Business

BUILD CANADA NOW: An Open Letter to the Prime Minister of Canada from Energy Leaders

From EnergyNow.Ca

We can strengthen economic sovereignty and resilience: Unlock private-sector investment, responsibly develop our world-class natural resources, support climate action

The Rt. Hon. Mark Carney, PC, MP

Prime Minister of Canada

Dear Prime Minister Carney,

On behalf of Canada’s leading energy companies, please accept our congratulations on your election victory and appointment as Canada’s new Prime Minister.

This moment marks not only the first chapter for your government, but also a vital opportunity for our nation to come together around shared goals and build the trust necessary to get big things done. Together we can Build Canada Now and strengthen economic sovereignty and resilience, by unlocking private sector investment, through responsibly developing Canada’s world class natural resources and supporting climate action to reduce emissions. As business leaders in Canada, we look forward to working constructively with you and your cabinet to achieve our energy sector’s potential and our shared goal to position our country as a global energy superpower.

For context, global prosperity will continue to rely on oil and natural gas for decades to come. Regardless of whether absolute global demand will grow or weaken over time, the natural decline of oil and natural gas production requires ongoing investment to replace that decline. Without continued investment, global supply could fall by more than half within 10 years—the question is, in what producing countries will investment occur, and the economic benefits realized? With abundant resources, a strong commitment to environmental stewardship and responsible energy production, it should be Canada, and it should be now. Canada can be a global energy leader and secure long-term economic prosperity.

We have reviewed your platform for governing Canada, particularly your ambition of building the fastest growing economy in the G7. As a major contributor to the Canadian economy, with significant untapped potential, the energy sector must play a pivotal role in your pursuit of this ambition. Growth in the Canadian oil and natural gas sector supports GDP growth, job creation, and tax revenue. Your focus on fostering energy independence and enhancing Canada’s energy infrastructure and clean technology, requires major sector investment and globally competitive energy and carbon policies. Over the last decade, the layering and complexity of energy policies has resulted in a lack of investor confidence and consequently, a barrier to investment – especially when compared to the United States, which is taking steps to simplify its permitting process.

In March, a subset of us wrote to you and the other federal leaders, outlining an urgent action plan needed to support ongoing and future investment from the energy sector in Canada. We note that many of these issues were talked about in your campaign and are of growing interest for Canadians as is evidenced by recent polling. The bullets below reflect our earlier action plan. Beneath each statement we have described opportunities to work together to deliver on our shared objectives.

- “Simplify regulation. The federal government’s Impact Assessment Act and West Coast tanker ban are impeding development and need to be overhauled and simplified. Regulatory processes need to be streamlined, and decisions need to withstand judicial challenges.”

- Current regulatory processes are complex, unpredictable, subjective, and excessively long. These processes inhibit the ability of industry to make timely investments, add unnecessary costs and create uncertainty within capital markets. Aligned with your proposal to streamline the approval process, industry is committed to working with your government to ensure Canada can grow exports of oil and natural gas to other regions.

- “Commit to firm deadlines for project approvals. The federal government needs to reduce regulatory timelines so that major projects are approved within 6 months of application.”

- Your proposal to have all federal regulatory authorities complete reviews of nationally significant projects within a two-year timeframe is a positive step, but insufficient. In our opinion, two years is still too long of a period for review and we must target a 6-month approval process to bring capital back to Canada. Additional clarity with regards to provincial jurisdiction is required. We believe that we can work together to accelerate this even further to accomplish urgent economic growth, while maintaining environmental standards and addressing Indigenous rights.

- “Grow production. The federal government’s unlegislated cap on emissions must be eliminated to allow the sector to reach its full potential.”

- We continue to believe the federal government’s cap on emissions creates uncertainty, is redundant, will limit growth and unnecessarily result in production cuts, and stifle infrastructure investments. Together, we can drive investment into emissions reductions by simplifying the regulatory regime, establishing an attractive fiscal environment, and ensuring carbon policies protect our export industries.

