Business

B.C. Credit Downgrade Signals Deepening Fiscal Trouble

Dan Knight

Dan Knight

Spending is up, debt is exploding, and taxpayers are footing the bill—how David Eby’s reckless economics just pushed British Columbia one step closer to the brink.

So here’s something they’re not going to explain on CBC—British Columbia just got slapped with yet another credit downgrade. Actually, two. On April 2nd, both S&P Global and Moody’s—two of the most powerful financial watchdogs on the planet—downgraded B.C.’s credit rating. And not by accident. This wasn’t a glitch in the system or some market hiccup. This was a direct consequence of political recklessness.

Let’s talk numbers. S&P cut B.C.’s rating from ‘AA-’ to ‘A+’. Moody’s dropped it from ‘aa1’ to ‘aa2’. That’s the fourth downgrade in four years. Four. This is a province that used to hold AAA status—the financial gold standard. That means British Columbia was once considered one of the most fiscally stable jurisdictions not just in Canada, but globally. Not anymore.

Even more alarming? S&P didn’t just hit their long-term rating—they downgraded the short-term rating too, from ‘A-1+’ to ‘A-1’. Why? Because even in the short term, B.C. is starting to look like a risk. A liquidity risk. That means the money might not be there when it’s needed. That’s a red flag for anyone with a calculator and a memory longer than five minutes.

This is not some vague bureaucratic move. This is a direct indictment of the NDP’s economic policies in British Columbia. This is what happens when you treat taxpayers like an ATM machine and the economy like a social experiment. And now, international financial institutions are officially saying what a lot of people have been screaming for years: B.C. is in serious fiscal trouble.

Causes: Spending, Deficits, and Revenue Pressure

The core driver behind the downgrades is the ballooning of operating and capital deficits, coupled with aggressive government spending. According to B.C.’s 2025 budget, unveiled by Finance Minister Brenda Bailey on March 4, the provincial deficit is projected to hit $10.9 billion in 2025–26—up from $9.1 billion the previous year. Moody’s projects an even higher shortfall of $14.3 billion, raising red flags about B.C.’s ability to fund programs without unsustainable borrowing.

S&P cited the impact of reduced immigration levels and ongoing trade uncertainty as key headwinds, limiting economic growth and shrinking the province’s revenue base. Moody’s pointed to persistent budgetary gaps and limited progress on deficit reduction, highlighting the growing gap between revenue and expenditure.

Additionally, spending growth has significantly outpaced both population and inflation. Data from the Fraser Institute shows that between 2019/20 and 2024/25, program spending increased by 51.6%, whereas only 29.2% was needed to keep pace with demographic and price trends. This excess has pushed real per-capita expenditures to historic highs, without a corresponding rise in revenue.

Opposition Blames NDP Mismanagement for Downgrade

But what does that actually mean for real people—not bureaucrats, not lobbyists—but the mom on a fixed income buying groceries? So I reached out to John Rustad, leader of the Official Opposition in B.C., to ask exactly that.

“Two downgrades! Absolute disaster,” he told me. “Under David Eby, we’ve gone from a AAA status to a single A with a negative outlook. This government’s reckless spending and irresponsible management will have a devastating effect—not just today, but for generations to come.”

He’s not exaggerating. According to Rustad, by the end of this fiscal period, B.C.’s debt will have nearly tripled since the NDP took power. Let that sink in—tripled. And no, this isn’t just some abstract macroeconomic trend. This hits you. Directly.

Rustad laid it out. These downgrades mean higher borrowing costs for the province. That’s code for more taxpayer money getting funneled into interest payments instead of hospitals, schools, or—God forbid—tax relief.

“By the end of this fiscal plan, even before the downgrade and before the loss of billions in carbon tax revenue, interest payments were projected to hit $7 billion annually,” Rustad said. “That’s about 30% of personal income tax revenue—just to pay the interest.”

That’s money you send to Victoria every month—just lighting it on fire.

And with the downgrade? Expect to pay another $1 billion more in interest. That’s around $200 per person, per year. Not for roads. Not for services. Just to keep the debt monster fed.

Meanwhile, Premier David Eby—well, he’s had months to plan for replacing the carbon tax, and guess what? Still no plan. Rustad told me he expected Eby to raise industrial taxes to make up the difference, but even that hasn’t happened yet. For now, the hole is just growing—a $2 billion loss in carbon tax revenue on top of an $11 billion deficit.

So What Does This Mean for the Average Mom?

