Business

Carney government’s throne speech—different delivery, same old approach to policy

From the Fraser Institute

By Jake Fuss and Grady Munro

For the first time in nearly 70 years, the speech from the throne—which marks the opening of a new Parliament and lays out the government’s policy priorities for the coming term—was delivered directly by Canada’s sovereign, King Charles III, as opposed to the governor general (his representative in Canada). A key theme throughout the speech was the idea of change, and that the Carney government has the opportunity to transform the Canadian economy.

But while Canada certainly needs change, peeling back the rhetoric reveals the government plans to utilize much of the same strategies as its predecessor when addressing the country’s problems. Consider the following three examples.

A New Fiscal Approach

Throughout the election, and again during the throne speech, the Carney government promised a new fiscal principle that will guide all of its actions—“spend less to invest more.” This “new fiscal discipline” is intended to depart from the fiscal approach of the previous government—which Prime Minister Mark Carney has said spent “too much.” To “spend less,” the government plans to split spending into two separate budgets—an operating and capital budget—and slow growth in operating spending to balance the operating budget over the next three years.

The problem is the government’s fiscal math simply doesn’t add up. In the speech, the government commits to major new investments in national defence and law enforcement, and personal income tax cuts—all of which put pressure on the budget. The government rightly identifies the need to cut spending elsewhere to offset this pressure, but essentially hamstrings efforts to rein in spending by taking approximately three-quarters of the budget—including (but not limited to) all transfers to provinces, territories and individuals, and major programs such as national dental care, pharmacare and daycare—off the table.

What is the result of the Carney government’s new fiscal approach? The government will spend more in total, run larger deficits and take on more debt over the next four years than was previously planned by the Trudeau government. Constantly hitting the gas on spending and debt is the same strategy that Carney’s predecessor employed time and time again.

Building the Strongest Economy in the G7

According to the throne speech, the government’s “core mission” is to “build the strongest economy in the G7.” Part of the government’s plan to do this is by removing internal trade barriers—something that has been long overdue—but there’s only so much the federal government can do, as much of the work must be done by the provinces. Missing from the speech was a comprehensive plan to reform and reduce taxes to promote economic growth, along with a clear commitment to dismantle the costly regulatory regime of the Trudeau government.

Canada’s tax system represents a significant drag on the Canadian economy, and while the Carney government plans to lower the bottom federal personal income tax (PIT) rate from 15 per cent to 14 per cent, this change will do little to increase economic growth because it will not meaningfully improve the economic incentives to work, save and invest, nor will it make Canada much better at attracting and retaining professionals, business owners and entrepreneurs. More ambitious and broad-based reforms and tax cuts are needed to make a meaningful impact on growth.

Similarly, it’s unclear whether the Carney government is willing to meaningfully depart from the regulatory regime of the Trudeau government. A number of studies have highlighted how overburdensome regulations implemented under the previous government (including Bill C-69 and the federal emissions cap) act as a major deterrent for the investments and projects needed to grow the economy.

However, despite the Carney government’s commitments to “catalyze” investments and projects while making Canada an “energy superpower,” the government has sent mixed signals regarding its willingness to significantly depart from the previous government’s approach to regulation and the energy sector.

Expanding Role of Federal Government

During the last decade under the Trudeau government, Canada experienced one of the largest increases in the size of government of any advanced country, in large part due to the previous government’s tendency to expand the federal government’s role in the economy (national dental care, pharmacare, daycare, etc.). Unfortunately, the throne speech suggests the Carney government will repeat these mistakes and continue to expand the federal government’s role in the economy.

For example, the government plans to speed up the time it takes to approve major projects within Canada to incentivize new investments and grow the economy. However, instead of eliminating the costly and burdensome regulations that make it hard to build projects in Canada, the Carney government plans to create a new government entity—the Major Federal Project Office—to reduce approval times. In other words, the government will create more bureaucracy and regulation to try and solve a problem created by too much regulation.

