Business

Carney’s Energy Mirage: Why the Prospects of Economic Recovery Remain Bleak

By Gwyn Morgan

By Gwyn Morgan

Gwyn Morgan argues that Mark Carney, despite his polished image and rhetorical shift on energy, remains ideologically aligned with the Trudeau-era net-zero agenda that stifled Canada’s energy sector and economic growth. Morgan contends that without removing emissions caps and embracing real infrastructure investment, Canada’s recovery will remain a mirage — not a reality.

Pete Townshend’s famous lyrics, “Meet the new boss / Same as the old boss,” aptly describe Canada’s new prime minister. Touted as a fresh start after the Justin Trudeau years, Mark Carney has promised to turn Canada into a “clean and conventional energy superpower.” But despite the lovey-dovey atmosphere at Carney’s recent meeting with Canada’s premiers, Canadians should not be fooled. His sudden apparent openness to new energy pipelines masks a deeper continuity, in my opinion: Carney remains just as ideologically committed to net-zero emissions.

Carney’s carefully choreographed scrapping of the consumer carbon tax before April’s election helped reduce gasoline prices and burnished his centrist image. In fact, he simply moved Canada’s carbon taxes “upstream”, onto manufacturers and producers, where they can’t be seen by voters. Those taxes will, of course, be largely passed back onto consumers in the form of higher prices for virtually everything. Many consumers will blame “greedy” businesses rather than the real villain, even as more and more Canadian companies and projects are rendered uncompetitive, leading to further reductions in capital investment, closing of beleaguered factories and facilities, and lost jobs.

This sleight-of-hand is hardly surprising. Carney spent years abroad in a career combining finance and eco-zealotry, co-founding the Glasgow Financial Alliance for Net Zero (GFANZ) and serving as the UN’s Special Envoy for Climate Action and Finance. Both roles centred on pressuring institutions to stop investing in carbon-intensive industries – foremost among them oil and natural gas. Now, he speaks vaguely of boosting energy production while pledging to maintain Trudeau’s oil and natural gas emissions cap – a contradiction that renders new pipeline capacity moot.

Canada doesn’t need a rhetorical energy superpower. It needs real growth. Our economy has just endured a lost decade of sluggish overall growth sustained mainly by a surging population, declining per-capita GDP and a doubling of the national debt. A genuine recovery requires the kind of private-sector capital investment and energy infrastructure that Trudeau suppressed. That means lifting the emissions cap, clearing regulatory bottlenecks and building pipelines that connect our resources to global markets.

We can’t afford not to do this. The oil and natural gas industry’s “extraction” activities contribute $70 billion annually to Canada’s GDP; surrounding value-added activities add tens of billions more. The industry generates $35 billion in annual royalties and supports 900,000 direct and indirect jobs. Oil and natural gas also form the backbone of Canada’s export economy, representing nearly $140 billion per year, or about 20 percent of our balance of trade.

Yet Quebec still imports oil from Algeria, Saudi Arabia and Nigeria because Ottawa won’t push for a pipeline connecting western Canada’s producing fields to Quebec and the Maritimes. Reviving the cancelled Energy East pipeline would overcome this absurdity and give Canadian crude access to European consuming markets.

Carney has hinted at supporting such a project but refuses to address the elephant in the room: without scrapping the emissions cap, there won’t be enough production growth to justify new infrastructure. So pipeline CEOs shouldn’t start ordering steel pipe or lining up construction crews just yet.

I continue to believe that Carney remains beholden to the same global green orthodoxy that inspired Trudeau’s decade of economic sabotage. While the United States shifts course on climate policy, pulling out of the Paris Accord, abandoning EV mandates and even investigating GFANZ itself, Canada is led by a man at the centre of those systems. Carney’s internationalist career and personal life – complete with multiple citizenships and a spouse known for environmental activism – underscore how far removed he is from ordinary Canadians.

Carney’s version of “clean energy” also reveals his bias. Despite the fact that 82 percent of Canada’s electricity already comes from non-greenhouse-gas-emitting sources like hydro and nuclear, Carney seems fixated on wind and solar-generated power. These options are less reliable and more expensive – though more ideologically fashionable. To climate zealots, not all zero-emission energy is created equal.

Even now, after all the damage that’s been done, Canada has the potential to resume a path to prosperity. We are blessed with vast natural resources and skilled workers. But no economy can thrive under perpetual policy uncertainty, regulatory obstruction and ideological hostility to its core industries. Energy projects worth an estimated $500 billion were blocked during the Trudeau years. That capital won’t return unless there is clarity and confidence in the government’s direction.

