Alberta

Why the oilsands’ weaknesses are turning into strengths

From the MacDonald Laurier Institute

By Heather Exner-Pirot

Global oil prices are recovering from a multi-year bust

Few industrial projects have been more maligned than Canada’s oilsands. It has been called tar sands, a carbon bomb, the “dirtiest oil on the planet.” It’s suffered through the shale revolution, the COVID-19 shutdown, and a torrent of ESG (Environmental, Social and Governance) divestment. Its grade of heavy oil has been discounted and shunned.

But despite the challenges, things are coming up roses. In almost every aspect of the sector that has looked weak in the past decade—costs, grade, carbon intensity—the oilsands are coming on strong, and poised to provide unprecedented revenue streams for Canadian public coffers.

Oilsands are known as “unconventional” oil, which is extraction from anything other than traditional, vertical wells. In northern Alberta, the expansive hydrocarbon resources are in bitumen form, a molasses-like consistency too heavy to flow on its own. It takes a lot of capital and energy to turn the oilsands’ oil into a product that can be transported, refined and used by consumers.

For this reason, the oilsands were seen in the early 2010s as an expensive form of oil, with high up-front costs and a high break-even price: up to USD$75/barrel for new oilsands mines. This made it difficult to compete with cheaper American shale, which came online at scale at the same time as the oilsands, to great chagrin in Calgary.

However, global oil prices are recovering from a multi-year bust, and new “in-situ” extraction technologies have greatly reduced oilsands recovery costs. Break-even prices now average less than USD$40/barrel, and BMO Capital Markets assessed in September that the average oilsands producers could cover their capital budgets and base dividends at USD$46/barrel. By contrast the average large U.S. producer requires USD$53.50/barrel. For new shale wells outside of Texas last year, it was $69/barrel.

Another advantage is that oilsands are low-decline, which means they have decades of inventory, or oil available to be extracted. Shale oil sites have declined as high as 50 percent in the first year. While the oilsands reap the benefits of past investments, shale producers need to continuously drill and invest in new production. (But they haven’t been of late: the U.S. oil rig count has fallen 21 percent since December 2022, largely because of new well costs.)

Another challenge for the oilsands has been its grade: “heavy” or dense, and “sour” or high in sulfur. Light, sweet crudes are easier to refine and have historically sold at a premium. The difference can be stark: at its worst in 2018, West Texas Intermediate (WTI) oil sold for USD$57 a barrel, compared to just USD$11 for heavy Western Canada Select (WCS).

But heavy oil has qualities that are desirable, even necessary for some refined products. Whereas light crude is primarily made into fuels, heavy oil is advantageous for plastics, petrochemicals, other fuels, and road surfacing: things we will still need in a post-combustion, net-zero world. Many American refineries are configured to process heavy oil. Because the U.S. produces virtually none itself, they depend on cheap Canadian sources.

Geopolitical factors are also bolstering heavy and sour oil. Recent production cuts by OPEC+, designed to lift global oil prices, have limited supply of medium and heavy sour grades, which matches the kind of oil the Biden Administration released in its big Strategic Petroleum Reserve sell-off last year. This has brought higher prices for heavy, sour oil, more good news for the oilsands.

As for the oilsands’ biggest Achilles heel, its carbon intensity, this is another weakness turning into a strength. The oilsands are geographically concentrated, with a small number of facilities producing large amounts of emissions. This makes them far easier to decarbonize than conventional oil, which needs huge fleets of rigs creating hundreds of emissions sources in order to produce comparable amounts of oil. Seizing the opportunity, the major oilsands producers are working together on one of the biggest carbon capture projects in the world, building a 400-km CO₂ pipeline that could link over 20 CCS facilities with a carbon storage hub in northeast Alberta. Small modular reactors are another option being explored to reduce emissions. It’s not easy or cheap, but it’s possible to reach net zero, which producers plan to do by 2050.

All of this is not just good news for the oilsands, but for Albertans and Canadians as well. In 2022, royalties going into public coffers from oil and gas extraction hit a record $33.8 billion; that’s more than all royalties from 2016-20 combined. The boost comes not just from higher prices but from Alberta’s strategy to charge significantly higher royalties—up to 40 percent—from oilsands facilities whose upfront development costs have been paid off and revenues are exceeding operating expenses.