Similarly, in its efforts to spur new homebuilding, the Carney government will create another new federal entity called Build Canada Homes, which will “get the government back in the business of building” by acting as a developer to build affordable housing while also providing financing to other affordable homebuilders. However, by increasing the federal government’s role in the economy, and continuing to expand bureaucratic influence, the government is unlikely to “catalyze” significant new homebuilding but it will likely expose taxpayers to significant risks.

Due to the presence of King Charles III, the delivery of this year’s speech from the throne differed significantly from years past. However, in substance, the Carney government promises much of the same.

Business

Taxing food is like slapping a surcharge on hunger. It needs to end

This article supplied by Troy Media.

Cutting the food tax is one clear way to ease the cost-of-living crisis for Canadians

About a year ago, Canada experimented with something rare in federal policymaking: a temporary GST holiday on prepared foods.

It was short-lived and poorly communicated, yet Canadians noticed it immediately. One of the most unavoidable expenses in daily life—food—became marginally less costly.

Families felt a modest but genuine reprieve. Restaurants saw a bump in customer traffic. For a brief moment, Canadians experienced what it feels like when government steps back from taxing something as basic as eating.

Then the tax returned with opportunistic pricing, restoring a policy that quietly but reliably makes the cost of living more expensive for everyone.

In many ways, the temporary GST cut was worse than doing nothing. It opened the door for industry to adjust prices upward while consumers were distracted by the tax relief. That dynamic helped push our food inflation rate from minus 0.6 per cent in January to almost four per cent later in the year. By tinkering with taxes rather than addressing the structural flaws in the system, policymakers unintentionally fuelled volatility. Instead of experimenting with temporary fixes, it is time to confront the obvious: Canada should stop taxing food altogether.

Start with grocery stores. Many Canadians believe food is not taxed at retail, but that assumption is wrong. While “basic groceries” are zero-rated, a vast range of everyday food products are taxed, and Canadians now pay over a billion dollars a year in GST/HST on food purchased in grocery stores.

That amount is rising steadily, not because Canadians are buying more treats, but because shrinkflation is quietly pulling more products into taxable categories. A box of granola bars with six bars is tax-exempt, but when manufacturers quietly reduce the box to five bars, it becomes taxable. The product hasn’t changed. The nutritional profile hasn’t changed. Only the packaging has changed, yet the tax flips on.

This pattern now permeates the grocery aisle. A 650-gram bag of chips shrinks to 580 grams and becomes taxable. Muffins once sold in six-packs are reformatted into three-packs or individually wrapped portions, instantly becoming taxable single-serve items. Yogurt, traditionally sold in large tax-exempt tubs, increasingly appears in smaller 100-gram units that meet the definition of taxable snacks. Crackers, cookies, trail mixes and cereals have all seen slight weight reductions that push them past GST thresholds created decades ago. Inflation raises food prices; Canada’s outdated tax code amplifies those increases.

At the same time, grocery inflation remains elevated. Prices are rising at 3.4 per cent, nearly double the overall inflation rate. At a moment when food costs are climbing faster than almost everything else, continuing to tax food—whether on the shelf or in restaurants—makes even less economic sense.

The inconsistencies extend further. A steak purchased at the grocery store carries no tax, yet a breakfast wrap made from virtually the same inputs is taxed at five per cent GST plus applicable HST. The nutritional function is not different. The economic function is not different. But the tax treatment is entirely arbitrary, rooted in outdated distinctions that no longer reflect how Canadians live or work.

Lower-income households disproportionately bear the cost. They spend 6.2 per cent of their income eating outside the home, compared with 3.4 per cent for the highest-income households. When government taxes prepared food, it effectively imposes a higher burden on those often juggling two or three jobs with limited time to cook.

But this is not only about the poorest households. Every Canadian pays more because the tax embeds itself in the price of convenience, time and the realities of modern living.

And there is an overlooked economic dimension: restaurants are one of the most effective tools we have for stimulating community-level economic activity. When people dine out, they don’t just buy food. They participate in the economy. They support jobs for young and lower-income workers. They activate foot traffic in commercial areas. They drive spending in adjacent sectors such as transportation, retail, entertainment and tourism.

