Business

Federal government’s accounting change reduces transparency and accountability

From the Fraser Institute

By Jake Fuss and Grady Munro

Carney’s deficit-spending plan over the next four years dwarfs the plan from Justin Trudeau, the biggest spender (per-person, inflation-adjusted) in Canadian history, and will add many more billions to Canada’s mountain of federal debt. Yet Prime Minister Carney has tried to sell his plan as more responsible than his predecessor’s.

All Canadians should care about government transparency. In Ottawa, the federal government must provide timely and comprehensible reporting on federal finances so Canadians know whether the government is staying true to its promises. And yet, the Carney government’s new spending framework—which increases complexity and ambiguity in the federal budget—will actually reduce transparency and make it harder for Canadians to hold the government accountable.

The government plans to separate federal spending into two budgets: the operating budget and the capital budget. Spending on government salaries, cash transfers to the provinces (for health care, for example) and to people (e.g. Old Age Security) will fall within the operating budget, while spending on “anything that builds an asset” will fall within the capital budget. Prime Minister Carney plans to balance the operating budget by 2028/29 while increasing spending within the capital budget (which will be funded by more borrowing).

According to the Liberal Party platform, this accounting change will “create a more transparent categorization of the expenditure that contributes to capital formation in Canada.” But in reality, it will muddy the waters and make it harder to evaluate the state of federal finances.

First off, the change will make it more difficult to recognize the actual size of the deficit. While the Carney government plans to balance the operating budget by 2028/29, this does not mean it plans to stop borrowing money. In fact, it will continue to borrow to finance increased capital spending, and as a result, after accounting for both operating and capital spending, will increase planned deficits over the next four years by a projected $93.4 billion compared to the Trudeau government’s last spending plan. You read that right—Carney’s deficit-spending plan over the next four years dwarfs the plan from Justin Trudeau, the biggest spender (per-person, inflation-adjusted) in Canadian history, and will add many more billions to Canada’s mountain of federal debt. Yet Prime Minister Carney has tried to sell his plan as more responsible than his predecessor’s.

In addition to obscuring the amount of borrowing, splitting the budget allows the government to get creative with its accounting. Certain types of spending clearly fall into one category or another. For example, salaries for bureaucrats clearly represent day-to-day operations while funding for long-term infrastructure projects are clearly capital investments. But Carney’s definition of “capital spending” remains vague. Instead of limiting this spending category to direct investments in long-term assets such as roads, ports or military equipment, the government will also include in the capital budget new “incentives” that “support the formation of private sector capital (e.g. patents, plants, and technology) or which meaningfully raise private sector productivity.” In other words, corporate welfare.

Indeed, based on the government’s definition of capital spending, government subsidies to corporations—as long as they somehow relate to creating an asset—could potentially land in the same spending category as new infrastructure spending. Not only would this be inaccurate, but this broad definition means the government could potentially balance the operating budget simply by shifting spending over to the capital budget, as opposed to reducing spending. This would add to the debt but allow the government to maneuver under the guise of “responsible” budgeting.

Finally, rather than split federal spending into two budgets, to increase transparency the Carney government could give Canadians a better idea of how their tax dollars are spent by providing additional breakdowns of line items about operating and capital spending within the existing budget framework.

Clearly, Carney’s new spending framework, as laid out in the Liberal election platform, will only further complicate government finances and make it harder for Canadians to hold their government accountable.

Alberta

ATA Collect $72 Million in Dues But Couldn’t Pay Striking Teachers a Dime

Marco Navarro-Génie

Marco Navarro-Génie

They Built a Sustaining Rainbow Bureaucracy Instead of a Warchest

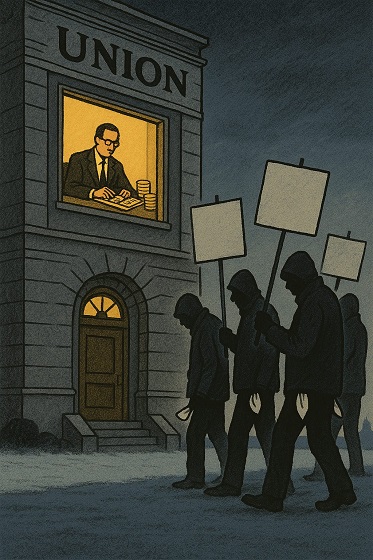

Alberta’s teachers walked off the job twice in a few years, which surprised anyone who still believed the old line that teachers avoid confrontation. A strike strips an organization to its essentials. It reveals whether a union carries real strength or only the appearance of it. When the Alberta Teachers’ Association entered a province-wide strike, it took on the posture of a century-old institution, but it drew on reserves of something far younger and far leaner. One question hangs in the air: How did a union that has existed since 1918 arrive at a major labour showdown with so little capacity to sustain its members?

