Energy

A picture is worth a thousand spreadsheets

From Resource Works

What if the secret to understanding Canada’s energy future lies not in spreadsheets but in storytelling?

When I think about who has done the most to make sense of Canada’s energy story — not just in charts and forecasts but in human terms — Peter Tertzakian sits near the top of that list. He’s an energy economist, author, and communicator who has spent decades helping Canadians understand the world beneath their light switches and fuel gauges — and why prosperity, energy, and responsible development are inseparable.

Peter is the founder and CEO of Studio.Energy. He is also widely known as the founder of the ARC Energy Research Institute and co-host of the ARC Energy Ideas podcast, alongside Jackie Forrest. Week after week, they unpack what’s happening in the markets, in technology, and in policy, always with the rare gift of clarity. He’s also the author of two influential books, A Thousand Barrels a Second and The End of Energy Obesity, both written long before “energy transition” became a household term.

When we sat down for our Power Struggle conversation, I mentioned how remarkable it is that someone with Peter’s credentials — an economist, investor, and advisor to industry — is also an exhibiting artist whose photography can regularly be found in a gallery in the Canadian Rockies. That’s when he smiled and said what has become one of his signature lines: “I’ve always said a picture is worth a thousand spreadsheets.”

What followed was a fascinating discussion about how visual storytelling can bridge the gap between data and understanding. Peter explained that what began as a hobby has evolved into a personal quest to communicate complex energy subjects more effectively. His photographs, which range from industrial scenes to landscapes shaped by human activity, help connect the emotional and analytical sides of the energy story. The pictures, he said, reveal the same truths that his spreadsheets do — only in a way that more people can feel.

That resonates deeply with what we do at Resource Works — translating complexity into clarity so that Canadians can see how responsible resource development strengthens communities, funds public services, and opens doors for Indigenous partnerships. Like Peter, we believe that understanding energy isn’t about choosing sides; it’s about understanding systems, trade-offs, and the people behind the numbers.

Peter’s concern — and one I share — is how difficult it has become to find truth amid the noise. “People are bombarded by noise, especially today. And not all of that noise is true,” he said. “The challenge now is extracting the signal.” Whether you’re a policymaker, a corporate leader, or just someone trying to make sense of global change, Peter’s approach is to step away from confrontation and toward comprehension. His ability to blend visuals, narrative, and numbers makes complicated issues accessible without oversimplifying them.

Prosperity, Not Population, Drives Energy Demand

Our conversation also turned to the forces shaping global energy demand. Peter reminded me that the biggest driver isn’t population growth — it’s prosperity. “When a person moves from a rural setting to a city, their energy consumption goes up twentyfold, sometimes more,” he said. The story of urbanization, particularly in China, explains much of the past few decades of energy growth. Renewables have slowed that curve, but as Peter points out, “our use of fossil fuels is still growing.”

What I most admire about Peter is that he doesn’t preach. “I don’t have all the answers,” he told me. “My role is to discuss treatment options — not to perform the surgery.” It’s a refreshingly honest stance in a world where too many experts claim certainty.

On Power Struggle, Peter Tertzakian reminded me why he’s so respected across the energy world: he brings intelligence without ego, curiosity without ideology, and a deep respect for the audience’s ability to think. His work reminds us that Canada’s resource story — when told with honesty and creativity — is one of innovation, community, and shared prosperity. And that storytelling — visual, verbal, and numerical — remains our most powerful tool for navigating change.

- Power Struggle audio and transcript

- Peter Tertzakian in Arc Energy Research Institute podcasts

- Peter Tertzakian on X

- Peter Tertzakian on LinkedIn

- Stewart Muir on X

- Stewart Muir on LinkedIn

Power Struggle on social media

Alberta

Federal budget: It’s not easy being green

From Resource Works

Canada’s climate rethink signals shift from green idealism to pragmatic prosperity.

Bill Gates raised some eyebrows last week – and probably the blood pressure of climate activists – when he published a memo calling for a “strategic pivot” on climate change.

In his memo, the Microsoft founder, whose philanthropy and impact investments have focused heavily on fighting climate change, argues that, while global warming is still a long-term threat to humanity, it’s not the only one.

There are other, more urgent challenges, like poverty and disease, that also need attention, he argues, and that the solution to climate change is technology and innovation, not unaffordable and unachievable near-term net zero policies.

“Unfortunately, the doomsday outlook is causing much of the climate community to focus too much on near-term emissions goals, and it’s diverting resources from the most effective things we should be doing to improve life in a warming world,” he writes.

Gates’ memo is timely, given that world leaders are currently gathered in Brazil for the COP30 climate summit. Canada may not be the only country reconsidering things like energy policy and near-term net zero targets, if only because they are unrealistic and unaffordable.

It could give some cover for Canadian COP30 delegates, who will be at Brazil summit at a time when Prime Minister Mark Carney is renegotiating his predecessor’s platinum climate action plan for a silver one – a plan that contains fewer carbon taxes and more fossil fuels.

It is telling that Carney is not at COP30 this week, but rather holding a summit with Alberta Premier Danielle Smith.

The federal budget handed down last week contains kernels of the Carney government’s new Climate Competitiveness Strategy. It places greater emphasis on industrial strategy, investment, energy and resource development, including critical minerals mining and LNG.

