Business

Freeland and Carney owe Canadians clear answer on carbon taxes

From the Canadian Taxpayers Federation

The Canadian Taxpayers Federation is calling on Liberal leadership front-runners Chrystia Freeland and Mark Carney to clearly state whether they will scrap the carbon tax.

“Taxpayers have one simple question for anyone who wants to be prime minister: Will you scrap the carbon tax?” said Franco Terrazzano, CTF Federal Director. “Freeland is running on her experience as finance minister, but she gave a rambling response about listening to Canadians instead of giving a clear and credible answer. Carney is running on his economic expertise as a central banker, but his response didn’t provide any clarity beyond a vague suggestion that he’s working on a replacement scheme.

“How can Freeland or Carney hope to have a shred of credibility if they don’t have a clear answer to the question: Will you scrap the carbon tax?”

Freeland was asked about the carbon tax during her leadership campaign launch in Toronto on Sunday.

“We have heard very clearly from Canadians in provinces where there is a consumer-facing price on carbon that they don’t like it,” Freeland said. “That’s something that we have to listen to. Democracy means when people tell you something you have to listen. I will say our party hasn’t been good enough at that. That has to change, and I am going to change that.”

Carney was equally unclear on the carbon tax at his campaign launch in Edmonton on Thursday.

“If you are going to take out the carbon tax, we should replace it with something that is at least, if not more, effective,” Carney said. “Perception may be that it takes out more than the rebate provides but reality is different, and Canadians will miss that money, so you need a comprehensive approach.”

Liberal Government House Leader Karina Gould also announced her leadership campaign on Sunday. Gould said she would keep the carbon tax but would “immediately cancel the increase to the price on pollution ahead of April 1.”

The federal carbon tax is set to increase on April 1 to 21 cents per litre of gasoline, 25 cents per litre of diesel and 18 cents per cubic metre of natural gas.

Prior to the carbon tax hike last year, a Leger poll commissioned by the CTF showed 69 per cent of Canadians opposed the carbon tax increase.

“Gould figured out it would be bad if the carbon tax goes up right at the start of an election campaign,” said Kris Sims, CTF Alberta Director. “But Canadian’s don’t want half-measures as proven by the backlash against the temporary carbon-tax exemption for home heating oil.

“Prime Minister Justin Trudeau has been clear from the start he would keep the carbon tax and Conservative Leader Pierre Poilievre has been clear he would axe the tax. Anyone who wants to be a credible candidate for prime minister needs a crystal-clear answer for this question: Will you scrap the carbon tax?”

Business

Finance Titans May Have Found Trojan Horse For ‘Climate Mandates’

From the Daily Caller News Foundation

By Audrey Streb

Major global asset managers including BlackRock and Blackstone have been looking to buy power utilities across America in a move that some industry insiders warn could harm consumers, raise electricity costs and advance a climate-driven energy agenda.

In recent months, Blackstone reportedly sought regulatory approval to buy utilities in New Mexico and Texas all while a BlackRock-led group won approval Friday to purchase a major utility in Minnesota. While BlackRock and other huge asset managers have distanced themselves from environmental, social and governance (ESG) investment practices in recent years, some energy experts and consumer advocates that spoke to the Daily Caller News Foundation are concerned that buying up utilities may represent a new frontier of financial giants orchestrating “climate mandates.”

“BlackRock isn’t just influencing utilities anymore, they’re buying them. After years of ESG-driven coercion that pushed utilities to abandon reliable energy in favor of China-dependent renewables, BlackRock is now taking direct control. The result will be more of the same: higher costs, weaker grids, and millions in unpaid bills, all driven by the very climate mandates they lobbied for,” Jason Isaac, CEO of the American Energy Institute, told the DCNF. “Minnesotans should brace for more unreliable power, rising rates, and a media narrative that blames Trump for ending taxpayer-funded handouts instead of holding the woke politicians and Wall Street elites responsible for the crisis.”

