Business

B.C. Lottery Corp Fined $1M in First Casino Laundering Case Since Cullen Report

BCLC appeals, reviving “linguistic and cultural” defenses as Eby’s government leaves Cullen’s reforms largely unfulfilled

Canada’s financial intelligence agency has hit the British Columbia Lottery Corporation with a $1.075-million penalty for failing to report suspicious transactions and monitor high-risk high-rollers — the first major suspected money-laundering case against the province’s casino arm since the Cullen Commission, whose more than 100 recommendations remain largely ignored by Premier David Eby’s government.

The case centers on BCLC’s failure to report suspicious cash transactions tied to a particular “high-risk” gambler, as well as its failure to maintain adequate compliance measures for such cases.

The provincial Crown corporation has appealed the decision in Federal Court, reportedly contending that Fintrac failed to consider whether the gambler’s “perceived uncooperativeness and inconsistencies arose from linguistic and cultural differences.”

This line of defense reflects a familiar refrain from the province’s casino administration: pushing back on audits and regulatory findings by pointing to cultural practices around gambling, especially large cash “buy-ins” by wealthy visitors from China.

The documents state that Fintrac examiners judged a patron to be evasive and at times dishonest, providing false or misleading information about their occupation and ownership of property.

Such gaps in vetting patrons echo a major vulnerability identified by the Cullen Commission.

But BCLC argues that in this case the perceived inconsistencies may have stemmed from language barriers and cultural context. The appeal reportedly specifies that the regulator neglected to take into account the patron’s English-language skills or the country from which they emigrated.

BCLC has a history of resisting anti-money-laundering enforcement. In 2010, it contested a $695,750 penalty, successfully securing its cancellation via a Federal Court consent order.

That judgment was followed by exponential increases in “Vancouver Model” laundering — which peaked with more than $1.2 billion in suspicious cash transactions in 2014, according to Commissioner Austin Cullen’s 2022 final report.

Fintrac’s July 17, 2025 decision cites three violations under the Proceeds of Crime (Money Laundering) and Terrorist Financing Act. BCLC failed to submit two suspicious transaction reports despite “reasonable grounds to suspect” that a high-volume patron’s play was linked to money laundering or terrorist financing. Fintrac’s examiners noted gaps in the corporation’s enhanced due diligence reviews and identified multiple laundering indicators that were overlooked. The regulator also found that BCLC failed to keep its compliance policies up to date and approved by senior officers, and lacked documented procedures for identifying high-risk patrons.

The latest penalty comes against the backdrop of the Cullen Commission’s scathing 2022 report, which catalogued how billions in drug-linked cash flowed unchecked through B.C. casinos, real estate, and luxury markets. Cullen issued 101 recommendations, calling for sweeping reforms to break the province’s dependence on illicit capital. Yet more than three years later, only a handful of recommendations have been implemented by the Eby government. The most urgent — Cullen’s call for an independent Anti-Money Laundering Commissioner to oversee the provincial response — underscores the vulnerabilities exposed by BCLC’s latest alleged failing.

“The only way to reverse the state of affairs is to vest with one office the responsibility to support, oversee, and monitor the provincial response to money laundering,” Cullen wrote.

One particular set of data from the Commission’s final report illustrates how integral Chinese underground banks were to B.C. casino operations, and how easily gangsters accessed government-regulated financial sites. “In 2014 alone, British Columbia casinos accepted nearly $1.2 billion in cash transactions of $10,000 or more, including 1,881 individual cash buy-ins of $100,000 or more,” Cullen’s report said. That means that in 2014, almost 2,000 times, a gambler was allowed to walk into a B.C. government casino carrying at least $100,000 in cash and buy casino chips. In almost all cases these were gamblers who traveled from China or gangsters who facilitated them. “In addition to the extraordinary amounts, the cash used in many of these transactions exhibited well-known characteristics of cash derived from crime,” Cullen’s June 2022 report added.

Documents obtained by The Bureau in 2023 revealed that the RCMP’s internal response to the Commission — dubbed Project Neutralize — was not aimed at cracking down on laundering, but rather at blunting the Commission’s damaging findings. Records showed federal police sought to negate criticism that the force had failed to investigate the unprecedented surge of Chinese underground banking and cartel cash in B.C. casinos.