A large number of facilities have already reached this threshold, and more are added each year. This flexible new paradigm of permanently higher royalties helps governments moderate the budget rollercoaster of volatile oil prices: nine times more at $55/barrel, and four and half times more at $120/barrel. Next year, when the TMX pipeline adds more than half a million barrels a day of capacity from the oilsands to new markets, the value of royalties will also increase, along with corporate taxes.

Of course, the oilsands still face headwinds from Ottawa, none bigger than a proposal to reduce oil and gas emissions by 42 percent (from 2019 levels) by 2030. Although the oil and gas sector has invested heavily in emissions reductions, and greenhouse gas intensity per barrel fell 20 percent between 2009 and 2020, there is no way to meet the new target without cutting production. S&P Global estimates that 1.3 million barrels of daily output will need to be slashed, which would be an existential threat to the sector. Fortunately, the political tide in Canada is turning in such a way that the oilsands could hang on long enough to see friendlier policies.

Finally, the oilsands remain unloved by investors, although the tide has been turning with higher prices. Their enterprise multiple (EV/DACF), a standard valuation formula, is on average 5.8x as of September and was even lower in 2022. This is much lower than the S&P 500, which has averaged between 11 to 16x in the last few years. In Calgary this has been called the Ottawa penalty box: the only logical explanation for their low valuation seems to be the lack of confidence investors associate with the Canadian energy policy landscape. At any rate, oilsands companies are currently free cashflow machines and are rewarding the shareholders they do have with share buybacks.

After nearly a decade on their back foot, the oilsands have reason for optimism. Lots of people still love to hate them, but they’re starting to rack up some wins.

Heather Exner-Pirot is the director of energy, natural resources and environment at the Macdonald-Laurier Institute.

Alberta

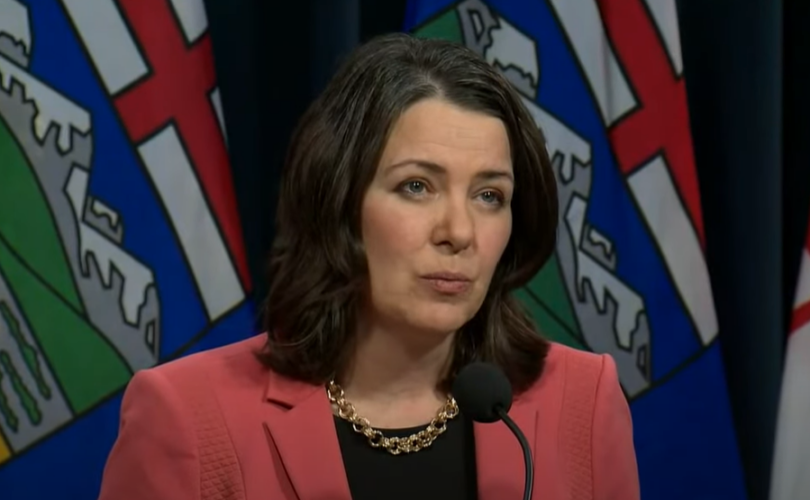

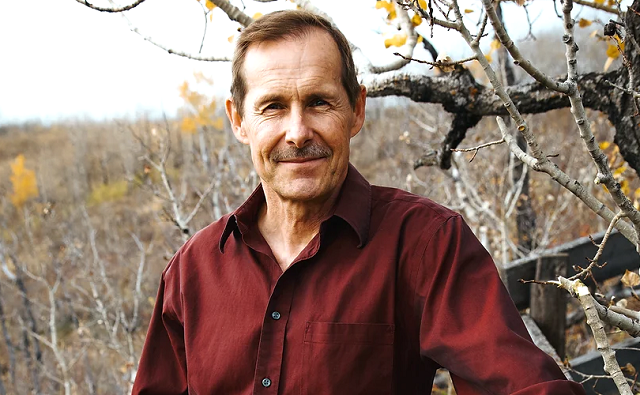

Canadian Christian chiropractor fights ‘illegal’ $65,000 fine for refusing to wear mask

From LifeSiteNews

Dr. Curtis Wall went against the College of Chiropractors of Alberta’s COVID mask mandate in 2020 and the organization has been pursuing disciplinary action ever since.