A healthy restaurant sector is a signal of economic confidence; it is often the first place consumers re-engage when they feel financially secure. Taxing prepared food, therefore, is not simply a tax on convenience—it is a tax on economic participation.

Restaurants Canada has been calling for the permanent removal of GST/HST on all food, and they are right. Eliminating the tax would generate $5.4 billion in consumer savings annually, create more than 64,000 foodservice jobs, add over 15,000 jobs in related sectors and support the opening of more than 2,600 new restaurants across the country. No other affordability measure available to the federal government delivers this combination of economic stimulus and direct relief.

And Canadians overwhelmingly agree. Eighty-four per cent believe food should not be taxed, regardless of where it is purchased. In a polarized political climate, a consensus of that magnitude is rare.

Ending the GST/HST on all food will not solve every affordability issue but it is one of the simplest, fairest and most effective measures the federal government can take immediately.

Food is food. The tax system should finally accept that.

Dr. Sylvain Charlebois is a Canadian professor and researcher in food distribution and policy. He is senior director of the Agri-Food Analytics Lab at Dalhousie University and co-host of The Food Professor Podcast. He is frequently cited in the media for his insights on food prices, agricultural trends, and the global food supply chain.

Troy Media empowers Canadian community news outlets by providing independent, insightful analysis and commentary. Our mission is to support local media in helping Canadians stay informed and engaged by delivering reliable content that strengthens community connections and deepens understanding across the country.

Business

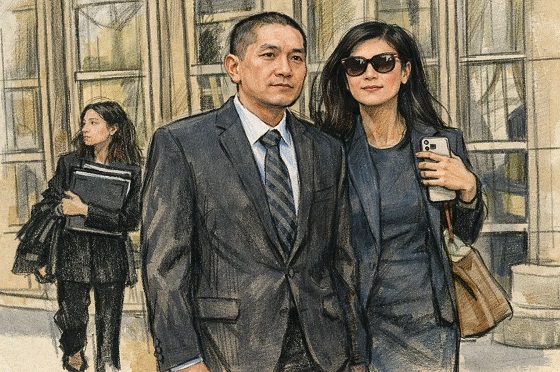

Deadlocked Jury Zeroes In on Alleged US$40 Million PPE Fraud in Linda Sun PRC Influence Case

A jury of New Yorkers will return to court Monday, heading into their second week of deliberations in a landmark foreign-agent and corruption trial that reaches into two governors’ offices, struggling to decide whether former state official Linda Sun secretly served Beijing’s interests while she and her husband built a small business and luxury-property empire cashing in on pandemic-era contracts as other Americans were locked down.

On Thursday — the fourth day of deliberations — the jury sent federal Judge Brian Cogan a blunt note saying they were deadlocked on the sprawling case, in which the federal government has asked jurors to accept its account of a complex web of family and Chinese-community financial transactions through which Sun and her husband allegedly secured many millions of dollars in Chinese business deals channeled through “United Front” proxies aligned with Beijing.

The defense, by contrast, argues that Sun and her husband were simply successful through legitimate, culturally familiar transactions, not any covert scheme directed by a foreign state.

“We deeply feel that no progress can be made to change any jurors’ judgment on all counts,” the panel wrote Thursday. “There are fundamental differences on the evidence and the interpretation of the law. We cannot come to a unanimous decision.”

Cogan reportedly responded with a standard “Allen charge” — an instruction often used in deadlock situations, urging jurors to keep an open mind and continue deliberating. Because a juror had to be replaced due to travel commitments, the reconstituted panel will need to restart deliberations from square one on Monday.

According to a message the U.S. Justice Department sent to The Bureau on Wednesday, the panel had already asked for transcripts from four witnesses — Sean Carroll, Mary Beth Hefner, Karen Gallacchi and Jenny Low.

Those requests underline just how dense the case is — and how much money was at stake in the pandemic-era PPE deals at the heart of several key counts. Sun and her husband, businessman Chris Hu, face 19 counts in total, including Sun acting as an unregistered foreign agent for the People’s Republic of China; visa-fraud and alien-smuggling charges tied to a 2019 Henan provincial delegation; a multimillion-dollar pandemic PPE kickback scheme; bank-fraud and identity-misuse allegations; and multiple money-laundering and tax-evasion counts.

