Canadian Energy Centre

Canada’s energy leaders send ‘urgent action plan’ to new federal government

From the Canadian Energy Center

38 oil and gas CEOs sign list of shared objectives, opportunities to work together

The CEOs of 38 of Canada’s largest energy companies have a message for the new federal government: after all the discussion on the campaign trail about the need to flex Canada’s role as a global energy superpower, the time is now to take action.

Heads of pipeline majors including Enbridge, TC Energy, Pembina and Inter Pipeline, chiefs of producers such as Canadian Natural Resources, Suncor Energy, Cenovus Energy, Tourmaline and ARC Resources released a joint letter to Prime Minister Mark Carney on April 30 with their “urgent action plan.”

The plan reflects a similar letter sent before the election from 14 heads of industry.

With the list of names more than doubling, the CEOs added their view of opportunities to work together with the federal government “to deliver on our shared objectives.”

“Many of these issues were talked about in your campaign and are of growing interest for Canadians as is evidenced by recent polling,” they wrote.

Here are their five priority areas:

1. Simplify regulation: The federal government’s Impact Assessment Act and West Coast tanker ban are impeding development and need to be overhauled and simplified. Regulatory processes need to be streamlined, and decisions need to withstand judicial challenges.

2. Commit to firm deadlines for project approvals: The federal government needs to reduce regulatory timelines so that major projects are approved within six months of application.

3. Grow production: The federal government’s unlegislated cap on emissions must be eliminated to allow the sector to reach its full potential.

4. Attract investment: The federal carbon levy on large emitters is not globally cost competitive and should be repealed to allow provincial governments to set more suitable carbon regulations.

5. Incent Indigenous co-investment opportunities: The federal government needs to provide Indigenous loan guarantees at scale so industry may create infrastructure ownership opportunities to increase prosperity for communities and to ensure that Indigenous communities benefit from development.

Alberta

‘Weird and wonderful’ wells are boosting oil production in Alberta and Saskatchewan

From the Canadian Energy Centre

Multilateral designs lift more energy with a smaller environmental footprint

A “weird and wonderful” drilling innovation in Alberta is helping producers tap more oil and gas at lower cost and with less environmental impact.

With names like fishbone, fan, comb-over and stingray, “multilateral” wells turn a single wellbore from the surface into multiple horizontal legs underground.

“They do look spectacular, and they are making quite a bit of money for small companies, so there’s a lot of interest from investors,” said Calin Dragoie, vice-president of geoscience with Calgary-based Chinook Consulting Services.

Dragoie, who has extensively studied the use of multilateral wells, said the technology takes horizontal drilling — which itself revolutionized oil and gas production — to the next level.

“It’s something that was not invented in Canada, but was perfected here. And it’s something that I think in the next few years will be exported as a technology to other parts of the world,” he said.

Dragoie’s research found that in 2015 less than 10 per cent of metres drilled in Western Canada came from multilateral wells. By last year, that share had climbed to nearly 60 per cent.

Royalty incentives in Alberta have accelerated the trend, and Saskatchewan has introduced similar policy.

Multilaterals first emerged alongside horizontal drilling in the late 1990s and early 2000s, Dragoie said. But today’s multilaterals are longer, more complex and more productive.

The main play is in Alberta’s Marten Hills region, where producers are using multilaterals to produce shallow heavy oil.

Today’s average multilateral has about 7.5 horizontal legs from a single surface location, up from four or six just a few years ago, Dragoie said.

One record-setting well in Alberta drilled by Tamarack Valley Energy in 2023 features 11 legs stretching two miles each, for a total subsurface reach of 33 kilometres — the longest well in Canada.

By accessing large volumes of oil and gas from a single surface pad, multilaterals reduce land impact by a factor of five to ten compared to conventional wells, he said.

The designs save money by skipping casing strings and cement in each leg, and production is amplified as a result of increased reservoir contact.

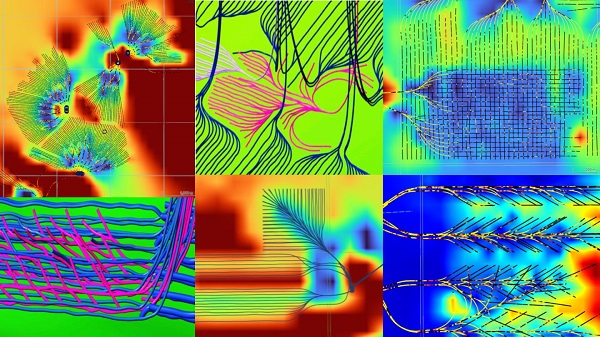

Here are examples of multilateral well design. Images courtesy Chinook Consulting Services.

Parallel

Fishbone

Fan

Waffle

Stingray

Frankenwells

Alberta

How economic corridors could shape a stronger Canadian future

Ship containers are stacked at the Panama Canal Balboa port in Panama City, Saturday, Sept. 20, 2025. The Panama Canals is one of the most significant trade infrastructure projects ever built. CP Images photo

From the Canadian Energy Centre

Q&A with Gary Mar, CEO of the Canada West Foundation

Building a stronger Canadian economy depends as much on how we move goods as on what we produce.