- “Attract investment. The federal carbon levy on large emitters is not globally cost competitive and should be repealed to allow provincial governments to set more suitable carbon regulations.”

- Recognizing the global nature of oil and natural gas, industry needs clear, competitive, and durable fiscal frameworks, including carbon policy and associated costs, sufficient to secure the required capital and incentivize investment in the sector. The current federal price and stringency trajectory results in uncompetitive costs compared to those we compete with to deliver our products to market. Additionally, the potential benefits of a federal approach, like consistency across jurisdictions and connected carbon markets, has failed to materialize. A solution is to revert back to the functioning system where provinces administer the policies and pricing to enable emissions-reduction investments, improve emissions performance, and maintain competitiveness.

- “Incent Indigenous co-investment opportunities. The federal government needs to provide Indigenous loan guarantees at scale so industry may create infrastructure ownership opportunities to increase prosperity for communities and to ensure that Indigenous communities benefit from development.”

- Your intention of doubling Indigenous Loan Guarantee Program to $10 billion to support infrastructure ownership opportunities and increase prosperity for communities is aligned with our earlier recommendation. That being said, Indigenous loan guarantee programs are only effective if Canada fosters a competitive investment environment. We look forward to working with you on this initiative to grow the prosperity of Indigenous communities and earn their support for our shared ambitions.

The time is now to take action, signaling to the global investment markets that Canada is ready to move forward with achieving our shared vision of Canada as a leading global energy superpower.

We know the decisions in the coming months will have a lasting impact on Canada’s economic sovereignty, economy and global position, and that each of us—governments, industry, and Canadians—has a role to play. We can’t do it without each other.

The energy industry looks forward to working together, with you and your government, on an urgent basis, for the benefit of this country and Canadians nationwide.

Regards,

Business

Natural gas bans are fuelling higher energy costs

This article supplied by Troy Media.

By Roslyn Kunin

By Roslyn Kunin

Governments are pulling the plug on natural gas with no real backup plan in place and Canadians are paying the price

Banning natural gas and pushing electricity without enough supply is a recipe for soaring energy costs and blackouts. Politicians may forget the basics of economics, but supply and demand won’t go away.

When the supply of anything goes up, its price falls. Limit or decrease supply and the price rises. Demand works in the opposite direction—high demand drives up prices, and lower demand brings them down.

Like gravity, the law of supply and demand is always there, but many politicians behave as though it doesn’t exist. Nowhere is that clearer than in energy policy, where environmental goals are prioritized while economic realities are sidelined. The drive to eliminate energy-related emissions

in just a few years may sound noble, but it ignores practical limits, and Canadians are paying the price.

Take natural gas. It emits far less carbon than coal or oil. In Canada, most natural gas comes from Alberta and British Columbia, and it’s one of the country’s most affordable and secure energy sources. Despite this, several jurisdictions in B.C. are banning its use in new and renovated buildings—moves encouraged by federal emissions targets and climate incentives.

These policies may be well-intentioned, but they ignore a basic fact: people still need to heat their homes and cook their meals. Without gas, they’ll be forced to use electricity. But unlike gas, electricity is already in short supply and getting more expensive. Our current generating capacity can’t keep up with rising demand, and that’s before we even consider the added strain from electric vehicles, data centres and energy-hungry artificial intelligence.

British Columbia’s Site C dam, a multibillion-dollar hydroelectric project under construction on the Peace River, is expected to generate enough electricity for 450,000 homes when complete. But all of that power is already spoken for. There are no Site C-scale replacements on the horizon. Meanwhile, our distribution infrastructure can’t meet today’s needs, let alone tomorrow’s.

In one recent case, buildings planning to install EV chargers were told by B.C. Hydro, the Crown corporation responsible for electricity in B.C., that there wasn’t enough power available. Major housing developments have even been blocked due to limited electricity supply.

