Alberta

Pocklington is Gone But Feelings Remain

Pocklington is Gone But Feelings Remain

Conflict decorates every yard of the sports world’s journey these days. If you can find an easy yes or no on such issues as relaxing COVID-19 precautions and finding agreement on matters like schedules and salary levels that happen year after year, you’re much smarter than I am.

Given the size of this emotional upheaval, this is the perfect time for Peter Pocklington and all the controversial memories tied to his name to remind all of us. yes again, that there probably would no National Hockey League team in Edmonton but for him, and the brilliance shown by the 1980 Edmonton Oilers would not be part of this city’s, or this province’s remarkable hockey history.

All it took to get the old fires burning was a simple public letter in which Peter Puck congratulated captain/coach/general manager Kevin Lowe on his induction into the Hockey Hall of Fame.

In less than a day, this familiar question was raised in my hearing at least once: does Pocklington also belong in the Hall that welcomed Lowe, Oilers general manager Ken Holland and four others earlier this week?

Without the slightest doubt, many in and around Alberta believe his act of buying the Oilers when they were in the old World Hockey Association and later becoming an owner in the WHA and part of the 1979-80 National Hockey League expansion. The team’s massive record for much of the next decade provides strong unspoken testimony in his behalf.

Had Wayne Gretzky not been part of the WHA’s expansion package, it’s fair to argue the expansion might never have happened. Slim and young, the budding superstar was an Oiler only because of Pocklington’s transaction with old friend Nelson Skalbania, who lost ample amounts while operating the Indianapolis Racers, who never became part of any expansion talk.

Ultimately, as the record shows, Pocklington’s instincts and diminishing financial stability led to loss of team control after years of operating on a line of credit with Alberta Treasury Branches. Money was exchanged, in addition to players, in the vast majority of trades under the control of Pocklington and Glen Sather.

Gretzky brought about $15 million from the Los Angeles Kings. “I was not traded,” Wayne said. “I was sold.”

Promising centre Jimmy Carson came to Alberta as part of the swap and later netted $5 million when he went to the Detroit Red Wings. Mark Messier, Jari Kurri and Paul Coffey also brought cash when they were moved.

David Cruise, co-author of a later book on hockey’s finances, summed things up, “The picture’s clear; the Oilers trade their assets for money.” A parallel was drawn between athletes and automobiles: “Buy the car, get as much mileage out of it as you can, then you sell it just before the block breaks.”

Many parallels have been drawn between Pocklington, found guilty in more than a few financial free-for-alls outside of hockey, and former Toronto Maple Leafs president Harold Ballard, the team’s alternate governor when the Leafs won Stanley Cups in 1962, 1963 and 1967 – the last time the Leafs have taken home the championship.

Ballard also spent time in jail, convicted on up to 47 charges of fraud. He embarrassed many Leaf greats, notably Darryl Sittler, Lanny MacDonald and Dave Keon, as well as respected coach Roger Neilson. In addition, Pal Hal defied NHL president John Ziegler on many resolutions – once refusing to put players names on jerseys.

But Ballard is in the Hockey Hall of Fame. Pocklington is on the outside. According to numerous critics, that’s where he belongs. It seems reasonable to bet the debate will rise again. Probably next year, at Hall of Fame selection time.

Alberta

Alberta Premier Danielle Smith Discusses Moving Energy Forward at the Global Energy Show in Calgary

From Energy Now

At the energy conference in Calgary, Alberta Premier Danielle Smith pressed the case for building infrastructure to move provincial products to international markets, via a transportation and energy corridor to British Columbia.

“The anchor tenant for this corridor must be a 42-inch pipeline, moving one million incremental barrels of oil to those global markets. And we can’t stop there,” she told the audience.

The premier reiterated her support for new pipelines north to Grays Bay in Nunavut, east to Churchill, Man., and potentially a new version of Energy East.

The discussion comes as Prime Minister Mark Carney and his government are assembling a list of major projects of national interest to fast-track for approval.

Carney has also pledged to establish a major project review office that would issue decisions within two years, instead of five.

Alberta

Punishing Alberta Oil Production: The Divisive Effect of Policies For Carney’s “Decarbonized Oil”

From Energy Now

By Ron Wallace

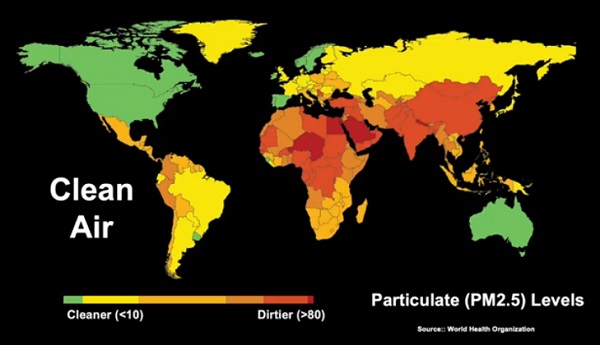

The federal government has doubled down on its commitment to “responsibly produced oil and gas”. These terms are apparently carefully crafted to maintain federal policies for Net Zero. These policies include a Canadian emissions cap, tanker bans and a clean electricity mandate.