Electricity demand is on the rise after years of stagnancy as the artificial intelligence (AI) race ushers in the build out of power-hungry data centers. Utility costs are also spiking as demand takes off in a trend that dates back to the Biden administration.

Against this backdrop, private investment titans like BlackRock and Blackstone are reportedly moving to buy power utility companies and invest in data center expansions and startups.

Minnesota recently granted the BlackRock-led group known as Global Infrastructure Partners (GIP) approval to buy one of the state’s major power utilities, Allete. GIP is also reportedly on the cusp of acquiring the major energy company, AES, according to sources familiar with the matter that spoke with Reuters. The Financial Times reported that the deal may be for $38 billion.

BlackRock referred the DCNF to Allete’s statement on regulators approving its partnership with GIP and declined to comment further for this story.

Allete’s statement notes that the impending partnership with the BlackRock-led group includes “guaranteed access to capital to fund ALLETE’s five-year plan for advancing transmission and renewable energy goals [and a] $50 million Clean Firm Technology Fund to support regional clean-energy projects and partnerships.”

The Federal Energy Regulatory Commission (FERC) renewed BlackRock’s ability to own up to 20% of utility voting shares in April, with former FERC Commissioner Mark Christie stating that BlackRock “pledged not to use its holdings to influence utility management” and that utilities need the access to capital.

Christie also warned in September 2024 that “this is an issue that deserves much greater scrutiny” and that “the influence that large shareholders, BlackRock or otherwise, can potentially exert across the consumer-serving utility industry should not be underestimated.”

Blackstone has reportedly sought regulatory approval to buy out the Public Service Company of New Mexico and Texas New Mexico Power Co. recently, according to The Associated Press. The asset management giant also secured a 19.9% stake in a Northern Indiana public utility for over $2 billion in January 2024.

“Blackstone’s sustainability strategy prioritizes accelerating decarbonization by investing in the energy transition and driving value accretive emissions reduction in our portfolio,” Blackstone’s 2024 sustainability report states. “We believe the transition to cleaner energy creates meaningful investment opportunities for private capital. For over a decade, we have pursued attractive investments in companies and assets that are part of the global energy transition as part of our broader energy investing strategy.”

Blackstone also announced on Sept. 15 that private equity funds affiliated with Blackstone Energy Transition Partners will acquire the Pennsylvania-based Hill Top Energy Center natural gas plant for almost $1 billion. The company also announced in July that funds managed by Blackstone Infrastructure and Blackstone Real Estate would invest over $25 billion to help build out Pennsylvania’s energy infrastructure to support the AI “revolution.”

“Renewable” energy goals and ESG investment tend to align with emissions-reduction targets, with some power companies, utilities and states that set goals to cut emissions striving to retire conventional energy sources like coal plants. Isaac added that companies like American Electric Power, in which BlackRock owns a significant stake, have been decommissioning coal plants and replacing them with intermittent sources like solar.

“What happens is when the wind stops blowing and the sun stops shining, then you have to ramp those generational assets back up, and that’s when price spikes happen,” Isaac said.

University of North Carolina at Chapel Hill professor of finance Greg Brown told the AP that the reason behind these buyouts are “very simple. Because there’s a lot of money to be made.”

Other experts devoted to consumer protection like Executive Director of Consumers’ Research Will Hild told the DCNF that investment companies like BlackRock stand to gain more than just a profit from these purchases.

“There is no world in which BlackRock’s ownership of American energy benefits ordinary American consumers,” Hild told the DCNF. “This is the same firm that proudly brought us the radical ESG rules and Net-Zero nonsense that forced all our energy bills to skyrocket. We wouldn’t have the scourge of woke capitalism without Larry Fink, who already controls nearly $13 trillion in assets and has been sued for violating anti-trust laws.”

