Business

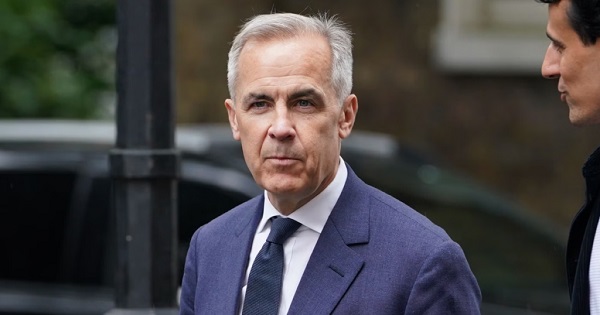

Carney’s carbon madness

Dan McTeague

Dan McTeague

Well, we are in quite the pickle.

In nine plus years as prime minister, Justin Trudeau has waged a multi-front war on the consumption and production of hydrocarbon energy, and, with that, on our economy, our quality of life, and our cost of living.

Trudeau zealously pursued and implemented anti-energy policies, most infamously the consumer Carbon Tax, but let’s not forget his so-called ”Clean Fuel” regulations; his Industrial Carbon Tax; his proposed emissions caps; his Electric Vehicle subsidies and mandates; Bill C-59, which bans businesses from touting the environmental positives of their work if it doesn’t meet a government-approved standard; and various other pieces of legislation which make the construction of new pipelines nearly impossible and significantly reduces our ability to sell our oil and gas overseas.

Every one of these policies can be traced back to the pernicious Net Zero ideology which informs them, and in which Trudeau and his bosom buddies — Gerald Butts, Steven Guilbeault, Mark Carney, etc — remain true believers.

And yet, despite those policies contributing to his party’s collapsing poll numbers and Trudeau’s unceremonious ouster, the Liberals are on the verge of naming as his replacement Mark Carney, one of the very Trudeau consiglieri who got us into this mess in the first place!

Now, Carney is currently doing everything in his power to downplay and dance around those aspects of his career which voters might find objectionable. He’s making quite a habit of it, in fact. And on the energy file, he’s being especially misleading, walking back his long-time support of the Carbon Tax — he’s said it has “served a purpose up until now” — and claiming that he intends to repeal it, while finding other ways to “make polluters pay.”

This is nonsense. In fact, Carney is a Carbon Tax superfan, and, if you listen to him closely, his actual critique of the Trudeau tax isn’t that it has made it more expensive to heat our homes, gas up our cars, and pay for our groceries (which it has.) It’s that it is too visible to voters. His vow to “make polluters pay” means, in fact, that he intends to “beef up” Trudeau’s less discussed Industrial Carbon Tax, targeting businesses, which will ultimately pass the cost down to consumers.

He’s even discussed enacting a Carbon tariff, which would apply to trade with countries which don’t adopt the onerous Net Zero policies which he wants to force on Canada.

That’s just who Mark Carney is.

And, unfortunately, Donald Trump’s tariff threats have provoked a “rally round the flag” sentiment, enabling the Liberals to close the polling gap with the Conservatives, with some polls currently showing them neck-and-neck. Which is to say, there is a possibility that, whenever we get around to having an election, anti-American animus could keep the Liberals in power, and propel Carney to the top job in our government.

This is, in a word, madness.

Let us not forget that it was the Liberals’ policies — especially their assault on our “golden goose,” the natural resource sector — which left us in such a precarious fiscal state that Trudeau felt the need to fly to Mar-a-Lago and tell the newly elected president that a tariff would “kill” our economy. That’s what provoked Trump’s “51st state” crack in the first place.

Access to U.S. markets will always be important for Canadian prosperity — they, by leaps and bounds, are our largest trading partner, after all — but without the Net Zero nonsense, we could have been an energy superpower, providing an alternative source of oil and natural gas for those countries leary about relying for energy on less-environmentally conscious, human-rights-abusing petrostates. We could have filled the void created by Russia, when they made themselves a pariah state in Europe by invading Ukraine.

In short, we might have been set up to negotiate with the Trump Administration from a position of strength. Instead, we’re proposing to double-down on Net Zero, pledging allegiance to a program which will make us less competitive and more likely to be steamrolled by major powers, including the U.S. but also (and less frequently mentioned) China.

Talk about cutting off your nose to spite your face! And all in the name of nationalism.