Haultain’s Substack is a reader-supported publication.

To receive new posts and support our work, please consider becoming a free or paid subscriber.

Try it out.

The answer, it turns out, is that the ATA spent a century perfecting the art of growing and protecting itself, but not the teachers who pay for it.

Early unions understood that withdrawing labour meant stepping into a void. Wages vanished at the factory door. Families survived on whatever the union could provide. From small collections grew one of the essential principles of organized labour: A union prepares for conflict by saving in peacetime. It builds the means to protect its members when negotiations break down.

When unions matured, industrial organizations built strike funds large enough to hold firm through prolonged stalemates. These reserves became equalizers. Without them, employers waited for hunger to do the work. With them, a union could bargain in earnest. Strike pay bought time. Time forced movement. Time was power.

Consider what proper unions accomplish. CUPE maintains a national strike fund holding $132.8 million as of 2023. With 650,000 members, that’s about $200 per member in reserve. CUPE pays striking workers $300 per week from day one, rising to $350 after eight weeks. OPSEU maintains a $70 million strike fund, paying $200 per week plus $50 per dependent, increasing to $300 per week at week four.

By contrast, the ATA had $25 million in its Special Emergency Fund when the recent strike began. That money lasted just over two weeks, covering member benefits, not strike pay. For a union with 51,000 members, that’s less than $500 per teacher. After those two weeks, the Association drained its general cash reserves. By the end of the three-week strike, the SEF was depleted. Compare this to CUPE’s $132 million for 650,000 members or OPSEU’s $70 million for 180,000 members, and the ATA’s inadequacy becomes stark.

A century of life gives any organization the chance to build such strength. Over decades it becomes serious. Over a century it becomes formidable. Yet when the association decided to strike on October 6, 2025, it had nothing approaching the reserve needed for a long contest. A union prepared for endurance needs a fund measured in the high tens of millions, not the low twenties. That cushion was missing.

Of course, it was missing. Building a war chest means acknowledging you might actually have to fight a war. Far safer to build a peacetime palace and hope nobody notices when the enemy arrives at the gates.

This weakness grew from the inward turn that overtakes institutions with stable revenue and public status. What begins as a tool for members becomes an organism that primarily protects itself. After the Teaching Profession Act of 1936 entrenched its place in Alberta’s landscape, the ATA expanded like any other public body—without constraint or self-examination. Staff increased. Departments multiplied. New programs became permanent fixtures. Over time, the structure thickened into bureaucracy.

Robert Michels observed more than a century ago that organizations drift toward oligarchy because staff become the custodians of continuity. Members cycle in and out. Staff remain. As this instinct grows, the organization develops a belief that its first duty is to preserve itself. The ATA is no exception. Salaries for staff, internal operations, communication units, legal services, research branches, and advocacy initiatives occupy the foreground of its budget. The association’s annual budget is approximately $50 million, with discretionary programming accounting for less than a quarter. The remainder goes to staff salaries, operations, and fixed expenditures. A strike fund becomes an afterthought. Annual fees for 2025-26 are set at $1,422 per teacher, generating roughly $72 million in yearly revenue. Where did it all go?

The ATA’s books are not open, but there is public evidence of where some spending goes. Much went to campaigns that had precious little to do with wages, benefits, or working conditions. The ATA maintains an elaborate apparatus devoted to social justice advocacy. It supports the Alberta GSA Network, produces extensive resources on sexual and gender minorities, runs a “Walking Together” reconciliation program complete with 25 Indigenous education facilitators, publishes anti-racism materials, maintains Diversity Equity Networks, and employs staff dedicated to promoting SOGI (Sexual Orientation and Gender Identity) inclusion in classrooms. When Premier Danielle Smith announced policies requiring parental notification for name and pronoun changes in schools, the ATA mobilized its complete communications apparatus to oppose the measures, with President Jason Schilling calling them “irresponsible and dangerous” and a “distraction from more important issues.” If that were so, Schilling allowed his organization to be distracted.