Business

New PBO report highlights the cost of ballooning bureaucracy

Without a thorough review, federal personnel spending could cost taxpayers upwards of $76 billion per year by the end of the decade, highlights the MEI in reaction to the latest report from the Parliamentary Budget Office (PBO).

“Federal priorities are determined by federal spending, and it is clear that Ottawa’s priority has been expanding the size and scope of government,” says Gabriel Giguère, senior policy analyst at the MEI. “If Prime Minister Carney is serious about returning to sound public finances, personnel spending will need to shrink, and fast.”

Total personnel spending is projected to reach $76.2 billion by 2029-2030, if nothing changes, according to the new PBO publication released this morning. This is up from $65.3 billion in 2023-24, a 16.7 per cent increase.

Average compensation is expected to reach $172,000 per full-time employee by 2029-2030.

When Prime Minister Carney’s predecessor, Justin Trudeau, came to power in 2015, personnel spending was $39.6 billion—a bit more than half of what it is today. Over the course of his tenure, the federal bureaucracy grew by over 100,000 employees.

Certain departments have grown substantially since 2015, including:

- Employment and Social Development Canada: +15,497

- Canada Revenue Agency: +17,257

- Public Services and Procurement Canada: +6,362

“New spending, programs, and taxes have gone hand in hand with the expansion of the federal workforce,” says Giguère. “If Ottawa is serious about cutting wasteful programs, it should begin by cutting the bureaucracies responsible for them.”

The C.D. Howe Institute recently projected that Prime Minister Carney’s first budget could feature a $92-billion deficit for 2025–2026.

Carney’s government has pledged to reduce spending by 15 per cent in select areas by the 2028–2029 fiscal year, following reductions of 7.5 per cent and 10 per cent in the two previous years, by shrinking departments and cutting waste.

In its prebudget submission, the MEI recommended that the federal government be more ambitious in carrying out this pledge. It called on Ottawa to reduce the federal bureaucracy by 17.4 per cent, mirroring the Chrétien reductions of the 1990s, which would eliminate 64,000 positions and save $10 billion a year.

Rolling back Employment and Social Development Canada, the Canada Revenue Agency, and Public Services and Procurement Canada to their 2015 levels could cut more than 39,000 full-time equivalent positions, halfway to that 64,000 goal.

“The fact that personnel has gone up with no measurable improvement in services is an indictment of the current system,” says Giguère. “Restoring balance means ensuring Canadians receive fair value for their taxes, and for that to happen, Ottawa needs to stop seeing the bureaucracy as a job creation scheme.”

* * *

The MEI is an independent public policy think tank with offices in Montreal, Ottawa, and Calgary. Through its publications, media appearances, and advisory services to policymakers, the MEI stimulates public policy debate and reforms based on sound economics and entrepreneurship.

Business

Carney’s tariff blunder cost you at the checkout

This article supplied by Troy Media.

And rolling them back is his way of admitting it

Prime Minister Mark Carney’s decision to roll back most counter-tariffs on Sept. 1 is more than welcome relief at the checkout. It’s an admission the tariffs never should have been imposed in the first place, and that consumers unfairly paid the price.

The rollback means lower grocery bills, greater choice for grocers and—most importantly—a brake on food inflation. The tariffs acted like the tide lifting all boats: when the price of orange juice, peanut butter or coffee jumped, it indirectly pushed prices elsewhere upward as grocers rebalanced their pricing.

As we enter the critical fall season, when demand for everyday staples like bread and dairy and prepared foods such as canned goods and ready-to-eat meals typically rises, removing artificial cost pressures will help keep food inflation in check.

But this move isn’t just about food prices. More to the point, it quietly acknowledges what many suspected: counter-tariffs were being applied to goods

that were technically exempt under the Canada–United States–Mexico Agreement (CUSMA), the trade deal that replaced NAFTA. That made them not only harmful to consumers but a likely violation of Canada’s own obligations under the agreement. Few Canadians were aware of it, but they certainly felt it in their wallets. The rollback is not just an economic fix—it is a political and legal admission of error.