Here’s hoping we wise up and change course while there’s still time. Because, in the words of America’s greatest philosopher, Yogi Berra, “It’s getting late early.”

Dan McTeague is President of Canadians for Affordable Energy.

Support Dan’s Work to Keep Canadian Energy Affordable!

Canadians for Affordable Energy is run by Dan McTeague, former MP and founder of Gas Wizard. We stand up and fight for more affordable energy.

Addictions

The War on Commonsense Nicotine Regulation

From the Brownstone Institute

Cigarettes kill nearly half a million Americans each year. Everyone knows it, including the Food and Drug Administration. Yet while the most lethal nicotine product remains on sale in every gas station, the FDA continues to block or delay far safer alternatives.

Nicotine pouches—small, smokeless packets tucked under the lip—deliver nicotine without burning tobacco. They eliminate the tar, carbon monoxide, and carcinogens that make cigarettes so deadly. The logic of harm reduction couldn’t be clearer: if smokers can get nicotine without smoke, millions of lives could be saved.

Sweden has already proven the point. Through widespread use of snus and nicotine pouches, the country has cut daily smoking to about 5 percent, the lowest rate in Europe. Lung-cancer deaths are less than half the continental average. This “Swedish Experience” shows that when adults are given safer options, they switch voluntarily—no prohibition required.

In the United States, however, the FDA’s tobacco division has turned this logic on its head. Since Congress gave it sweeping authority in 2009, the agency has demanded that every new product undergo a Premarket Tobacco Product Application, or PMTA, proving it is “appropriate for the protection of public health.” That sounds reasonable until you see how the process works.

Manufacturers must spend millions on speculative modeling about how their products might affect every segment of society—smokers, nonsmokers, youth, and future generations—before they can even reach the market. Unsurprisingly, almost all PMTAs have been denied or shelved. Reduced-risk products sit in limbo while Marlboros and Newports remain untouched.

Only this January did the agency relent slightly, authorizing 20 ZYN nicotine-pouch products made by Swedish Match, now owned by Philip Morris. The FDA admitted the obvious: “The data show that these specific products are appropriate for the protection of public health.” The toxic-chemical levels were far lower than in cigarettes, and adult smokers were more likely to switch than teens were to start.

The decision should have been a turning point. Instead, it exposed the double standard. Other pouch makers—especially smaller firms from Sweden and the US, such as NOAT—remain locked out of the legal market even when their products meet the same technical standards.

The FDA’s inaction has created a black market dominated by unregulated imports, many from China. According to my own research, roughly 85 percent of pouches now sold in convenience stores are technically illegal.

The agency claims that this heavy-handed approach protects kids. But youth pouch use in the US remains very low—about 1.5 percent of high-school students according to the latest National Youth Tobacco Survey—while nearly 30 million American adults still smoke. Denying safer products to millions of addicted adults because a tiny fraction of teens might experiment is the opposite of public-health logic.

There’s a better path. The FDA should base its decisions on science, not fear. If a product dramatically reduces exposure to harmful chemicals, meets strict packaging and marketing standards, and enforces Tobacco 21 age verification, it should be allowed on the market. Population-level effects can be monitored afterward through real-world data on switching and youth use. That’s how drug and vaccine regulation already works.

Sweden’s evidence shows the results of a pragmatic approach: a near-smoke-free society achieved through consumer choice, not coercion. The FDA’s own approval of ZYN proves that such products can meet its legal standard for protecting public health. The next step is consistency—apply the same rules to everyone.

Combustion, not nicotine, is the killer. Until the FDA acts on that simple truth, it will keep protecting the cigarette industry it was supposed to regulate.

Alberta

Canada’s heavy oil finds new fans as global demand rises

From the Canadian Energy Centre

By Will Gibson

“The refining industry wants heavy oil. We are actually in a shortage of heavy oil globally right now, and you can see that in the prices”

Once priced at a steep discount to its lighter, sweeter counterparts, Canadian oil has earned growing admiration—and market share—among new customers in Asia.

Canada’s oil exports are primarily “heavy” oil from the Alberta oil sands, compared to oil from more conventional “light” plays like the Permian Basin in the U.S.

One way to think of it is that heavy oil is thick and does not flow easily, while light oil is thin and flows freely, like fudge compared to apple juice.

“The refining industry wants heavy oil. We are actually in a shortage of heavy oil globally right now, and you can see that in the prices,” said Susan Bell, senior vice-president of downstream research with Rystad Energy.