Some optimists argue that Carney is ultimately a political opportunist who may shift pragmatically to boost the economy. But those of us who have seen this movie before are sceptical. During my time as a CEO in the oil and natural gas sector, I witnessed Justin’s father Pierre Trudeau try to dismantle our industry under the guise of progress. Carney, despite or perhaps because of his polish, may be the most dangerous of the three.

The original, full-length version of this article was recently published in C2C Journal.

Gwyn Morgan is a retired business leader who was a director of five global corporations.

Business

Trump’s Tariffs Have Not Caused Economy To Collapse

From the Daily Caller News Foundation

By Mark Simon

The APEC Summit in Korea last week marked a pivotal moment for U.S. trade policy, delivering tangible wins for American interests. Solid deals were struck with South Korea, while the U.S. and China de-escalated their long-simmering trade war—a clear positive for President Trump. In the chaotic world of Donald Trump, such normalcy disappointed the news media and foreign policy pundits, who grumbled that the event lacked the drama of a disaster.

Yet, as Trump departed Busan, a deeper transformation unfolded, largely overlooked by observers. In just two days, President Trump orchestrated the most significant shift in U.S. trade strategy since China’s 2001 entry into the World Trade Organization (WTO).

The real triumph? Widespread acceptance by Asian trading partners of U.S. tariffs as a cornerstone of a reimagined American economic model. This acceptance dismantles nearly a century of unwavering belief in low tariffs as the unassailable path to global prosperity.

Trump’s tariff approach disrupts the post-World War II global trading system, particularly the U.S.-championed free-trade orthodoxy embraced by both parties for over 50 years. By wielding tariffs effectively, Trump challenges the free-market gospel enshrined in the WTO and echoed by World Economic Forum elites and corporate-sponsored Washington think tanks like AEI and CATO, which decry tariffs as heresy.

At APEC, there was no fiery backlash—only quiet nods to moderate tariffs as fixtures in the evolving economic order. Leaders from across the Asia-Pacific assessed the tariffs’ impacts and moved forward without spectacle, signaling a pragmatic pivot toward Trump’s view of international commerce.

Historically, tariff reductions in Asia stemmed from U.S. pressure to open markets. Mercantilist instincts run deep in most Asian governments—except in freewheeling Hong Kong and Singapore. These nations, built on exports inside protected markets, grasp how tariffs can revitalize U.S. manufacturing and bolster federal revenue. Unlike America’s one-sided openness to Asian imports, Trump’s reciprocity feels like overdue fairness.

As a former free-market purist who once decried tariffs, I initially missed their nuance in Trump’s arsenal. Tariffs impose costs, but the genius lies in offsetting them strategically. Trump’s aggressive deregulation, sweeping tax reforms, and drive for rock-bottom domestic energy prices mitigate burdens and generate a net economic surge—one that Asian leaders implicitly endorsed.

This “internal free-market trio” forms the bedrock of the new U.S. paradigm: moderate tariffs generate revenue and incentivize factory repatriation; deregulation slashes red tape; tax cuts keep capital flowing competitively; and abundant, cheap energy undercuts foreign advantages.

Together, they magnetize global investment, upending a century of free-trade dogma. Energy dominance is key. Through promotion of domestic oil, gas, and renewables, Trump has driven U.S. energy costs 30–50% below those in Europe or much of Asia. For capital-intensive sectors like steel, semiconductors, and electric vehicles, this is structural superiority, not subsidy. Layer on the 2017 Tax Cuts and Jobs Act—slashing the corporate rate to 21% and allowing immediate capital expensing—and the math tilts toward U.S. production. Tariffs may raise import prices by 20–30%, but deregulation accelerates cost-cutting, while energy savings absorb part of the hit.

Critics claim tariffs ravaged the economy post-2018, but COVID-19, not tariffs, triggered the downturn. Trump’s initial round was a successful pilot, extended by Biden—yet without Trump’s deregulation and energy surge, the tariffs became un-offset weight. Blanket cost hikes under Biden stifled growth; Trump’s selective offsets ensure expansion.

America’s edge sharpens as rivals falter. Europe, shackled by leftist policies, environmental mandates, and the Ukraine quagmire, hemorrhages capital to the U.S. In North Asia—China, Korea, Japan, Taiwan—demographic headwinds make investments unappealing compared to North America’s burgeoning market. Aging populations and shrinking workforces amplify this disparity.

APEC underscored America as a vibrant, tariff-protected haven primed for onshoring. Amid Asia’s labor crunch, nations view the U.S. as an investment beacon, mirroring Japan’s model: a high-value exporter offloading low-end manufacturing while retaining competitiveness. Summit chatter revealed minimal tariff gripes. China voiced tepid concerns over escalations, but these seemed rhetorical—testing boundaries rather than igniting conflict.