The legal team for Dr. Curtis Wall, a Canadian chiropractor who was recently fined $65,000 by his medical college for not wearing a mask in 2020 despite the fact public health orders last year were nullified by a court, has vowed to fight the “illegal” fine, saying that Wall was targeted because he is a “Christian man of integrity and principle.”

“Dr. Wall should not pay any fines or costs when the public health orders he was charged with not following have been declared void by the courts,” said Wall’s legal team, Liberty Coalition Canada (LCC), in a press release.

“He is a Christian man of integrity and principle — attributes that make him a target for government overreach in the era of COVID.”

Wall was practicing in Calgary in 2020 when the COVID crisis was gearing up, went against Alberta’s public health orders and chose not to wear a mask during patient visits. Many of his patients also decided to not wear masks during their visits, which quickly drew the ire of College of Chiropractors of Alberta, which had mandated that all chiropractors wear masks.

Wall, who has been seeing patients for the last 25 years with a pristine record, was then targeted by the College, which tried to strip him of his license to practice. The College was unable to strip Wall of his license and he continued to practice, sans mask in 2021 and 2022.

In 2021, the College had brought against Wall, as per the LCC, “a long list of charges of unprofessional conduct against Dr. Wall, most of which related to Dr. Wall not wearing a mask while treating patients and permitting his patients to not wear a mask.”

Wall was then brought before a disciplinary hearing Tribunal to mediate his case, which went well into 2022, and had placed a publication ban on all “identities of all witnesses,” including Wall’s.

James Kitchen, Wall’s lawyer from the LCC, was successful in getting the publication ban lifted, as the LCC noted due to the College “wishing to avoid likely defeat before the courts” regarding keeping the ban in place.

Fined chiropractor says college did not recognize his ‘Christian convictions’

In 2023, the Tribunal ruled against Wall entirely and in favor of the College.

The Tribunal’s decision noted the LCC is “riddled with errors of fact and law and is so poorly decided it is an embarrassment to the chiropractic profession.”

Wall spoke with LifeSiteNews and observed that while in his point of view he does not feel his fines and costs imposed on him by the college “are a direct result of my Christian faith,” he did note that the tribunal did “not recognize my honest Christian convictions as a valid reason for my not wearing a mask.”

“They put placed no merit in the argument that as a Christian I believe I am created in the image of God,” Wall said.

“My face is an expression of Him. Having man arbitrarily mandate that I cover my face is an affront to that expression and signifies that I am living in the fear of man, not by faith. So, in all, I don’t feel directly persecuted as a Christian, but certainly indirectly.”

Wall told LifeSiteNews that in his opinion the college could have “handled this issue much differently.”

“There must always be room for exceptions to a rule. I did present a doctor’s note to verify my inability to wear a mask. They did not place any weight on that note. They blamed me for ‘self-diagnosing’ my problem,” Wall said.

“Number one, I’m a doctor. I think eight years of schooling has given me some wisdom to diagnose my own signs and symptoms. Number two, if someone eats a peanut and their throat swells shut, can they not diagnose themselves and stay away from nuts? It’s not a problem to self-diagnose.”

Wall said that despite his legal team presenting four expert witnesses to demonstrate “the obvious inadequacy and lack of efficacy in mask-wearing, not to mention the harms as well,” the college “did not cite the record once in their verdict.”

He noted that “common sense, science and past and present studies overwhelmingly demonstrate” the lack of efficacy regarding mask-wearing.

The LCC noted that although both Kitchen and Wall hoped for an “unbiased decision from the tribunal,” they knew it was more “likely the tribunal members would lack the courage to oppose the government’s COVID narrative by accepting the scientific evidence masks are utterly ineffective at preventing the transmission of COVID and harmful to wearers.”

“Nonetheless, it is shocking the lengths the tribunal went to dismiss the evidence of Dr. Wall, three of his patients, and his four expert witnesses while blithely accepting all the evidence of the College.”

Wall’s charges laid despite a recent court ruling nullifying all Alberta COVID health orders

According to LCC, the charges brought against Wall show that the College of Chiropractors of Alberta has “ignored the law” relating to non-criminal COVID-era charges handed out in the province.

As reported by LifeSiteNews before, last year a judge from Alberta ruled that politicians violated the province’s health act by making decisions regarding COVID mandates without authorization. This ruling came from the Alberta’s Court of Kings Bench’s Ingram v. Alberta decision, which put into doubt all cases involving those facing non-criminal COVID-related charges in the province. In effect, the ruling struck down and nullified all health orders issued by Dr. Deena Hinshaw, Alberta’s former chief medical officer of health.

