Business

BREAKING ALERT: Trump Threatens 25% Tariff on All Goods From Canada and Mexico, Cites Flood of Fentanyl and Illegal Migrants

In a stunning announcement Monday, President-Elect Donald Trump vowed swift action to combat what he described as a surge in fentanyl trafficking and illegal migration at the U.S. borders with Mexico and Canada.

Trump pledged to impose a 25% tariff on all imports from both countries, citing their alleged failure to address the crises. He announced the policy would be enacted through an Executive Order on January 20, the day he officially takes office.

“Thousands of people are pouring through Mexico and Canada, bringing Crime and Drugs at levels never seen before,” Trump said in a statement. He singled out an incoming “unstoppable” caravan from Mexico as emblematic of what he described as the failures of both neighboring countries to address the crisis.

“This Tariff will remain in effect until such time as Drugs, in particular Fentanyl, and all Illegal Aliens stop this Invasion of our Country!” Trump posted on his Truth Social platform.

The backdrop to Trump’s shocking policy against Canada—long perceived as a strong ally of the U.S.—includes a recent high-profile case against TD Bank in the United States, resulting in a multi-billion-dollar fine. Months prior to Trump’s announcement, David Asher, a former Trump administration official and consultant on DEA investigations related to the TD probe, told The Bureau that U.S. investigators believe the “command and control” for the fentanyl money-laundering networks allegedly cited in the TD case leads directly to Toronto and Vancouver.

These networks—according to Asher—involve transnational Triads laundering cash from fentanyl distributed in America by Mexican cartels, who source their precursors from China.

In an exclusive interview with The Bureau, Asher criticized the Canadian government for inadequate cooperation in broader fentanyl-trafficking and Triad money laundering investigations, pointing to gang leaders in Canada with alleged ties to Beijing. Asher suggested that possible political and financial influences are hampering effective law enforcement in Canada.

“The key thing is the Canadian connection, and in almost all the investigations as far as money laundering, we saw the command control seemed to go back to our network analysis. When we seized their phones, we’d see Canada light up like a Christmas tree, especially Toronto, and also British Columbia,” Asher said.

Regarding allegations that Triads in Toronto and Vancouver are running fentanyl money-laundering networks for Mexican cartels, Asher added: “The question is, what does the Canadian government know, and why haven’t they tried to judicially prosecute?”

Asher emphasized that the failure to disrupt these networks is contributing to the ongoing fentanyl crisis, which claims tens of thousands of lives annually in the U.S. and Canada.

Furthermore, Asher disclosed that U.S. Congressional investigators allege the People’s Republic of China is not only incentivizing fentanyl precursor exports but also methamphetamine sales.

The tariff, Trump emphasized, will remain until Mexico and Canada take what he called their “absolute right and power” to stop the flow of illegal drugs and migrants.

“We hereby demand that they use this power, and until such time that they do, it is time for them to pay a very big price,” Trump declared.

The announcement has already sparked sharp reactions from political leaders and trade experts. Critics warn that such sweeping tariffs could disrupt North American trade agreements and exacerbate economic tensions with key allies.

This is a developing story. Stay tuned to The Bureau for updates.

The Bureau is a reader-supported publication. To receive new posts and support my work, consider becoming a free or paid subscriber.

Business

What Pelosi “earned” after 37 years in power will shock you

Nancy Pelosi isn’t just walking away from Congress — she’s cashing out of one of the most profitable careers ever built inside it. According to an investigation by the New York Post, the former House Speaker and her husband, venture capitalist Paul Pelosi, turned a modest stock portfolio worth under $800,000 into at least $130 million over her 37 years in office — a staggering 16,900% return that would make even Wall Street’s best blush.

The 85-year-old California Democrat — hailed as the first woman to wield the Speaker’s gavel and infamous for her uncanny market timing — announced this week she will retire when her term ends in January 2027. The Post reported that when Pelosi first entered Congress in 1987, her financial disclosure showed holdings in just a dozen stocks, including Citibank, worth between $610,000 and $785,000. Today, the Pelosis’ net worth is estimated around $280 million — built on trades that have consistently outperformed the Dow, the S&P 500, and even top hedge funds.

The Post found that while the Dow rose roughly 2,300% over those decades, the Pelosis’ reported returns soared nearly seven times higher, averaging 14.5% a year — double the long-term market average. In 2024 alone, their portfolio reportedly gained 54%, more than twice the S&P’s 25% and better than every major hedge fund tracked by Bloomberg.

Pelosi’s latest financial disclosure shows holdings in some two dozen individual stocks, including millions invested in Apple, Nvidia, Salesforce, Netflix, and Palo Alto Networks. Apple remains their single largest position, valued between $25 million and $50 million. The couple also owns a Napa Valley winery worth up to $25 million, a Bay Area restaurant, commercial real estate, and a political data and consulting firm. Their home in San Francisco’s Pacific Heights is valued around $8.7 million, and they maintain a Georgetown townhouse bought in 1999 for $650,000.

The report comes as bipartisan calls grow to ban lawmakers and their spouses from trading individual stocks — a move critics say is long overdue. “What I’ll miss most is how she trades,” said Dan Weiskopf, portfolio manager of an ETF that tracks congressional investments known as “NANC.” He described Pelosi’s trading as “high conviction and aggressive,” noting her frequent use of leveraged options trades. “You only do that if you’ve got confidence — or information,” Weiskopf told the Post.