In response to a direct question about what this credit downgrade means for a mother living on a fixed income, Opposition Leader John Rustad laid out the long-term consequences in no uncertain terms:

“The average person will not notice this immediately. But what it does mean is higher borrowing costs, So with the massive deficit and debt, more money will need to be spent on interest payments. By the end of this fiscal, before loss of billions in carbon tax revenue and before the debt downgrades, interest payments would increase to about $7 billion by the end of the fiscal plan. To put that in perspective, that would be the equivalent of 30% or more of personal income taxes just to pay interest.”

He continued:

“The debt downgrades mean the province will have to pay more in interest—likely 1/4 to 1/2% more. On $220+ billion, that could mean $1 billion more in interest. That could be about $200 per man, woman and child annually in more interest by 2027.”

And with no plan to rein in spending, Rustad issued a stark warning:

“The compounding problem is: will this mean service cuts, more taxes, or yet more debt to be paid by our children?”

Final Thoughts

So here’s a question no one on CBC is going to ask: What actually happens when a progressive government can’t manage a budget? I’ll tell you. You get poorer. That’s what happens. You, the person who gets up every day and works a real job, pays the price while the people in charge keep living large off your labour.

Let’s walk through it. First, you pay provincial income tax—a tax just for working. Imagine that. You go out, earn a living, and the government takes a cut just because you dared to be productive. Then there’s the PST—you buy something, anything, and you get taxed again. Why? Because you had the audacity to participate in the economy.

And then there’s the carbon tax, the holy grail of progressive grifts. This wasn’t about saving the planet—it was about propping up the very same government that couldn’t manage a piggy bank, let alone a provincial budget. That tax was floating David Eby’s spending addiction. Now it’s gone, and surprise—there’s no plan to replace it. Just more debt, more interest, and more economic chaos.

But wait—here’s the part that really insults your intelligence. After taxing you into the ground, they turn around and say, “Don’t worry, we’ll give you a rebate.” A rebate? You mean you’re going to give me back a tiny fraction of the money you stole from me and act like you’re doing me a favour? Please. That’s not generosity—it’s gaslighting. It’s economic abuse wrapped in a government cheque.

And that’s why I keep saying it: fiscal responsibility matters. Because I’d rather have that money in my wallet, feeding my kids, paying my bills, building my future—than watching David Eby burn it on pet projects, political theatre, and bloated bureaucracy.

But here’s the thing—there is hope. It’s not all doom and despair. In the last election, something incredible happened. The BC Conservatives, a party written off by the elites and ignored by the media, pulled off a political miracle. They surged from obscurity to contention—why? Because regular people are waking up. Because the voters who pay the bills, raise the kids, and still believe in common sense are done being treated like ATMs for a government that doesn’t even pretend to respect them.

And maybe—just maybe—after a little more pain, after a little more David Eby-style financial recklessness, the voters of this province will finally realize why fiscal responsibility matters. Not because it sounds good in a press release, but because without it, your future vanishes. Your freedom shrinks. And the people in charge? They just keep spending.

So next time, when the ballots are counted and the smoke clears, maybe British Columbia will finally remember who this province belongs to—not to bureaucrats, not to activists, not to the political class in Victoria—but to you.

And that day can’t come soon enough.

Subscribe to The Opposition with Dan Knight .

For the full experience, upgrade your subscription.

Business

‘TERMINATED’: Trump Ends Trade Talks With Canada Over Premier Ford’s Ronald Reagan Ad Against Tariffs

From the Daily Caller News Foundation

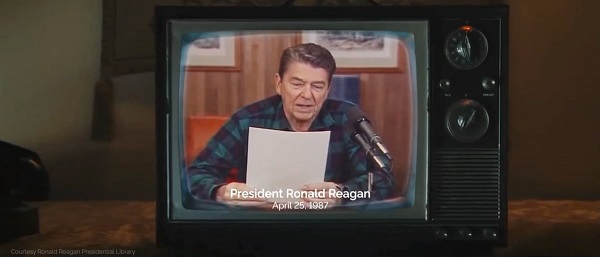

President Donald Trump announced late Thursday that trade negotiations with Canada “ARE HEREBY TERMINATED” after what he called “egregious behavior” tied to an Ontario TV ad that used former President Ronald Reagan’s voice to criticize tariffs.

The ad at the center of the feud was funded by Ontario Premier Doug Ford’s government as part of a multimillion-dollar campaign running on major U.S. networks. The spot features Reagan warning that tariffs may appear patriotic but ultimately “hurt every American worker and consumer.”

