Business

Clean energy transition price tag over $150 billion and climbing, with very little to show for it

From the Fraser Institute

By Jake Fuss, Julio Mejía, Elmira Aliakbari, Karen Graham and Jock Finlayson

Ottawa and the four biggest provinces have spent (or foregone revenues) of at least $158 billion to create at most 68,000 “clean” jobs since 2014

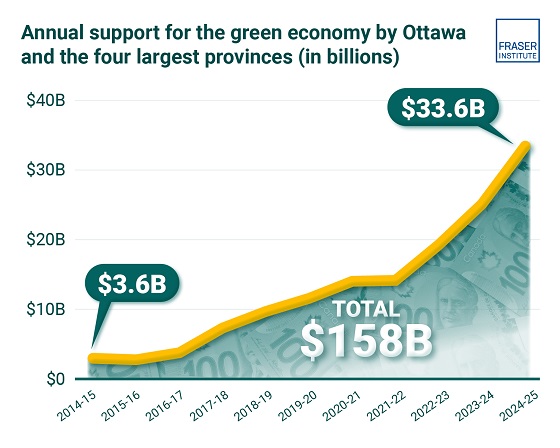

Despite the hype of a “clean” economic transition, governments in Ottawa and in the four largest provinces have spent or foregone revenues of more than $150 billion (inflation-adjusted) on low-carbon initiatives since 2014/15, but have only created, at best, 68,000 clean jobs, according to two new studies published by the Fraser Institute, an independent, non-partisan Canadian public policy think-tank.

“Governments, activists and special interest groups have been making a lot of claims about the opportunities of a clean economic transition, but after a decade of policy interventions and more than $150 billion in taxpayers’ money, the results are

extremely underwhelming,” said Elmira Aliakbari, director of natural resource studies and co-author of The Fiscal Cost of Canada’s Low-Carbon Economy.

The study finds that since 2014/15, the federal government and provincial governments in the country’s four largest provinces (Ontario, Quebec, Alberta and British Columbia) combined have spent and foregone revenues of $158 billion (inflation adjusted to 2024 dollars) trying to create clean jobs, as defined by Statistics Canada’s Environmental and Clean Technology Products Economic Account.

Importantly, that cost estimate is conservative since it does not account for an exhaustive list of direct government spending and it does not measure the costs from Canada’s other six provinces, municipalities, regulatory costs and other economic

costs because of the low-carbon spending and tax credits.

A second study, Sizing Canada’s Clean Economy, finds that there was very little change over the 2014 to 2023 period in terms of the share of the total economy represented by the clean economy. For instance, in 2014, the clean economy represented 3.1 per cent of GDP compared to 3.6 per cent in 2023.

“The evidence is clear—the much-hyped clean economic transition has failed to fundamentally transform Canada’s $3.3 trillion economy,” said study co-author and Fraser Institute senior fellow Jock Finlayson.

State of the Green Economy

- The Fiscal Cost of Canada’s Low-Carbon Economy documents spending initiatives by the federal government and the governments of Ontario, British Columbia, Alberta, and Quebec since 2014 to promote the low-carbon economy, as well as how much revenue they have foregone through offering tax credits.

- Overall, the combined cost of spending and tax credits supporting a low-carbon economy by the federal government and the four provincial governments is estimated at $143.6 billion from 2014–15 to 2024–25, in nominal terms. When adjusted for inflation, the total reaches $158 billion in 2024 dollars.

- These estimates are based on very conservative assumptions, and they do not cover every program area or government-controlled expenditure related to the low-carbon economy and/or reducing greenhouse gas emissions.

- Sizing Canada’s Green Economy assesses the composition, growth, share of Gross Domestic Product (GDP) output, and employment of Canada’s “clean economy” from 2014 to 2023.

- Canada’s various environmental and clean technology industries collectively have accounted for between 3.07% and 3.62% of all-industry GDP over the 10-year period from 2014 to 2023. While it has grown, the sector as a whole has not been expanding at a pace that meaningfully exceeds the growth of the overall Canadian economy, despite significant policy attention and mounting public subsidies.

- The clean economy represents a respectable and relatively stable share of Canada’s $3.3 trillion economy. However, it remains a small part of Canada’s broader industrial mix, it is not a major source of export earnings, and it is not about to supplant the many other industries that underpin the country’s prosperity and dominate its international exports.

