Alberta

Alberta Institute – Provincial Election Roundup – Day 1

Submitted by Alberta Institute

Campaign Roundup – Day 1:

- The writs for the Alberta 2023 election were issued today, meaning the election campaign has officially begun.

- The UCP kicked off their campaign with a big tax policy announcement, promising to lower taxes for every Albertan. Danielle Smith announced that, if reelected, the UCP would create a new 8% tax bracket, meaning that Albertans would only be taxed at 8% instead of 10% on the first $60,000 of their income. This would be a substantial saving for every Albertan, capped at a maximum of roughly $760 per year for those earning over $60,000.

- The UCP also promised to index all tax thresholds for inflation and extend the Fuel Tax Holiday until December 31st, 2023, saving Albertans 13 cents per litre at the pump, approximately equivalent to the cost of the federal government’s carbon tax.

- The NDP, by contrast, kicked off their campaign with a rally instead of a policy announcement. Rachel Notley didn’t commit to any specific action or platform item today, but promised to focus on what she believes to be Albertans’ priorities – health care, education, affordability, and job creation.

- In a piece in The Hub, economist Trevor Tombe made the case that the election could be very tight. He argued that based on his projections, just a few hundred votes in a handful of ridings could be all it would take to change the outcome of the entire election.

- Former Calgary Councillor, Jeromy Farkas, made the opposite argument on Real Talk with Ryan Jesperson, noting that based on his experience talking to Calgarians on the ground, he’s feeling things swing more back towards the UCP, with Danielle Smith dominating the airwaves, ensuring the media and public are talking about the issues she wants to be talking about, and quickly retaking control of the narrative when distractions come up.

- Finally, if you don’t know who your local candidates are yet, there’s now a handy searchable database online with an interactive map. If you don’t know which riding you’re in yet, head to the Elections Alberta’s website to figure that out first.

Support Our Work:

The Alberta Institute doesn’t accept any government funding and never will. We think you should be free to choose, for yourself, which organizations to support. If you’re in a position to contribute financially, you can make a donation here:

If you’re not in a position to donate, we understand, but if you appreciate our work, you can help by spreading our message. Please forward this email to your friends, follow us on Facebook and Twitter, and help make sure every Albertan knows what’s going on in our province.

Alberta

Canada’s heavy oil finds new fans as global demand rises

From the Canadian Energy Centre

By Will Gibson

“The refining industry wants heavy oil. We are actually in a shortage of heavy oil globally right now, and you can see that in the prices”

Once priced at a steep discount to its lighter, sweeter counterparts, Canadian oil has earned growing admiration—and market share—among new customers in Asia.

Canada’s oil exports are primarily “heavy” oil from the Alberta oil sands, compared to oil from more conventional “light” plays like the Permian Basin in the U.S.

One way to think of it is that heavy oil is thick and does not flow easily, while light oil is thin and flows freely, like fudge compared to apple juice.

“The refining industry wants heavy oil. We are actually in a shortage of heavy oil globally right now, and you can see that in the prices,” said Susan Bell, senior vice-president of downstream research with Rystad Energy.

A narrowing price gap

Alberta’s heavy oil producers generally receive a lower price than light oil producers, partly a result of different crude quality but mainly because of the cost of transportation, according to S&P Global.

The “differential” between Western Canadian Select (WCS) and West Texas Intermediate (WTI) blew out to nearly US$50 per barrel in 2018 because of pipeline bottlenecks, forcing Alberta to step in and cut production.

So far this year, the differential has narrowed to as little as US$10 per barrel, averaging around US$12, according to GLJ Petroleum Consultants.

“The differential between WCS and WTI is the narrowest I’ve seen in three decades working in the industry,” Bell said.

Trans Mountain Expansion opens the door to Asia

Oil tanker docked at the Westridge Marine Terminal in Burnaby, B.C. Photo courtesy Trans Mountain Corporation

The price boost is thanks to the Trans Mountain expansion, which opened a new gateway to Asia in May 2024 by nearly tripling the pipeline’s capacity.

This helps fill the supply void left by other major regions that export heavy oil – Venezuela and Mexico – where production is declining or unsteady.

Canadian oil exports outside the United States reached a record 525,000 barrels per day in July 2025, the latest month of data available from the Canada Energy Regulator.

China leads Asian buyers since the expansion went into service, along with Japan, Brunei and Singapore, Bloomberg reports.

Asian refineries see opportunity in heavy oil

“What we are seeing now is a lot of refineries in the Asian market have been exposed long enough to WCS and now are comfortable with taking on regular shipments,” Bell said.

Kevin Birn, chief analyst for Canadian oil markets at S&P Global, said rising demand for heavier crude in Asia comes from refineries expanding capacity to process it and capture more value from lower-cost feedstocks.

“They’ve invested in capital improvements on the front end to convert heavier oils into more valuable refined products,” said Birn, who also heads S&P’s Center of Emissions Excellence.

Refiners in the U.S. Gulf Coast and Midwest made similar investments over the past 40 years to capitalize on supply from Latin America and the oil sands, he said.

While oil sands output has grown, supplies from Latin America have declined.

Mexico’s state oil company, Pemex, reports it produced roughly 1.6 million barrels per day in the second quarter of 2025, a steep drop from 2.3 million in 2015 and 2.6 million in 2010.

Meanwhile, Venezuela’s oil production, which was nearly 2.9 million barrels per day in 2010, was just 965,000 barrels per day this September, according to OPEC.

