Fraser Institute

Health-care lessons from Switzerland for a Canada ready for reform

From the Fraser Institute

Last year marked the 40th anniversary of the Canada Health Act, long considered a pillar of national identity. But today, that symbol is showing signs of strain. Despite record government spending, health-care wait times have reached historic highs—more than 30 weeks on average for planned treatment—and access to care continues to deteriorate. Fewer than one in five Canadians now say the system works well.

While political leaders tinker at the margins, countries such as Switzerland have taken bold steps to build universal health-care systems that are more responsive, more flexible and, above all, more accessible.

Switzerland achieves universal health coverage through a fundamentally different and patient-centered model. Instead of relying on a government monopoly, the Swiss health-care system is organized around principles of regulated competition. Forty-four private non-profit insurers offer standardized basic coverage, and every resident must enroll. But unlike in Canada, Swiss patients are free to choose their insurer and switch plans twice a year. This freedom of choice drives insurers to innovate, tailor benefits, and ultimately improve service.

Switzerland’s universal system is also more comprehensive than Canada’s. It covers not only hospital and physician services, but also prescription drugs, mental health care and certain long-term care services. At the same time, patients can choose from a variety of plan designs, which have varying deductibles and premiums, and manage care based on their preferences.

By contrast, the Canadian system offers virtually no choice. The government enrols every citizen in the same plan, with the same benefits, on the same terms. The Canada Health Act, the federal legislation meant to promote equity, prohibits flexibility. It’s a lowest-common-denominator model—rigid, bureaucratic and unresponsive to patient needs.

Nowhere is this clearer than how we access care. In Canada, patients must go through a family doctor—compulsory gatekeeping—before seeing a specialist. But six million Canadians don’t even have a family doctor. For them, this requirement isn’t just inconvenient, it’s a dead end. The result is long delays, lost diagnoses and growing public frustration.

Conversely, the Swiss model prioritizes adaptability, driven by the power of patient choice and regulated competition among insurance providers. Because residents can switch insurers twice a year and select among different care models, insurers are incentivized to innovate and respond to evolving needs. As a result, patients can choose from a variety of insurance plans: a standard model with no gatekeeping; managed care with family doctors; pharmacy-based coordination; telemedicine-first plans, or other models. And they don’t have wait long. According to the latest survey from the Commonwealth Fund, 76 per cent of Swiss residents are able to obtain a medical appointment with a doctor or nurse within five days, compared to only 46 per cent of Canadians.

In addition to expanding patient choice, these different plan options help insurers control costs by reducing unnecessary consultations and hospitalizations. Studies show that such models can lower the cost of care by up to 34 per cent without compromising quality while also discouraging unnecessary treatments or hospital visits. And these plans encourage health-care providers to focus on prevention and chronic care management, ultimately improving efficiency and outcomes while the savings allow insurers to reduce premiums and control long-term spending. In fact, despite offering greater choice and a broader package of health-care services than Canada, real health-care spending (per person) in Switzerland has grown by less than 2 per cent annually since the mid-1990s compared to 2.7 per cent in Canada.

These Swiss facts, which are likely music to the ears of Canadians, raise a key question: how much do Swiss citizens pay out-of-pocket for health care?

While Swiss residents do share some costs through deductibles and co-payments, these costs are capped and vulnerable populations (children, pregnant women, low-income people, etc.) are exempt.

In 2022 (the latest year of available data), average annual out-of-pocket spending per insured person in Switzerland was 581 Swiss francs, equivalent to C$792. For people who don’t require much care, the costs are much lower or non-existent. And nearly 28 per cent of the population receives subsidies to cover their premiums.

Of course, many Canadians assume our system as “free,” forgetting that it’s funded through general taxation. They also tend to overlook our significant out-of-pocket costs not covered by the public system (prescription drugs, mental health care, long-term care, etc.).

Nevertheless, Canada can’t simply copy-and-paste the Swiss model. The Canada Health Act currently prohibits co-payments and mandates uniform public insurance. But that doesn’t mean we have nothing to learn. Switzerland shows that universality isn’t incompatible with choice and competition. In fact, these goals can strengthen each other. When patients have freedom of choice, a health-care system becomes not only more efficient but also more responsive to their needs and preferences. In other words, it becomes a true health-care system.

Canada’s health-care debate has long been framed as a rigid dichotomy between a government monopoly and a privately-funded system where any reform is seen as a threat to universality. This mindset has stifled innovation and made it harder to build a system that is both universal and responsive. Switzerland points the way forward, with a model that reconciles equity, choice and adaptability in ways Canadian policymakers can no longer afford to ignore.