Carroll and Hefner’s testimony is central to the government’s key procurement-corruption allegation. Prosecutors say Sun used her influence to help steer more than US$40 million in PPE contracts to companies tied to her husband in China, with an expected profit of roughly US$8 million — money they allege was partly kicked back to Sun and Hu and funneled through accounts opened in Sun’s mother’s name and via friends and relatives.

Prosecutors say the clearest money trail in the Sun case runs through New York’s COVID PPE scramble and a pair of Jiangsu-linked emails.

“What was Linda Sun’s reward for taking official action to steer these contracts through the procurement process? Millions of dollars in kickbacks or bribes. It was money that she knew would be coming her way if she pushed these contracts through,” prosecutor Alexander Solomon told jurors in closing.

He argued that in March 2020, as the pandemic hit, a Jiangsu provincial official in Albany emailed state staff, including Sun, with information on four Chinese PPE and medical suppliers — and that the next day Sun forwarded herself a second email that copied the language about two of those vendors but added a new line claiming that “High Hope comes highly recommended by the Jiangsu Department of Commerce.”

A New York State IT specialist testified that this exact phrase appears only once in the state’s entire email system, in Sun’s self-forwarded message. Prosecutors urged jurors to see it as a fabricated email.

They suggest it is one of a number of frauds and forgeries, including claims that Sun repeatedly faked Governor Kathy Hochul’s signature on invitation letters used to bring Chinese provincial officials into the United States as part of plans to build a large education complex in New York.

On the PPE dealings, prosecutors say that during a period when Sun still had broad latitude to vet vendors, she sent procurement official Sean Carroll a proposal for High Hope to supply five million masks.

Prosecutors say she did not disclose that High Hope was tied to family associate Henry Hua or that she had a financial interest in the deal, but did repeat language that the company “came recommended” by Jiangsu authorities — phrasing Carroll testified he understood as an official validation from the Chinese side.

Prosecutors then linked the High Hope contracts that moved through Carroll’s office to alleged downstream cash flows laid out in a Chris Hu spreadsheet: PPE contract money Hu recorded as owed by Jay Chen, marked as wired into an account called “Golden” and then on to “HC Paradise,” the vehicle Hu allegedly used to pay for a Hawaii property.

In the government’s telling, that is how a doctored Jiangsu government “recommendation” for High Hope ultimately turned into New York taxpayer funds helping to buy a Hawaiian condo.

As The Bureau has reported in detail, prosecutor Alexander Solomon used his closing argument to give jurors one of the clearest open-court narratives yet of how the Chinese Communist Party’s United Front allegedly seeks to shape Western politics through diaspora networks — and to argue that Sun sat at the center of such a network in Albany.

Solomon walked the panel through a cast that ran from Sun’s family and business partners in Queens to United Front–linked association bosses in New York, provincial officials in Henan and Guangdong, and senior staff at China’s New York consulate. In his account, Sun — officially feted in Beijing as an “eminent young overseas Chinese” after a 2017 political tour — became a “trusted insider” who quietly repurposed New York State letterhead, access and messaging to serve Beijing’s priorities on Taiwan, Uyghurs and trade, while keeping that relationship hidden from her own colleagues.

Among the most striking elements of the government’s case, as The Bureau reported from Solomon’s summation, were that Sun allegedly forged Hochul’s signature on multiple invitation letters that Chinese officials then used to secure U.S. visas for provincial delegations — promising meetings in Albany that, Solomon said, no one in state government had actually approved — as part of a broader push by Henan Province to anchor a major education complex in the United States.

He then tied that influence narrative to money: millions in lobster-export deals for Chris Hu, allegedly greased by Chinese officials and New York-based United Front intermediaries; coded “apple” cash drop-offs funneled through third-party accounts; and the pandemic PPE contracts.

In Solomon’s formulation, all of that adds up to clandestine agency for Beijing.

