Business

Estonia’s solution to Canada’s stagnating economic growth

From the Fraser Institute

By Callum MacLeod and Jake Fuss

The only taxes corporations face are on profits they distribute to shareholders. This allows the profits of Estonian firms to be reinvested tax-free permitting higher returns for entrepreneurs.

A new study found that the current decline in living standards is one of the worst in Canada’s recent history. While the economy has grown, it hasn’t kept pace with Canada’s surging population, which means gross domestic product (GDP) per person is on a downward trajectory. Carolyn Rogers, senior deputy governor of the Bank of Canada, points to Canada’s productivity crisis as one of the primary reasons for this stagnation.

Productivity is a key economic indicator that measures how much output workers produce per hour of work. Rising productivity is associated with higher wages and greater standards of living, but growth in Canadian productivity has been sluggish: from 2002 to 2022 American productivity grew 160 per cent faster than Canadian productivity.

While Canada’s productivity issues are multifaceted, Rogers pointed to several sources of the problem in a recent speech. Primarily, she highlighted strong business investment as an imperative to productivity growth, and an area in which Canada has continually fallen short. There is no silver bullet to revive faltering investment, but tax reform would be a good start. Taxes can have a significant effect on business incentives and investment, but Canada’s tax system has largely stood in the way of economic progress.

With recent hikes in the capital gains tax rate and sky-high compliance costs, Canada’s taxes continue to hinder its growth. Canada’s primary competitor is the United States, which has considerably lower tax rates. Canada’s rates on personal income and businesses are similarly uncompetitive when compared to other advanced economies around the globe. Uncompetitive taxes in Canada prompt investment, businesses, and workers to relocate to jurisdictions with lower taxes.

The country of Estonia offers one of the best models for tax reform. The small Baltic state has a unique tax system that puts it at the top of the Tax Foundation’s tax competitiveness index. Estonia has lower effective tax rates than Canada—so it doesn’t discourage work the way Canada does—but more interestingly, its business tax model doesn’t punish investment the way Canada’s does.

Their business tax system is a distributed profits tax system, meaning that the only taxes corporations face are on profits they distribute to shareholders. This allows the profits of Estonian firms to be reinvested tax-free permitting higher returns for entrepreneurs.

The demand for investment is especially strong for capital-intensive companies such as information, communications, and technology (ICT) enterprises, which are some of the most productive in today’s economy. A Bank of Canada report highlighted the lack of ICT investment as a major contributor to Canada’s sluggish growth in the 21st century.

While investment is important, another ingredient to economic growth is entrepreneurship. Estonia’s tax system ensures entrepreneurs are rewarded for success and the result is that Estonians start significantly more businesses than Canadians. In 2023, for every 1,000 people, Estonia had 17.8 business startups, while Canada had only 4.9. This trend is even worse for ICT companies, Estonians start 45 times more ICT businesses than Canadians on a per capita basis.

The Global Entrepreneurship Monitor’s (GEM) 2023/24 report on entrepreneurship confirms that a large part of this difference comes from government policy and taxation. Canada ranked below Estonia on all 13 metrics of the Entrepreneurial Framework. Notably, Estonia scored above Canada when taxes, bureaucracy, burdens and regulation were measured.

While there’s no easy solution to Canada’s productivity crisis, a better tax regime wouldn’t penalize investment and entrepreneurship as much as our current system does. This would allow Canadians to be more productive, ultimately improving living standards. Estonia’s business tax system is a good example of how to promote economic growth. Examples of successful tax structures, such as Estonia’s, should prompt a conversation about how Canadian governments could improve economic outcomes for citizens.

Authors:

Business

President Trump And The Doomsday Glacier… a blow to the planet, or to funding for climate alarmism?

From the Daily Caller News Foundation

By Steve Milloy

President Donald Trump is driving climate researchers literally to the ends of the Earth as they try to save their taxpayer funding. Expect to see a slew of hand-wringing reports about, and even perhaps from, the Thwaites (aka “Doomsday”) glacier in West Antarctica.

