Economy

Federal government should listen to Canadians and restrain spending in upcoming budget

From the Fraser Institute

By Grady Munro and Jake Fuss

The Trudeau government has repeatedly demonstrated a proclivity to increase spending and run deficits. Recent polling data shows that most Canadians are not in favour of this approach. When it tables its next budget on April 16, the government should listen to Canadians, restrain spending and provide a concrete plan to balance the budget.

The Trudeau government has increased spending substantially since taking office in 2015. When comparing the levels of inflation-adjusted, per-person program spending under every prime minister, Prime Minister Justin Trudeau has overseen the five-highest years of spending in the country’s history—even when COVID-related spending is excluded. Unsurprisingly, this proclivity to spend has resulted in eight consecutive deficits from 2015/16 to 2022/23, with another six planned from 2023/24 to 2028/29.

These eight years of borrowing have contributed to an $867.2 billion (or 82.0 per cent) increase in total gross government debt since 2014/15. Not only does this represent hundreds of billions that must be paid back by future generations, this debt run-up has also imposed significant costs on taxpayers through rising interest payments. In 2023/24, interest costs on federal government debt will reach a projected $46.5 billion—meaning more taxpayer dollars will go towards servicing debt than child-care benefits ($31.2 billion).

Again, while the Trudeau government was originally elected on the promise of higher spending for infrastructure and temporary deficits, recent polling data shows that Canadians are not happy with this approach—62.9 per cent of Canadians want the Trudeau government to cut spending. Conversely, less than a quarter (24.6 per cent) of respondents want the government to continue as planned (8.7 per cent want further increases in spending).

Of the respondents that feel the government should cut spending, 60.1 per cent want to use the savings to repay debt while 39.9 per cent want tax cuts. Debt reduction or tax relief would be a welcome development. But how much would the federal government need to cut spending to be in a position to balance the budget in the near future?

A recent study shows the federal government could simply limit the growth in annual program spending to 0.3 per cent for two years and balance the budget by 2026/27. In other words, the government could grow annual program spending by $2.9 billion from 2024/25 to 2026/27 and still balance the budget.

This is not to say the government wouldn’t face tough decisions in determining how to limit spending growth, and which areas of spending to target, but there’s a clear path to budget balance if the government wants to respect the wishes of most Canadians. And there are clear areas of spending where savings could be found.

For example, corporate welfare (i.e. government subsidies to businesses). Federal business subsidies nearly doubled from $6.5 billion in 2019 to $11.2 billion in 2022, yet research shows that they do little to promote economic growth and may actually harm the economy. Reducing or eliminating corporate welfare would help restrain overall spending.

After nearly a decade of growing spending and continuous deficits, Canadians have expressed a desire for the federal government to finally change its approach to fiscal policy. Through restrained spending there’s a clear path to a balanced budget that brings opportunities for debt reduction or tax relief—a path the Trudeau government can choose in its upcoming budget.

Authors:

Business

Canada’s combative trade tactics are backfiring

This article supplied by Troy Media.

Defiant messaging may play well at home, but abroad it fuels mistrust, higher tariffs and a steady erosion of Canada’s agri-food exports

The real threat to Canadian exporters isn’t U.S. President Donald Trump’s tariffs, it’s Ottawa and Queen’s Park’s reckless diplomacy.

The latest tariff hike, whether triggered by Ontario’s anti-tariff ad campaign or not, is only a symptom. The deeper problem is Canada’s escalating loss of credibility at the trade table. Washington’s move to raise duties from 35 per cent to 45 per cent on nonCUSMA imports (goods not covered under the Canada-United States-Mexico Agreement, the successor to NAFTA) reflects a diplomatic climate that is quickly souring, with very real consequences for Canadian exporters.

Some analysts argue that a 10-point tariff increase is inconsequential. It is not. The issue isn’t just what is being tariffed; it is the tone of the relationship. Canada is increasingly seen as erratic and reactive, negotiating from emotion rather than strategy. That kind of reputation is dangerous when dealing with the U.S., which remains Canada’s most important trade partner by a wide margin.

