Alberta

Nothing stops the Loyal Company of the River Valley

Imagine loving a team so much that you do a podcast about it. And then the team folds. What do you do?

If you’re soccer fans Nathan Terlesky and Adam Huber, you keep going. Your show, called Loyal Company of the River Valley, goes on (CLICK to listen). You get involved in the movement to resurrect FC Edmonton, and you campaign to get it into the new Canadian Premier League. You push ticket sales, and you help start a new supporters group, and you keep the flame alive until your team is on the pitch again.

With their cry of “Fear no foe!” these guys are fierce (but nice) fans. And they can’t wait until spring comes, when FC Edmonton will start battling Calgary’s Cavalry FC and the rest of the teams in the new league.

Let’s learn a little more about Loyal Company of the River Valley, via co-host Terlesky:

What will people get out of listening to your podcast?

A. I believe that we offer an unique perspective on both Canadian soccer and FC Edmonton. We have been able to bring in a variety of interesting and meaningful guests. I think people will gain a new appreciation for the sport, and the local impact, through our podcast.

How did you meet your co-host?

A. Adam and I met in 2011 through our love of soccer. We joined the same supporters group, and after several years, ended up leaving that group and becoming closer friends. We started the podcast shortly after, and have been podcasting together for over three years now.

If you could have any guest on your show, who would you ask?

A. Someone higher up in Canada soccer would be amazing, like John Herdman, coach of the national team. We have been very fortunate in having several players, staff and coaches on over the years.

Why do you think people enjoy podcasts

A. Podcasts allow people to find engaging hosts and a wide variety of topics that you might not find on traditional radio.

Write your own epitaph — what would it say?

A. Always ready to kick a ball or drink a pint.

What has been your favourite episode so far?

A. My personal favourite was our interview with Tim Adams and Leah Cavanagh from Free Footie. They were very humble people, despite having run a very successful program for youth for years.

Be sure to connect with Loyal Company of the River Valley on Twitter, Facebook and Instagram.

Each week Todayville will introduce you to members of the Alberta Podcast Network, so you can invite even more Alberta-made podcasts into your ears! You can find Loyal Company of the River Valley and dozens of other shows at albertapodcastnetwork.com.

About Alberta Podcast Network

The Alberta Podcast Network, powered by ATB, is on a mission to:

- Help Alberta-based podcasters create podcasts of high quality and reach larger audiences;

- Foster connections among Alberta-based podcasters;

- Provide a powerful marketing opportunity for local businesses and organizations.

Alberta Podcast Network Ltd. is pursuing this mission with funding from ATB Financial and support from other sponsors.

Listen to more podcasts right here on Todayville.

Alberta

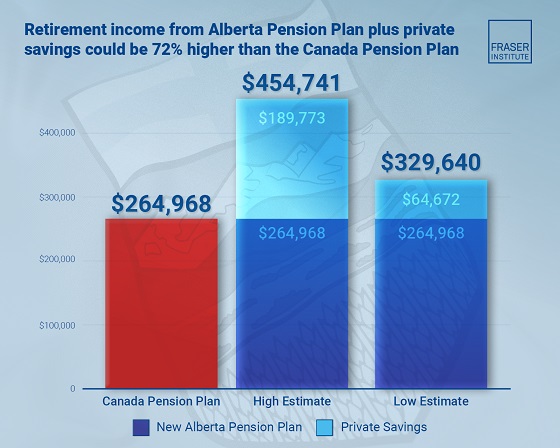

Median workers in Alberta could receive 72% more under Alberta Pension Plan compared to Canada Pension Plan

From the Fraser Institute

By Tegan Hill and Joel Emes

Moving from the CPP to a provincial pension plan would generate savings for Albertans in the form of lower contribution rates (which could be used to increase private retirement savings while receiving the same pension benefits as the CPP under the new provincial pension), finds a new study published today by the Fraser Institute, an independent, non-partisan Canadian public policy think-tank.

“Due to Alberta’s comparatively high rates of employment, higher average incomes, and younger population, Albertans would pay a lower contribution rate through a separate provincial pension plan while receiving the same benefits as under the CPP,” said Tegan Hill, director of Alberta policy at the Fraser Institute and co-author of Illustrating the Potential of an Alberta Pension Plan.

Assuming Albertans invested the savings from moving to a provincial pension plan into a private retirement account, and assuming a contribution rate of 5.85 per cent, workers earning the median income in Alberta ($53,061 in 2025) could accrue a stream of retirement payments totalling $454,741 (pre-tax)—a 71.6 per cent increase from their stream of CPP payments ($264,968).

Put differently, under the CPP, a median worker receives a total of $264,968 in retirement income over their life. If an Alberta worker saved the difference between what they pay now into the CPP and what they would pay into a new provincial plan, the income they would receive in retirement increases. If the contribution rate for the new provincial plan was 5.85 per cent—the lower of the available estimates—the increase in retirement income would total $189,773 (or an increase of 71.6 per cent).