As a result, multiple people facing charges, such as Dr. Michal Princ, pizzeria owner Jesse Johnson, café owner Chris Scott, and Alberta pastors James Coates, Tim Stephens, and Artur Pawlowski who were jailed for keeping churches open under then-Premier Jason Kenney, have had COVID charges against them dropped due to the court ruling.

The Alberta’s Court of Kings Bench’s Ingram v. Alberta decision put into doubt all cases involving those facing non-criminal COVID-related charges in the province.

As a result of the court ruling, Alberta Crown Prosecutions Service (ACPS) said Albertans facing COVID-related charges will likely not be convicted but instead have their charges stayed.

However, last year, the College, and of important note after the Ingram ruling, ordered Wall to pay $65,000 in fines and costs “under threat of immediately losing his license to practice if he does not pay,” the LCC said.

Chiropractor’s lawyer to fight fine tooth and nail

According to the LCC, the College’s new complaints director said she will enforce the tribunal’s court-defying order and mandate Wall pay the $65,000.

Because of this, Kitchen submitted an application to the College “to prevent this injustice” against Wall, the LCC noted.

“The Application will be heard on June 21. It will be heard virtually and is open to public, although the College has erected a number of barriers to people attending its hearings. For one, people must register with the hearings director and must do so many days in advance,” he told LifeSiteNews.

“The Tribunal elected to ignore the Ingram decision despite issuing its decision over two weeks after Ingram was released by the Court.”

Kitchen noted that the Tribunal had a lawyer advising it who was being paid some $700 an hour. He told LifeSiteNews that “Tribunals can do whatever they want and often do.”

“Only if the affected person takes further legal action can they hold the Tribunals accountable. And even then, that’s very difficult because the first appeals are to the councils of the Colleges, which almost always rubber stamp whatever the Tribunals decide. Real accountability isn’t had until the impugned professional is able to reach the Court of Appeal, which of course takes years and an enormous amount of funding for lawyer fees,” Kitchen said.

Kitchen is working Wall’s case at discounted rates and noted that high legal costs in such cases dealing with tribunals, who can drag things on for years, to him appear to be a tactic the Colleges count on for “avoiding accountability.”

The LCC estimates the College, which is funded through payments from all chiropractors, paid some $600,000 in legal fees to fight Wall.

“LCC asks supporters to donate toward Dr. Wall’s case so he and Mr. Kitchen can hold the College of Chiropractors of Alberta accountable and bring an end to the unjust persecution of Dr. Curtis Wall. Liberty Coalition Canada is assisting Dr. Wall with his legal expenses through the Legal Defense Fund.”

Kenney quit after losing the confidence of his United Conservative Party (UCP) members for backtracking on his promise to not impose a COVID vaccine passport. Under Kenney, thousands of businesses, notably restaurants and small shops, were negatively impacted by severe COVID restrictions, mostly in 2020-21, that forced them to close their doors for a time. Many never reopened. At the same time, as in the rest of Canada, big box stores were allowed to operate unimpeded.

Under Kenney, thousands of nurses, doctors, healthcare and government workers lost their jobs for choosing to not get the jabs, leading Premier Danielle Smith to say – only minutes after being sworn in – that over the past year the “unvaccinated” were the “most discriminated against” people in her lifetime.

Recently, LifeSiteNews reported on how Alberta-based Rath & Company is in the process of putting together a class-action lawsuit against the Alberta government on behalf of many business owners in the province who faced massive losses or permanent closures from what it says were “illegal” COVID public health orders enacted by provincial officials.

Alberta

Game changer: Trans Mountain pipeline expansion complete and starting to flow Canada’s oil to the world

Workers complete the “golden weld” of the Trans Mountain pipeline expansion on April 11, 2024 in the Fraser Valley between Hope and Chilliwack, B.C. The project saw mechanical completion on April 30, 2024. Photo courtesy Trans Mountain Corporation

From the Canadian Energy Centre

By Will Gibson

‘We’re going to be moving into a market where buyers are going to be competing to buy Canadian oil’

It is a game changer for Canada that will have ripple effects around the world.

The Trans Mountain pipeline expansion is now complete. And for the first time, global customers can access large volumes of Canadian oil, with the benefits flowing to Canada’s economy and Indigenous communities.