Ontario Premier Doug Ford’s stand up to America messaging, complete with a nostalgic Ronald Reagan cameo, may have been rooted in genuine conviction. Many Canadians share his instinct to defend the country’s interests with bold language. But in diplomacy, tone often outweighs intent. What plays well domestically can sound defiant abroad, and the consequences are already being felt in boardrooms and warehouses across the country.

Ford’s public criticisms of companies such as Crown Royal, accused of abandoning Ontario, and Stellantis, which recently announced it will shift production of its Jeep Compass from Brampton to Illinois as part of a US$13 billion U.S. investment, may appeal to voters who like to see politicians get tough. But those theatrics reinforce the impression that Canada is hostile to

international investors. At a time when global capital can move freely, that perception is damaging. Collaboration, not confrontation, is what’s needed most to secure investment in Canada’s economy.

Such rhetoric fuels uncertainty on both sides of the border. The results are clear: higher tariffs, weaker investor confidence and American partners quietly pivoting away from Canadian suppliers.

Many Canadian food exporters are already losing U.S. accounts, not because of trade rules but because of eroding trust. Executives in the agri-food sector are beginning to wonder whether Canada can still be counted on as a reliable partner, and some have already shifted contracts southward.

Ford’s political campaigns may win applause locally, but Washington’s retaliatory measures do not distinguish between provinces. They hit all exporters, including Canada’s food manufacturers that rely heavily on the U.S. market, which purchases more than half of Canada’s agri-food exports. That means farmers, processors and transportation companies across the country are caught in the crossfire.

Those who believe the new 45 per cent rate will have little effect are mistaken. Some Canadian importers now face steeper duties than competitors in Vietnam, Laos or even Myanmar. And while tariffs matter, perception matters more. Right now, the optics for Canada’s agri-food sector are poor, and once confidence is lost, it is difficult to regain.

While many Canadians dismiss Trump as unpredictable, the deeper question is what happened to Canada’s once-cohesive Team Canada approach to trade. The agri-food industry depends on stability and predictability. Alienating our largest customer, representing 34 per cent of the global consumer market and millions of Canadian jobs tied to trade, is not just short-sighted, it’s economically reckless.

There is no trade war. What we are witnessing is an American recalibration of domestic fiscal policy with global consequences. Canada must adapt with prudence, not posturing.

The lesson is simple: reckless rhetoric is costing Canada far more than tariffs. It’s time to change course, especially at Queen’s Park.

Dr. Sylvain Charlebois is a Canadian professor and researcher in food distribution and policy. He is senior director of the Agri-Food Analytics Lab at Dalhousie University and co-host of The Food Professor Podcast. He is frequently cited in the media for his insights on food prices, agricultural trends, and the global food supply chain

Troy Media empowers Canadian community news outlets by providing independent, insightful analysis and commentary. Our mission is to support local media in helping Canadians stay informed and engaged by delivering reliable content that strengthens community connections and deepens understanding across the country

Business

Trans Mountain executive says it’s time to fix the system, expand access, and think like a nation builder

Mike Davies calls for ambition and reform to build a stronger Canada

A shift in ambition

A year after the Trans Mountain Expansion Project came into service, Mike Davies, President and Chief Operating Officer at Trans Mountain, told the B.C. Business Summit 2025 that the project’s success should mark the beginning of a new national mindset — one defined by ambition, reform, and nation building.

“It took fifteen years to get this version of the project built,” Davies said. “During that time, Canadian producers lost about $50 billion in value because they were selling into a discounted market. We have some of the world’s largest reserves of oil and gas, but we can only trade with one other country. That’s unusual.”

With the expansion now in operation, that imbalance is shifting. “The differential on Canadian oil has narrowed by about $13 billion,” he said. “That’s value that used to be extracted by the United States and now stays in Canada — supporting healthcare, reconciliation, and energy transformation. About $5 billion of that is in royalties and taxes. It’s meaningful for us as a society.”

Davies rejected the notion that Trans Mountain was a public subsidy. “The federal government lent its balance sheet so that nation-building infrastructure could get built,” he said. “In our first full year of operation, we’ll return more than $1.3 billion to the federal government, rising toward $2 billion annually as cleanup work wraps up.”