Carney did the right thing, and on balance, it was a good day for Canada. His decision reflects an understanding that the countertariffs were never about a direct trade war between Canada and the U.S. Instead, they were a response to a broader geopolitical shift an America First agenda from Washington aimed at reinforcing U.S. leverage globally, not targeting Canada specifically. By resetting the relationship with Washington, Carney is

prioritizing the bigger picture: CUSMA and broader North American integration. The rollback is a gesture of goodwill that acknowledges that reality.

That goodwill matters because Carney’s move also reflects a simple truth: we need to get along with the U.S. More than 70 per cent of our trade flows through the U.S. market. For food, the dependency is even deeper, with supply chains tightly interwoven across the border. Stability in this relationship directly influences the prices Canadians pay for groceries.

That’s what makes the current strain so dangerous. Canada is already facing one of its worst trade crises in a generation. The recent U.S. tariff hikes on Canadian agri-food products aren’t just policy wrinkles—they’re a gut punch. In that context, the rollback isn’t just symbolic—it’s urgent. It offers a timely response to mounting pressures on both farmers and consumers. If Ottawa fails to go further, Canadians will continue to pay the price.

Rolling back counter-tariffs is only a first step. Ottawa still has unfinished business. The costs of moving food across provinces remain unnecessarily high, with different rules on food and alcohol creating internal trade barriers that drive up prices. Removing these would improve efficiency and lower costs for consumers. Canada must also address escalating tensions with other key partners. China is a critical buyer of Canadian canola and pork; India is central to our pulse exports. Both relationships are strained and the food economy is feeling the consequences. A comprehensive strategy that recognizes both geography and geopolitics is needed.

For now, though, eliminating counter-tariffs sends the right signal: Canada is ready to reduce friction, strengthen North American cooperation and give consumers some long-overdue relief at the checkout.

Dr. Sylvain Charlebois is a Canadian professor and researcher in food distribution and policy. He is senior director of the Agri-Food Analytics Lab at Dalhousie University and co-host of The Food Professor Podcast. He is frequently cited in the media for his insights on food prices, agricultural trends, and the global food supply chain.

Troy Media empowers Canadian community news outlets by providing independent, insightful analysis and commentary. Our mission is to support local media in helping Canadians stay informed and engaged by delivering reliable content that strengthens community connections and deepens understanding across the country.

-

C2C Journal2 days ago

C2C Journal2 days agoCreating Federal Institutions that Work for Our Times

-

Alberta2 days ago

Alberta2 days agoMaster agreement approved for event park and Village at ICE District

-

Business1 day ago

Business1 day agoU.S. rejection of climate-alarmed worldview has massive implications for Canada

-

Crime1 day ago

Crime1 day ago8-year-old and 10-year-old killed in church pews, 17 others injured in shooting at Minneapolis Catholic church

-

International2 days ago

International2 days agoTrump’s executive order against flag burning sparks free speech debate

-

Artificial Intelligence2 days ago

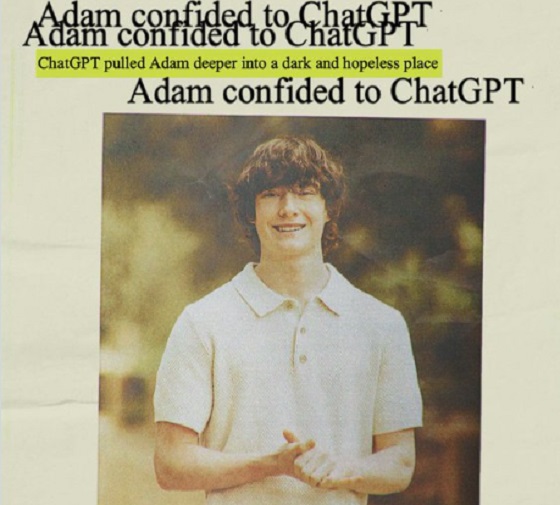

Artificial Intelligence2 days agoParents sue OpenAI, claim ChatGPT acted as teen’s “suicide coach”

-

Business2 days ago

Business2 days agoTrump goes on attack over digital services taxes, threatens tariffs

-

Business1 day ago

Business1 day agoMounties, Overstretched and Overmatched by Foreign Mafias, No Longer Fit for Service