The glacier got its nickname from a Rolling Stone reporter in 2017 in an article titled: “The Doomsday Glacier: In the farthest reaches of Antarctica, a nightmare scenario of crumbling ice – and rapidly rising seas – could spell disaster for a warming planet.”

Past the ominous title, the scare is that the Thwaites is melting and could raise sea levels by 10 feet, which would submerge about 2-3 percent of the global land mass, excluding Antarctica.

Last May, the Trump administration announced it would cut funding for the Nathaniel B. Palmer, a football field-long icebreaker that has been taking researchers to study the Thwaites glacier. In its 2026 budget request, the National Science Foundation said it was terminating the lease. There is no replacement ship on the horizon.

Researchers wanting to go to Antarctica, where it is now summer, have had to scramble for ships. This scramble has been made more challenging because ship owners and researchers, afraid of losing taxpayer funding, are also taking reporters and their crews along to dramatize the budget cuts using the backdrop of the scariest thing they can imagine – the Doomsday glacier.

New York Times reporter Raymond Zhong has already filed articles since Dec. 30. PBS has a reporter aboard a ship sending alarmist reports. Undoubtedly, there are other reports on their way as well.

Will the Doomsday glacier live up to its name? Or will it be another in a long line of failed, if not dishonest, apocalyptic climate predictions?

It seems to be true that the Thwaites glacier is melting. But there’s much more to consider just than that.

The rate of melting is very slow. A 2023 study estimated that over the next 50 years, the Thwaites glacier might add as much as a few millimeters (about one-tenth of an inch) to global sea level over the next 50 years. That is a far cry from the claim of 10 feet of sea level rise.

Next, the fate of the Thwaites doesn’t seem to have anything to do with emissions or “global warming.” Research indicates that there are 91 volcanoes under the West Antarctic ice sheet. Not surprisingly, the Thwaites glacier is melting from the inferno beneath.

Of course, the Thwaites couldn’t be melting at the surface because there’s been no warming in West Antarctica since the late 1990s. In fact, West Antarctica has cooled by about 3°F since 1999.

Another recent study reported that the Thwaites glacier started melting in the 1940s as the result of an El Nino, a little-understood, but periodic natural warming of the Pacific Ocean: “The glacier retreat in the Amundsen Sea was initiated by natural climate variability in the 1940s. That ice streams such as Thwaites Glacier and Pine Island Glacier have continued to retreat since then indicates that they were unable to recover after the exceptionally large El Niño event of the 1940s,” the researchers concluded.

The more one reads about the Thwaites glacier, the easier it becomes to understand why they have to call it the “Doomsday glacier.” Once you understand the non-threatening reality, the only way to make it scary is to give it a scary name and hope people are too frightened to look past it.

Three cheers for Trump for defunding this and other climate research. As these researchers lose their funding, maybe they can move to Hollywood and try writing disaster scripts.

Steve Milloy is a biostatistician and lawyer. He posts on X at @JunkScience.

Business

Canada’s Illusion of Stability May Crumble in 2026 Amid Increasingly Dangerous Geopolitics

This year also reaffirmed Canada’s habit of strategic hesitation. Despite overwhelming evidence and allied action, the federal government continued to delay meaningful steps against hostile foreign actors operating within our borders.

As 2026 starts with high-consequence geopolitical events in Venezuela and Iran, Canada continues to present itself to the world as stable, prosperous, and benign. Yet the defining lesson of this past year is that our perceived strength is increasingly an illusion — a façade sustained by political denial, regulatory weakness, and the monetization of risk.

Across multiple fronts — land ownership, real estate, immigration, organized crime, and national security — the same pattern has repeated itself. Warnings were issued. Evidence accumulated. And Ottawa largely chose inaction.

The result is a country drifting further into vulnerability while congratulating itself on tolerance and openness.

Canada’s economy remains dangerously reliant on sectors that are poorly regulated and easily exploited: real estate, land, natural resources, and mass immigration. Throughout the year, investigative reporting and law enforcement intelligence continued to show how foreign capital — often opaque, sometimes criminal — flows freely into these systems with little resistance.

