Economy

Greater oil and gas export capacity will boost Canadian dollar – and productivity

From the Frontier Centre for Public Policy

By Ian Madsen

It may be overly optimistic to think that Canadian producers could reap CAD$10 in gross profit per GJ, let alone the full almost-$20 price differential. However, even if it is just $5 per GJ, that generates $90 million per day, or almost $33 billion per year.

Canada’s productivity performance has been dismal, having not increased over the last nearly ten years. Economists calculate productivity as the value of output divided by hours worked to generate that output. However, the numerator, being the value of the goods and services produced, has been either neglected, or, when it is actually addressed, is looked at from the perspective of new, ‘high tech’ products and services (information technology, artificial intelligence, or advanced equipment, materials and devices). While all these industries are important, other sectors boost value, too.

Foremost among those sectors is energy – where Canada has outstanding competitive advantages, but still does not get full value for its output. Canada’s oil exports now go entirely to the United States, mostly via pipelines from Alberta and Saskatchewan, with a small amount sent by ship from the Vancouver area to U.S. West Coast customers. All Canadian natural gas exports go entirely to the U.S., which already has a surplus.

The situation severely harms Canadian producers’ bargaining power, which causes them to experience severe discounts on natural gas and oil (whether heavy oil sands, Western Canada Select, ‘bitumen’; or conventional crude oil). Fortunately, the situation will change radically, either next year, or, possibly, later this year.

The reason: Canada LNG, the first of possibly several West Coast liquefied natural gas liquefaction export terminals, should soon commence shipments to foreign buyers (South Korean, Japanese utilities, and others in East Asia). The export capacity of the Kitimat, BC, facility is 1.8 billion cubic feet daily, or 1.8 million Gigajoules, ‘GJ’.

Natural gas now sells for about $2.50/GJ Canadian in Alberta, whereas East Asian recent prices were US$16.70: about CAD$22.25. (It costs several dollars to liquify, load, transport and re-gasify at destination each GJ.) Every dollar of after-cost price differential flows directly to producers, and Canada’s balance of payments. The balance of payments determines our loonie’s value, and, thus, Canada’s standard of living (also, to some extent, inflation).

It may be overly optimistic to think that Canadian producers could reap CAD$10 in gross profit per GJ, let alone the full almost-$20 price differential. However, even if it is just $5 per GJ, that generates $90 million per day, or almost $33 billion per year. As total exports were $596.9 billion in 2022, this would constitute an increase of about 5.5%. This amounts to roughly $1,610 per person in Canada’s current 20.5 million-strong labour force – a big productivity increase for ‘little’ extra work (as everything will have already been built).

Yet, that is not all. There is also the TransMountain, ‘TMX’, pipeline expansion, scheduled for completion this year. Its extra capacity of 590,000 barrels per day is all slated to be exported. If ‘just’ $10 extra per barrel is garnered (the U.S. heavy oil differential exceeds that, typically), that would bring $5.9 million more per day: $2.15 billion annually.

This would also contribute to a better balance of payments (perhaps becoming positive once more), a higher loonie, higher productivity, lower inflation, and a higher standard of living. Australia, which now outperforms Canada, does not interfere with its own massive LNG exports. If Canadian politicians can restrain themselves from blocking more oil or gas pipelines and LNG export terminals, a bright future awaits.

Ian Madsen is the Senior Policy Analyst at the Frontier Centre for Public Policy

Watch Ian Madsen on Frontier Live on X here.

Business

Taxing food is like slapping a surcharge on hunger. It needs to end

This article supplied by Troy Media.

Cutting the food tax is one clear way to ease the cost-of-living crisis for Canadians

About a year ago, Canada experimented with something rare in federal policymaking: a temporary GST holiday on prepared foods.

It was short-lived and poorly communicated, yet Canadians noticed it immediately. One of the most unavoidable expenses in daily life—food—became marginally less costly.

Families felt a modest but genuine reprieve. Restaurants saw a bump in customer traffic. For a brief moment, Canadians experienced what it feels like when government steps back from taxing something as basic as eating.

Then the tax returned with opportunistic pricing, restoring a policy that quietly but reliably makes the cost of living more expensive for everyone.

In many ways, the temporary GST cut was worse than doing nothing. It opened the door for industry to adjust prices upward while consumers were distracted by the tax relief. That dynamic helped push our food inflation rate from minus 0.6 per cent in January to almost four per cent later in the year. By tinkering with taxes rather than addressing the structural flaws in the system, policymakers unintentionally fuelled volatility. Instead of experimenting with temporary fixes, it is time to confront the obvious: Canada should stop taxing food altogether.

