Business

Elon Musk declares ‘war’ over plot to ‘kill’ X by NGO linked to Kamala Harris, Keir Starmer

From LifeSiteNews

By Frank Wright

Elon Musk said ‘this is war’ after a plan to ‘kill Twitter’ (now X) was exposed by two journalists. The Center for Countering Digital Hate is considered an ‘ally’ of U.K. Prime Minister Keir Starmer, and its founder is now advising Kamala Harris.

The world’s most successful African-American, Elon Musk, has declared “this is war” after a plan to “kill Twitter” (now X) was revealed.

Leaked documents published by Twitter files journalist Matt Taibbi and Paul Thacker show how an NGO linked to both Kamala Harris and the British Prime Minister Keir Starmer in a “real foreign election interference story.”

As Taibbi and Thacker reported on October 22: “Internal documents from the Center for Countering Digital Hate – whose founder is British political operative Morgan McSweeney, now advising the Kamala Harris campaign – show the group plans in writing to “kill Musk’s Twitter” while strengthening ties with the Biden/Harris administration and Democrats like Senator Amy Klobuchar, who has introduced multiple bills to regulate online ‘misinformation.’”

Following the publication of the report, X owner Elon Musk responded with three explosive words:

This is war https://t.co/tesncwEoXE

— Elon Musk (@elonmusk) October 22, 2024

The Center for Countering Digital Hate (CCDH) is a pro-censorship pressure group and “ally of Prime Minister Keir Starmer’s Labour Party,” according to the joint report. McSweeney, who founded the group, has ties so close to the Democratic Party that Politico has called Labour and the Democrats “sister parties.”

The leaks expose a partnership between the U.K. Labour Party and the Democrats to make good on a plan that has been months in the making – to rid the globalists on both sides of the Atlantic of Elon Musk’s free speech platform.

In the U.S., says the report, the CCDH has run “multiple successful boycotts of media figures across the spectrum” in the past – with attempts to shut down The Federalist and Zerohedge U.S. cutout Stop Funding Fake News. McSweeney’s group sought directly to shut down Substack over claims it had published “misinformation” about the so-called COVID-19 mRNA “vaccines.”

The same tactics are now being used against X, the report continues: “Now, CCDH’s growing Washington office is working on similar plans to ‘kill’ the online presence of Democratic rivals like Musk by attacking X’s advertising revenue.”

Whilst Donald Trump was banned from the platform whilst serving as president, Musk’s tenure has seen the rocket launching billionaire clash directly with U.K. Prime Minister Keir Starmer over the Labour leader’s draconian “two-tier” policing.

Musk had described Starmer as wanting “Soviet Britain,” expressing alarm at Britons “arrested for posting on Facebook.” It seems that war had already been declared on Musk, and his remark was more an acknowledgement of hostilities already well underway.

This is the second attempt on the life of the platform. The move follows efforts in 2023 by the Anti-Defamation League (ADL) to “kill this platform,” which pressured advertisers to defund X – leading to an estimated loss of $22 billion.

Since the acquisition, The @ADL has been trying to kill this platform by falsely accusing it & me of being anti-Semitic

— Elon Musk (@elonmusk) September 4, 2023

In a September 4, 2023 post, Musk claimed that the league was “trying to kill this platform by falsely accusing it & me of being anti-Semitic.” Musk threatened to sue the Anti-Defamation League – for defaming him, and for the massive loss of revenue resulting from its defamatory campaign.

Evidence of ties to the “Deep State” in the plot to “kill Twitter” has been uncovered, showing how the CCDH’s chairman is also on the Atlantic Council.

As Mike Benz reported in July 2023, “The Chairman of CCDH’s Board is Simon Clark, straight outta the Atlantic Council’s Digital Forensic Lab. Atlantic Council has 7 former CIA directors on its board and is funded by the UK Foreign Office (and the US State Dept and US Department of Defense.”

Benz, a well-known critic and analyst of the Deep State, showed that the “anti-disinformation” group’s former communication chief was a “self-described CIA operative.”