To free-trade zealots, Trump’s heresy is demolishing sacred economic theory. Past protectionists erred by isolating tariffs without cost-lowering measures. Trump integrates them: selective duties paired with deregulation, technological leaps, and economic decentralization beyond urban centers.

In equilibrium, tariffs harvest revenue and reclaim jobs, capitalizing on America’s fiscal and regulatory advantages. Trump’s blueprint restores balance to free trade, honoring national sovereignty while exposing borderless markets’ perils. It proves moderated protectionism can ignite growth, spur innovation, and draw capital—heralding a bolder, self-reliant American century.

Mark Simon is former group director for Next Digital, parent company for Apple Daily, the leading pro-democracy newspaper in Hong Kong until it was forced to close in 2021.

Brownstone Institute

Bizarre Decisions about Nicotine Pouches Lead to the Wrong Products on Shelves

From the Brownstone Institute

A walk through a dozen convenience stores in Montgomery County, Pennsylvania, says a lot about how US nicotine policy actually works. Only about one in eight nicotine-pouch products for sale is legal. The rest are unauthorized—but they’re not all the same. Some are brightly branded, with uncertain ingredients, not approved by any Western regulator, and clearly aimed at impulse buyers. Others—like Sweden’s NOAT—are the opposite: muted, well-made, adult-oriented, and already approved for sale in Europe.

Yet in the United States, NOAT has been told to stop selling. In September 2025, the Food and Drug Administration (FDA) issued the company a warning letter for offering nicotine pouches without marketing authorization. That might make sense if the products were dangerous, but they appear to be among the safest on the market: mild flavors, low nicotine levels, and recyclable paper packaging. In Europe, regulators consider them acceptable. In America, they’re banned. The decision looks, at best, strange—and possibly arbitrary.

What the Market Shows

My October 2025 audit was straightforward. I visited twelve stores and recorded every distinct pouch product visible for sale at the counter. If the item matched one of the twenty ZYN products that the FDA authorized in January, it was counted as legal. Everything else was counted as illegal.

Two of the stores told me they had recently received FDA letters and had already removed most illegal stock. The other ten stores were still dominated by unauthorized products—more than 93 percent of what was on display. Across all twelve locations, about 12 percent of products were legal ZYN, and about 88 percent were not.

The illegal share wasn’t uniform. Many of the unauthorized products were clearly high-nicotine imports with flashy names like Loop, Velo, and Zimo. These products may be fine, but some are probably high in contaminants, and a few often with very high nicotine levels. Others were subdued, plainly meant for adult users. NOAT was a good example of that second group: simple packaging, oat-based filler, restrained flavoring, and branding that makes no effort to look “cool.” It’s the kind of product any regulator serious about harm reduction would welcome.

Enforcement Works

To the FDA’s credit, enforcement does make a difference. The two stores that received official letters quickly pulled their illegal stock. That mirrors the agency’s broader efforts this year: new import alerts to detain unauthorized tobacco products at the border (see also Import Alert 98-06), and hundreds of warning letters to retailers, importers, and distributors.

But effective enforcement can’t solve a supply problem. The list of legal nicotine-pouch products is still extremely short—only a narrow range of ZYN items. Adults who want more variety, or stores that want to meet that demand, inevitably turn to gray-market suppliers. The more limited the legal catalog, the more the illegal market thrives.

Why the NOAT Decision Appears Bizarre

The FDA’s own actions make the situation hard to explain. In January 2025, it authorized twenty ZYN products after finding that they contained far fewer harmful chemicals than cigarettes and could help adult smokers switch. That was progress. But nine months later, the FDA has approved nothing else—while sending a warning letter to NOAT, arguably the least youth-oriented pouch line in the world.

The outcome is bad for legal sellers and public health. ZYN is legal; a handful of clearly risky, high-nicotine imports continue to circulate; and a mild, adult-market brand that meets European safety and labeling rules is banned. Officially, NOAT’s problem is procedural—it lacks a marketing order. But in practical terms, the FDA is punishing the very design choices it claims to value: simplicity, low appeal to minors, and clean ingredients.

This approach also ignores the differences in actual risk. Studies consistently show that nicotine pouches have far fewer toxins than cigarettes and far less variability than many vapes. The biggest pouch concerns are uneven nicotine levels and occasional traces of tobacco-specific nitrosamines, depending on manufacturing quality. The serious contamination issues—heavy metals and inconsistent dosage—belong mostly to disposable vapes, particularly the flood of unregulated imports from China. Treating all “unauthorized” products as equally bad blurs those distinctions and undermines proportional enforcement.