Alberta

Calgary mayor should retain ‘blanket rezoning’ for sake of Calgarian families

From the Fraser Institute

By Tegan Hill and Austin Thompson

Calgary’s new mayor, Jeromy Farkas, has promised to scrap “blanket rezoning”—a policy enacted by the city in 2024 that allows homebuilders to construct duplexes, townhomes and fourplexes in most neighbourhoods without first seeking the blessing of city hall. In other words, amid an affordability crunch, Mayor Farkas plans to eliminate a policy that made homebuilding easier and cheaper—which risks reducing housing choices and increasing housing costs for Calgarian families.

Blanket rezoning was always contentious. Debate over the policy back in spring 2024 sparked the longest public hearing in Calgary’s history, with many Calgarians airing concerns about potential impacts on local infrastructure, parking availability and park space—all important issues.

Farkas argues that blanket rezoning amounts to “ignoring the community” and that Calgarians should not be forced to choose between a “City Hall that either stops building, or stops listening.” But in reality, it’s virtually impossible to promise more community input on housing decisions and build more homes faster.

If Farkas is serious about giving residents a “real say” in shaping their neighbourhood’s future, that means empowering them to alter—or even block—housing proposals that would otherwise be allowed under blanket rezoning. Greater public consultation tends to give an outsized voice to development opponents including individuals and groups that oppose higher density and social housing projects.

Alternatively, if the mayor and council reform the process to invite more public feedback, but still ultimately approve most higher-density projects (as was the case before blanket rezoning), the consultation process would be largely symbolic.

Either way, homebuilders would face longer costlier approval processes—and pass those costs on to Calgarian renters and homebuyers.

It’s not only the number of homes that matters, but also where they’re allowed to be built. Under blanket rezoning, builders can respond directly to the preferences of Calgarians. When buyers want duplexes in established neighbourhoods or renters want townhomes closer to work, homebuilders can respond without having to ask city hall for permission.

According to Mayor Farkas, higher-density housing should instead be concentrated near transit, schools and job centres, with the aim of “reducing pressure on established neighbourhoods.” At first glance, that may sound like a sensible compromise. But it rests on the flawed assumption that politicians and planners should decide where Calgarians are allowed to live, rather than letting Calgarians make those choices for themselves. With blanket rezoning, new homes are being built in areas in response to buyer and renter demand, rather than the dictates of city hall. The mayor also seems to suggest that city hall should thwart some redevelopment in established neighbourhoods, limiting housing options in places many Calgarians want to live.

The stakes are high. Calgary is not immune to Canada’s housing crisis, though it has so far weathered it better than most other major cities. That success partly reflects municipal policies—including blanket rezoning—that make homebuilding relatively quick and inexpensive.

A motion to repeal blanket rezoning is expected to be presented to Calgary’s municipal executive committee on Nov. 17. If it passes, which is likely, the policy will be put to a vote during a council meeting on Dec. 15. As the new mayor and council weigh changes to zoning rules, they should recognize the trade-offs. Empowering “the community” may sound appealing, but it may limit the housing choices available to families in those communities. Any reforms should preserve the best elements of blanket rezoning—its consistency, predictability and responsiveness to the housing preferences of Calgarians—and avoid erecting zoning barriers that have exacerbated the housing crisis in other cities.

Austin Thompson

Fraser Institute

Courts and governments caused B.C.’s property crisis—they’re not about to fix it

From the Fraser Institute

By Bruce Pardy

In British Columbia, property rights are in turmoil. The B.C. Supreme Court recently declared that Aboriginal title exists on 800 acres of land in Richmond, a suburb of Vancouver. Aboriginal title, said the court, is “senior and prior” to fee simple interests. In the shadow of the decision, given the implications, Aboriginal title claims are receiving more attention. Kamloops and Sun Peaks ski resort are targets in one such claim. Meanwhile, the B.C. government has been conferring Aboriginal title across the province too. It continues to make agreements, such as on Haida Gwaii, to transfer control over land use in the province.

Courts and governments have caused this problem. The framers of Canada’s new constitution, adopted in 1982, excluded rights to private property. But at the last hour, they guaranteed existing Aboriginal rights and title. Over decades, the Supreme Court of Canada has expanded the scope of those rights. The recent decision about Richmond is a culmination of its work. That decision is under appeal, first to the B.C. Court of Appeal. After that, we may find out if the Supreme Court approves. But that could take years.

It’s not just the courts. In 2015, the Trudeau government agreed to implement the United Nations Declaration on the Rights of Indigenous Peoples (UNDRIP). UNDRIP says that Aboriginal groups have the right to own, use, develop and control any lands that they traditionally occupied or used. In 2019, the B.C. legislature incorporated UNDRIP into BC law. Known as DRIPA, the statute requires B.C. law to be consistent with UNDRIP. The NDP government has been granting Aboriginal title and control across the province accordingly.