His evidence shows that the U.K. government-backed censorship group is also linked through the Atlantic Council to Biden family connection Burisma.

“The Atlantic Council was also directly partnered with Burisma and had a direct partnership with DHS to censor Trump supporters ahead of the 2020 election,” Benz said in a post on October 22, adding that the Atlantic Council has “7 CIA directors on its board.”

Interesting.

In our case, they would potentially be on the hook for destroying half the value of the company, so roughly $22 billion.

— Elon Musk (@elonmusk) September 4, 2023

The plot to silence the world’s leading free speech platform reveals a deep network of UK and US government coordination through its many proxies to destroy any challenge to its narrative control.

An in-depth report by Zerohedge, which survived a shutdown attack by the CCDH last year, shows a breathtaking network of covert and overt operations with enormous power in the U.S. going back years.

Zerohedge published evidence of a 2020 campaign by the CCDH directing state attorneys general to deplatform the “Disinformation Dozen” of twelve leading COVID “vaccine” critics – including Robert F. Kennedy Jr.

As Zerohedge notes, “However, these are only the visible parts of the British invasion. McSweeney’s Labour Together has been operating in the U.S. for several years through CCDH.”

Yet this transatlantic conspiracy goes beyond the business of limiting speech – and defunding those who defend its freedom. Reports now show direct interference in the U.S. presidential election.

The Trump-Vance campaign has filed a Federal Election Commission complaint against Starmer’s ruling Labour Party after it publicized moves to “recruit and send … far-left party members” members to canvass for Kamala Harris “in critical battleground states.”

In a statement titled “The British Are Coming!” Trump-Vance campaign co-manager Susie Wiles said “the failing Harris campaign is seeking foreign influence to boost its radical message” – charging that this amounts to “election interference.”

The move comes alongside reports comparing both Trump and Elon Musk to Hitler. Musk responded to the charge in Germany’s Der Spiegel with a humourous tweet which was immediately used by CNN to re-Hitlerize him.

Well, I did Nazi that coming! Those fools will Goebbels anything down …

I bet their pronouns are He/Himmler! https://t.co/Lwlh0wKvW4

— Elon Musk (@elonmusk) October 21, 2024

The exposure of this second plot to “kill Twitter” shows Elon Musk, Robert F. Kennedy, and now Trump and Vance themselves, directly targeted by a globalist “Grand Atlantic Alliance” and its covert and overt agents.

This amounts to a mission not only against these men, but against regime-critical media from across the political spectrum. This is a scandal which reveals the mechanism by which permanent rule is intended to be secured.

With Musk’s declaration, the first shots have been fired in a war for the future of freedom of speech – and for the nature of the free world itself.

Business

Some Of The Wackiest Things Featured In Rand Paul’s New Report Alleging $1,639,135,969,608 In Gov’t Waste

From the Daily Caller News Foundation

Republican Kentucky Sen. Rand Paul released the latest edition of his annual “Festivus” report Tuesday detailing over $1 trillion in alleged wasteful spending in the U.S. government throughout 2025.

The newly released report found an estimated $1,639,135,969,608 total in government waste over the past year. Paul, a prominent fiscal hawk who serves as the chairman of the Senate Homeland Security and Governmental Affairs Committee, said in a statement that “no matter how much taxpayer money Washington burns through, politicians can’t help but demand more.”

“Fiscal responsibility may not be the most crowded road, but it’s one I’ve walked year after year — and this holiday season will be no different,” Paul continued. “So, before we get to the Feats of Strength, it’s time for my Airing of (Spending) Grievances.”

Dear Readers:

As a nonprofit, we are dependent on the generosity of our readers.

Please consider making a small donation of any amount here.

Thank you!

The 2025 “Festivus” report highlighted a spate of instances of wasteful spending from the federal government, including the Department of Health and Human Services (HHS) spent $1.5 million on an “innovative multilevel strategy” to reduce drug use in “Latinx” communities through celebrity influencer campaigns, and also dished out $1.9 million on a “hybrid mobile phone family intervention” aiming to reduce childhood obesity among Latino families living in Los Angeles County.