If the contribution rate for a new Alberta pension plan was 8.21 per cent—the higher of the available estimates—a median Alberta worker would still receive an additional $64,672 in retirement income over their life, a marked increase of 24.4 per cent compared to the CPP alone.

Put differently, assuming a contribution rate of 8.21 per cent, Albertan workers earning the median income could accrue a stream of retirement payments totaling $329,640 (pre-tax) under a provincial pension plan—a 24.4 per cent increase from their stream of CPP payments.

“While the full costs and benefits of a provincial pension plan must be considered, its clear that Albertans could benefit from higher retirement payments under a provincial pension plan, compared to the CPP,” Hill said.

Illustrating the Potential of an Alberta Pension Plan

- Due to Alberta’s comparatively high rates of employment, higher average incomes, and younger population, Albertans would pay a lower contribution rate with a separate provincial pension plan, compared with the CPP, while receiving the same benefits as under the CPP.

- Put differently, moving from the CPP to a provincial pension plan would generate savings for Albertans, which could be used to increase private retirement income. This essay assesses the potential savings for Albertans of moving to a provincial pension plan. It also estimates an Albertan’s potential increase in total retirement income, if those savings were invested in a private account.

- Depending on the contribution rate used for an Alberta pension plan (APP), ranging from 5.85 to 8.2 percent, an individual earning the CPP’s yearly maximum pensionable earnings ($71,300 in 2025), would accrue a stream of retirement payments under the total APP (APP plus private retirement savings), yielding a total retirement income of between $429,524 and $584,235. This would be 22.9 to 67.1 percent higher, respectively, than their stream of CPP payments ($349,545).

- An individual earning the median income in Alberta ($53,061 in 2025), would accrue a stream of retirement payments under the total APP (APP plus private retirement savings), yielding a total retirement income of between $329,640 and $454,741, which is between 24.4 percent to 71.6 percent higher, respectively, than their stream of CPP payments ($264,968).

Joel Emes

Alberta

Alberta ban on men in women’s sports doesn’t apply to athletes from other provinces

From LifeSiteNews

Alberta’s Fairness and Safety in Sport Act bans transgender males from women’s sports within the province but cannot regulate out-of-province transgender athletes.

Alberta’s ban on gender-confused males competing in women’s sports will not apply to out-of-province athletes.

In an interview posted July 12 by the Canadian Press, Alberta Tourism and Sport Minister Andrew Boitchenko revealed that Alberta does not have the jurisdiction to regulate out-of-province, gender-confused males from competing against female athletes.

“We don’t have authority to regulate athletes from different jurisdictions,” he said in an interview.

Ministry spokeswoman Vanessa Gomez further explained that while Alberta passed legislation to protect women within their province, outside sporting organizations are bound by federal or international guidelines.

As a result, Albertan female athletes will be spared from competing against men during provincial competition but must face male competitors during inter-provincial events.

In December, Alberta passed the Fairness and Safety in Sport Act to prevent biological men who claim to be women from competing in women’s sports. The legislation will take effect on September 1 and will apply to all school boards, universities, as well as provincial sports organizations.

The move comes after studies have repeatedly revealed what almost everyone already knew was true, namely, that males have a considerable advantage over women in athletics.

Indeed, a recent study published in Sports Medicine found that a year of “transgender” hormone drugs results in “very modest changes” in the inherent strength advantages of men.

Additionally, male athletes competing in women’s sports are known to be violent, especially toward female athletes who oppose their dominance in women’s sports.

Last August, Albertan male powerlifter “Anne” Andres was suspended for six months after a slew of death threats and harassments against his female competitors.

In February, Andres ranted about why men should be able to compete in women’s competitions, calling for “the Ontario lifter” who opposes this, apparently referring to powerlifter April Hutchinson, to “die painfully.”

Interestingly, while Andres was suspended for six months for issuing death threats, Hutchinson was suspended for two years after publicly condemning him for stealing victories from women and then mocking his female competitors on social media. Her suspension was later reduced to a year.

-

Opinion1 day ago

Opinion1 day agoPreston Manning: Three Wise Men from the East, Again

-

Uncategorized1 day ago

Uncategorized1 day agoCNN’s Shock Climate Polling Data Reinforces Trump’s Energy Agenda

-

Addictions1 day ago

Addictions1 day agoWhy B.C.’s new witnessed dosing guidelines are built to fail

-

Business22 hours ago

Business22 hours agoCarney Liberals quietly award Pfizer, Moderna nearly $400 million for new COVID shot contracts

-

Business20 hours ago

Business20 hours agoMark Carney’s Fiscal Fantasy Will Bankrupt Canada

-

COVID-1919 hours ago

COVID-1919 hours agoTrump DOJ dismisses charges against doctor who issued fake COVID passports

-

Business2 days ago

Business2 days agoCarney government should apply lessons from 1990s in spending review

-

Alberta19 hours ago

Alberta19 hours agoTemporary Alberta grid limit unlikely to dampen data centre investment, analyst says