What can be done? The Canadian constitution has an onerous amending formula. Repealing the section on Aboriginal rights would be next to impossible. So would adding private property guarantees to the Charter. But last week, Dwight Newman, professor of law at the University of Saskatchewan, suggested an alternative in the Post. Rather than attempt wholesale change, he proposed an amendment specific to B.C.

Section 43 is one of the ways to amend the Canadian constitution. It allows changes “in relation to any provision that applies to one or more, but not all, provinces.” The requirements are simple. The legislature in one province and the federal Parliament must both pass a resolution declaring the amendment. That’s it. Such a resolution, Newman suggests, could guarantee that private property in B.C. has priority over Aboriginal title.

He might be right. Section 43 has been used, for example, to alter constitutional denominational school rights in Quebec and Newfoundland. In 1993, New Brunswick used Section 43 to add a provision to the Charter about linguistic rights in the province.

But Section 43 might be narrower than hoped. The New Brunswick amendment was not challenged in court at the time of its enactment. So, yes, Section 43 was used to change the Charter, but not with judicial benediction. Moreover, the Supreme Court has not considered the ways in which Section 43 can be used. Section 43 amendments so far have been minor, mere “tweaks” to the constitutional order. We do not know what meaning the Court might give to “any provision that applies to one province.” It could mean any new provision, but more likely it means any existing provision that applies only to the province. Which would rule out using Section 43 to protect property rights from Aboriginal title in B.C. If the Court allowed Section 43 to be used for that purpose, then Section 43 could theoretically be used for anything, including amending the Charter wholesale until each province had its own version.

Even if Section 43 could be used to fix the property mess, it requires both the province and Ottawa to act. In addition, B.C. legislation requires that such changes be first approved by referendum. The B.C. and federal governments have helped to cause the crisis and continue to do so. They seem intent on undermining the system of land tenure in their own society. They are not likely to disrupt the constitution to frustrate their own work.

Moreover, there are other, simpler places to begin. The federal government could reverse its support for UNDRIP. The B.C. legislature could repeal DRIPA. Neither sitting government will do that. Few political actors will step out of line on Aboriginal questions, even to defend the country’s land, economy, and people. Will we discover whether there is anything more Canadian, after all, than acquiescence? In Canada, truth and reconciliation has morphed into fiction and capitulation.

Canada’s property crisis runs deep, and not just in B.C. Aboriginal rights are widely regarded as the natural and proper order of things. Special status for Aboriginal people is deeply ingrained in Canadian culture as well as the constitution. But it is dead wrong. Legal rights should not depend on lineage or group affiliation. Everyone born in Canada is native to the place. In a free country, laws apply not to distinctive peoples, but to individual people and their private property.

-

Crime2 days ago

Crime2 days agoCBSA Bust Uncovers Mexican Cartel Network in Montreal High-Rise, Moving Hundreds Across Canada-U.S. Border

-

Environment2 days ago

Environment2 days agoThe Myths We’re Told About Climate Change | Michael Shellenberger

-

Health2 days ago

Health2 days agoLack of adequate health care pushing Canadians toward assisted suicide

-

Alberta1 day ago

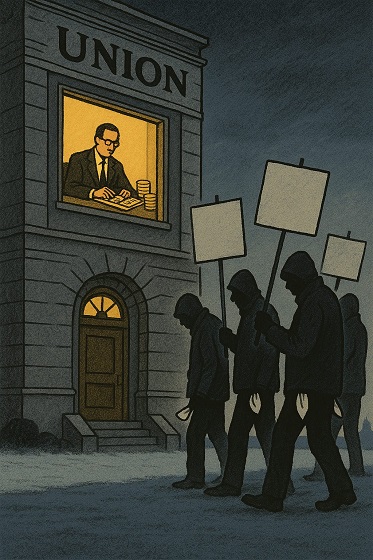

Alberta1 day agoATA Collect $72 Million in Dues But Couldn’t Pay Striking Teachers a Dime

-

Artificial Intelligence2 days ago

Artificial Intelligence2 days agoAI Faces Energy Problem With Only One Solution, Oil and Gas

-

Media1 day ago

Media1 day agoBreaking News: the public actually expects journalists to determine the truth of statements they report

-

Artificial Intelligence1 day ago

Artificial Intelligence1 day agoAI seems fairly impressed by Pierre Poilievre’s ability to communicate

-

National1 day ago

National1 day agoWatchdog Demands Answers as MP Chris d’Entremont Crosses Floor