Business

Flying saucers, crystal paperweights and branded apples: inside the feds’ promotional merch splurge

By Jen Hodgson

“It’s like the government had a contest to see which department could come up with the dumbest way to spend taxpayers’ money and they all won”

Bamboo toothbrushes and beeswax wraps. Temporary tattoos and hockey pucks. Maple candy and “chocolat bon bons.” Tractor-shaped air fresheners and Yukon soap. Moccasins and socks.

The feds seem eager to slap a logo on just about anything and pay any price to make it happen. Federal departments and Crown corporations spent about $13 million on branded promotional items since January 2022, according to government records obtained by the Canadian Taxpayers Federation.

“It’s like the government had a contest to see which department could come up with the dumbest way to spend taxpayers’ money and they all won,” said Franco Terrazzano, CTF Federal Director. “This is what happens when you have too many bureaucrats with too many tax dollars.”

The government shelled out $207,000 on various hats across all departments, $607,000 on different types of bags and $40,500 on Yeti and Stanley drinkware.

In an apparent shout out to former prime minister Justin Trudeau, the feds collectively splurged on $51,800 worth of socks.

The feds spent $25,600 on maple syrup and maple products.

The government released the data in response to an order paper question submitted by Conservative MP Michelle Rempel Garner (Calgary Nose Hill). Rempel Garner asked for records of all branded or promotional products purchased by departments or Crown corporations from Jan. 1, 2022, to June 6, 2025.

The CTF reviewed the 900-page release package – a virtual catalogue of capricious spending.

The Royal Canadian Mounted Police was the biggest spender by far, with a merch price tag of $4 million. However, the Mounties declined to submit a detailed inventory of expenditures.

Canadian Heritage was next in line for the feds’ spending spree. The department dropped about $2 million on purchases including branded hockey pucks, candle holders and lip balm. And not even the good kind of lip balm – it’s specifically “without sun protection.”

National Defence spent nearly $1.4 million on branded merch. That works out to about $34,000 on average each month.

Farm Credit Canada spent a total of $870,500, including $32,600 on tractor shaped air fresheners.

Export Development Canada blew $4,100 on climate change card games, $3,400 on Yukon soap, $10,700 on apple peel notebooks with bamboo pens, $4,500 on branded apples and $1,100 on “chocolat bon bons.”

Destination Canada spent $26,900 on moccasins, $13,300 on candles and $9,000 on charcuterie boards. Natural Resources Canada spent $3,200 on phone wallets and $1,350 on temporary tattoos.

VIA Rail spent $11,400 on “Pride” paraphernalia and $2,600 on belt bags. The Department of Immigration spent $12,000 on bamboo toothbrushes and terry towels for various “outreach events” and the Masters Indigenous Games.

The Royal Canadian Mint wrote a cheque for $41,800 for leather journals and laser pens. The National Capital Commission spent $12,000 on bicycle lights. Canada Lands Company spent $1,800 on flying saucers.

Canadian Race Relations Foundation dropped $2,400 on wool-blend branded toques and $2,800 for branded fleece blankets – for a board meeting.

The list goes on and on.

Prairies Economic Development Canada dipped into the public purse to the tune of $1,300 for bamboo cutlery and $3,800 for beeswax wraps. Pacific Economic Development Canada dropped $12,000 on beeswax wraps alone.

But remember, it’s hard being a government bureaucrat. Across all departments, the feds bought $11,900 worth of stress balls.

“Government bureaucrats dropping thousands of dollars on stress balls really stresses taxpayers out,” Terrazzano said. “Unless the temporary tattoos show the national debt to remind bureaucrats to cut spending, it’s a waste of money.

“Prime Minister Mark Carney needs to tell government bureaucrats to knock it off with the card games, charcuterie boards, laser pens and flying saucers.”

Some federal agencies refused to spill the beans on their branding budgets, leaving taxpayers to imagine a clandestine empire of logoed mugs and pens.

CBC/Radio-Canada did not bother to track their spending on promotional materials at all. The CBC claims it didn’t have time to provide accurate information in response to the request.

The lack of transparency didn’t end there. The Canada Border Services Agency and the National Arts Centre also claimed they lacked the time and resources to submit expenditure details.

