Business

The Great Wealth Transfer – Billions To Change Hands By 2026

Here comes the boom.

What is ‘The Great Wealth Transfer’?

This term has been coined by several major wealth managers across North America; referring to the tremendous amount of wealth that will be transferred to younger generations over the next decade. Wealth amassed by baby boomers will eventually be passed down to their families or beneficiaries, typically with the aid of a trusted wealth manager or financial advisor.

Similar in a way to climate change, when we visit some of the data that has been reported in both Canada and the US, this issue seems to be far more pressing than most people are aware. Depending on the publication, the exact amount of wealth that will be transferred is questionable. Cited in Forbes, a report done by the Coldwell Banker Global Luxury® program and WealthEngine claim that $68 Trillion will change hands in the US by 2030.

We spoke with Gwen Becker and Devin St. Louis, two VP’s, Portfolio Managers and Wealth Advisors for RBC Wealth Management, offering their expert insight into the industry and the vast amount of wealth that is changing hands in Canada.

According to RBC Wealth Management, their numbers in terms of the wealth transfer report $150 billion is set to change hands by 2026. The industry as a whole is at the forefront of this generational shift, whereas a trusted advisor can onboard younger family members to ensure the highest level of support through the process. Gwen offers her perspective:

“Certainly just around the corner; something that we are definitely paying attention to. My practice has always been very relationship-driven. It has been my privilege to advise many of my clients for decades. I have been intentional to welcome and include multiple generations of the same family. I advise grandparents who are now in their 90s, to which the majority of their children are my clients and even beginning to onboard grandchildren.”

This is an example of what is referred to as multi-generational estate planning. Being in the midst of the ‘great transfer of wealth’, this type of planning is crucial for advisors to implement early so they can continue to support the same family in the future. According to the Canadian Financial Capability Survey conducted in 2019, 51% of Canadians over the age of 65 will refer to a financial advisor to seek literacy and support. Contrary to that, Canadians aged 18-34 show that 51% are more likely to use online resources to aid in their financial literacy.

Devin offers his perspective on how the importance of family legacy plays a role when an advisor poses this question: What is your wealth for?

“If you sat down with a couple 10 years ago, they may say, when I pass away, whatever wealth is left can be distributed evenly amongst our children. That has changed quite a lot now because elder family members are now more concerned about how their wealth is passed on to the next generation. Onboarding grandchildren can ensure that a family legacy that receives their wealth, uses it to benefit their family and their community.”

An important question to consider. Clearly there is a shift in attitude towards having a family legacy live on through younger generations of a family. Evident that having the support of a financial advisor or wealth manager not only ensures the most efficient use of your money and assets but also ensures financial stability for your family in their future.

If we revisit the above study in how a younger demographic is more likely to utilize online resources, interesting how a more digitally inclined audience will be receptive to advisors. Boiling down to how millennials and younger age groups will perceive wealth management if those in that space fail to offer their services through online communication.

Devin agrees that RBC is uniquely positioned for this digital shift:

“interesting that everybody had to transform their processes online through this COVID-19 pandemic. Every company has been forced to step up their technology means, RBC has definitely risen to that occasion. RBC has adapted quickly, improving a great technology base that already existed. I don’t perceive it at this point to be a challenge. I believe we have the right focus. I think it’ll be a good transition for us.”

Gwen continues:

“I do agree that RBC is very well positioned. The younger generations below millennials that would eventually take over some of this wealth carries some challenges. How does that age demographic think, and what are their expectations of wealth management or financial advisors? It is difficult to understand what that generation will expect out of digital advisors. Estate planning matters, and it will always be tied to you knowing the family, it’s a relationship business”

Consider that RBC Wealth Management oversees $1.05 trillion globally under their administration, has over 4,800 professionals to serve their clients and was the recipient of the highest-ranking bank-owned investment brokerage by the 2020 Investment Executive Brokerage Report Card, safe to say their decades of professionalism, expertise and ‘get it done’ attitude speaks for itself.

So, what does this mean for younger members of families who may not understand the field of wealth management?

Starting the conversation early

Whether you are the elder family member who has their financial ‘quarterback’ preparing their estate to change hands or are younger family members who may be the beneficiary of wealth in the near future, starting the conversation amongst family members early is important for the process to be successful. Considering that some possessions have more than just monetary value, but an emotional tie to the family legacy can be a difficult asset to distribute evenly. Of course, it can be a tough conversation to have, it may involve discussing the passing away of a loved one or even setting a plan to cover future expenses. Gwen mentions:

“I encourage my clients to have open conversations with their children while they are alive so that their intentions are clear. Depending on the dynamics of the family, things such as an annual family meeting with a beneficiary can be effective once it’s put in place. If they are not comfortable leading that conversation, bring a trusted adviser to the table to be impartial and logical.”

There is no way to know what ramifications will come of this ‘great transfer of wealth’. It may be that we see the resurgence of a strong bull market in the near future, we may see new tech innovation that we cannot yet grasp or new business investments that continue to disrupt traditional processes. Only time will tell.