“We’re going to be moving into a market where buyers are going to be competing to buy Canadian oil,” BMO Capital Markets director Randy Ollenberger said recently, adding this is expected to result in a better price for Canadian oil relative to other global benchmarks.

The long-awaited expansion nearly triples capacity on the Trans Mountain system from Edmonton to the West Coast to approximately 890,000 barrels per day. Customers for the first shipments include refiners in China, California and India, according to media reports.

Shippers include all six members of the Pathways Alliance, a group of companies representing 95 per cent of oil sands production that together plan to reduce emissions from operations by 22 megatonnes by 2030 on the way to net zero by 2050.

The first tanker shipment from Trans Mountain’s expanded Westridge Marine Terminal is expected later in May.

Photo courtesy Trans Mountain Corporation

Photo courtesy Trans Mountain Corporation

The new capacity on the Trans Mountain system comes as demand for Canadian oil from markets outside the United States is on the rise.

According to the Canada Energy Regulator, exports to destinations beyond the U.S. have averaged a record 267,000 barrels per day so far this year, up from about 130,000 barrels per day in 2020 and 33,000 barrels per day in 2017.

“Oil demand globally continues to go up,” said Phil Skolnick, New York-based oil market analyst with Eight Capital.

“Both India and China are looking to add millions of barrels a day of refining capacity through 2030.”

In India, refining demand will increase mainly for so-called medium and heavy oil like what is produced in Canada, he said.

“That’s where TMX is the opportunity for Canada, because that’s the route to get to India.”

Led by India and China, oil demand in the Asia-Pacific region is projected to increase from 36 million barrels per day in 2022 to 52 million barrels per day in 2050, according to the U.S. Energy Information Administration.

More oil coming from Canada will shake up markets for similar world oil streams including from Russia, Ecuador, and Iraq, according to analysts with Rystad Energy and Argus Media.

Expanded exports are expected to improve pricing for Canadian heavy oil, which “have been depressed for many years” in part due to pipeline shortages, according to TD Economics.

Photo courtesy Trans Mountain Corporation

Photo courtesy Trans Mountain Corporation

In recent years, the price for oil benchmark Western Canadian Select (WCS) has hovered between $18-$20 lower than West Texas Intermediate (WTI) “to reflect these hurdles,” analyst Marc Ercolao wrote in March.

“That spread should narrow as a result of the Trans Mountain completion,” he wrote.

“Looking forward, WCS prices could conservatively close the spread by $3–4/barrel later this year, which will incentivize production and support industry profitability.”

Canada’s Parliamentary Budget Office has said that an increase of US$5 per barrel for Canadian heavy oil would add $6 billion to Canada’s economy over the course of one year.

The Trans Mountain Expansion will leave a lasting economic legacy, according to an impact assessment conducted by Ernst & Young in March 2023.

In addition to $4.9 billion in contracts with Indigenous businesses during construction, the project leaves behind more than $650 million in benefit agreements and $1.2 billion in skills training with Indigenous communities.

Ernst & Young found that between 2024 and 2043, the expanded Trans Mountain system will pay $3.7 billion in wages, generate $9.2 billion in GDP, and pay $2.8 billion in government taxes.

-

COVID-191 day ago

COVID-191 day agoCOVID Is Over — But Did We Learn Anything From It?

-

Energy1 day ago

Energy1 day agoU.S. EPA Unveils Carbon Dioxide Regulations That Could End Coal and Natural Gas Power Generation

-

John Stossel1 day ago

John Stossel1 day agoThe Swamp Survived: Why Trump Failed to “Drain the Swamp”

-

Alberta2 days ago

Alberta2 days agoCanadian Christian chiropractor fights ‘illegal’ $65,000 fine for refusing to wear mask

-

Environment1 day ago

Environment1 day agoScientific Report Pours Cold Water On Major Talking Point Of Climate Activists

-

conflict1 day ago

conflict1 day agoAmerica Is Really Bad At Foreign Interventions. Why Does Biden Think Ukraine Will Be Any Different?

-

Opinion19 hours ago

Opinion19 hours agoBoy Scouts of America changes name to ‘Scouting America’ to be ‘more inclusive’

-

Media2 days ago

Media2 days agoCBC tries to hide senior executive bonuses