Among her most striking trades was a late-2023 move that allowed the Pelosis to buy 50,000 shares of Nvidia at just $12 each — less than a tenth of the market price. The $2.4 million investment is now worth more than $7 million. “She’s buying deep in the money and putting up a lot of money doing it,” Weiskopf said. “We don’t see a lot of flip-flopping on her trading activity.”

Republicans blasted Pelosi’s record as proof of Washington’s double standard. “Nancy Pelosi’s true legacy is becoming the most successful insider trader in American history,” said RNC spokesperson Kiersten Pels. “If anyone else had turned $785,000 into $133 million with better returns than Warren Buffett, they’d be retiring behind bars.”

Business

Ottawa should stop using misleading debt measure to justify deficits

From the Fraser Institute

By Jake Fuss and Grady Munro

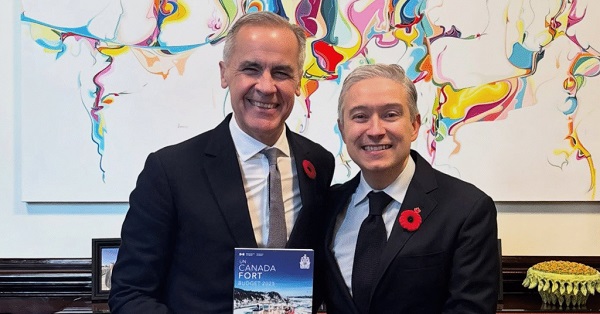

Based on the rhetoric, the Carney government’s first budget was a “transformative” new plan that will meet and overcome the “generational” challenges facing Canada. Of course, in reality this budget is nothing new, and delivers the same approach to fiscal and economic policy that has been tried and failed for the last decade.

First, let’s dispel the idea that the Carney government plans to manage its finances any differently than its predecessor. According to the budget, the Carney government plans to spend more, borrow more, and accumulate more debt than the Trudeau government had planned. Keep in mind, the Trudeau government was known for its recklessly high spending, borrowing and debt accumulation.

While the Carney government has tried to use different rhetoric and a new accounting framework to obscure this continued fiscal mismanagement, it’s also relied on an overused and misleading talking point about Canada’s debt as justification for higher spending and continued deficits. The talking point goes something like, “Canada has the lowest net debt-to-GDP ratio in the G7” and this “strong fiscal position” gives the government the “space” to spend more and run larger deficits.

Technically, the government is correct—Canada’s net debt (total debt minus financial assets) is the lowest among G7 countries (which include France, Germany, Italy, Japan, the United Kingdom and the United States) when measured as a share of the overall economy (GDP). The latest estimates put Canada’s net debt at 13 per cent of GDP, while net debt in the next lowest country (Germany) is 49 per cent of GDP.

But here’s the problem. This measure assumes Canada can use all of its financial assets to offset debt—which is not the case.

When economists measure Canada’s net debt, they include the assets of the Canada Pension Plan (CPP) and the Quebec Pension Plan (QPP), which were valued at a combined $890 billion as of mid-2025. But obviously Canada cannot use CPP and QPP assets to pay off government debt without compromising the benefits of current and future pensioners. And we’re one of the only industrialized countries where pension assets are accounted in such a way that it reduces net debt. Simply put, by falsely assuming CPP and QPP assets could pay off debt, Canada appears to have a stronger fiscal position than is actually the case.

A more accurate measure of Canada’s indebtedness is to look at the total level of debt.

Based on the latest estimates, Canada’s total debt (as a share of the economy) ranked 5th-highest among G7 countries at 113 per cent of GDP. That’s higher than the total debt burden in the U.K. (103 per cent) and Germany (64 per cent), and close behind France (117 per cent). And over the last decade Canada’s total debt burden has grown faster than any other G7 country, rising by 25 percentage points. Next closest, France, grew by 17 percentage points. Keep in mind, G7 countries are already among the most indebted, and continue to take on some of the most debt, in the industrialized world.

In other words, looking at Canada’s total debt burden reveals a much weaker fiscal position than the government claims, and one that will likely only get worse under the Carney government.

Prior to the budget, Prime Minister Mark Carney promised Canadians he will “always be straight about the challenges we face and the choices that we must make.” If he wants to keep that promise, his government must stop using a misleading measure of Canada’s indebtedness to justify high spending and persistent deficits.

-

Crime13 hours ago

Crime13 hours agoPublic Execution of Anti-Cartel Mayor in Michoacán Prompts U.S. Offer to Intervene Against Cartels

-

Alberta12 hours ago

Alberta12 hours agoCanada’s heavy oil finds new fans as global demand rises

-

Bruce Dowbiggin10 hours ago

Bruce Dowbiggin10 hours agoA Story So Good Not Even The Elbows Up Crew Could Ruin It

-

Environment14 hours ago

Environment14 hours agoThe era of Climate Change Alarmism is over

-

Addictions11 hours ago

Addictions11 hours agoThe War on Commonsense Nicotine Regulation

-

Business2 days ago

Business2 days agoCarney’s Deficit Numbers Deserve Scrutiny After Trudeau’s Forecasting Failures

-

Alberta1 day ago

Alberta1 day agoAlberta Announces Members of Class Size and Complexity Committee

-

armed forces1 day ago

armed forces1 day agoIt’s time for Canada to remember, the heroes of Kapyong