adding anyone to the base.

So the DEMs leadership intimidates its followers with this fatal equation, claiming to be the party of the future. There are a scarce few who remind their colleagues of what’s been lost. Pennsylvania senator John Fetterman who won his crucial seat despite enduring a stroke during the election run-up, is sounding warnings, however.

“Unchecked extreme rhetoric, like labels as Hitler or fascist, will foment more extreme outcomes,” Fetterman wrote. “Political violence is always wrong — no exceptions. We must all turn the temperature down.”

“Absolutely, it’s a reward for Hamas,” he said after Canada and other nations recognized a Palestinian state. “That’s going to be their narrative. They’re going to claim ‘That’s why we did 10/7. That birthed our nation,’ and I can’t ever give that to them.”

But his fellow party members are too engrossed in Jimmy Kimmel’s veneration at BlueSky, the Woke site, to notice that their base has deserted them. Canada’s liberals looking over the edge still get their reinforcement from like-minded people and a bribed media. But as Jacques says, the end is nigh, and everyone knows it.

Bruce Dowbiggin @dowbboy is the editor of Not The Public Broadcaster A two-time winner of the Gemini Award as Canada’s top television sports broadcaster, his new book Deal With It: The Trades That Stunned The NHL And Changed hockey is now available on Amazon. Inexact Science: The Six Most Compelling Draft Years In NHL History, his previous book with his son Evan, was voted the seventh-best professional hockey book of all time by bookauthority.org . His 2004 book Money Players was voted sixth best on the same list, and is available via brucedowbigginbooks.ca.

-

Automotive2 days ago

Automotive2 days agoCanada’s EV subsidies are wracking up billions in losses for taxpayers, and not just in the auto industry

-

Business1 day ago

Business1 day agoUK Government Dismisses Public Outcry, Pushes Ahead with Controversial Digital ID Plan

-

Crime1 day ago

Crime1 day agoThe “Strong Borders Act,” Misses the Mark — Only Deep Legal Reforms Will Confront Canada’s Fentanyl Networks

-

COVID-192 days ago

COVID-192 days agoBiden admin put ‘anti-maskers’ on TSA no-fly list normally reserved for terrorists

-

Business2 days ago

Business2 days agoBrave Browser Surpasses 100 Million Monthly Users

-

Business2 days ago

Business2 days agoCarney government refuses to make tough decisions to avoid larger deficit

-

Censorship Industrial Complex1 day ago

Censorship Industrial Complex1 day agoBill C-9 and the Tyranny of Feeling Heading Straight for Canadians

-

Red Deer1 day ago

Red Deer1 day agoThe City or Red Deer Financial Troubles: The Role of Good Governance, Effective Policies and Key Performance Metrics.