Alberta

Alberta COVID-19 update: Fines. Forming an ‘Isolated Group’ with a second household. Financial relief.

Update 12: COVID-19 pandemic in Alberta (March 25)

Sixty-one additional cases of COVID-19 have been confirmed, bringing the total number of cases in the province to 419.

Aggressive public health measures continue to help limit the spread of COVID-19.

Latest updates

- Cases have been identified in all zones across the province:

- 250 cases in the Calgary zone

- 100 cases in the Edmonton zone

- 23 cases in the North zone

- 35 cases in the Central zone

- 10 cases in the South zone

- One case where the zone is still under investigation

- Of these cases, 20 are currently hospitalized of which eight have been admitted to intensive care units (ICU).

- In total, 24 people have been hospitalized and two patients have died.

- Up to 33 of the 419 cases may be due to community transmission.

- A COVID-19 outbreak was confirmed March 24 at the Nelson Home, a Calgary group home for persons with developmental disabilities. A caseworker and two residents have tested positive for COVID-19 and two other residents are symptomatic. All individuals are self-isolating.

- To date, nine cases have been identified in continuing care facilities, including one case in Rosedale on the Park and two at Shepherd’s Care Kensington Campus, both in the Edmonton zone.

- The number of confirmed recovered cases remains at three. A longer-term process for determining timely reporting of recovered cases is underway.

- Aggregate data, showing cases by age range and zone, as well as by local geographical areas, is available online at alberta.ca/covid19statistics.

- All Albertans need to work together to help prevent the spread and overcome COVID-19.

Enforcement of public health orders

Public health orders will now be enforced by law to protect the health and safety of Albertans. Fines for violating an order have increased to a prescribed fine of $1,000 per occurrence. Courts will also have increased powers to administer fines of up to $100,000 for a first offence and up to $500,000 for a subsequent offence for more serious violations. These new fines will be in force over the coming days.

- Public health orders will include mandatory self-isolation for travellers returning from outside of Canada for 14 days, plus an additional 10 days from the onset of any symptoms should they occur, whichever is longer.

- This legal requirement also applies to close contacts of confirmed COVID-19 cases, as well as to any individual with COVID-19 symptoms, which consist of a cough, fever, shortness of breath, runny nose, or sore throat.

- Orders regarding restrictions around mass gatherings, public recreational facilities, private entertainment facilities, and visitations to long-term care and other continuing care facilities are also enforceable, along with any future public health orders.

Emergency isolation supports

Emergency isolation supports are now available for Albertans who are self-isolating or who are the sole caregivers for someone in self-isolation, and have no other source of income. Applicants can view eligibility criteria and apply at alberta.ca.

Community and social services

Funding criteria and forms for the emergency funding to charities, non-profits and civil society organizations are now posted online.

The Emergency Financial Assistance web page now includes information on the federal and provincial supports/programs and a link to the COVID-19 page for more information.

Community and Social Services has suspended in-person service delivery in its program offices and Alberta Supports Centres. Albertans should contact 1-877-644-9992 for more information.

Offers of help

The Alberta Emergency Management Agency Unsolicited Offers Program has been set up in response to growing offers of generosity from individuals and organizations to help with the challenges many Albertans are facing due to the COVID-19 pandemic. Those wanting to help can go to alberta.ca/COVID19offersprogram for more information.

Quick facts

- The most important measures that Albertans can take to prevent respiratory illnesses, including COVID-19, is to practise good hygiene.

- This includes cleaning your hands regularly for at least 20 seconds, avoiding touching your face, coughing or sneezing into your elbow or sleeve, disposing of tissues appropriately, and staying home and away from others if you are sick.

- Anyone who has health concerns or is experiencing symptoms of COVID-19 should complete an online COVID-19 self-assessment.

- For recommendations on protecting yourself and your community, visit alberta.ca/COVID19.

Alberta

Alberta bill would protect freedom of expression for doctors, nurses, other professionals

From LifeSiteNews

‘Peterson’s law,’ named for Canadian psychologist Jordan Peterson, was introduced by Alberta Premier Danielle Smith.

Alberta’s Conservative government introduced a new law that will set “clear expectations” for professional regulatory bodies to respect freedom of speech on social media and online for doctors, nurses, engineers, and other professionals.

The new law, named “Peterson’s law” after Canadian psychologist Jordan Peterson, who was canceled by his regulatory body, was introduced Thursday by Alberta Premier Danielle Smith.

“Professionals should never fear losing their license or career because of a social media post, an interview, or a personal opinion expressed on their own time,” Smith said in a press release sent to media and LifeSiteNews.

“Alberta’s government is restoring fairness and neutrality so regulators focus on competence and ethics, not policing beliefs. Every Albertan has the right to speak freely without ideological enforcement or intimidation, and this legislation makes that protection real.”

The law, known as Bill 13, the Regulated Professions Neutrality Act, will “set clear expectations for professional regulatory bodies to ensure professionals’ right to free expression is protected.”

According to the government, the new law will “Limit professional regulatory bodies from disciplining professionals for expressive off-duty conduct, except in specific circumstances such as threats of physical violence or a criminal conviction.”

It will also restrict mandatory training “unrelated to competence or ethics, such as diversity, equity, and inclusion training.”

Bill 13, once it becomes law, which is all but guaranteed as Smith’s United Conservative Party (UCP) holds a majority, will also “create principles of neutrality that prohibit professional regulatory bodies from assigning value, blame or different treatment to individuals based on personally held views or political beliefs.”