The report also mentions that HHS spent more than $40 million on influencers to promote getting vaccinated against COVID-19 for racial and ethnic minority groups.

The State Department doled out $244,252 to Stand for Peace in Islamabad to produce a television cartoon series that teaches children in Pakistan how to combat climate change and also spent $1.5 million to promote American films, television shows and video games abroad, according to the report.

The Department of Veterans Affairs (VA) spent more than $1,079,360 teaching teenage ferrets to binge drink alcohol this year, according to Paul’s report.

The report found that the National Science Foundation (NSF) shelled out $497,200 on a “Video Game Challenge” for kids. The NSF and other federal agencies also paid $14,643,280 to make monkeys play a video game in the style of the “Price Is Right,” the report states.

Paul’s 2024 “Festivus” report similarly featured several instances of wasteful federal government spending, such as a Las Vegas pickleball complex and a cabaret show on ice.

The Trump administration has been attempting to uproot wasteful government spending and reduce the federal workforce this year. The administration’s cuts have shrunk the federal workforce to the smallest level in more than a decade, according to recent economic data.

Festivus is a humorous holiday observed annually on Dec. 23, dating back to a popular 1997 episode of the sitcom “Seinfeld.” Observance of the holiday notably includes an “airing of grievances,” per the “Seinfeld” episode of its origin.

Alberta

A Christmas wish list for health-care reform

From the Fraser Institute

By Nadeem Esmail and Mackenzie Moir

It’s an exciting time in Canadian health-care policy. But even the slew of new reforms in Alberta only go part of the way to using all the policy tools employed by high performing universal health-care systems.

For 2026, for the sake of Canadian patients, let’s hope Alberta stays the path on changes to how hospitals are paid and allowing some private purchases of health care, and that other provinces start to catch up.

While Alberta’s new reforms were welcome news this year, it’s clear Canada’s health-care system continued to struggle. Canadians were reminded by our annual comparison of health care systems that they pay for one of the developed world’s most expensive universal health-care systems, yet have some of the fewest physicians and hospital beds, while waiting in some of the longest queues.

And speaking of queues, wait times across Canada for non-emergency care reached the second-highest level ever measured at 28.6 weeks from general practitioner referral to actual treatment. That’s more than triple the wait of the early 1990s despite decades of government promises and spending commitments. Other work found that at least 23,746 patients died while waiting for care, and nearly 1.3 million Canadians left our overcrowded emergency rooms without being treated.

At least one province has shown a genuine willingness to do something about these problems.

The Smith government in Alberta announced early in the year that it would move towards paying hospitals per-patient treated as opposed to a fixed annual budget, a policy approach that Quebec has been working on for years. Albertans will also soon be able purchase, at least in a limited way, some diagnostic and surgical services for themselves, which is again already possible in Quebec. Alberta has also gone a step further by allowing physicians to work in both public and private settings.

While controversial in Canada, these approaches simply mirror what is being done in all of the developed world’s top-performing universal health-care systems. Australia, the Netherlands, Germany and Switzerland all pay their hospitals per patient treated, and allow patients the opportunity to purchase care privately if they wish. They all also have better and faster universally accessible health care than Canada’s provinces provide, while spending a little more (Switzerland) or less (Australia, Germany, the Netherlands) than we do.

While these reforms are clearly a step in the right direction, there’s more to be done.

Even if we include Alberta’s reforms, these countries still do some very important things differently.

Critically, all of these countries expect patients to pay a small amount for their universally accessible services. The reasoning is straightforward: we all spend our own money more carefully than we spend someone else’s, and patients will make more informed decisions about when and where it’s best to access the health-care system when they have to pay a little out of pocket.

The evidence around this policy is clear—with appropriate safeguards to protect the very ill and exemptions for lower-income and other vulnerable populations, the demand for outpatient healthcare services falls, reducing delays and freeing up resources for others.