These constraints aren’t just technical—they’re already making it harder to build new housing. Canadians may accept higher costs for environmental gains, but pushing up both housing and energy bills risks crossing a line. Banning natural gas makes it harder to build and maintain affordable homes, directly undermining what governments claim to support. In homes forced to switch from gas to electricity, heating and hot water bills could quadruple. Reliability also drops. Builders are now being advised to install backup generators to handle expected power outages—ironically, those generators will often run on the very natural gas being banned.

We can no longer assume the government will keep the lights on. That’s a serious blow to Canadians’ standard of living.

Some argue these trade-offs are justified if they cut emissions. But even that goal is questionable. The gas we don’t burn here will simply be sold elsewhere—likely to countries still relying on coal, oil or even dung. Because emissions don’t respect borders, the global climate impact remains the same, or worse.

Of course, Canada could go further and stop producing natural gas altogether. Leave it all in the ground. But doing so would deliver a major blow to our economy and standard of living: something no elected government is likely to survive. Alternatively, Canada could export more of its low-cost, lower-emission natural gas to displace dirtier fuels abroad. That would reduce global emissions more effectively than restricting gas at home.

Canadians care about the environment. But we need smart, balanced policies—ones that use our resources wisely, not wastefully. We can pursue conservation and cleaner technologies while still recognizing that economic laws apply, even when they’re inconvenient.

It’s not about choosing between prosperity and the planet. It’s about realizing that ignoring the fundamentals—like supply and demand—comes at a cost most Canadians can’t afford.

Dr. Roslyn Kunin is a respected Canadian economist known for her extensive work in economic forecasting, public policy, and labour market analysis. She has held various prominent roles, including serving as the regional director for the federal government’s Department of Employment and Immigration in British Columbia and Yukon and as an adjunct professor at the University of British Columbia. Dr. Kunin is also recognized for her contributions to economic development, particularly in Western Canada.

Troy Media empowers Canadian community news outlets by providing independent, insightful analysis and commentary. Our mission is to support local media in helping Canadians stay informed and engaged by delivering reliable content that strengthens community connections and deepens understanding across the country.

Business

WEF has a plan to overhaul the global financial system by monetizing nature

From LifeSiteNews

By Tim Hinchliffe of The Sociable

The WEF is plowing full steam ahead with the globalist agenda to monitor and monetize everything in nature, including the air we breathe, the water we drink, and the very earth we walk upon.

With billionaires Larry Fink and Andre Hoffmann as the new co-chairs, the World Economic Forum (WEF) publishes a 50-page blueprint on how to monetize everything in nature.

The WEF’s latest insight report, “Finance Solutions for Nature: Pathways to Returns and Outcomes,” provides “stakeholders” with dozens of financial solutions for monetizing everything in nature.

Nature pricing, biodiversity crediting schemes, natural asset companies, debt-for-nature swaps, and so much more are all packed into this agenda to overhaul the global financial system with nature-based activities:

The landscape of nature finance is rapidly evolving. From sovereign debt instruments and blended capital platforms to biodiversity credits and emerging asset classes, a growing range of mechanisms is being deployed to fund, finance and de-risk nature-positive action.

The WEF leadership page says that in their work on the board of trustees, “members do not represent any personal or professional interests.”

However, the target audiences for latest WEF insight report are “institutional investors, banks, asset managers, and development actors” – the very business interests that Hoffmann and Fink represent.

WEF interim co-chairs Larry Fink and Andre Hoffmann have everything to gain in their business dealings should the documentation, monetization, and tokenization of everything in nature ever come to full fruition.

And they are well on their way.

Fink’s BlackRock manages over $11 trillion in assets, and last year BlackRock said it was “conducting proprietary research on natural capital investment signals, identifying companies poised for financial advantage in avoiding nature-related risks or leaning into opportunities. Those signals cover themes such as energy management, water management, waste management and biodiversity – and can feed into portfolio construction or support custom exposures.”

Hoffmann is also a key player in a whole host of so-called green financing initiatives, including biodiversity crediting schemes, through his various roles as founder, president, and chairman at several companies and NGOs such as: Innovate 4 Nature – the “accelerator for nature-positive solutions” and Systemiq – the “system change company” established specifically to advance U.N. Agenda 2030.

