Uncategorized

Catholic Social Services raises over $3.1 million to help refugees settling in Edmonton, Red Deer and Central Alberta

2022 Sign of Hope campaign raises $3.1 million

For the second year in a row, Catholic Social Services surpasses its fundraising goal

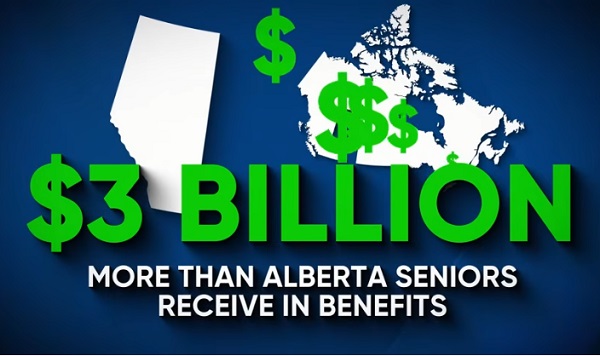

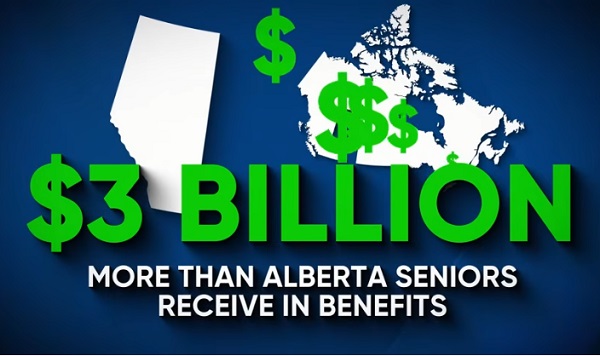

Catholic Social Services (CSS) today announced its 2022 Sign of Hope fundraising campaign surpassed its $2.6 million goal and raised $3.1 million for programs and services supporting vulnerable Albertans. This is the second year in a row that CSS has exceeded its goal. In 2021 CSS aimed to raise $2.1 million and brought in $3.3 million. Prior to that, the last time CSS raised more than $3 million in a single year was in 2014.

“We are absolutely overwhelmed and humbled by the support we continue to receive from Albertans,” says Dr. Troy Davies, CEO. “We know times are tough for many. We see it every day, in the work we do. That makes the ongoing success of our fundraising efforts all the more meaningful; it tells us Albertans support our work, and believe in CSS’s ability to help those who need it most during these hard times.”

Sign of Hope, the charitable fundraising arm for CSS, provides funding for more than a dozen programs, including shelters and homes for victims of domestic violence, programs for seniors experiencing isolation and abuse, supports for recently and vulnerably housed Albertans, and refugees fleeing war, conflict, and persecution.

Catholic Social Services is one of the largest providers of social services to vulnerable people in western Canada, serving as many as 20,000 each year. Donations to CSS’ Sign of Hope campaign fund programs which are unable to rely on sufficient government funding to meet the demand in the community.

“We have seen an increase in demand for nearly every service we provide,” says Dr. Davies. “At the same time, the needs of the clients we serve have grown increasingly complex.”

In 2022, donations to Sign of Hope allowed Catholic Social Services to:

- Provide emergency relief to 2,300 refugees and 2,500 Ukrainian Nationals arriving in Edmonton, Red Deer, and other communities across central Alberta.

- Offer safety and support to 430 women and their children escaping domestic violence, at two shelters and one transitional housing program.

- Help 56 formerly homeless individuals remain housed.

- Provide mental health support and counselling services to 1,200 individuals and families in Edmonton.

- And, offer supplemental funding to countless other programs, touching nearly every area in which the agency operates.

“While this is a ‘good news story,’ it is not the end of the story,” says Dr. Davies, of the Sign of Hope campaign’s success. “This is our calling to work harder, and keep pushing to raise more, because we know how many people are counting on us to do so.”

Sign of Hope accepts donations throughout the year and runs a dedicated fundraising campaign each fall, from September to December. Anyone interested in donating can do so online at cssalberta.ca or by calling 780-439-HOPE(4673).

Background:

The Sign of Hope campaign funds multiple Catholic Social Services’ programs each year including shelters and supported housing for vulnerable women and children, subsidized counselling services, supports for seniors experiencing abuse, supports for new immigrants and refugees, and supports for the recently housed.

For 60 years, CSS has been providing help to the most vulnerable. Today, CSS works in three priority areas, serving newcomers to Canada, serving individuals with disabilities, and serving individuals, children, and families. Each year, more than 21,000 Albertans in 12 communities across central Alberta, are uplifted and empowered through CSS.

Uncategorized

Kananaskis G7 meeting the right setting for U.S. and Canada to reassert energy ties

Energy security, resilience and affordability have long been protected by a continentally integrated energy sector.

The G7 summit in Kananaskis, Alberta, offers a key platform to reassert how North American energy cooperation has made the U.S. and Canada stronger, according to a joint statement from The Heritage Foundation, the foremost American conservative think tank, and MEI, a pan-Canadian research and educational policy organization.