Dear Readers:

As a nonprofit, we are dependent on the generosity of our readers.

Please consider making a small donation of any amount here.

Thank you!

“They only did this to interfere with the decision of the U.S. Supreme Court, and other courts. TARIFFS ARE VERY IMPORTANT TO THE NATIONAL SECURITY, AND ECONOMY, OF THE U.S.A,” Trump wrote on his Truth Social platform late Thursday. “Based on their egregious behavior, ALL TRADE NEGOTIATIONS WITH CANADA ARE HEREBY TERMINATED.”

Ford first posted the ad online on Oct. 16, writing in a caption, “Using every tool we have, we’ll never stop making the case against American tariffs on Canada. The way to prosperity is by working together.”

The Ronald Reagan Presidential Foundation and Institute criticized the ad Thursday evening, saying it “misrepresents” Reagan’s 1987 radio address on free and fair trade. The foundation said Ontario did not request permission to use or alter the recording and that it is reviewing its legal options.

The president posted early Friday that Canada “cheated and got caught,” adding that Reagan actually “loved tariffs for our country.”

The ad splices audio from Reagan’s original remarks but includes his authentic statement: “When someone says, ‘let’s impose tariffs on foreign imports’, it looks like they’re doing the patriotic thing by protecting American products and jobs. And sometimes, for a short while it works, but only for a short time.”

Reagan also noted at the end of his remarks that, in “certain select cases,” he had taken steps to stop unfair trade practices against American products and added that the president’s “options” in trade matters should not be restricted, which the ad did not include.

Since returning to the White House, Trump has imposed tariffs on Canadian aluminum, steel, automobiles and lumber, arguing they are vital to protecting U.S. manufacturing and national security.

The Supreme Court is set to hear arguments in November over whether the administration overstepped its authority by invoking the International Emergency Economic Powers Act to impose reciprocal tariffs on dozens of nations, including Canada. Tariffs on commodities such as steel, aluminum and copper were implemented under Section 232 of the Trade Expansion Act and are not currently being challenged, as they align with longstanding precedent established by prior administrations.

Thursday’s move marks the second time this year Trump has canceled trade talks with Ottawa. In June, he briefly halted discussions after Canada imposed a digital services tax on American tech firms, though the Canadian government repealed the measure two days later.

Business

A Middle Finger to Carney’s Elbows Up

Elbows Up Stengthens U.S. Tariff Resolve at Canada’s Expense

The disastrously misguided “Elbows Up” campaign championed by the Carney government rooted in the fantasy that a smug, arrogant Liberal elite wields leverage over the largest economy in human history, has suffered yet another devastating blow. The latest fallout: U.S.-based truck manufacturer Paccar Inc., maker of iconic heavyweights such as Kenworth and Peterbilt, is slashing Canadian production and laying off hundreds of workers in anticipation of a 25-per-cent U.S. import tariff set to take effect next month.

Employees at Paccar’s Sainte-Thérèse, Quebec plant were informed Wednesday that the company will move production of trucks destined for the U.S. market back to its American facilities. According to Daniel Cloutier, Quebec director for Unifor, approximately 300 jobs will be eliminated, leaving roughly 500 workers at the plant.

Honking for Freedom Substack is a reader-supported publication.

To receive new posts and support my work, consider becoming a free or paid subscriber.

“They will continue building trucks for the Canadian market,” Cloutier said, noting that domestic demand represents a much smaller portion of output. At its peak, the plant produced 96 trucks per day; production will now drop to just 18 units daily. That is an 81% drop.

Paccar declined to confirm the restructuring or provide additional details. However, in a financial earnings call a day earlier, CEO Preston Feight described the U.S. tariff policy as advantageous for the company. “I think it helps Paccar significantly,” Feight said. “It gives us a competitive leg up from where we’ve been.”

U.S. Tariffs Driving Industry Shift

U.S. President Donald Trump has confirmed that all medium and heavy-duty trucks imported into the United States will face a 25-per-cent tariff beginning Nov. 1, along with an additional 10-per-cent duty on buses. The tariffs are being imposed under Section 232 of the Trade Expansion Act, which targets imports deemed to pose a national security risk.

These measures follow earlier tariffs that have already struck Canadian steel, aluminum, automobiles, copper, and lumber, forcing companies to shelve investments and reconsider their North American strategies.