ESG investors weigh a company by its social and environmental choices as well as its finances in a move that critics say bogs down businesses with new costs while doing little to combat climate change. One August 2023 InfluenceMap report showed that as Republicans at the state level and in Congress ramped up their opposition to ESG-focused practices, BlackRock and other major U.S. asset managers decreased their support for climate-related resolutions.

BlackRock CEO Larry Fink also said in June 2023 that he no will no longer use the term ESG because it has been “politicized,” less than a year after he noted that climbing energy prices are “accelerating” the green energy transition.

“BlackRock has backpedaled on its ESG messaging and its aggressive, unapologetic imposition of ESG on everything they touch. But the leopard hasn’t changed its spots,” President of the Heartland Institute James Taylor told the DCNF. “It still has the same management group with the same values, and it’s still doing whatever it can to impose ESG on everything it touches, in actuality, if not in name.”

Taylor argued that whether BlackRock buys or acquires a large stake of a utility, it “can now assert itself over legislatures in dictating energy policy.”

Notably, the Federal Trade Commission (FTC) and the Department of Justice (DOJ) threw their weight behind an antitrust lawsuit against major asset managers that alleges the firms colluded to tank coal production with their embrace of zero-emissions goals in May.

The lawsuit, backed by 11 state attorneys general, alleges that BlackRock and multiple other asset managers used their market power to suppress coal production, thereby hurting consumers by causing the price of coal to climb.

The DOJ and FTC’s “support for this baseless case undermines the Trump Administration’s goal of American energy independence,” a BlackRock spokesperson previously told the DCNF. “As we made clear in our earlier motion to dismiss, this case is trying to re-write antitrust law and is based on an absurd theory that coal companies conspired with their shareholders to reduce coal production.”

Business

UN, Gates Foundation push for digital ID across 50 nations by 2028

From LifeSiteNews

With 30 nations enrolled, the UN and Gates Foundation’s digital ID campaign signals accelerating efforts to create a global digital infrastructure that centralizes identity and data.

The 50-in-5 campaign to accelerate digital ID, fast payment systems, and data exchanges in 50 countries by 2028 reaches a 30 country milestone.

Launched in November 2023, the 50-in-5 campaign is a joint effort of the United Nations, the Bill and Melinda Gates Foundation, and their partners to rollout out at least one component of Digital Public Infrastructure (DPI) in 50 nations within five years.

DPI is a civic technology stack consisting of three major components: digital ID, fast payment systems, and massive data sharing between public and private entities.

30 countries have now joined the UN/Gates 50-in-5 DPI campaign to rollout Digital ID, Fast Payment Systems & Massive Data Exchanges between public & private entities https://t.co/dOYCfQHObt pic.twitter.com/yP6V7zxnUD

— Tim Hinchliffe (@TimHinchliffe) October 2, 2025

50-in-5 started with 11 first-mover countries, and with the count now at 30 the participating countries include:

Bangladesh, Brazil, Cambodia, Dominican Republic, Estonia, Ethiopia, France, Guatemala, Jamaica, Kazakhstan, Lesotho, Malawi, Mexico, Moldova, Nigeria, Norway, Senegal, Sierra Leone, Singapore, Sri Lanka, South Africa, South Sudan, Somalia, Togo, Trinidad and Tobago, Uganda, Ukraine, Uruguay, Uzbekistan, and Zambia.

The 50-in-5 campaign celebrated its 30-country milestone during a sideline event at the U.N. General Assembly in New York on September 22.

There, government officials, like Ukraine’s deputy prime minister, praised the work of 50-in-5 while the ministers of digital economy from Nigeria and Togo called for an interoperable digital identity system for the entire African continent.

Nigeria’s Minister of Communications, Innovation and Digital Economy Bosun Tijani said that each country could build their own digital identity scheme, but that they should all be interoperable with one another – demonstrating both the digital ID and data sharing as good potential use cases for DPI.

“Nations want to maintain their own ID databases, but I think we have a unique opportunity to apply strong data exchange system interoperability,” said Tijani.