“Energy cooperation between Canada, Mexico and the United States is vital for the Western World’s energy security,” says Diana Furchtgott-Roth, director of the Center for Energy, Climate and Environment and the Herbert and Joyce Morgan Fellow at the Heritage Foundation, and one of America’s most prominent energy experts. “Both President Trump and Prime Minister Carney share energy as a key priority for their respective administrations.

She added, “The G7 should embrace energy abundance by cooperating and committing to a rapid expansion of energy infrastructure. Members should commit to streamlined permitting, including a one-stop shop permitting and environmental review process, to unleash the capital investment necessary to make energy abundance a reality.”

North America’s energy industry is continentally integrated, benefitting from a blend of U.S. light crude oil and Mexican and Canadian heavy crude oil that keeps the continent’s refineries running smoothly.

Each day, Canada exports 2.8 million barrels of oil to the United States.

These get refined into gasoline, diesel and other higher value-added products that furnish the U.S. market with reliable and affordable energy, as well as exported to other countries, including some 780,000 barrels per day of finished products that get exported to Canada and 1.08 million barrels per day to Mexico.

A similar situation occurs with natural gas, where Canada ships 8.7 billion cubic feet of natural gas per day to the United States through a continental network of pipelines.

This gets consumed by U.S. households, as well as transformed into liquefied natural gas products, of which the United States exports 11.5 billion cubic feet per day, mostly from ports in Louisiana, Texas and Maryland.

“The abundance and complementarity of Canada and the United States’ energy resources have made both nations more prosperous and more secure in their supply,” says Daniel Dufort, president and CEO of the MEI. “Both countries stand to reduce dependence on Chinese and Russian energy by expanding their pipeline networks – the United States to the East and Canada to the West – to supply their European and Asian allies in an increasingly turbulent world.”

Under this scenario, Europe would buy more high-value light oil from the U.S., whose domestic needs would be back-stopped by lower-priced heavy oil imports from Canada, whereas Asia would consume more LNG from Canada, diminishing China and Russia’s economic and strategic leverage over it.

* * *

The MEI is an independent public policy think tank with offices in Montreal, Ottawa, and Calgary. Through its publications, media appearances, and advisory services to policymakers, the MEI stimulates public policy debate and reforms based on sound economics and entrepreneurship.

As the nation’s largest, most broadly supported conservative research and educational institution, The Heritage Foundation has been leading the American conservative movement since our founding in 1973. The Heritage Foundation reaches more than 10 million members, advocates, and concerned Americans every day with information on critical issues facing America.

Uncategorized

Poilievre on 2025 Election Interference – Carney sill hasn’t fired Liberal MP in Chinese election interference scandal

From Conservative Party Communications

“Yes. He must be disqualified. I find it incredible that Mark Carney would allow someone to run for his party that called for a Canadian citizen to be handed over to a foreign government on a bounty, a foreign government that would almost certainly execute that Canadian citizen.

“Think about that for a second. We have a Liberal MP saying that a Canadian citizen should be handed over to a foreign dictatorship to get a bounty so that that citizen could be murdered. And Mark Carney says he should stay on as a candidate. What does that say about whether Mark Carney would protect Canadians?

“Mark Carney is deeply conflicted. Just in November, he went to Beijing and secured a quarter-billion-dollar loan for his company from a state-owned Chinese bank. He’s deeply compromised, and he will never stand up for Canada against any foreign regime. It is another reason why Mr. Carney must show us all his assets, all the money he owes, all the money that his companies owe to foreign hostile regimes. And this story might not be entirely the story of the bounty, and a Liberal MP calling for a Canadian to be handed over for execution to a foreign government might not be something that the everyday Canadian can relate to because it’s so outrageous. But I ask you this, if Mark Carney would allow his Liberal MP to make a comment like this, when would he ever protect Canada or Canadians against foreign hostility?

“He has never put Canada first, and that’s why we cannot have a fourth Liberal term. After the Lost Liberal Decade, our country is a playground for foreign interference. Our economy is weaker than ever before. Our people more divided. We need a change to put Canada first with a new government that will stand up for the security and economy of our citizens and take back control of our destiny. Let’s bring it home.”

-

Alberta1 day ago

Alberta1 day agoCOVID mandates protester in Canada released on bail after over 2 years in jail

-

armed forces1 day ago

armed forces1 day agoCanada’s Military Can’t Be Fixed With Cash Alone

-

International1 day ago

International1 day agoTrump transportation secretary tells governors to remove ‘rainbow crosswalks’

-

Business1 day ago

Business1 day agoCanada’s loyalty to globalism is bleeding our economy dry

-

Business1 day ago

Business1 day agoCarney’s spending makes Trudeau look like a cheapskate

-

Alberta1 day ago

Alberta1 day agoAlberta Next: Alberta Pension Plan

-

Crime2 days ago

Crime2 days agoProject Sleeping Giant: Inside the Chinese Mercantile Machine Linking Beijing’s Underground Banks and the Sinaloa Cartel

-

C2C Journal24 hours ago

C2C Journal24 hours agoCanada Desperately Needs a Baby Bump