The Canada Mortgage and Housing Corporation had “nothing to report.” Parks Canada dropped $847,000 on promotional items, but provided no details on itemized spending.

The Canadian Security Intelligence Services confirmed it purchased promotional material, but declined to say what it bought or how much it spent – because, you know, it’s probably spy stuff.

“Carney said he’s going to cut waste and if he’s serious he would put the government’s promotional merch spending spree on the chopping block,” Terrazzano said. “Anyone who claims there’s no fat to cut needs to be reminded that the government is spending millions of dollars on branded merch.”

Business

Trans Mountain executive says it’s time to fix the system, expand access, and think like a nation builder

Mike Davies calls for ambition and reform to build a stronger Canada

A shift in ambition

A year after the Trans Mountain Expansion Project came into service, Mike Davies, President and Chief Operating Officer at Trans Mountain, told the B.C. Business Summit 2025 that the project’s success should mark the beginning of a new national mindset — one defined by ambition, reform, and nation building.

“It took fifteen years to get this version of the project built,” Davies said. “During that time, Canadian producers lost about $50 billion in value because they were selling into a discounted market. We have some of the world’s largest reserves of oil and gas, but we can only trade with one other country. That’s unusual.”

With the expansion now in operation, that imbalance is shifting. “The differential on Canadian oil has narrowed by about $13 billion,” he said. “That’s value that used to be extracted by the United States and now stays in Canada — supporting healthcare, reconciliation, and energy transformation. About $5 billion of that is in royalties and taxes. It’s meaningful for us as a society.”

Davies rejected the notion that Trans Mountain was a public subsidy. “The federal government lent its balance sheet so that nation-building infrastructure could get built,” he said. “In our first full year of operation, we’ll return more than $1.3 billion to the federal government, rising toward $2 billion annually as cleanup work wraps up.”

At the Westridge Marine Terminal, shipments have increased from one tanker a week to nearly one a day, with more than half heading to Asia. “California remains an important market,” Davies said, “but diversification is finally happening — and it’s vital to our long-term prosperity.”

Fixing the system to move forward

Davies said this moment of success should prompt a broader rethinking of how Canada approaches resource development. “We’re positioned to take advantage of this moment,” he said. “Public attitudes are shifting. Canadians increasingly recognize that our natural resource advantages are a strength, not a liability. The question now is whether governments can seize it — and whether we’ll see that reflected in policy.”

He called for “deep, long-term reform” to restore scalability and investment confidence. “Linear infrastructure like pipelines requires billions in at-risk capital before a single certificate is issued,” he said. “Canada has a process for everything — we’re a responsible country — but it doesn’t scale for nation-building projects.”

Regulatory reform, he added, must go hand in hand with advancing economic reconciliation. “The challenge of our generation is shifting Indigenous communities from dependence to participation,” he said. “That means real ownership, partnership, and revenue opportunities.”

Davies urged renewed cooperation between Alberta and British Columbia, calling for “interprovincial harmony” on West Coast access. “I’d like to see Alberta see B.C. as part of its constituency,” he said. “And I’d like to see B.C. recognize the need for access.”

He summarized the path forward in plain terms: “We need to stem the exit of capital, create an environment that attracts investment, simplify approvals to one major process, and move decisions from the courts to clear legislation. If we do that, we can finally move from being a market hostage to being a competitor — and a nation builder.”

-

Media2 days ago

Media2 days agoCarney speech highlights how easily newsrooms are played by politicians

-

Business47 mins ago

Business47 mins agoTrans Mountain executive says it’s time to fix the system, expand access, and think like a nation builder

-

Business24 hours ago

Business24 hours agoThe painful return of food inflation exposes Canada’s trade failures

-

Business24 hours ago

Business24 hours agoCBC uses tax dollars to hire more bureaucrats, fewer journalists

-

Sports2 days ago

Sports2 days agoWhile Ohtani marches into MLB history, Nippon league’s shame lingers

-

National23 hours ago

National23 hours agoElection Officials Warn MPs: Canada’s Ballot System Is Being Exploited

-

Alberta1 day ago

Alberta1 day agoCoutts border officers seize 77 KG of cocaine in commercial truck entering Canada – Street value of $7 Million

-

Business23 hours ago

Business23 hours agoPaying for Trudeau’s EV Gamble: Ottawa Bought Jobs That Disappeared