For more stories, visit Todayville Calgary

Alberta

A Christmas wish list for health-care reform

From the Fraser Institute

By Nadeem Esmail and Mackenzie Moir

It’s an exciting time in Canadian health-care policy. But even the slew of new reforms in Alberta only go part of the way to using all the policy tools employed by high performing universal health-care systems.

For 2026, for the sake of Canadian patients, let’s hope Alberta stays the path on changes to how hospitals are paid and allowing some private purchases of health care, and that other provinces start to catch up.

While Alberta’s new reforms were welcome news this year, it’s clear Canada’s health-care system continued to struggle. Canadians were reminded by our annual comparison of health care systems that they pay for one of the developed world’s most expensive universal health-care systems, yet have some of the fewest physicians and hospital beds, while waiting in some of the longest queues.

And speaking of queues, wait times across Canada for non-emergency care reached the second-highest level ever measured at 28.6 weeks from general practitioner referral to actual treatment. That’s more than triple the wait of the early 1990s despite decades of government promises and spending commitments. Other work found that at least 23,746 patients died while waiting for care, and nearly 1.3 million Canadians left our overcrowded emergency rooms without being treated.

At least one province has shown a genuine willingness to do something about these problems.

The Smith government in Alberta announced early in the year that it would move towards paying hospitals per-patient treated as opposed to a fixed annual budget, a policy approach that Quebec has been working on for years. Albertans will also soon be able purchase, at least in a limited way, some diagnostic and surgical services for themselves, which is again already possible in Quebec. Alberta has also gone a step further by allowing physicians to work in both public and private settings.

While controversial in Canada, these approaches simply mirror what is being done in all of the developed world’s top-performing universal health-care systems. Australia, the Netherlands, Germany and Switzerland all pay their hospitals per patient treated, and allow patients the opportunity to purchase care privately if they wish. They all also have better and faster universally accessible health care than Canada’s provinces provide, while spending a little more (Switzerland) or less (Australia, Germany, the Netherlands) than we do.

While these reforms are clearly a step in the right direction, there’s more to be done.

Even if we include Alberta’s reforms, these countries still do some very important things differently.

Critically, all of these countries expect patients to pay a small amount for their universally accessible services. The reasoning is straightforward: we all spend our own money more carefully than we spend someone else’s, and patients will make more informed decisions about when and where it’s best to access the health-care system when they have to pay a little out of pocket.

The evidence around this policy is clear—with appropriate safeguards to protect the very ill and exemptions for lower-income and other vulnerable populations, the demand for outpatient healthcare services falls, reducing delays and freeing up resources for others.

Charging patients even small amounts for care would of course violate the Canada Health Act, but it would also emulate the approach of 100 per cent of the developed world’s top-performing health-care systems. In this case, violating outdated federal policy means better universal health care for Canadians.

These top-performing countries also see the private sector and innovative entrepreneurs as partners in delivering universal health care. A relationship that is far different from the limited individual contracts some provinces have with private clinics and surgical centres to provide care in Canada. In these other countries, even full-service hospitals are operated by private providers. Importantly, partnering with innovative private providers, even hospitals, to deliver universal health care does not violate the Canada Health Act.

So, while Alberta has made strides this past year moving towards the well-established higher performance policy approach followed elsewhere, the Smith government remains at least a couple steps short of truly adopting a more Australian or European approach for health care. And other provinces have yet to even get to where Alberta will soon be.

Let’s hope in 2026 that Alberta keeps moving towards a truly world class universal health-care experience for patients, and that the other provinces catch up.

Business

Warning Canada: China’s Economic Miracle Was Built on Mass Displacement

If you think the CCP will treat foreigners better than its own people, when it extends its power over you, please think again: Dimon Liu’s warning to Canadian Parliament.

Editor’s Note: The Bureau is publishing the following testimony to Canada’s House of Commons committee on International Human Rights from Dimon Liu, a China-born, Washington, D.C.-based democracy advocate who testified in Parliament on December 8, 2025, about the human cost of China’s economic rise. Submitted to The Bureau as an op-ed, Liu’s testimony argues that the Canadian government should tighten scrutiny of high-risk trade and investment, and ensure Canada’s foreign policy does not inadvertently reward coercion. Liu also warns that the Chinese Communist Party could gain leverage over Canadians and treat them as it has done to its own subjugated population—an implied message to Prime Minister Mark Carney, who has pledged to engage China as a strategic partner without making that position clear to Canadians during his election campaign.

OTTAWA — It is an honor to speak before you at the Canadian Parliament.

My testimony will attempt to explain why China’s economic success is built on the backs of the largest number of displaced persons in human history.

It is estimated that these displaced individuals range between 300 to 400 million — it is equivalent to the total population of the United States being uprooted and forced to relocate. These displaced persons are invisible to the world, their sufferings unnoticed, their plights ignored.

In 1978, when economic reform began, China’s GDP was $150 billion USD.

In 2000, when China joined the WTO, it was approximately $1.2 trillion USD.

China’s current GDP is approximately $18 trillion USD.

In 2000 China’s manufacturing output was smaller than Italy’s.

Today it’s larger than America, Europe, Japan, and South Korea combined.