Charging patients even small amounts for care would of course violate the Canada Health Act, but it would also emulate the approach of 100 per cent of the developed world’s top-performing health-care systems. In this case, violating outdated federal policy means better universal health care for Canadians.

These top-performing countries also see the private sector and innovative entrepreneurs as partners in delivering universal health care. A relationship that is far different from the limited individual contracts some provinces have with private clinics and surgical centres to provide care in Canada. In these other countries, even full-service hospitals are operated by private providers. Importantly, partnering with innovative private providers, even hospitals, to deliver universal health care does not violate the Canada Health Act.

So, while Alberta has made strides this past year moving towards the well-established higher performance policy approach followed elsewhere, the Smith government remains at least a couple steps short of truly adopting a more Australian or European approach for health care. And other provinces have yet to even get to where Alberta will soon be.

Let’s hope in 2026 that Alberta keeps moving towards a truly world class universal health-care experience for patients, and that the other provinces catch up.

-

Bruce Dowbiggin2 days ago

Bruce Dowbiggin2 days agoHunting Poilievre Covers For Upcoming Demographic Collapse After Boomers

-

Censorship Industrial Complex1 day ago

Censorship Industrial Complex1 day agoCanadian university censors free speech advocate who spoke out against Indigenous ‘mass grave’ hoax

-

Business1 day ago

Business1 day agoState of the Canadian Economy: Number of publicly listed companies in Canada down 32.7% since 2010

-

Alberta2 days ago

Alberta2 days agoHousing in Calgary and Edmonton remains expensive but more affordable than other cities

-

Alberta2 days ago

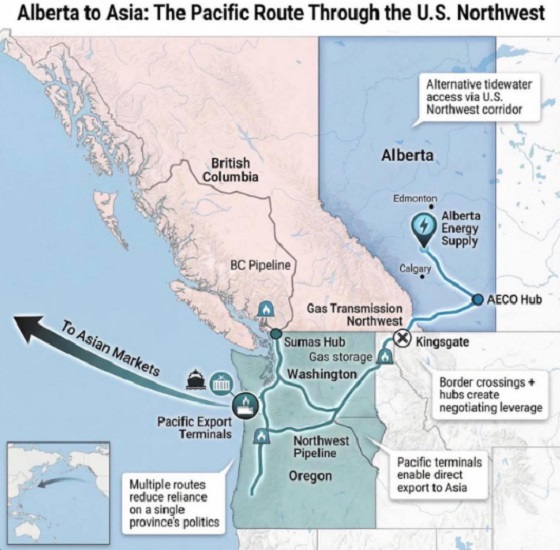

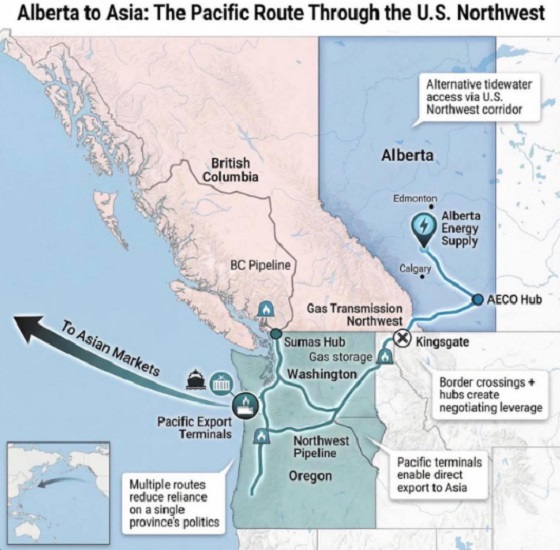

Alberta2 days agoWhat are the odds of a pipeline through the American Pacific Northwest?

-

Business2 days ago

Business2 days agoWarning Canada: China’s Economic Miracle Was Built on Mass Displacement

-

Agriculture2 days ago

Agriculture2 days agoThe Climate Argument Against Livestock Doesn’t Add Up

-

International1 day ago

International1 day agoGeorgia county admits illegally certifying 315k ballots in 2020 presidential election