International

France seeks to deploy nuclear shield across Europe

MxM News

MxM News

Quick Hit:

France is reportedly prepared to extend its nuclear deterrent to protect Europe, as concerns grow over U.S. commitment to NATO under the Trump administration. Fighter jets carrying nuclear weapons could be stationed in Germany, marking a major shift in European defense policy.

Key Details:

- French nuclear-capable fighter jets could be deployed to Germany as the U.S. considers reducing its military presence in Europe.

- German Chancellor-elect Friedrich Merz has urged Britain and France to extend nuclear protection to Europe as he seeks to reduce dependence on the U.S.

- Emmanuel Macron discussed his European security strategy with Donald Trump at the White House, emphasizing that peace in Ukraine must not mean surrender.

Diving Deeper:

France is poised to extend its nuclear deterrent to help protect Europe, with potential plans to station nuclear-capable fighter jets in Germany. The move comes amid growing uncertainty over U.S. military commitments on the continent.

Friedrich Merz, who won Germany’s recent elections and is expected to become chancellor, has been vocal about securing European “independence” from American security guarantees. Merz has called on France and Britain to expand their nuclear umbrella to Germany, arguing that Europe can no longer rely on Washington’s protection.

A French official told The Telegraph that deploying nuclear jets in Germany would send a strong message to Russia, while Berlin-based diplomats suggested that such a move could pressure British Prime Minister Sir Keir Starmer to take similar action. “Posting a few French nuclear jet fighters in Germany should not be difficult and would send a strong message,” the official said.

Macron, a longtime advocate for European strategic autonomy, discussed the nuclear defense initiative with Merz on Sunday night before traveling to Washington. At the White House, he presented his vision for Europe’s security and the defense of Ukraine to President Trump. During a joint press conference, Trump indicated that the U.S. would not offer security guarantees to Ukraine once a peace agreement was signed.

Macron, standing beside Trump, emphasized that any peace settlement “must not be a surrender of Ukraine” and called on European nations to take greater responsibility for the continent’s security.

For decades, the U.S. has maintained Europe’s security with a nuclear arsenal of roughly 100 missiles, many of which are based in Germany. However, France’s nuclear program operates independently from NATO, while Britain’s serves as a core component of the alliance’s defense strategy. Merz has urged both nations to consider expanding their nuclear security umbrella to include Germany.

On Monday, former British Prime Minister Boris Johnson added to the debate, arguing that Ukraine itself should have nuclear weapons as a deterrent against future Russian aggression. Speaking to The Telegraph during a visit to Kyiv, Johnson said there was a “moral case” for Ukraine to develop its own nuclear arsenal.

Although talks on a formal European nuclear deterrent have yet to begin, Germany’s diplomatic circles acknowledge the growing pressure on Berlin to consider France’s offer. Macron has long pushed for a European dialogue on the role of France’s nuclear weapons in defending the continent. A Berlin diplomat suggested that Macron’s push would also challenge Starmer to clarify Britain’s role in European defense.

Artificial Intelligence

UK Police Chief Hails Facial Recognition, Outlines Drone and AI Policing Plans

Any face in the crowd can be caught in the dragnet of a digital police state.

|

|

Business

Global elites insisting on digital currency to phase out cash

From LifeSiteNews

By David James

The aim is to have the digital euro fully in place by 2030 in order to move Europe fully into the United Nations’ post-capitalist system described in Agenda 2030.

It always pays to scrutinize closely the comments of financial elites because they are rarely honest about their intentions. An instance is the comments of Christine Lagarde, president of the European Central Bank (ECB) who said there will be a vote next month in the European Union parliament on the next step toward creating a digital euro, which would be a central bank digital currency (CBDC).

A central bank digital currency is money issued by the central bank in digital form as opposed to digital credit issued by banks, which is the dominant form of money in Western societies. She claims that it will mean more freedom for Europeans and that there is nothing to fear.

Lagarde anticipates launching the digital euro in about 18 months. The aim is to have it fully in place by 2030 in order to move Europe fully into the United Nations’ post-capitalist system that is described in Agenda 2030.

Lagarde’s blandishments about what the digital euro represents do not survive close examination. She acknowledged that the main concern of the population is the privacy implications, claiming the ECB is looking at a technology that will offer protections. The private banks, she said, will apply the “rules of scrutiny” that already have access to the transactions. “We are not interested in the data. The private banks are interested in the data.”

Lagarde also said that the “people have dictated” the transition to a digital euro. This looks dubious. Neither the EU Commission nor the ECB is democratically elected. And if the main concern people have with a CBDC is privacy, then why would people prefer it over cash, which is immune to scrutiny? It is not as if a digital euro would satisfy an unmet need. Digital money – credit and online transactions – is already freely available in the banking system.

The ECB is also speaking out of both sides of its mouth, saying on one hand that the digital euro will only complement cash and on the other that cash will be eliminated.

Lagarde made it clear that the aim is to phase out cash completely. Agenda 2030, she claims, “can only be enforced in a cashless economy.” Why? What is it about cash that makes environmental policies impossible to implement? The answer is surely that a digital euro is needed to control people’s behavior, forcing them to comply with environmental rules.