“The economy depends on natural resources. Their value derives not only from their use as direct inputs to production – such as timber for construction – but also for their benefits to society like living trees that help clean the air. Economists use the term “natural capital” to refer to the total value that natural resources provide to the economy and to people.” — BlackRock, Capital at risk: nature through an investment lens, August 2024

Investigative journalist Whitney Webb: BlackRock and other companies are attempting to seize control over the natural world under the guise of "saving the planet".

"BlackRock being able to unlock and take control of as many natural assets as possible… is obviously a way for… pic.twitter.com/XgRBBqW7qr

— Wide Awake Media (@wideawake_media) February 26, 2025

“Debt-for-nature swaps [DNS] are a financial mechanism that allow countries to restructure bilateral or multilateral debt in exchange for commitments to fund local conservation and restoration. They are also known as ‘debt-for-nature conversion.’” — WEF, Finance Solutions for Nature: Pathways to Returns and Outcomes, September 2025

Is your country millions, billions, or trillions in debt? No problem!

With debt-for-nature swaps, you can restructure your nation’s debt just by letting somebody else come in and take control of your natural resources under the guise of conservation and restoration, but what they’ll really be doing is forcing you to “take out private insurance policies to ‘mitigate the financial impact of natural disasters‘ as well as ‘political risk,’” as investigative journalists Whitney Webb and Mark Goodwin report in Bitcoin Magazine.

Don’t have any money, but want to create value out of thin air, water, soil, or trees? You can set up natural asset companies that can “convert the full economic value of nature into financial flows via equity models.”

Want to help asset managers, bankers, and hedge fund execs get extremely rich while leaving you with only a tiny fraction? Go ahead and get involved in a Payment for Environmental Services (PES) scheme, where financial incentives are provided to individuals or communities in exchange for maintaining or restoring ecosystem services, like carbon sequestration or biodiversity conservation

And if you’re compliant with their rules, you can be rewarded by producing “positive nature and biodiversity outcomes (e.g. species, ecosystems and natural habitats) through the creation and sale of either land or ocean-based biodiversity units over a fixed period” with biodiversity credits, aka “environmental credits.”

Prefer to be left alone and live on the property that you worked hard for all your life? You better be compliant with all the environmental regulations that are coming in the name of preserving biodiversity, so that the $44 trillion of economic value generated by nature doesn’t diminish.

With Larry Fink & Andre Hoffmann having everything to gain, today the WEF published a blueprint for the complete monetization of everything in nature. Natural Asset Companies, Biodiversity Credits, Debt for Nature Swaps, Payments for Ecosystem Services https://t.co/bV1SBKlM41 pic.twitter.com/knqErANBlV

— Tim Hinchliffe (@TimHinchliffe) September 11, 2025

“Environmental credits are verified units of positive environmental outcomes, including biodiversity, water, carbon and nutrient credits. Though developed independently, projects increasingly blend credits via stacking, bundling or stapling.” — WEF, Finance Solutions for Nature: Pathways to Returns and Outcomes, September 2025

“Nature is rapidly emerging as a strategic investment frontier and more institutional capital is flowing into new business models and projects.” — WEF, Finance Solutions for Nature: Pathways to Returns and Outcomes, September 2025

In keeping with the own self-interests of the co-chairs and their business relations, the report highlights “10 priority financial solutions” for these stakeholders to implement:

- Sustainability-linked bonds (SLBs):

- Commercial bonds tying coupon rates to nature-related targets for corporates or governments.

- Thematic (or use-of-proceeds) bonds:

- Bonds with proceeds earmarked for nature projects. Scaling-up requires clearer guidance and aggregation to improve outcomes for issuers and investors.

- Sustainability-linked loans (SLLs):

- Flexible debt, linking interest rates to nature-related targets. SLLs need simpler verification, standardized metrics and stronger triggers to drive nature-positive lending.