“I think a digital identity system that can go with you wherever you are going on the African continent would be a fantastic example,” he added.

Nigeria's minister of Communications, Innovation & Digital Economy Bosun Tijani calls for Digital ID to be interoperable across all Africa: "A digital identity system that can go with you wherever you go on the African continent will be fantastic." 50-in-5 https://t.co/dOYCfQHObt pic.twitter.com/KB380uQrmd

— Tim Hinchliffe (@TimHinchliffe) October 2, 2025

In March 2025, the Nigerian government published a framework to develop national Digital Public Infrastructure that would leverage digital ID to track and trace “key life events” of every citizen from the cradle to the grave.

“Throughout a citizen’s life, from birth to old age, there are marked moments of significant life events requiring support or service from the government,” the paper begins.

“Some of these services include registration of births, antenatal healthcare, vaccines, school enrollment, scholarships, health insurance for business registrations, filing of taxes, etc.”

These “life events” require every citizen to have a digital ID:

The Federal Government of Nigeria is on a mission to appropriately deploy digital technology to support Nigerians through these significant and profound moments so they can integrate into the state and enjoy the benefits of citizenhood from cradle to old age.

Back at the 50-in-5 milestone event, Togo’s Minister of Digital Economy and Transformation Cina Lawson called for a free, cross-border, interoperable digital ID powered by the Modular Open Source Identity Platform (MOSIP).

MOSIP is a Gates-funded platform that “helps govts & other user organizations implement a digital, foundational identity system.”

Said Lawson, “We’ve initiated conversations with our neighbors, namely Benin, to have interoperability of our ID systems, but also Burkina Faso and other countries such as Senegal, because we’re using MOSIP platform, so what we do is that we host meetings of countries that are interested the platform, so that we could see how we [are] operating it and so on.”

“Our ID system, using the MOSIP platform, is really the ID that the majority of the Togolese will have because first of all it’s free, it doesn’t require to show proof of citizenship, and so on, so that is the ID card of the poorest of the Togolese,” she added.

Togo’s Minister of Digital Economy & Transformation Cina Lawson calls for free, cross-border, interoperable Digital ID using Gates-funded MOSIP platform. UN/Gates 50-in-5 event https://t.co/dOYCfQHObt pic.twitter.com/wPC4vpms9l

— Tim Hinchliffe (@TimHinchliffe) October 2, 2025

Lawson also spoke at the 50-in-5 launch event in November 2023, where she explained that Togo’s DPI journey began with the arrival of COVID-19.

First, the government set up a digital payments system within 10 days.

“We deployed it, and we were able to pay out 25 percent of all Togolese adults, and we distributed $34 million that the most vulnerable Togolese received directly through their mobile phones,” said Lawson.

Then, came vaccine passports.

“We created a digital COVID certificate. All of a sudden, the fight against the pandemic became really about using digital tools to be more effective,” she added at the time.

Today, Togo became the first sub-Saharan African country whose digital COVID-19 vaccination certificate is recognized by the @eu_commission. Travelers with a Togolese certificate will be able to validly present it in the EU & vice versa. @AmbUETogo @KoenDoens pic.twitter.com/Uy9mRF8bkU

— Cina Lawson (@cinalawson) November 24, 2021

To get an idea where DPI is heading, Ukraine’s Deputy Prime Minister Myhailo Fedorov gave a pre-recorded speech for the 50-in-5 milestone event, saying that his country was successful in building “the state in a smartphone” via the DIIA app, which had reached 23 million users.

“For every citizen, government should be simple, convenient, nearly invisible, and accessible in just a few clicks,” said Fedorov.

“Today, 23 million people use the DIIA app […] Since the launch of DIIA in 2020, Ukrainians and the state have saved about $4.5 billion to date.”

“This is the combined anti-corruption and economic effect of digitalizing services.”