From farmland acquisitions on Prince Edward Island and the Prairies, to urban real estate markets untethered from domestic incomes, Canada has treated ownership and sovereignty as inconveniences rather than safeguards. Weak beneficial ownership registries and limited enforcement ensure that we often do not know who truly controls critical assets — and, worse, seem uninterested in finding out.

This is not economic growth. It is asset stripping disguised as prosperity.

The most brutal manifestation of these blind spots remains fentanyl. In 2025, Canada further cemented its reputation as a preferred destination for laundering synthetic drug profits. Chinese triads, Mexican cartels, and domestic gangs continue to exploit casinos, shell companies, and real estate — not because they are clever, but because Canada is permissive.

Each overdose death is more than a public health failure. It is a financial crime, a national security issue, and a policy indictment. While peer nations have hardened their anti–money laundering regimes, Canada remains slow, fragmented, and politically cautious — a combination that organized crime understands perfectly.

This year also reaffirmed Canada’s habit of strategic hesitation. Despite overwhelming evidence and allied action, the federal government continued to delay meaningful steps against hostile foreign actors operating within our borders.

Some critics charge that Mark Carney’s Liberals are already seeking to water down the long-delayed foreign agent registry, with fines of as little as $50 for non-compliance, while the government has estimated almost 1,800 entities would be expected to register, with 50 additions every year, if this future law were adhered to.

The failure to decisively confront Iranian regime proxies, foreign influence operations, and transnational criminal networks reflects a broader unwillingness to accept that Canada is no longer insulated by geography or reputation.

Our allies increasingly see Canada not as a leader, but as a weak link.

Perhaps nowhere was short-term thinking more evident than in immigration and education policy. Foreign students have become a financial lifeline for institutions, yet oversight remains inadequate. Education visas increasingly function as labour permits in all but name, feeding industries already plagued by regulatory gaps.

Public safety consequences — including in commercial trucking — are no longer theoretical. Nor are concerns about transnational criminal exploitation of these pathways. Yet the federal response continues to prioritize revenue and labour supply over integrity and enforcement.

These are not isolated failures. They are symptoms of a governing philosophy that treats risk as politically inconvenient and accountability as optional. Critics are dismissed as alarmist. Warnings are reframed as xenophobic. And systemic problems are deferred until they become crises.

Canada has been entrusted with extraordinary abundance — land, resources, institutions, and social cohesion. Over the past year, it has become clearer than ever that we are squandering that inheritance.

A nation can only live on reputation for so long. The erosion visible in 2025 will accelerate unless decisive reforms follow: real transparency in ownership, enforceable anti–money laundering laws, a serious national security posture, and immigration systems rooted in integrity rather than expedience.

Canada does not need to abandon openness. It needs to pair openness with vigilance.

The year behind us should be remembered as a warning. Whether the year ahead becomes a correction — or a collapse — will depend on whether leaders finally choose stewardship over denial.

As former Conservative immigration minister Jason Kenney and Conservative Senate leader Leo Housakos have noted, as reported in The Bureau’s analysis of the information war emerging from the Trump administration’s indictment alleging a Maduro narco-state conspiracy, the events in Venezuela are global in nature, and connect directly to Canadian vulnerabilities to transnational money laundering and lax immigration controls that are strategically leveraged by hostile regimes from Beijing to Tehran and Moscow.

And according to Housakos, due to actions emanating from Central and South American authoritarian regimes, including Venezuela, and ultimately instigated by enemies from Beijing, Tehran and Moscow, the upshot is that Western democracies are now facing hybrid warfare threats unprecedented since the Second World War.

In other words, through the tools of transnational drug mafias, political corruption, disinformation, terror and protest, human trafficking, and weaponized migration, Xi, Putin, and the Iranian clerics are attempting to destabilize our societies, softening our defenses before kinetic warfare, or defeating us from within without firing a shot.

Without urgent and decisive leadership in Canada, and the moral clarity and just force that has been in such lack, the continuity of our nation’s great promise is increasingly in doubt.

The Bureau is a reader-supported publication.

To receive new posts and support my work, consider becoming a free or paid subscriber.