Gary Mar, CEO of the Canada West Foundation, says economic corridors — the networks that connect producers, ports and markets — are central to the nation-building projects Canada hopes to realize.

He spoke with CEC about how these corridors work and what needs to change to make more of them a reality.

CEC: What is an economic corridor, and how does it function?

Gary Mar: An economic corridor is a major artery connecting economic actors within a larger system.

Consider the road, rail and pipeline infrastructure connecting B.C. to the rest of Western Canada. This infrastructure is an important economic corridor facilitating the movement of goods, services and people within the country, but it’s also part of the economic corridor connecting western producers and Asian markets.

Economic corridors primarily consist of physical infrastructure and often combine different modes of transportation and facilities to assist the movement of many kinds of goods.

They also include social infrastructure such as policies that facilitate the easy movement of goods like trade agreements and standardized truck weights.

The fundamental purpose of an economic corridor is to make it easier to transport goods. Ultimately, if you can’t move it, you can’t sell it. And if you can’t sell it, you can’t grow your economy.

CEC: Which resources make the strongest case for transport through economic corridors, and why?

Gary Mar: Economic corridors usually move many different types of goods.

Bulk commodities are particularly dependent on economic corridors because of the large volumes that need to be transported.

Some of Canada’s most valuable commodities include oil and gas, agricultural commodities such as wheat and canola, and minerals such as potash.

CEC: How are the benefits of an economic corridor measured?

Gary Mar: The benefits of economic corridors are often measured via trade flows.

For example, the upcoming Roberts Bank Terminal 2 in the Port of Vancouver will increase container trade capacity on Canada’s west coast by more than 30 per cent, enabling the trade of $100 billion in goods annually, primarily to Asian markets.

Corridors can also help make Canadian goods more competitive, increasing profits and market share across numerous industries. Corridors can also decrease the costs of imported goods for Canadian consumers.

For example, after the completion of the Trans Mountain Expansion in May 2024 the price differential between Western Canada Select and West Texas Intermediate narrowed by about US$8 per barrel in part due to increased competition for Canadian oil.

This boosted total industry profits by about 10 per cent, and increased corporate tax revenues to provincial and federal governments by about $3 billion in the pipeline’s first year of operation.

CEC: Where are the most successful examples of these around the world?

Gary Mar: That depends how you define success. The economic corridors transporting the highest value of goods are those used by global superpowers, such as the NAFTA highway that facilitates trade across Canada, the United States and Mexico.

The Suez and Panama canals are two of the most significant trade infrastructure projects ever built, facilitating 12 per cent and five per cent of global trade, respectively. Their success is based on their unique geography.

Canada’s Asia-Pacific Gateway, a coordinated system of ports, rail lines, roads, and border crossings, primarily in B.C., was a highly successful initiative that contributed to a 48 per cent increase in merchandise trade with Asia from $44 million in 2006 to $65 million in 2015.

China’s Belt and Road initiative to develop trade infrastructure in other countries is already transforming global trade. But the project is as much about extending Chinese influence as it is about delivering economic returns.

Piles of coal awaiting export and gantry cranes used to load and unload containers onto and from cargo ships are seen at Deltaport, in Tsawwassen, B.C., on Monday, September 9, 2024. CP Images photo

CEC: What would need to change in Canada in terms of legislation or regulation to make more economic corridors a reality?

Gary Mar: A major regulatory component of economic corridors is eliminating trade barriers.

The federal Free Trade and Labour Mobility in Canada Act is a good start, but more needs to be done at the provincial level to facilitate more internal trade.

Other barriers require coordinated regulatory action, such as harmonizing weight restrictions and road bans to streamline trucking.

By taking a systems-level perspective – convening a national forum where Canadian governments consistently engage on supply chains and trade corridors – we can identify bottlenecks and friction points in our existing transportation networks, and which investments would deliver the greatest return on investment.

-

Alberta2 days ago

Alberta2 days agoNational Crisis Approaching Due To The Carney Government’s Centrally Planned Green Economy

-

Carbon Tax1 day ago

Carbon Tax1 day agoCarney fails to undo Trudeau’s devastating energy policies

-

Agriculture2 days ago

Agriculture2 days agoFederal cabinet calls for Canadian bank used primarily by white farmers to be more diverse

-

Business1 day ago

Business1 day agoThe UN Pushing Carbon Taxes, Punishing Prosperity, And Promoting Poverty

-

Health1 day ago

Health1 day agoNEW STUDY: Infant Vaccine “Intensity” Strongly Predicts Autism Rates Worldwide

-

Business1 day ago

Business1 day agoClimate Climbdown: Sacrificing the Canadian Economy for Net-Zero Goals Others Are Abandoning

-

Great Reset2 days ago

Great Reset2 days agoCanadian government forcing doctors to promote euthanasia to patients: report

-

Artificial Intelligence1 day ago

Artificial Intelligence1 day agoLawsuit Claims Google Secretly Used Gemini AI to Scan Private Gmail and Chat Data