As reported by LifeSiteNews, Peterson has been embattled with the College of Psychologists of Ontario (CPO) after it mandated he undergo social media “training” to keep his license following posts he made on X, formerly Twitter, criticizing Trudeau and LGBT activists.

He recently noted how the CPO offered him a deal to “be bought,” in which the legal fees owed to them after losing his court challenge could be waived but only if he agreed to quit his job as a psychologist.

Early this year, LifeSiteNews reported that the CPO had selected Peterson’s “re-education coach” for having publicly opposed the LGBT agenda.

The Alberta government directly referenced Peterson’s (who is from Alberta originally) plight with the CPO, noting “the disciplinary proceedings against Dr. Jordan Peterson by the College of Psychologists of Ontario, demonstrate how regulatory bodies can extend their reach into personal expression rather than professional competence.”

“Similar cases involving nurses, engineers and other professionals revealed a growing pattern: individuals facing investigations, penalties or compulsory ideological training for off-duty expressive conduct. These incidents became a catalyst, confirming the need for clear legislative boundaries that protect free expression while preserving professional standards.”

Alberta Minister of Justice and Attorney General Mickey Amery said regarding Bill 13 that the new law makes that protection of professionals “real and holds professional regulatory bodies to a clear standard.”

Last year, Peterson formally announced his departure from Canada in favor of moving to the United States, saying his birth nation has become a “totalitarian hell hole.”

Alberta

‘Weird and wonderful’ wells are boosting oil production in Alberta and Saskatchewan

From the Canadian Energy Centre

Multilateral designs lift more energy with a smaller environmental footprint

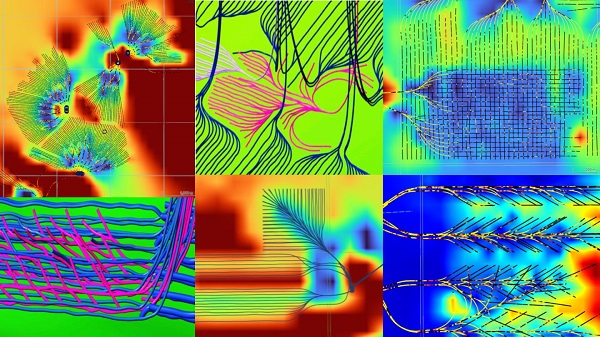

A “weird and wonderful” drilling innovation in Alberta is helping producers tap more oil and gas at lower cost and with less environmental impact.

With names like fishbone, fan, comb-over and stingray, “multilateral” wells turn a single wellbore from the surface into multiple horizontal legs underground.

“They do look spectacular, and they are making quite a bit of money for small companies, so there’s a lot of interest from investors,” said Calin Dragoie, vice-president of geoscience with Calgary-based Chinook Consulting Services.

Dragoie, who has extensively studied the use of multilateral wells, said the technology takes horizontal drilling — which itself revolutionized oil and gas production — to the next level.

“It’s something that was not invented in Canada, but was perfected here. And it’s something that I think in the next few years will be exported as a technology to other parts of the world,” he said.

Dragoie’s research found that in 2015 less than 10 per cent of metres drilled in Western Canada came from multilateral wells. By last year, that share had climbed to nearly 60 per cent.

Royalty incentives in Alberta have accelerated the trend, and Saskatchewan has introduced similar policy.

Multilaterals first emerged alongside horizontal drilling in the late 1990s and early 2000s, Dragoie said. But today’s multilaterals are longer, more complex and more productive.

The main play is in Alberta’s Marten Hills region, where producers are using multilaterals to produce shallow heavy oil.

Today’s average multilateral has about 7.5 horizontal legs from a single surface location, up from four or six just a few years ago, Dragoie said.

One record-setting well in Alberta drilled by Tamarack Valley Energy in 2023 features 11 legs stretching two miles each, for a total subsurface reach of 33 kilometres — the longest well in Canada.

By accessing large volumes of oil and gas from a single surface pad, multilaterals reduce land impact by a factor of five to ten compared to conventional wells, he said.

The designs save money by skipping casing strings and cement in each leg, and production is amplified as a result of increased reservoir contact.

Here are examples of multilateral well design. Images courtesy Chinook Consulting Services.

Parallel

Fishbone

Fan

Waffle

Stingray

Frankenwells

-

Health2 days ago

Health2 days agoCDC’s Autism Reversal: Inside the Collapse of a 25‑Year Public Health Narrative

-

Crime2 days ago

Crime2 days agoCocaine, Manhunts, and Murder: Canadian Cartel Kingpin Prosecuted In US

-

Health2 days ago

Health2 days agoBREAKING: CDC quietly rewrites its vaccine–autism guidance

-

National2 days ago

National2 days agoPsyop-Style Campaign That Delivered Mark Carney’s Win May Extend Into Floor-Crossing Gambits and Shape China–Canada–US–Mexico Relations

-

Energy2 days ago

Energy2 days agoHere’s what they don’t tell you about BC’s tanker ban

-

Bruce Dowbiggin2 days ago

Bruce Dowbiggin2 days agoBurying Poilievre Is Job One In Carney’s Ottawa

-

Daily Caller2 days ago

Daily Caller2 days agoBREAKING: Globalist Climate Conference Bursts Into Flames

-

Great Reset1 day ago

Great Reset1 day agoEXCLUSIVE: A Provincial RCMP Veterans’ Association IS TARGETING VETERANS with Euthanasia