If you have ever wondered how China managed to grow so fast in such a short time, Charles Li, former CEO of the Hong Kong Stock Exchange, has the answers for you.

He listed 4 reasons: 1) cheapest land, 2) cheapest labor, 3) cheapest capital, and 4) disregard of environmental costs.

“The cheapest land” because the CCP government took the land from the farmers at little to no compensation.

“The cheapest labor,” because these farmers, without land to farm, were forced to find work in urban areas at very low wages.

The communist household registration system (hukou 戶口) ties them perpetually to the rural areas. This means they are not legal residents, and cannot receive social benefits that legal urban residents are entitled. They could be evicted at any time.

One well known incident of eviction occurred in November 2017. Cai Qi, now the second most powerful man in China after Xi Jinping, was a municipal official in Beijing. He evicted tens of thousands into Beijing’s harsh winter, with only days, or just moments of notice. Cai Qi made famous a term, “low-end population” (低端人口), and exposed CCP’s contempt of rural migrants it treats as second class citizens.

These displaced migrant workers have one tradition they hold dear — it is to reunite with their families during the Chinese Lunar New Year holiday, making this seasonal migration of 100 to 150 million people a spectacular event. In China’s economic winter of 2025 with waves of bankruptcies and factory closures, the tide of unemployed migrant workers returning home to where there is also no work, and no land to farm, has become a worrisome event.

Historically in the last 2,000 years, social instability has caused the collapse of many ruling regimes in China.

“The cheapest capital” is acquired through predatory banking practices, and through the stock markets, first to rake in the savings of the Chinese people; and later international investments by listing opaque, and state owned enterprises in leading stock markets around the world.

“A disregard of environmental costs” is a hallmark of China’s industrialization. The land is poisoned, so is the water; and China produces one-third of all global greenhouse gases.

Chinese Communist officials often laud their system as superior. The essayist Qin Hui has written that the Chinese communist government enjoys a human rights abuse advantage. This is true. By abusing its own people so brutally, the CCP regime has created an image of success, which will prove to be a mirage.

If you think the CCP will treat foreigners better than its own people, when it extends its power over you, please think again.

The Bureau is a reader-supported publication.

To receive new posts and support my work, consider becoming a free or paid subscriber.

-

Alberta1 day ago

Alberta1 day agoAlberta Next Panel calls to reform how Canada works

-

Automotive2 days ago

Automotive2 days agoCanada’s EV gamble is starting to backfire

-

International6 hours ago

International6 hours agoGeorgia county admits illegally certifying 315k ballots in 2020 presidential election

-

Digital ID23 hours ago

Digital ID23 hours agoCanadian government launches trial version of digital ID for certain licenses, permits

-

Business22 hours ago

Business22 hours agoThe “Disruptor-in-Chief” places Canada in the crosshairs

-

Agriculture1 day ago

Agriculture1 day agoEnd Supply Management—For the Sake of Canadian Consumers

-

Alberta6 hours ago

Alberta6 hours agoCalgary’s new city council votes to ban foreign flags at government buildings

-

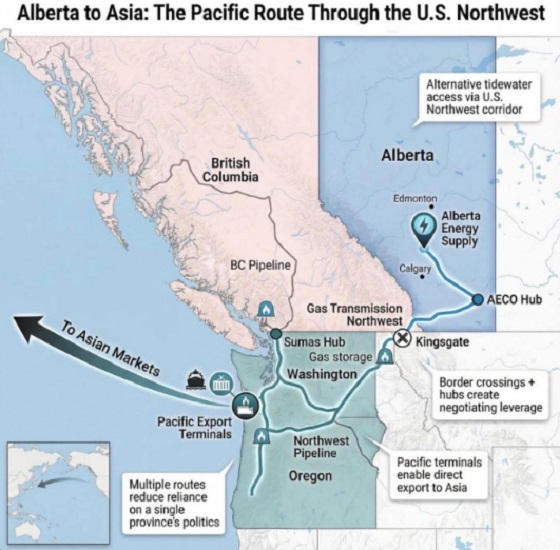

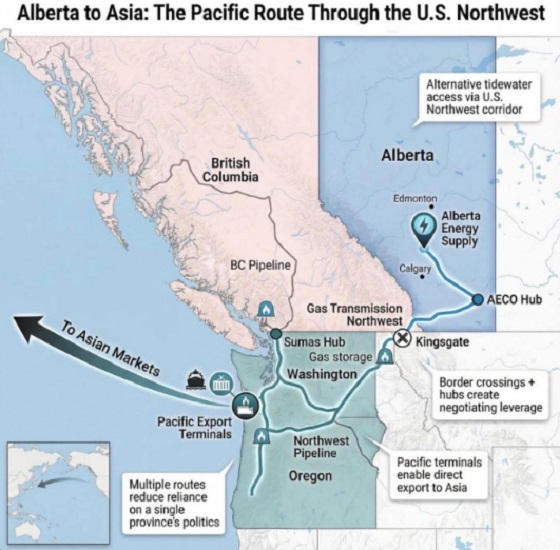

Alberta9 hours ago

Alberta9 hours agoWhat are the odds of a pipeline through the American Pacific Northwest