A Better Balance: Enforce Upstream, Widen the Legal Path

My small Montgomery County survey suggests a simple formula for improvement.

First, keep enforcement targeted and focused on suppliers, not just clerks. Warning letters clearly change behavior at the store level, but the biggest impact will come from auditing distributors and importers, and stopping bad shipments before they reach retail shelves.

Second, make compliance easy. A single-page list of authorized nicotine-pouch products—currently the twenty approved ZYN items—should be posted in every store and attached to distributor invoices. Point-of-sale systems can block barcodes for anything not on the list, and retailers could affirm, once a year, that they stock only approved items.

Third, widen the legal lane. The FDA launched a pilot program in September 2025 to speed review of new pouch applications. That program should spell out exactly what evidence is needed—chemical data, toxicology, nicotine release rates, and behavioral studies—and make timely decisions. If products like NOAT meet those standards, they should be authorized quickly. Legal competition among adult-oriented brands will crowd out the sketchy imports far faster than enforcement alone.

The Bottom Line

Enforcement matters, and the data show it works—where it happens. But the legal market is too narrow to protect consumers or encourage innovation. The current regime leaves a few ZYN products as lonely legal islands in a sea of gray-market pouches that range from sensible to reckless.

The FDA’s treatment of NOAT stands out as a case study in inconsistency: a quiet, adult-focused brand approved in Europe yet effectively banned in the US, while flashier and riskier options continue to slip through. That’s not a public-health victory; it’s a missed opportunity.

If the goal is to help adult smokers move to lower-risk products while keeping youth use low, the path forward is clear: enforce smartly, make compliance easy, and give good products a fair shot. Right now, we’re doing the first part well—but failing at the second and third. It’s time to fix that.

-

Business2 days ago

Business2 days agoTrans Mountain executive says it’s time to fix the system, expand access, and think like a nation builder

-

International2 days ago

International2 days agoBiden’s Autopen Orders declared “null and void”

-

MAiD2 days ago

MAiD2 days agoStudy promotes liver transplants from Canadian euthanasia victims

-

Business2 days ago

Business2 days agoCanada has given $109 million to Communist China for ‘sustainable development’ since 2015

-

Internet2 days ago

Internet2 days agoMusk launches Grokipedia to break Wikipedia’s information monopoly

-

Business2 days ago

Business2 days agoCanada’s combative trade tactics are backfiring

-

Business2 days ago

Business2 days agoYou Won’t Believe What Canada’s Embassy in Brazil Has Been Up To

-

Crime1 day ago

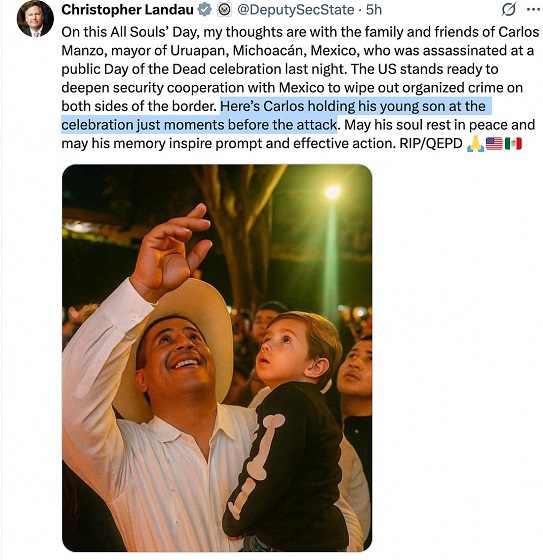

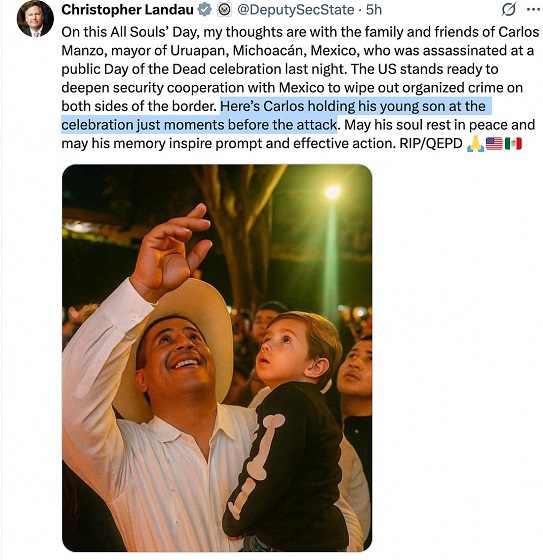

Crime1 day agoPublic Execution of Anti-Cartel Mayor in Michoacán Prompts U.S. Offer to Intervene Against Cartels