- Thematic (or use-of-proceeds) loans:

- Loans for specific nature-related projects. Greater clarity on taxonomies and aggregation is needed to enhance capital flows.

- Impact funds:

- Funds investing in nature-positive outcomes, often accepting higher risk or longer pathways to returns.

- Natural asset companies (NACs):

- Publicly and privately listed companies that convert the full economic value of nature into financial flows via equity models. NACs hold significant potential but need more transactions for price discovery and replicable investment blueprints.

- Environmental credits:

- Tradeable certificates for verified environmental benefits, used in compliance or voluntary markets.

- Debt-for-nature swaps (DNS):

- Mechanisms to restructure sovereign debt in exchange for conservation or restoration commitments, with investable components including bonds and loans.

- Payments for ecosystem services (PES):

- Contracts rewarding conservation for specific ecosystem services, driven by the public sector. Private sector schemes require longer contracts, aggregation and supply chain integration to scale up.

- Internal nature pricing (INP):

- Unexplored, voluntary shadow pricing or fee-based tools to incentivize nature-positive performance in companies or across investment portfolios, similar to internal carbon pricing (ICP).

“While some components of nature – such as food, timber and ecotourism are priced and traded in global markets, the value of many critical ecosystem services remains undervalued….

Carbon sequestration, water filtration, flood protection and pollination are often treated as ‘free’ inputs, despite underpinning our economies and societies.” — WEF, Finance Solutions for Nature: Pathways to Returns and Outcomes, September 2025

“The natural capital approach extends the economic concept of capital to the environment, conceptualizing stocks of natural resources as conventional goods worth restoring, maintaining and enhancing for their productive flows.

This approach includes both accounting – embedding nature in national and corporate balance sheets – and valuation – pricing nature’s contributions into cost-benefit and investment analysis.” — WEF, Finance Solutions for Nature: Pathways to Returns and Outcomes, September 2025

Putting prices on water, air, and soil is a hot topic among globalists at the U.N., the G20, the World Economic Forum (WEF), and the COP meetings.

At the WEF Annual Meeting in Davos this year, Singapore’s President Tharman Shanmugaratnam said that water credits and biodiversity credits should be “stapled” on to carbon credits.

Singapore President Tharman Shanmugaratnam tells the WEF he wants to put a price on everything in nature: "Just like we've got carbon credits, WE NEED TO DEVELOP THE MARKET FOR WATER CREDITS & BIODIVERSITY CREDITS" #wef25 https://t.co/wv04rzht3K pic.twitter.com/UuSiDBSuu3

— Tim Hinchliffe (@TimHinchliffe) January 21, 2025

"Much better that we work on a reliable CARBON CREDIT system with the stapling on of WATER & BIODIVERSITY CREDITS": Singapore President Tharman Shanmugaratnam at the WEF #wef25 https://t.co/wv04rzht3K pic.twitter.com/EhWCvZAsxj

— Tim Hinchliffe (@TimHinchliffe) January 21, 2025

The year prior, at the 2024 WEF Annual Meeting of the New Champions, aka “Summer Davos” meeting in communist China, University of Cambridge Institute for Sustainability Leadership CEO Lindsay Hooper told the panel on “Understanding Nature’s Ledger” that every part of the economy depends on nature, and that in order to protect natural systems, one solution would be to “bring nature onto the balance sheet.”

"We can't do business on a dead planet. If we're going to protect natural systems, one of the solutions is to bring nature onto the balance sheet; bring nature into the ways that decisions are made within business to allocate a value to it" Lindsay Hooper WEF #AMNC Summer Davos pic.twitter.com/Y1dpjMgmS6

— Tim Hinchliffe (@TimHinchliffe) June 27, 2024

In addition to putting “nature on the balance sheet,” another proposal coming at the end of the panel discussion suggested putting a tax on natural systems like water in the same vein as carbon taxes.