He told jurors that while Sun was boasting to Chinese consulate officials that she could treat Hochul “like her puppet,” she was acting “like an agent,” treating PRC officials as her “real bosses,” and seeking and receiving benefits. Sun kept doing so, Solomon said, even after an FBI agent warned her about the Foreign Agents Registration Act and the risks of working too closely with the consulate.

Defense lawyers for Sun and Hu, in their own summations, urged the jury to reject that picture of a couple monetizing their access to senior American politicians in order to enrich themselves through clandestine business dealings facilitated by community leaders secretly working for Beijing’s United Front units. According to the Global Investigations Review summary and other accounts, they argued that prosecutors have overreached by criminalizing ordinary diaspora politics, networking and pandemic procurement.

On the defense view, much of what the government calls “direction and control” is better understood as routine back-and-forth involving a diaspora liaison in the governor’s office and community or trade groups with ties to China. None of the government’s evidence, they argue, amounts to an agreement to operate under the “direction or control” of a foreign principal — the core FARA requirement.

The Bureau is a reader-supported publication.

To receive new posts and support my work, consider becoming a free or paid subscriber.

-

Censorship Industrial Complex16 hours ago

Censorship Industrial Complex16 hours agoDeath by a thousand clicks – government censorship of Canada’s internet

-

Automotive21 hours ago

Automotive21 hours agoPoliticians should be honest about environmental pros and cons of electric vehicles

-

Great Reset19 hours ago

Great Reset19 hours agoViral TikTok video shows 7-year-old cuddling great-grandfather before he’s euthanized

-

Daily Caller17 hours ago

Daily Caller17 hours agoChinese Billionaire Tried To Build US-Born Baby Empire As Overseas Elites Turn To American Surrogates

-

Alberta18 hours ago

Alberta18 hours agoSchools should go back to basics to mitigate effects of AI

-

Daily Caller2 days ago

Daily Caller2 days ago‘Almost Sounds Made Up’: Jeffrey Epstein Was Bill Clinton Plus-One At Moroccan King’s Wedding, Per Report

-

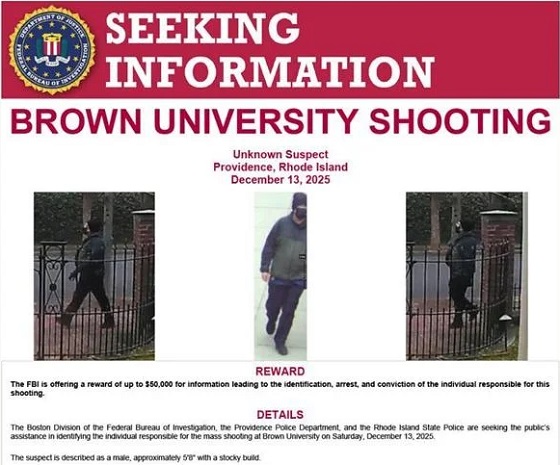

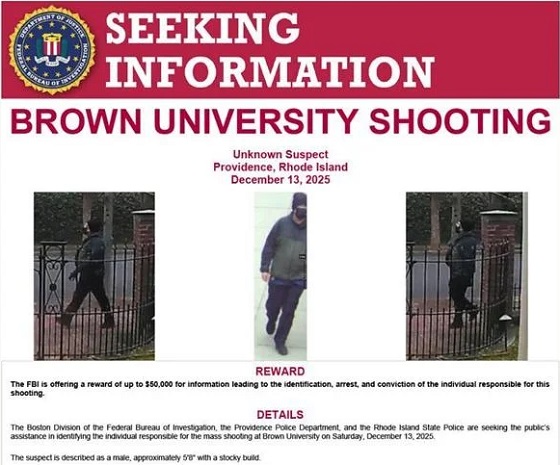

Crime2 days ago

Crime2 days agoBrown University shooter dead of apparent self-inflicted gunshot wound

-

Bruce Dowbiggin1 day ago

Bruce Dowbiggin1 day agoHunting Poilievre Covers For Upcoming Demographic Collapse After Boomers