Broader Auto Sector Retrenchment

Other automakers are also pulling back production in Canada. General Motors announced Tuesday it is ending production of the Chevrolet BrightDrop electric delivery van in Ingersoll, Ontario, costing over 1,100 workers their jobs. Stellantis recently confirmed plans to shift production of the Jeep Compass from Brampton, Ontario, to Belvidere, Illinois, as part of a strategy to increase U.S. output by 50 per cent by 2029.

Quebec Plant at Risk

The Sainte-Thérèse plant, which manufactures Class 5, 6 and 7 Kenworth and Peterbilt trucks, has already endured two rounds of layoffs over the past year as uncertainty around tariffs weakened demand. At peak production, the facility employed over 1,400 people.

Cloutier said the union is pressing both the Quebec and federal governments to prioritize the purchase of domestically made vehicles to sustain production levels. Without such measures, he warned, the plant could be forced to close due to high fixed costs and insufficient volume. “Let’s not pretend global trade hasn’t changed with this President,” Cloutier said. “We need to stop twiddling our thumbs.”

Bus Manufacturers Also Exposed

Quebec is also home to two major bus manufacturers, Prevost and Nova Bus, both owned by Volvo Group that could face similar challenges due to new tariffs on buses entering the U.S. Executives at both companies say they are still assessing the impact of the policy shift.

What can we learn from all this?

Perhaps our deep reliance on American innovation has consequences we have been unwilling to confront. The warning signs were evident well before Donald Trump’s election. He was explicit that tariffs would be used as a strategic tool to financially incentivize American companies to return to the United States. This was not hidden, it was a core pillar of his economic agenda.

I have said repeatedly on the Marc Patrone Show on Sauga 960 that my frustration is not with America’s strategy, but with Canada’s political class. Their smug arrogance lies in the belief that, as great as Canada can be, we could somehow dominate the greatest economy in the history of civilization rather than work with it. The Trump administration never wanted Canada to become the 51st state; they want our valuable resources and are willing to pay fair value for them, and they expect Canada to finally take our internal security threats seriously; something I have personally presented on in the United States. Yet instead of leveraging our strategic position, Canada’s leadership chose performative resistance over pragmatic partnership.

The most telling moment came when President Trump reportedly asked Justin Trudeau what would happen if the United States imposed a 25-per-cent tariff on all Canadian goods. Trudeau’s response, “It would destroy Canada” was an example of catastrophic stupidity. It handed Trump the gun he could use to execute Canada economically and perhaps cost Canada its sovereignty over the long term.

Reminiscent of the scene from The Hunt for Red October, when Captain Tupolev, in an act of smug Laurentian style arrogance, fires a torpedo at Ramius only for it to circle back and destroy his own submarine, a catastrophic miscalculation born of arrogance and a complete misunderstanding of the enemy’s capabilities. A catastrophic miscalculation that mirrors Elbows Up stupidity.

Order Now!

Honking For Freedom – The Trucker Convoy That Gave Us Hope HonkingForFreedom.com

Twitter | Locals | Rumble | Instagram

www.BenjaminjDichter.com

Audio

Freedom Coffee Podcast

Honking for Freedom Substack is a reader-supported publication.

To receive new posts and support my work, consider becoming a free or paid subscriber.

-

Agriculture1 day ago

Agriculture1 day agoFrom Underdog to Top Broodmare

-

City of Red Deer2 days ago

City of Red Deer2 days agoCindy Jefferies is Mayor. Tristin Brisbois, Cassandra Curtis, Jaelene Tweedle, and Adam Goodwin new Councillors – 2025 Red Deer General Election Results

-

Bruce Dowbiggin2 days ago

Bruce Dowbiggin2 days agoIs The Latest Tiger Woods’ Injury Also A Death Knell For PGA Champions Golf?

-

Alberta2 days ago

Alberta2 days agoAlberta’s licence plate vote is down to four

-

Health1 day ago

Health1 day agoSovereignty at Stake: Why Parliament Must Review Treaties Before They’re Signed

-

Censorship Industrial Complex2 days ago

Censorship Industrial Complex2 days agoCanada’s justice minister confirms ‘hate crimes’ bill applies to online content

-

Business1 day ago

Business1 day ago$15B and No Guarantees? Stellantis Deal explained by former Conservative Shadow Minister of Innovation, Science and Technology

-

RCMP1 day ago

RCMP1 day agoPolice arrest thieves using garage-door openers to access homes in Vanier, West Park, Anders Park, and Evergreen