Following meetings in Saskatoon in early June between Prime Minister Mark Carney and Canadian provincial and territorial leaders, the federal government expressed renewed interest in the completion of new oil pipelines to reduce reliance on oil exports to the USA while providing better access to foreign markets. However Carney, while suggesting that there is “real potential” for such projects nonetheless qualified that support as being limited to projects that would “decarbonize” Canadian oil, apparently those that would employ carbon capture technologies. While the meeting did not result in a final list of potential projects, Alberta Premier Danielle Smith said that this approach would constitute a “grand bargain” whereby new pipelines to increase oil exports could help fund decarbonization efforts. But is that true and what are the implications for the Albertan and Canadian economies?

The federal government has doubled down on its commitment to “responsibly produced oil and gas”. These terms are apparently carefully crafted to maintain federal policies for Net Zero. These policies include a Canadian emissions cap, tanker bans and a clean electricity mandate. Many would consider that Canadians, especially Albertans, should be wary of these largely undefined announcements in which Ottawa proposes solely to determine projects that are “in the national interest.”

The federal government has tabled legislation designed to address these challenges with Bill C-5: An Act to enact the Free Trade and Labour Mobility Act and the Building Canada Act (the One Canadian Economy Act). Rather than replacing controversial, and challenged, legislation like the Impact Assessment Act, the Carney government proposes to add more legislation designed to accelerate and streamline regulatory approvals for energy and infrastructure projects. However, only those projects that Ottawa designates as being in the national interest would be approved. While clearer, shorter regulatory timelines and the restoration of the Major Projects Office are also proposed, Bill C-5 is to be superimposed over a crippling regulatory base.

It remains to be seen if this attempt will restore a much-diminished Canadian Can-Do spirit for economic development by encouraging much-needed, indeed essential interprovincial teamwork across shared jurisdictions. While the Act’s proposed single approval process could provide for expedited review timelines, a complex web of regulatory processes will remain in place requiring much enhanced interagency and interprovincial coordination. Given Canada’s much-diminished record for regulatory and policy clarity will this legislation be enough to persuade the corporate and international capital community to consider Canada as a prime investment destination?

As with all complex matters the devil always lurks in the details. Notably, these federal initiatives arrive at a time when the Carney government is facing ever-more pressing geopolitical, energy security and economic concerns. The Organization for Economic Co-operation and Development predicts that Canada’s economy will grow by a dismal one per cent in 2025 and 1.1 per cent in 2026 – this at a time when the global economy is predicted to grow by 2.9 per cent.

It should come as no surprise that Carney’s recent musing about the “real potential” for decarbonized oil pipelines have sparked debate. The undefined term “decarbonized”, is clearly aimed directly at western Canadian oil production as part of Ottawa’s broader strategy to achieve national emissions commitments using costly carbon capture and storage (CCS) projects whose economic viability at scale has been questioned. What might this mean for western Canadian oil producers?

The Alberta Oil sands presently account for about 58% of Canada’s total oil output. Data from December 2023 show Alberta producing a record 4.53 million barrels per day (MMb/d) as major oil export pipelines including Trans Mountain, Keystone and the Enbridge Mainline operate at high levels of capacity. Meanwhile, in 2023 eastern Canada imported on average about 490,000 barrels of crude oil per day (bpd) at a cost estimated at CAD $19.5 billion. These seaborne shipments to major refineries (like New Brunswick’s Irving Refinery in Saint John) rely on imported oil by tanker with crude oil deliveries to New Brunswick averaging around 263,000 barrels per day. In 2023 the estimated total cost to Canada for imported crude oil was $19.5 billion with oil imports arriving from the United States (72.4%), Nigeria (12.9%), and Saudi Arabia (10.7%). Since 1988, marine terminals along the St. Lawrence have seen imports of foreign oil valued at more than $228 billion while the Irving Oil refinery imported $136 billion from 1988 to 2020.

What are the policy and cost implication of Carney’s call for the “decarbonization” of western Canadian produced, oil? It implies that western Canadian “decarbonized” oil would have to be produced and transported to competitive world markets under a material regulatory and financial burden. Meanwhile, eastern Canadian refiners would be allowed to import oil from the USA and offshore jurisdictions free from any comparable regulatory burdens. This policy would penalize, and makes less competitive, Canadian producers while rewarding offshore sources. A federal regulatory requirement to decarbonize western Canadian crude oil production without imposing similar restrictions on imported oil would render the One Canadian Economy Act moot and create two market realities in Canada – one that favours imports and that discourages, or at very least threatens the competitiveness of, Canadian oil export production.

Ron Wallace is a former Member of the National Energy Board.

-

International8 hours ago

International8 hours agoIsrael’s Decapitation Strike on Iran Reverberates Across Global Flashpoints

-

Business1 day ago

Business1 day agoThe carbon tax’s last stand – and what comes after

-

Business17 hours ago

Business17 hours agoTrump: ‘Changes are coming’ to aggressive immigration policy after business complaints

-

International1 day ago

International1 day agoPentagon agency to simulate lockdowns, mass vaccinations, public compliance messaging

-

illegal immigration17 hours ago

illegal immigration17 hours agoLA protests continue as judge pulls back CA National Guard ahead of ‘No Kings Day’

-

Health1 day ago

Health1 day agoRFK Jr. appoints Robert Malone, Martin Kulldorff, other COVID shot critics to overhauled CDC vaccine panel

-

Business1 day ago

Business1 day agoOur addiction to dairy supply management is turning Canada into a trade pariah

-

Alberta1 day ago

Alberta1 day agoOil prices are headed for a hard fall