Canadians have been told for years that population decline was unthinkable, that it was an economic death spiral, that only mass immigration could save us. That was the line. Now the numbers are in, and suddenly the people who said that are very quiet.

Statistics Canada reports that between July 1 and October 1, 2025, Canada’s population fell by 76,068 people, a decline of 0.2 percent, bringing the total population to 41,575,585. This is not a rounding error. It is not a model projection. It is an official quarterly population loss, outside the COVID period, confirmed by the federal government’s own data

The reason matters. This did not happen because Canadians suddenly stopped having children or because of a natural disaster. It happened because the number of non‑permanent residents dropped by 176,479 people in a single quarter, the largest quarterly decline since comparable records began in 1971. Permit expirations outpaced new permits by more than two to one. Outflows totaled 339,505, while inflows were just 163,026

That is the so‑called growth engine shutting down.

Permanent immigration continued at roughly the same pace as before. Canada admitted 102,867 permanent immigrants in the quarter, consistent with recent levels. Births minus deaths added another 17,600 people. None of that was enough to offset the collapse in temporary residency. Net international migration overall was negative, at minus 93,668

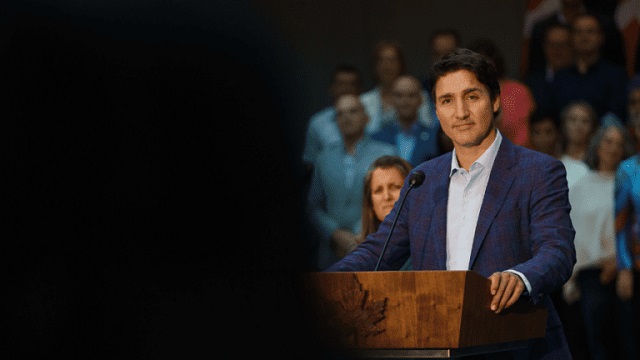

And here’s the part you’re not supposed to say out loud. For the Liberal‑NDP government, this is bad news. Their entire economic story has rested on population‑driven GDP growth, not productivity. Add more people, claim the economy is growing, borrow more money, and run the national credit card a little harder. When population growth reverses, that illusion collapses. GDP per capita does not magically improve. Housing shortages do not disappear. The math just stops working.

The regional numbers make that clear. Ontario’s population fell by 0.4 percent in the quarter. British Columbia fell by 0.3 percent. Every province and territory lost population except Alberta and Nunavut, and even Alberta’s growth was just 0.2 percent, its weakest since the border‑closure period of 2021

Now watch who starts complaining first. Universities are already bracing for it. Study permit holders alone fell by 73,682 people in three months, with Ontario losing 47,511 and British Columbia losing 14,291. These are the provinces with the largest university systems and the highest dependence on international tuition revenue

You’re going to hear administrators and activists say this is a crisis. What they mean is that fewer students are paying international tuition to subsidize bloated campuses and programs that produce no measurable economic value. When the pool of non‑permanent residents shrinks, departments that exist purely because enrollment was artificially inflated start to disappear. That’s not mysterious. That’s arithmetic.

For years, Canadians were told that any slowdown in population growth was dangerous. The truth is more uncomfortable. What’s dangerous is building a national economic model on temporary residents, borrowed money, and headline GDP numbers while productivity stagnates. The latest StatsCan release doesn’t just show a population decline. It shows how fragile the story really was, and how quickly it unravels when the numbers stop being padded.