The case for more Canadian pipelines

Worker at an oil sands SAGD processing facility in northern Alberta. Photo courtesy Strathcona Resources

“The growth in heavy demand, and decline of other sources of heavy supply has contributed to a tighter market for heavy oil and narrower spreads,” Birn said.

Even the International Energy Agency, known for its bearish projections of future oil demand, sees rising global use of extra-heavy oil through 2050.

The chief impediments to Canada building new pipelines to meet the demand are political rather than market-based, said both Bell and Birn.

“There is absolutely a business case for a second pipeline to tidewater,” Bell said.

“The challenge is other hurdles limiting the growth in the industry, including legislation such as the tanker ban or the oil and gas emissions cap.”

A strategic choice for Canada

Because Alberta’s oil sands will continue a steady, reliable and low-cost supply of heavy oil into the future, Birn said policymakers and Canadians have options.

“Canada needs to ask itself whether to continue to expand pipeline capacity south to the United States or to access global markets itself, which would bring more competition for its products.”

Alberta

From Underdog to Top Broodmare

WATCH From Underdog to Top Broodmare (video)

Executive Producers Jeff Robillard (Horse Racing Alberta) and Mike Little (Shinelight Entertainment)

What began as an underdog story became a legacy of excellence. Crackers Hot Shot didn’t just race — she paved the way for future generations, and in doing so became one of the most influential producers the province has known.

The extraordinary journey of Crackers Hot Shot — once overlooked, now revered — stands as one of Alberta’s finest success stories in harness racing and breeding.

Born in humble circumstances and initially considered rough around the edges, Crackers Hot Shot overcame long odds to carve out a career that would forever impact the province’s racing industry. From a “wild, unhandled filly” to Alberta’s “Horse of the Year” in 2013, to producing foals who carry her spirit and fortitude into future generations.

Her influence ripples through Alberta’s racing and breeding landscape: from how young stock are prepared, to the aspirations of local breeders who now look to “the mare that did it” as proof that world-class talent can emerge from Alberta’s paddocks.

“Crackers Hot Shot, she had a tough start. She wasn’t much to look at when we first got her” — Rod Starkewski

“Crackers Hot Shot was left on her own – Carl Archibald heard us talking, he said ‘I’ll go get her – I live by there’. I think it took him 3 days to dig her out of the snow. She was completely wild – then we just started working on her. She really needed some humans to work with her – and get to know that people are not scary.” — Jackie Starkewski

“Crackers Hot Shot would be one of the top broodmares in Albeta percentage wise if nothing else. Her foals hit the track – they’re looking for the winners circle every time.” — Connie Kolthammer

Visit thehorses.com to learn more about Alberta’s Horse Racing industry.

-

Business2 days ago

Business2 days agoTrans Mountain executive says it’s time to fix the system, expand access, and think like a nation builder

-

International2 days ago

International2 days agoBiden’s Autopen Orders declared “null and void”

-

MAiD2 days ago

MAiD2 days agoStudy promotes liver transplants from Canadian euthanasia victims

-

Business2 days ago

Business2 days agoCanada’s combative trade tactics are backfiring

-

Business2 days ago

Business2 days agoCanada has given $109 million to Communist China for ‘sustainable development’ since 2015

-

Business2 days ago

Business2 days agoYou Won’t Believe What Canada’s Embassy in Brazil Has Been Up To

-

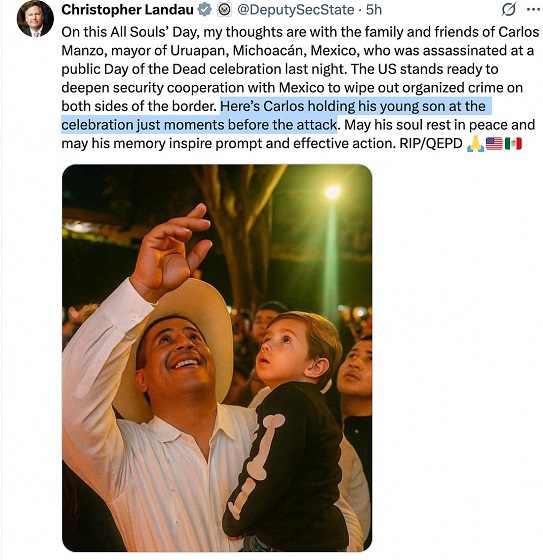

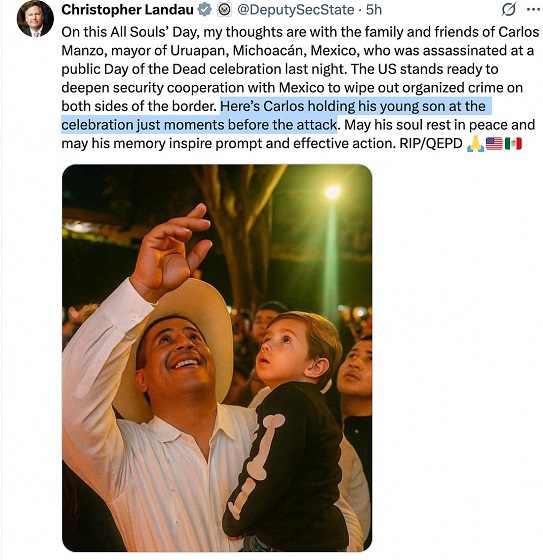

Crime1 day ago

Crime1 day agoPublic Execution of Anti-Cartel Mayor in Michoacán Prompts U.S. Offer to Intervene Against Cartels

-

Automotive2 days ago

Automotive2 days agoCarney’s Budget Risks Another Costly EV Bet