A narrowing price gap

Alberta’s heavy oil producers generally receive a lower price than light oil producers, partly a result of different crude quality but mainly because of the cost of transportation, according to S&P Global.

The “differential” between Western Canadian Select (WCS) and West Texas Intermediate (WTI) blew out to nearly US$50 per barrel in 2018 because of pipeline bottlenecks, forcing Alberta to step in and cut production.

So far this year, the differential has narrowed to as little as US$10 per barrel, averaging around US$12, according to GLJ Petroleum Consultants.

“The differential between WCS and WTI is the narrowest I’ve seen in three decades working in the industry,” Bell said.

Trans Mountain Expansion opens the door to Asia

Oil tanker docked at the Westridge Marine Terminal in Burnaby, B.C. Photo courtesy Trans Mountain Corporation

The price boost is thanks to the Trans Mountain expansion, which opened a new gateway to Asia in May 2024 by nearly tripling the pipeline’s capacity.

This helps fill the supply void left by other major regions that export heavy oil – Venezuela and Mexico – where production is declining or unsteady.

Canadian oil exports outside the United States reached a record 525,000 barrels per day in July 2025, the latest month of data available from the Canada Energy Regulator.

China leads Asian buyers since the expansion went into service, along with Japan, Brunei and Singapore, Bloomberg reports.

Asian refineries see opportunity in heavy oil

“What we are seeing now is a lot of refineries in the Asian market have been exposed long enough to WCS and now are comfortable with taking on regular shipments,” Bell said.

Kevin Birn, chief analyst for Canadian oil markets at S&P Global, said rising demand for heavier crude in Asia comes from refineries expanding capacity to process it and capture more value from lower-cost feedstocks.

“They’ve invested in capital improvements on the front end to convert heavier oils into more valuable refined products,” said Birn, who also heads S&P’s Center of Emissions Excellence.

Refiners in the U.S. Gulf Coast and Midwest made similar investments over the past 40 years to capitalize on supply from Latin America and the oil sands, he said.

While oil sands output has grown, supplies from Latin America have declined.

Mexico’s state oil company, Pemex, reports it produced roughly 1.6 million barrels per day in the second quarter of 2025, a steep drop from 2.3 million in 2015 and 2.6 million in 2010.

Meanwhile, Venezuela’s oil production, which was nearly 2.9 million barrels per day in 2010, was just 965,000 barrels per day this September, according to OPEC.

The case for more Canadian pipelines

Worker at an oil sands SAGD processing facility in northern Alberta. Photo courtesy Strathcona Resources

“The growth in heavy demand, and decline of other sources of heavy supply has contributed to a tighter market for heavy oil and narrower spreads,” Birn said.

Even the International Energy Agency, known for its bearish projections of future oil demand, sees rising global use of extra-heavy oil through 2050.

The chief impediments to Canada building new pipelines to meet the demand are political rather than market-based, said both Bell and Birn.

“There is absolutely a business case for a second pipeline to tidewater,” Bell said.

“The challenge is other hurdles limiting the growth in the industry, including legislation such as the tanker ban or the oil and gas emissions cap.”

A strategic choice for Canada

Because Alberta’s oil sands will continue a steady, reliable and low-cost supply of heavy oil into the future, Birn said policymakers and Canadians have options.

“Canada needs to ask itself whether to continue to expand pipeline capacity south to the United States or to access global markets itself, which would bring more competition for its products.”

-

Business1 day ago

Business1 day agoTrans Mountain executive says it’s time to fix the system, expand access, and think like a nation builder

-

International1 day ago

International1 day agoBiden’s Autopen Orders declared “null and void”

-

MAiD1 day ago

MAiD1 day agoStudy promotes liver transplants from Canadian euthanasia victims

-

Business1 day ago

Business1 day agoCanada has given $109 million to Communist China for ‘sustainable development’ since 2015

-

Internet1 day ago

Internet1 day agoMusk launches Grokipedia to break Wikipedia’s information monopoly

-

Business1 day ago

Business1 day agoCanada’s combative trade tactics are backfiring

-

Business1 day ago

Business1 day agoYou Won’t Believe What Canada’s Embassy in Brazil Has Been Up To

-

Automotive1 day ago

Automotive1 day agoCarney’s Budget Risks Another Costly EV Bet