Business

Dallas mayor invites NYers to first ‘sanctuary city from socialism’

From The Center Square

By

After the self-described socialist Zohran Mamdani won the Democratic primary for mayor in New York, Dallas Mayor Eric Johnson invited New Yorkers and others to move to Dallas.

Mamdani has vowed to implement a wide range of tax increases on corporations and property and to “shift the tax burden” to “richer and whiter neighborhoods.”

New York businesses and individuals have already been relocating to states like Texas, which has no corporate or personal income taxes.

Johnson, a Black mayor and former Democrat, switched parties to become a Republican in 2023 after opposing a city council tax hike, The Center Square reported.

“Dear Concerned New York City Resident or Business Owner: Don’t panic,” Johnson said. “Just move to Dallas, where we strongly support our police, value our partners in the business community, embrace free markets, shun excessive regulation, and protect the American Dream!”

Fortune 500 companies and others in recent years continue to relocate their headquarters to Dallas; it’s also home to the new Texas Stock Exchange (TXSE). The TXSE will provide an alternative to the New York Stock Exchange and Nasdaq and there are already more finance professionals in Texas than in New York, TXSE Group Inc. founder and CEO James Lee argues.

From 2020-2023, the Dallas-Fort Worth-Arlington MSA reported the greatest percentage of growth in the country of 34%, The Center Square reported.

Johnson on Thursday continued his invitation to New Yorkers and others living in “socialist” sanctuary cities, saying on social media, “If your city is (or is about to be) a sanctuary for criminals, mayhem, job-killing regulations, and failed socialist experiments, I have a modest invitation for you: MOVE TO DALLAS. You can call us the nation’s first official ‘Sanctuary City from Socialism.’”

“We value free enterprise, law and order, and our first responders. Common sense and the American Dream still reside here. We have all your big-city comforts and conveniences without the suffocating vice grip of government bureaucrats.”

As many Democratic-led cities joined a movement to defund their police departments, Johnson prioritized police funding and supporting law and order.

“Back in the 1800s, people moving to Texas for greater opportunities would etch ‘GTT’ for ‘Gone to Texas’ on their doors moving to the Mexican colony of Tejas,” Johnson continued, referring to Americans who moved to the Mexican colony of Tejas to acquire land grants from the Mexican government.

“If you’re a New Yorker heading to Dallas, maybe try ‘GTD’ to let fellow lovers of law and order know where you’ve gone,” Johnson said.

Modern-day GTT movers, including a large number of New Yorkers, cite high personal income taxes, high property taxes, high costs of living, high crime, and other factors as their reasons for leaving their states and moving to Texas, according to multiple reports over the last few years.

In response to Johnson’s invitation, Gov. Greg Abbott said, “Dallas is the first self-declared “Sanctuary City from Socialism. The State of Texas will provide whatever support is needed to fulfill that mission.”

The governor has already been doing this by signing pro-business bills into law and awarding Texas Enterprise Grants to businesses that relocate or expand operations in Texas, many of which are doing so in the Dallas area.

“Texas truly is the Best State for Business and stands as a model for the nation,” Abbott said. “Freedom is a magnet, and Texas offers entrepreneurs and hardworking Texans the freedom to succeed. When choosing where to relocate or expand their businesses, more innovative industry leaders recognize the competitive advantages found only in Texas. The nation’s leading CEOs continually cite our pro-growth economic policies – with no corporate income tax and no personal income tax – along with our young, skilled, diverse, and growing workforce, easy access to global markets, robust infrastructure, and predictable business-friendly regulations.”

Business

The Grocery Greed Myth

Haultain’s Substack is a reader-supported publication.

To receive new posts and support our work, please consider becoming a free or paid subscriber.

Try it out.

The Justin Trudeau and Jagmeet Singh charges of “greedflation” collapses under scrutiny.

“It’s not okay that our biggest grocery stores are making record profits while Canadians are struggling to put food on the table.” —PM Justin Trudeau, September 13, 2023.

A couple of days after the above statement, the then-prime minister and his government continued a campaign to blame rising food prices on grocery retailers.

The line Justin Trudeau delivered in September 2023, triggered a week of political theatre. It also handed his innovation minister, François-Philippe Champagne, a ready-made role: defender of the common shopper against supposed corporate greed. The grocery price problem would be fixed by Thanksgiving that year. That was two years ago. Remember the promise?

But as Ian Madsen of the Frontier Centre for Public Policy has shown, the numbers tell a different story. Canada’s major grocers have not been posting “record profits.” They have been inching forward in a highly competitive, capital-intensive sector. Madsen’s analysis of industry profit margins shows this clearly.

Take Loblaw. Its EBITDA margin (earnings before interest, taxes, depreciation, and amortization) averaged 11.2 per cent over the three years ending 2024. That is up slightly from 10 per cent pre-COVID. Empire grew from 3.9 to 7.6 per cent. Metro went from 7.6 to 9.6. These are steady trends, not windfalls. As Madsen rightly points out, margins like these often reflect consolidation, automation, and long-term investment.

Meanwhile, inflation tells its own story. From March 2020 to March 2024, Canada’s money supply rose by 36 per cent. Consumer prices climbed about 20 per cent in the same window. That disparity suggests grocers helped absorb inflationary pressure rather than drive it. The Justin Trudeau and Jagmeet Singh charges of “greedflation” collapses under scrutiny.