At the Westridge Marine Terminal, shipments have increased from one tanker a week to nearly one a day, with more than half heading to Asia. “California remains an important market,” Davies said, “but diversification is finally happening — and it’s vital to our long-term prosperity.”

Fixing the system to move forward

Davies said this moment of success should prompt a broader rethinking of how Canada approaches resource development. “We’re positioned to take advantage of this moment,” he said. “Public attitudes are shifting. Canadians increasingly recognize that our natural resource advantages are a strength, not a liability. The question now is whether governments can seize it — and whether we’ll see that reflected in policy.”

He called for “deep, long-term reform” to restore scalability and investment confidence. “Linear infrastructure like pipelines requires billions in at-risk capital before a single certificate is issued,” he said. “Canada has a process for everything — we’re a responsible country — but it doesn’t scale for nation-building projects.”

Regulatory reform, he added, must go hand in hand with advancing economic reconciliation. “The challenge of our generation is shifting Indigenous communities from dependence to participation,” he said. “That means real ownership, partnership, and revenue opportunities.”

Davies urged renewed cooperation between Alberta and British Columbia, calling for “interprovincial harmony” on West Coast access. “I’d like to see Alberta see B.C. as part of its constituency,” he said. “And I’d like to see B.C. recognize the need for access.”

He summarized the path forward in plain terms: “We need to stem the exit of capital, create an environment that attracts investment, simplify approvals to one major process, and move decisions from the courts to clear legislation. If we do that, we can finally move from being a market hostage to being a competitor — and a nation builder.”

-

Alberta2 days ago

Alberta2 days agoFrom Underdog to Top Broodmare

-

Business1 day ago

Business1 day agoTrans Mountain executive says it’s time to fix the system, expand access, and think like a nation builder

-

Economy2 days ago

Economy2 days agoIn his own words: Stunning Climate Change pivot from Bill Gates. Poverty and disease should be top concern.

-

Business2 days ago

Business2 days agoPaying for Trudeau’s EV Gamble: Ottawa Bought Jobs That Disappeared

-

International1 day ago

International1 day agoBiden’s Autopen Orders declared “null and void”

-

Addictions2 days ago

Addictions2 days agoThe Shaky Science Behind Harm Reduction and Pediatric Gender Medicine

-

Business2 days ago

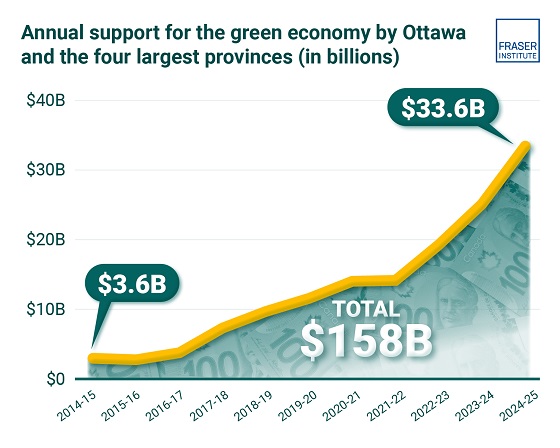

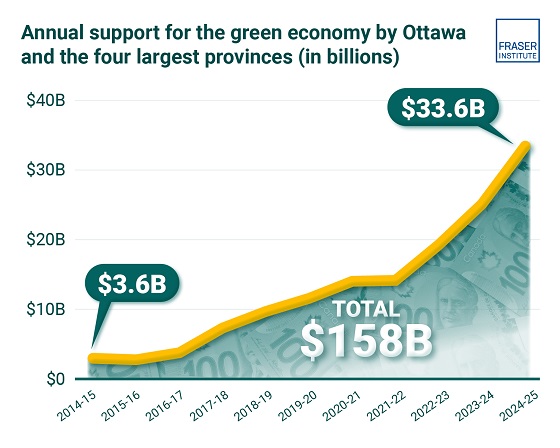

Business2 days agoClean energy transition price tag over $150 billion and climbing, with very little to show for it

-

MAiD23 hours ago

MAiD23 hours agoStudy promotes liver transplants from Canadian euthanasia victims