Start with grocery stores. Many Canadians believe food is not taxed at retail, but that assumption is wrong. While “basic groceries” are zero-rated, a vast range of everyday food products are taxed, and Canadians now pay over a billion dollars a year in GST/HST on food purchased in grocery stores.

That amount is rising steadily, not because Canadians are buying more treats, but because shrinkflation is quietly pulling more products into taxable categories. A box of granola bars with six bars is tax-exempt, but when manufacturers quietly reduce the box to five bars, it becomes taxable. The product hasn’t changed. The nutritional profile hasn’t changed. Only the packaging has changed, yet the tax flips on.

This pattern now permeates the grocery aisle. A 650-gram bag of chips shrinks to 580 grams and becomes taxable. Muffins once sold in six-packs are reformatted into three-packs or individually wrapped portions, instantly becoming taxable single-serve items. Yogurt, traditionally sold in large tax-exempt tubs, increasingly appears in smaller 100-gram units that meet the definition of taxable snacks. Crackers, cookies, trail mixes and cereals have all seen slight weight reductions that push them past GST thresholds created decades ago. Inflation raises food prices; Canada’s outdated tax code amplifies those increases.

At the same time, grocery inflation remains elevated. Prices are rising at 3.4 per cent, nearly double the overall inflation rate. At a moment when food costs are climbing faster than almost everything else, continuing to tax food—whether on the shelf or in restaurants—makes even less economic sense.

The inconsistencies extend further. A steak purchased at the grocery store carries no tax, yet a breakfast wrap made from virtually the same inputs is taxed at five per cent GST plus applicable HST. The nutritional function is not different. The economic function is not different. But the tax treatment is entirely arbitrary, rooted in outdated distinctions that no longer reflect how Canadians live or work.

Lower-income households disproportionately bear the cost. They spend 6.2 per cent of their income eating outside the home, compared with 3.4 per cent for the highest-income households. When government taxes prepared food, it effectively imposes a higher burden on those often juggling two or three jobs with limited time to cook.

But this is not only about the poorest households. Every Canadian pays more because the tax embeds itself in the price of convenience, time and the realities of modern living.

And there is an overlooked economic dimension: restaurants are one of the most effective tools we have for stimulating community-level economic activity. When people dine out, they don’t just buy food. They participate in the economy. They support jobs for young and lower-income workers. They activate foot traffic in commercial areas. They drive spending in adjacent sectors such as transportation, retail, entertainment and tourism.

A healthy restaurant sector is a signal of economic confidence; it is often the first place consumers re-engage when they feel financially secure. Taxing prepared food, therefore, is not simply a tax on convenience—it is a tax on economic participation.

Restaurants Canada has been calling for the permanent removal of GST/HST on all food, and they are right. Eliminating the tax would generate $5.4 billion in consumer savings annually, create more than 64,000 foodservice jobs, add over 15,000 jobs in related sectors and support the opening of more than 2,600 new restaurants across the country. No other affordability measure available to the federal government delivers this combination of economic stimulus and direct relief.

And Canadians overwhelmingly agree. Eighty-four per cent believe food should not be taxed, regardless of where it is purchased. In a polarized political climate, a consensus of that magnitude is rare.

Ending the GST/HST on all food will not solve every affordability issue but it is one of the simplest, fairest and most effective measures the federal government can take immediately.

Food is food. The tax system should finally accept that.

Dr. Sylvain Charlebois is a Canadian professor and researcher in food distribution and policy. He is senior director of the Agri-Food Analytics Lab at Dalhousie University and co-host of The Food Professor Podcast. He is frequently cited in the media for his insights on food prices, agricultural trends, and the global food supply chain.

Troy Media empowers Canadian community news outlets by providing independent, insightful analysis and commentary. Our mission is to support local media in helping Canadians stay informed and engaged by delivering reliable content that strengthens community connections and deepens understanding across the country.

Community

Charitable giving on the decline in Canada

From the Fraser Institute

By Jake Fuss and Grady Munro

There would have been 1.5 million more Canadians who donated to charity in 2023—and $755.5 million more in donations—had Canadians given to the same extent they did 10 years prior

According to recent polling, approximately one in five Canadians have skipped paying a bill over the past year so they can buy groceries. As families are increasingly hard-pressed to make ends meet, this undoubtedly means more and more people must seek out food banks, shelters and other charitable organizations to meet their basic necessities.

And each year, Canadians across the country donate their time and money to charities to help those in need—particularly around the holiday season. Yet at a time when the relatively high cost of living means these organizations need more resources, new data published by the Fraser Institute shows that the level of charitable giving in Canada is actually falling.