I am not passing judgment on whether their causes lack merit or that teachers shouldn’t care about them. That’s their business and their money. But a union exists first and foremost to protect the material interests of its members. When teachers lose a month’s salary because their union spent decades building a rainbow bureaucracy instead of a strike fund, the priorities become clear. The ATA allocated resources to produce toolkits on creating “SOGI-inclusive classrooms” and funded campaigns about transgender policy while its Special Emergency Fund remained woefully inadequate. It hired facilitators to deliver workshops on dismantling anti-Indigenous racism, but couldn’t pay striking teachers a dime. This is ideology dressed up as unionism, performance masquerading as protection.

Haultain’s Substack is a reader-supported publication.

To receive new posts and support our work, please consider becoming a free or paid subscriber.

Try it out.

And here’s the greater irony: when teachers walked the picket lines, union executives kept drawing their salaries. Strike or no strike, the apparatus hummed along. The people running the ATA never missed a paycheque while the members they represent watched their bank accounts drain. In the 2025 strike, teachers lost a month’s salary. In return for this sacrifice, they gained precisely nothing. The settlement forced upon them by the government’s Back to School Act offered no improvement over what was available before they walked out. In fact, 89.5 per cent of teachers had already rejected this very offer on September 29, before the strike even began. In an era of persistent inflation, that lost income hurts. It hurt while union apparatchiks cashed their cheques on schedule.

The pattern of misplaced priorities extends beyond budgeting. When governments announce reforms, the ATA responds with press conferences, research papers, social media campaigns, and policy briefs. These are the tools of a professional bureaucracy, revolutionary in rhetoric, managerial in practice. They convey activity. They project influence. They cost a fortune. The ATA spent approximately $1.2 million on communications advocacy campaigns. Yet none of these tools matter when the government decides to hold firm during wage negotiations. Only endurance matters. Endurance rests on savings. Discipline has been scarce, but glossy newsletters have been plentiful.

The ATA fashions itself as the vanguard of progressive change, draping its pronouncements in the language of social justice and systemic transformation. It speaks like Che Guevara but budgets like a mid-tier insurance company. This is the defanged wolf: all growl, no bite. When push comes to shove, when teachers actually need material support to withstand a strike and make it count, the revolutionary rhetoric evaporates like morning dew. What remains is a comfortable administrative class that has confused advocacy theatre with actual power.

For a union that seeks to control so much of the province’s educational life, the ATA demonstrated a remarkable inability to control its own strike capacity. When the moment arrived to exercise the most fundamental power a union possesses—the withdrawal of labour—it had nothing. This is not the behaviour of a serious labour organization. This is the behaviour of a professional association that occasionally remembers it is supposed to be a union.

The ATA speaks of solidarity and resolve. It encourages teachers to show unity. It frames strikes as moral moments. It talks tough, pushed by its political branch, the NDP. Yet solidarity without resources is fragile. Resolve without savings falters when the bills arrive. A union that accepts going on strike without the means to sustain its membership hands the employer a strategic advantage from the outset. Employers read the same budgets. A union with a thin reserve can shout but cannot stand long, no matter what assurances Nenshi and their political allies make. The employer knows time will do the work. The people insulated from this reality are the NDP MLAs who cheered them on and the union administrators whose paycheques never depend on winning the fight.

It becomes difficult to tell whether the ATA has become an arm of the NDP or whether the NDP serves as the political branch of the ATA. Either way, the relationship has proven costly and fruitless. Opposition leader Naheed Nenshi stood ready with soundbites throughout the strike, encouraging teachers to hold firm while offering nothing of material value. NDP MLAs treated striking teachers and disrupted students as convenient instruments to embarrass the government, cheering on a labour action that could never succeed without the financial backing to sustain it. The enemy of your employer is not necessarily your friend. An independent union would have recognized this and built its strength accordingly, rather than spending resources and political capital on an alliance that delivers applause but not wages.

But it’s a professional association and not a conventional trade union, many will say. Members chose to strike against the leadership’s recommendations. That only seals the argument: It is an admission that the organization has no business going on strike. And if the membership voted for a strike, the leadership should have resigned. No youth leader would ever accept leading Girl Guides into a battlefield against seasoned warriors.