“For us, it’s powerful proof of DIIA’s efficiency and the real impact of building a digital state,” he added.

Ukraine Deputy PM Mykhailo Fedorov praises DIIA Digital ID app, with 23M users, for being a "STATE IN A SMARTPHONE" & "BUILDING AN (INVISIBLE) DIGITAL STATE." An "ANTI-CORRUPTION/ECONOMIC EFFECT OF DIGITALIZING SERVICES." Includes "ONLINE MARRIAGE" 50-in-5 https://t.co/dOYCfQHObt pic.twitter.com/MUFwbW4Yyy

— Tim Hinchliffe (@TimHinchliffe) October 3, 2025

Speaking at the World Economic Forum (WEF) Global Technology Governance Summit on April 7, 2021, Fedorov told the panelists of the “Scaling Up Digital Identity Systems” session, that it was Ukraine’s goal to “enable all life situations with this digital ID.”

“The pandemic has accelerated our progress […] People have no choice but to trust technology,” Fedorov said at the time.

“We have to make a product that is so convenient that a person will be able to disrupt their stereotypes, to break through from their fears, and start using a government-made application,” he added.

The 50-in-5 campaign is a collaboration between the Bill and Melinda Gates Foundation, the United Nations Development Program, the Digital Public Goods Alliance, the Center for Digital Public Infrastructure, and Co-Develop; with support from GovStack, the Inter-American Development Bank, and UNICEF.

The Center for Digital Public Infrastructure is backed by Co-Develop and Nilekani Philanthropies.

Nandan Nilekani is one of the architects of India’s digital identity system, Aadhaar.

Co-Develop was founded by The Rockefeller Foundation, the Bill & Melinda Gates Foundation, Nilekani Philanthropies, and the Omidyar Network.

The Omidyar Network is a funder of MOSIP.

The Digital Public Goods Alliance lists both the Gates and Rockefeller foundations in its roadmap showcasing “activities that advance digital public goods,” along with other organizations and several governments.

At last year’s Summit of the Future, 193 nations agreed to the non-binding “Pact for the Future,” which dedicates a section in its annex, the “Global Digital Compact,” to implement DPI in member states.

One year later, the U.K. announced it was going to force Britons into mandatory digital ID schemes under the guise of combatting illegal immigration.

Reprinted with permission from The Sociable.

-

Red Deer2 days ago

Red Deer2 days agoThe City of Red Deer’s Financial Troubles: Here Are The Candidates I Am Voting For And Why.

-

Business2 days ago

Business2 days agoCanada Post is failing Canadians—time to privatize it

-

Business2 days ago

Business2 days agoYour $350 Grocery Question: Gouging or Economics?

-

2025 Federal Election14 hours ago

2025 Federal Election14 hours agoProtestor Behind ‘Longest Ballot’ Chaos targeting Poilievre pontificates to Commons Committee

-

Media2 days ago

Media2 days agoResponse to any budget sleight of hand will determine which audience media have decided to serve

-

Education2 days ago

Education2 days agoClassroom Size Isn’t The Real Issue

-

illegal immigration2 days ago

illegal immigration2 days ago$4.5B awarded in new contracts to build Smart Wall along southwest border

-

International2 days ago

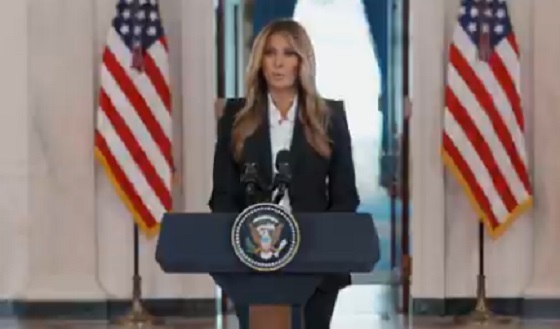

International2 days agoMelania Trump quietly reunites children divided by Ukraine war