-

Frontier Centre for Public Policy1 day ago

Frontier Centre for Public Policy1 day agoIs Canada still worth the sacrifice for immigrants?

-

Bruce Dowbiggin1 day ago

Bruce Dowbiggin1 day agoThe Olympic Shutout: No Quebec Players Invited For Canada

-

Canadian Energy Centre1 day ago

Canadian Energy Centre1 day agoFive reasons why 2026 could mark a turning point for major export expansions

-

International1 day ago

International1 day agoNetwork of Nonprofits with Marxist and CCP Ties, and Elected Socialists Race to Counter Washington’s Narrative of the Maduro Raid

-

Business1 day ago

Business1 day agoPolicy uncertainty continues to damage Canada’s mining potential

-

Alberta1 day ago

Alberta1 day agoTrump’s Venezuela Geopolitical Earthquake Shakes up Canada’s Plans as a “Net Zero” Energy Superpower

-

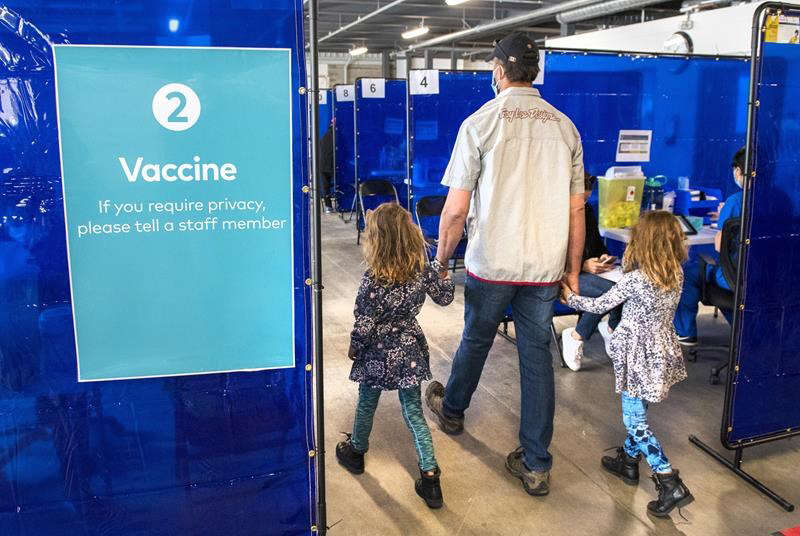

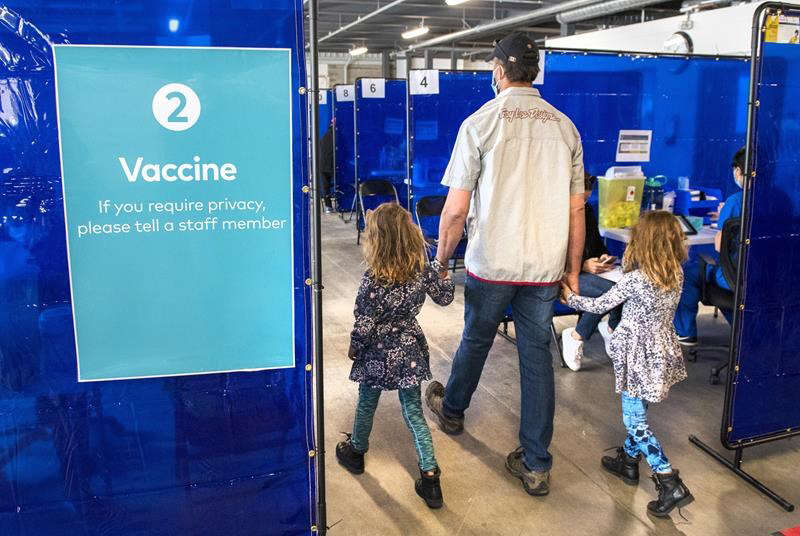

COVID-192 days ago

COVID-192 days agoA new study proves, yet again, that the mRNA Covid jabs should NEVER have been approved for young people.

-

Environment1 day ago

Environment1 day agoLeft-wing terrorists sabotage German power plant, causing massive power outage