If the NDP functions as the political arm of the ATA, then the union has wasted considerable time and treasure on a supremely ineffective partner. A union serious about protecting its members would invest in strike capacity, not in subsidizing a moribund political movement that cannot deliver victories.

The institutional incentives explain much of this failure. Once an organization builds programs and layers of administration, cutting them becomes painful. Every department has defenders. Every initiative has champions. A strike fund has no constituency except prudence, and prudence has no allies among radicals. Prudence is no match for the seductive appeal of another communications coordinator or tattoo-covered diversity officer. Virtue-signalling solidarity wants no sacrifice. It is easier still when the people making these decisions know they will be paid regardless of whether the teachers they represent can hold out through week three of a strike.

Alberta teachers should demand clarity. They have paid dues for generations. They are told the association exists to protect them. Protection cannot be rhetorical. It must take the form of financial strength when the moment demands it. If the ATA built a bureaucracy instead of a war chest, if it prioritized the comfort of its administrative class over the security of its members, then teachers deserve that truth without varnish. They deserve to know why their union leadership never missed a meal while asking them to tighten their belts for the cause.

The defanged wolf is hurt now. It lashes out with its claws, backing recall campaigns against elected officials and organizing petitions to defund non-ATA school instruction. A Calgary high school teacher and ATA governing council representative wants to end public funding for Alberta’s independent schools, where roughly 2,000 teachers work outside ATA membership, costing the association approximately $2.84 million in foregone dues revenue annually. The petition to defund independent schools masquerades as concern for public education but reeks of institutional self-interest. Those 2,000 teachers represent nearly $3 million in annual dues that never reach ATA coffers. The defunding campaign is not about protecting students. It is about eliminating competition and conscripting teachers into membership. This is the Borg logic of an assimilating monopoly, not solidarity.

Wolves can be declawed, too. A union that cannot win at the bargaining table but insists on fighting everywhere else will find itself further diminished, further isolated, and ultimately less able to serve the teachers who still pay its bills. Vindictiveness is not a substitute for competence, and performative rage cannot replace the strength that comes from prudent preparation.

A century of dues offered the ATA a chance to build real power for its members. That chance slipped away into offices, programs, campaigns, and the salaries of people who never had to worry about surviving a strike because they were never actually on strike. The next century should begin with a different understanding of duty, rooted in prudence rather than performance, in stewardship rather than self-preservation, and in the recognition that a union leadership that doesn’t share the risks of its members has no business sending them into battle.

A defanged wolf can howl all it wants. Until it grows its teeth back, no one needs to take it seriously.

To receive new posts and support our work, please consider becoming a free or paid subscriber.

Try it out.

Business

Will Paramount turn the tide of legacy media and entertainment?

From the Daily Caller News Foundation

The recent leadership changes at Paramount Skydance suggest that the company may finally be ready to correct course after years of ideological drift, cultural activism posing as programming, and a pattern of self-inflicted financial and reputational damage.

Nowhere was this problem more visible than at CBS News, which for years operated as one of the most partisan and combative news organizations. Let’s be honest, CBS was the worst of an already left biased industry that stopped at nothing to censor conservatives. The network seemed committed to the idea that its viewers needed to be guided, corrected, or morally shaped by its editorial decisions.

This culminated in the CBS and 60 Minutes segment with Kamala Harris that was so heavily manipulated and so structurally misleading that it triggered widespread backlash and ultimately forced Paramount to settle a $16 million dispute with Donald Trump. That was not merely a legal or contractual problem. It was an institutional failure that demonstrated the degree to which political advocacy had overtaken journalistic integrity.

Dear Readers:

As a nonprofit, we are dependent on the generosity of our readers.

Please consider making a small donation of any amount here.

Thank you!

For many longtime viewers across the political spectrum, that episode represented a clear breaking point. It became impossible to argue that CBS News was simply leaning left. It was operating with a mission orientation that prioritized shaping narratives rather than reporting truth. As a result, trust collapsed. Many of us who once had long-term professional, commercial, or intellectual ties to Paramount and CBS walked away.

David Ellison’s acquisition of Paramount marks the most consequential change to the studio’s identity in a generation. Ellison is not anchored to the old Hollywood ecosystem where cultural signaling and activist messaging were considered more important than story, audience appeal, or shareholder value.