Previous comments by central bankers suggest there is good reason for Europeans to be extremely suspicious. In 2021, the general manager of the Bank for International Settlements, Agustín Carstens, said: “We don’t know who’s using a $100 bill today and we don’t know who’s using a 1,000-peso bill today. The key difference with the CBDC is the central bank will have absolute control on the rules and regulations that will determine the use of that expression of central bank liability, and also we will have the technology to enforce that.”

The pretext for the financial power play is climate change and the push toward net zero. A European CBDC is not, as implied by Lagarde, the creation of a new digital monetary mechanism. As economist Richard Werner points out, that already exists – credit and debit cards, for example. The significance of a digital euro is that it threatens the banking system.

A CBDC, like cash, has no interest rate on it. So why would people continue to use credit produced by private entities such as banks or credit card companies – currently over 95 percent of the money supply – on which they have to pay interest? As the Reserve Bank of New Zealand noted, CBDCs have the potential to destroy private banks.

That problem does not seem to concern the ECB, however. Indeed, fundamentally altering the banking system may be what they are aiming for. Lagarde said “climate compliance” will become a core element of bank supervision, not a separate initiative, “because climate change presents significant, material financial risks to banks and the entire financial system.”

The ECB’s supervision will mandate that banks integrate the management of climate-related and environmental risks into their existing risk management processes, particularly through new prudential transition planning requirements under what is called CRD VI. European banking, it seems, will no longer be defined by profitability and fiscal soundness but also by the politics of climate change.

The slipperiness of the ECB‘s arguments point to a much darker ambition. Werner says when CBDCs are connected to digital IDs “we are talking about the most totalitarian control system in human history … it gives you as a controller complete visibility on what everyone is doing, every transaction.

“The monitoring is only one aspect. These CBDCs are programmable and you can use big data algorithms, which they sell to us as artificial intelligence, in order to have rules about who can buy what and for what purpose, at what time and at what place – and therefore control all your movement. In the history of dictatorships, there never has been such a powerful control tool.”

There is a flaw, though, in the ECB’s push to change Europe’s financial architecture that may prove fatal to its ambitions. The EU and ECB do not have genuine central control. When the euro was established in 1998, the only way Germany was able to join was on the condition there was no consolidation of the government debt. So, although the ECB notionally sets interest rates for the zone, government debt is held at the national level and each country’s interest rate differs.

The ECB is thus a central bank in name only, unlike the U.S. Federal Reserve, or for that matter most country’s central banks, that oversee their national government debt. A European nation can choose to exit the EU, and each has to have its own monetary policy in spite of the ECB setting a uniform rate.

The push to create a digital euro is most likely an attempt to deal with these contradictions, but at best it will be a makeshift solution and it will take very little for it to fall apart. Disintegration of the European Union, and the common currency, is not out of the question.

Meanwhile, the U.S. is going in the opposite direction. In July, the U.S. House of Representatives passed the Anti-CBDC Surveillance State Act, which prevents the Federal Reserve from issuing a retail CBDC directly to individuals.

European debt is becoming increasingly parlous, especially in France where there have even been suggestions that there might need to be assistance from the International Monetary Fund. Italy’s debt, which is 138 percent of GDP, is also problematic. Lagarde is hoping for a rollout of the digital euro in 2027 and completion in 2030. But the Euro zone, and the ECB that oversees it, may not last that long.

-

Business2 days ago

Business2 days agoCarney Admits Deficit Will Top $61.9 Billion, Unveils New Housing Bureaucracy

-

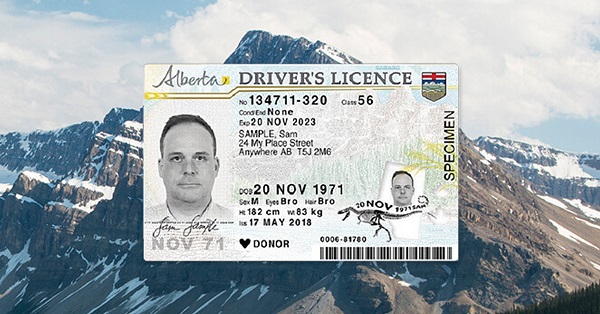

Alberta1 day ago

Alberta1 day agoAlberta first to add citizenship to licenses

-

Alberta1 day ago

Alberta1 day agoBreak the Fences, Keep the Frontier

-

Business13 hours ago

Business13 hours agoCarney’s ‘major projects’ list no cause for celebration

-

Business2 days ago

Business2 days agoCarney’s Ethics Test: Opposition MP’s To Challenge Prime Minister’s Financial Ties to China

-

Business14 hours ago

Business14 hours agoGlobal elites insisting on digital currency to phase out cash

-

Business12 hours ago

Business12 hours agoRed tape is killing Canadian housing affordability

-

Business1 day ago

Business1 day agoAttrition doesn’t go far enough, taxpayers need real cuts