Specifically, over the last 10 years (2013 to 2023, the latest year of available data) the share of tax-filers who reported donating to charity fell from 21.9 per cent to 16.8 per cent. And while fewer Canadians are donating to charity, they’re also donating a smaller share of their income—during the same 10-year period, the share of aggregate income donated to charity fell from 0.55 per cent to 0.52 per cent.

To put this decline into perspective, consider this: there would have been 1.5 million more Canadians who donated to charity in 2023—and $755.5 million more in donations—had Canadians given to the same extent they did 10 years prior. Simply put, this long-standing decline in charitable giving in Canada ultimately limits the resources available for charities to help those in need.

On the bright side, despite the worrying long-term trends, the share of aggregate income donated to charity recently increased from 0.50 per cent in 2022 to 0.52 per cent in 2023. While this may seem like a marginal improvement, 0.02 per cent of aggregate income for all Canadians in 2023 was $255.7 million.

The provinces also reflect the national trends. From 2013 to 2023, every province saw a decline in the share of tax-filers donating to charity. These declines ranged from 15.4 per cent in Quebec to 31.4 per cent in Prince Edward Island.

Similarly, almost every province recorded a drop in the share of aggregate income donated to charity, with the largest being the 24.7 per cent decline seen in P.E.I. The only province to buck this trend was Alberta, which saw a 3.9 per cent increase in the share of aggregate income donated over the decade.

Just as Canada as a whole saw a recent improvement in the share of aggregate income donated, so too did many of the provinces. Indeed, seven provinces (except Manitoba, Nova Scotia and Newfoundland and Labrador) saw an increase in the share of aggregate income donated to charity from 2022 to 2023, with the largest increases occurring in Saskatchewan (7.9 per cent) and Alberta (6.7 per cent).

Canadians also volunteer their time to help those in need, yet the latest data show that volunteerism is also on the wane. According to Statistics Canada, the share of Canadians who volunteered (both formally and informally) fell by 8 per cent from 2018 to 2023. And the total numbers of hours volunteered (again, both formal and informal) fell by 18 per cent over that same period.

With many Canadians struggling to make ends meet, food banks, shelters and other charitable organizations play a critical role in providing basic necessities to those in need. Yet charitable giving—which provides resources for these charities—has long been on the decline. Hopefully, we’ll see this trend turn around swiftly.

-

Censorship Industrial Complex1 day ago

Censorship Industrial Complex1 day agoDeath by a thousand clicks – government censorship of Canada’s internet

-

Daily Caller1 day ago

Daily Caller1 day agoChinese Billionaire Tried To Build US-Born Baby Empire As Overseas Elites Turn To American Surrogates

-

Automotive1 day ago

Automotive1 day agoPoliticians should be honest about environmental pros and cons of electric vehicles

-

Great Reset1 day ago

Great Reset1 day agoViral TikTok video shows 7-year-old cuddling great-grandfather before he’s euthanized

-

Digital ID1 day ago

Digital ID1 day agoCanada releases new digital ID app for personal documents despite privacy concerns

-

Community23 hours ago

Community23 hours agoCharitable giving on the decline in Canada

-

Alberta1 day ago

Alberta1 day agoSchools should go back to basics to mitigate effects of AI

-

Bruce Dowbiggin1 day ago

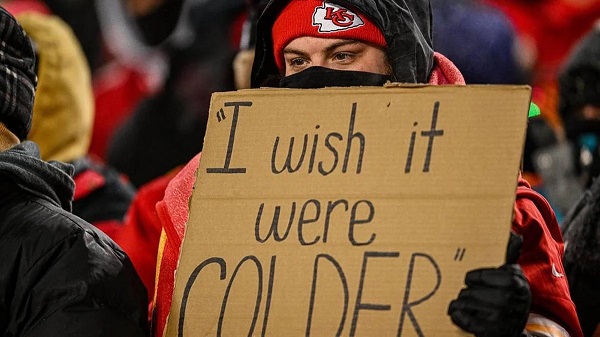

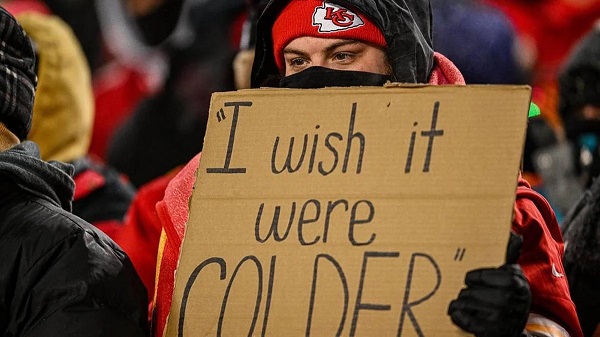

Bruce Dowbiggin1 day agoNFL Ice Bowls Turn Down The Thermostat on Climate Change Hysteria