"Beyond carbon [taxes] let's think about other aspects of nature that are easier to quantify.. What about water? That's quite possible for us to start integrating systematically into current trading carbon pricing mechanisms" WEF managing director Gim Neo #AMNC24 Summer Davos pic.twitter.com/0rlomVk3ph

— Tim Hinchliffe (@TimHinchliffe) June 27, 2024

With putting prices on nature comes tokenization and derivatives.

At least that’s what former Bank of England adviser Michael Sheren said at COP27 in November 2022.

'Carbon is moving very quickly into a system where it's going to be very close to a currency' …

Next, 'We start thinking about putting prices on water, on trees, on biodiversity … How do we start tokenizing?': Michael Sheren, Former Bank of England Advisor #COP27 pic.twitter.com/r5Nw3b2aeo— Tim Hinchliffe (@TimHinchliffe) November 9, 2022

“Carbon, we already figured out, and carbon is moving very quickly into a system where it’s going to be very close to a currency, basically being able to take a ton of absorbed or sequestered carbon and being able to create a forward-pricing curve, with financial service architecture, documentation,” said Sheren.

And with carbon being close to a currency, “There are going to be derivatives.”

"The biggest challenge is how do we move from a SHAREHOLDER ECONOMY to a STAKEHOLDER ECONOMY" Andre Hoffmann WEF interim co-chair. Agenda 2030 advocate, Club of Rome member, Chatham House Adviser, heir to the 5th largest pharma company in the world, Roche https://t.co/NQlEF36IRy pic.twitter.com/kPI2jtDNxL

— Tim Hinchliffe (@TimHinchliffe) August 20, 2025

Now, under the newfound leadership of Fink and Hoffmann, whose personal business dealings stand everything to gain, the WEF is plowing full steam ahead with the globalist agenda to monitor and monetize everything in nature, including the air we breathe, the water we drink, and the very earth that we walk upon.

Reprinted with permission from The Sociable.

-

Business5 hours ago

Business5 hours agoOver $2B California Solar Plant Built To Last, Now Closing Over Inefficiency

-

Alberta2 days ago

Alberta2 days agoFederal policies continue to block oil pipelines

-

Autism2 days ago

Autism2 days agoAutism – what we know

-

Business4 hours ago

Business4 hours agoWEF has a plan to overhaul the global financial system by monetizing nature

-

espionage1 day ago

espionage1 day agoCanada Under Siege: Sparking a National Dialogue on Security and Corruption

-

Business1 day ago

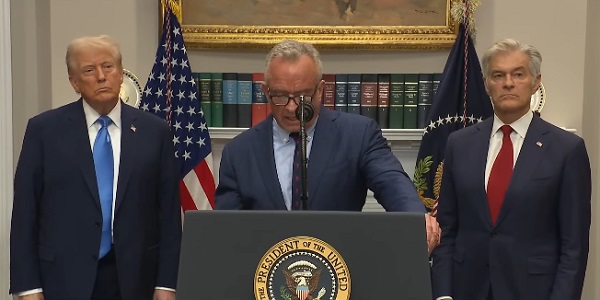

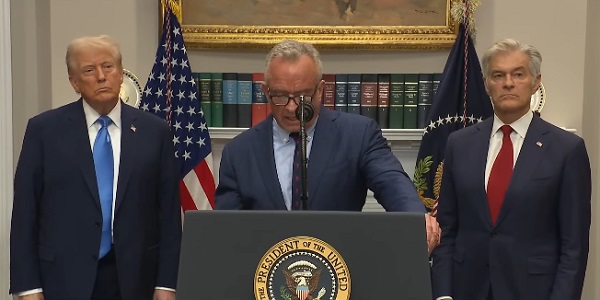

Business1 day agoGoogle Admits Biden White House Pressured Content Removal, Promises to Restore Banned YouTube Accounts

-

COVID-192 days ago

COVID-192 days agoSecond Massive Population Study Finds COVID-19 “Vaccines” Increase Risk of 6 Major Cancers

-

Business6 hours ago

Business6 hours agoThe Leaked Conversation at the heart of the federal Gun Buyback Boondoggle