His professional history in film and strategic business management suggests an approach grounded in commercial performance, audience trust, and brand rebuilding rather than ideological identity. That shift matters because Paramount has spent years creating content and news coverage that seemed designed to provoke or instruct viewers rather than entertain or inform them. It was an approach that drained goodwill, eroded market share, and drove entire segments of the viewing public elsewhere.

The appointment of Bari Weiss as the new chief editor of CBS News is so significant. Weiss has built her reputation on rejecting ideological conformity imposed from either side. She has consistently spoken out against antisemitism and the moral disorientation that emerges when institutions prioritize political messaging over honesty.

Her brand centers on the belief that journalism should clarify rather than obscure. During President Trump’s recent 60 Minutes interview, he praised Weiss as a “great person” and credited her with helping restore integrity and editorial seriousness inside CBS. That moment signaled something important. Paramount is no longer simply rearranging executives. It is rethinking identity.

The appointment of Makan Delrahim as Chief Legal Officer was an early indicator. Delrahim’s background at the Department of Justice, where he led antitrust enforcement, signals seriousness about governance, compliance, and restoring institutional discipline.

But the deeper and more meaningful shift is occurring at the ownership and editorial levels, where the most politically charged parts of Paramount’s portfolio may finally be shedding the habits that alienated millions of viewers.The transformation will not be immediate. Institutions develop habits, internal cultures, and incentive structures that resist correction. There will be internal opposition, particularly from staff and producers who benefited from the ideological culture that defined CBS News in recent years.

There will be critics in Hollywood who see any shift toward balance as a threat to their influence. And there will be outside voices who will insist that any move away from their preferred political posture is regression.

But genuine reform never begins with instant consensus. It begins with leadership willing to be clear about the mission.

Paramount has the opportunity to reclaim what once made it extraordinary. Not as a symbol. Not as a message distribution vehicle. But as a studio that understands that good storytelling and credible reporting are not partisan aims. They are universal aims. Entertainment succeeds when it connects with audiences rather than instructing them. Journalism succeeds when it pursues truth rather than victory.

In an era when audiences have more viewing choices than at any time in history, trust is an economic asset. Viewers are sophisticated. They recognize when they are being lectured rather than engaged. They know when editorial goals are political rather than informational. And they are willing to reward any institution that treats them with respect.

There is now reason to believe Paramount understands this. The leadership is changing. The tone is changing. The incentives are being reassessed.

It is not the final outcome. But it is a real beginning. As the great Winston Churchill once said; “Now this is not the end. It is not even the beginning of the end. But it is, perhaps, the end of the beginning”.

For the first time in a long time, the door to cultural realignment in legacy media is open. And Paramount is standing at the threshold and has the capability to become a market leader once again. If Paramount acts, the industry will follow.

Bill Flaig and Tom Carter are the Co-Founders of The American Conservatives Values ETF, Ticker Symbol ACVF traded on the New York Stock Exchange. Ticker Symbol ACVF

Learn more at www.InvestConservative.com

-

Daily Caller2 days ago

Daily Caller2 days agoUS Nuclear Bomber Fleet Shares Fence With Trailer Park Linked To Chinese Intel-Tied Fraudster

-

espionage2 days ago

espionage2 days agoChinese-Owned Trailer Park Beside U.S. Stealth Bomber Base Linked to Alleged Vancouver Repression Case

-

Daily Caller2 days ago

Daily Caller2 days agoLaura Ingraham Presses Trump On Allowing Flood Of Chinese Students Into US

-

Daily Caller2 days ago

Daily Caller2 days agoMcKinsey outlook for 2025 sharply adjusts prior projections, predicting fossil fuels will dominate well after 2050

-

Crime11 hours ago

Crime11 hours agoCBSA Bust Uncovers Mexican Cartel Network in Montreal High-Rise, Moving Hundreds Across Canada-U.S. Border

-

International2 days ago

International2 days agoBBC boss quits amid scandal over edited Trump footage

-

Business2 days ago

Business2 days agoCarney’s Floor-Crossing Campaign. A Media-Staged Bid for Majority Rule That Erodes Democracy While Beijing Hovers

-

Agriculture2 days ago

Agriculture2 days agoFarmers Take The Hit While Biofuel Companies Cash In