Yet Ottawa pressed ahead with its chosen solution: the Grocery Code of Conduct. It was crafted in the wake of pandemic disruptions and billed as a tool for fairness. In practice, it is a voluntary framework with no enforcement and no teeth. The dispute resolution process will not function until 2026. Key terms remain undefined. Suppliers are told they can expect “reasonable substantiation” for sudden changes in demand. They are not told what that means. But food inflation remains.

This ambiguity helps no one. Large suppliers will continue to settle matters privately. Small ones, facing the threat of lost shelf space, may feel forced to absorb losses quietly. As Madsen observes, the Code is unlikely to change much for those it claims to protect.

What it does serve is a narrative. It lets the government appear responsive while avoiding accountability. It shifts attention away from the structural causes of price increases: central bank expansion, regulatory overload, and federal spending. Instead of owning the crisis, the state points to a scapegoat.

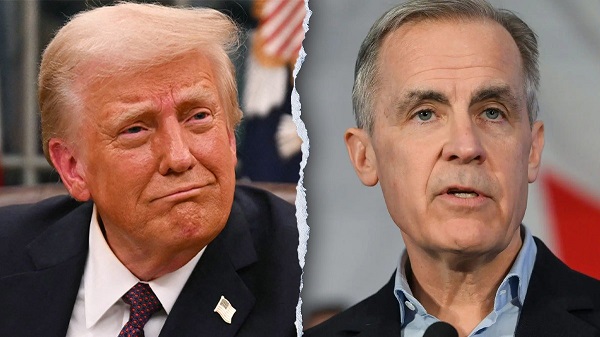

This method is not new. The Trudeau government, of which Carney’s is a continuation, has always shown a tendency to favour symbolism over substance. Its approach to identity politics follows the same pattern. Policies are announced with fanfare, dissent is painted as bigotry, and inconvenient facts are set aside.

The Grocery Code fits this model. It is not a policy grounded in need or economic logic. It is a ritual. It gives the illusion of action. It casts grocers as villains. It gives the impression to the uncaring public that the government is “providing solutions,” and that “it has their backs.” It flatters the state.

Madsen’s work cuts through that illusion. It reminds us that grocery margins are modest, inflation was monetary, and the public is being sold a story.

Canadians deserve better than fables, but they keep voting for the same folks. They don’t think to think that they deserve a government that governs within its limits; a government that accept its role in the crises it helped cause, and restores the conditions for genuine economic freedom. The Grocery Code is not a step in that direction. It was always a distraction, wrapped in a moral pose.

And like most moral poses in Ottawa, it leaves the facts behind.

Haultain’s Substack is a reader-supported publication.

To receive new posts and support our work, please consider becoming a free or paid subscriber.

Try it out.

Business

Tax filing announcement shows consultation was a sham

The Canadian Taxpayers Federation is criticizing Prime Minister Mark Carney for announcing that the government is expanding automatic tax filing within hours of the government’s consultation ending.

“There’s no way government bureaucrats pulled an all-nighter reading through thousands of submissions and survey responses before sending Carney out to make an announcement on automatic tax filing the next morning,” said Franco Terrazzano, CTF Federal Director. “Asking Canadians for their opinion and then ignoring them isn’t a good look for Carney, it makes it look like the government is holding sham consultations.”

The government of Canada announced consultations on automatic tax filing so Canadians could give the government “broad input through an online questionnaire.”

The government’s consultation ended on Thursday, Oct. 9, 2025.

Hours after the consultation ended, Carney today announced the government would expand automatic tax filing.

The CRA is already one of the largest arms of the federal government with 52,499 bureaucrats.

The CRA added 13,015 employees since 2016 – a 33 per cent increase. For comparison, America’s Internal Revenue Service has 90,516 bureaucrats. The CRA has one bureaucrat for every 800 Canadians. The IRS has one bureaucrat for every 3,800 Americans.

“The CRA can barely answer the phone, so Carney shouldn’t be giving those bureaucrats more busy work to do,” Terrazzano said. “The CRA is a bloated mess, and Carney should be cutting the cost of bureaucracy not scheming up ways to give the bureaucracy more power over taxpayers.”

The CRA only answered about 36 per cent of the 53.5 million calls it received between March 2016 and March 2017, according to a 2017 Auditor General report. When Canadians were able to get the CRA on the phone, call centre agents gave inaccurate information about 30 per cent of the time.

“The CRA acting as both tax collector and tax filer is a serious conflict of interest,” Terrazzano said. “Trusting the taxman to do your tax return is like trusting your dog to protect your burger.

“Carney should stop the CRA power grab and instead cut taxes and simplify the tax code.”

-

National7 hours ago

National7 hours agoCanada’s birth rate plummets to an all-time low

-

Crime6 hours ago

Crime6 hours agoPierre Poilievre says Christians may be ‘number one’ target of hate violence in Canada

-

Alberta5 hours ago

Alberta5 hours agoJason Kenney’s Separatist Panic Misses the Point

-

Automotive8 hours ago

Automotive8 hours agoBig Auto Wants Your Data. Trump and Congress Aren’t Having It.

-

Aristotle Foundation2 days ago

Aristotle Foundation2 days agoEfforts to halt Harry Potter event expose the absurdity of trans activism

-

Bruce Dowbiggin2 days ago

Bruce Dowbiggin2 days agoCanada’s Humility Gene: Connor Skates But Truckers Get Buried

-

Energy2 days ago

Energy2 days ago“It is intellectually dishonest not to acknowledge the … erosion of trust among global customers in Canada’s ability to deliver another oil pipeline.”

-

Energy2 days ago

Energy2 days agoIn the halls of Parliament, Ellis Ross may be the most high-profile advocate of Indigenous-led development in Canada.