Despite his Davos credentials, Carney is clearly alive to the fact it’s a different ballgame now. Canada cannot afford a hyper-focus on net zero and the green economy. It’s going to need some high octane fuel – oil, natural gas and mining – to prime Canada’s stuttering economic engine.

The prosperity promised from the green economy has not quite lived up to its billing, as a recent Fraser Institute study reveals.

Spending and tax incentives totaling $150 billion over a decade by Ottawa, B.C, Ontario, Alberta and Quebec created a meagre 68,000 jobs, the report found.

“It’s simply not big enough to make a huge difference to the overall performance of the economy,” said Jock Finlayson, chief economist for the Independent Contractors and Business Association and co-author of the report.

“If they want to turn around what I would describe as a moribund Canadian economy…they’re not going to be successful if they focus on these clean, green industries because they’re just not big enough.”

There are tentative moves in the federal budget and Climate Competitiveness Strategy to recalibrate Canada’s climate action policies, though the strategy is still very much in draft form.

Carney’s budget acknowledges that the world has changed, thanks to deglobalization and trade strife with the U.S.

“Industrial policy, once seen as secondary to market forces, is returning to the forefront,” the budget states.

Last week’s budget signals a shift from regulations towards more investment-based measures.

These measures aim to “catalyse” $500 billion in investment over five years through “strengthened industrial carbon pricing, a streamlined regulatory environment and aggressive tax incentives.”

There is, as-yet, no commitment to improve the investment landscape for Alberta’s oil industry with the three reforms that Alberta has called for: scrapping Bill C-69, a looming oil and gas emissions cap and a West Coast oil tanker moratorium, which is needed if Alberta is to get a new oil pipeline to the West Coast.

“I do think, if the Carney government is serious about Canada’s role, potentially, as an global energy superpower, and trying to increase our exports of all types of energy to offshore markets, they’re going to have to revisit those three policy files,” Finlayson said.

Heather Exner-Pirot, director of energy, natural resources and environment at the Macdonald-Laurier Institute, said she thinks the emissions cap at least will be scrapped.

“The markets don’t lie,” she said, pointing to a post-budget boost to major Canadian energy stocks. “The energy index got a boost. The markets liked it. I don’t think the markets think there is going to be an emissions cap.”

Some key measures in the budget for unlocking investments in energy, mining and decarbonization include:

- incentives to leverage $1 trillion in investment over the next five years in nuclear and wind power, energy storage and grid infrastructure;

- an expansion of critical minerals eligible for a 30% clean technology manufacturing investment tax credit;

- $2 billion over five years to accelerate critical mineral production;

- tax credits for turquoise hydrogen (i.e. hydrogen made from natural gas through methane pyrolysis); and

- an extension of an investment tax credit for carbon capture utilization and storage through to 2035.

As for carbon taxes, the budget promises “strengthened industrial carbon pricing.”

This might suggest the government’s plan is to simply simply shift the burden for carbon pricing from the consumer entirely onto industry. If that’s the case, it could put Canadian resource industries at a disadvantage.

“How do we keep pushing up the carbon price — which means the price of energy — for these industries at a time when the United States has no carbon pricing at all?” Finlayson wonders.

Overall, Carney does seem to be moving in the right direction in terms of realigning Canada’s energy and climate policies.

“I think this version of a Liberal government is going to be more focused on investment and competitiveness and less focused around the virtue-signaling on climate change, even though Carney personally has a reputation as somebody who cares a lot about climate change,” Finlayson said.

“It’s an awkward dance for them. I think they are trying to set out a different direction relative to the Trudeau years, but they’re still trying to hold on to the Trudeau climate narrative.”

Pictured is Mark Carney at COP26 as UN Special Envoy on Climate Action and Finance. He is not at COP30 this week. UNRIC/Miranda Alexander-Webber

Resource Works News

Energy

Canada’s oilpatch shows strength amid global oil shakeup

This article supplied by Troy Media.

Global oil markets are stumbling under too much supply and too little demand but Canada’s energy sector is managing to hold its own

Oil prices are sliding under the weight of global oversupply and weakening demand, but Canada’s oilpatch is holding steady—perhaps even thriving—as others flounder.

Crude is piling up in tankers, major producers are flooding the system, and demand is fading fast. According to a Windward report cited by Oilprice.com, the amount of oil held in floating storage—tankers sitting offshore waiting for buyers —has hit record highs. Sanctions on Russian and Iranian crude have sidelined entire fleets. Meanwhile, Middle East cargoes continue to pour in, keeping global supply bloated.

Gunvor CEO Torbjorn Tornqvist called the scale “unprecedented,” warning the market would be flooded overnight if sanctions against Russian and Iran were lifted.

And there’s more coming. U.S. crude production has hit a new record of 13.8 million barrels per day in August. And China’s Changqing oilfield just surpassed 20 million tonnes in cumulative output, and national totals have topped 400 million tonnes of oil equivalent this year. More barrels. More pressure. Less price support.

At the same time, demand is slipping. U.S. gasoline use is down. Global shipping activity has slowed. JPMorgan just trimmed its 2025 oil demand forecast by 300,000 barrels per day. China’s manufacturing sector shrank for the seventh month in a row.

Japan’s purchasing index dropped to an 18-month low. And recession fears are back in the headlines.

OPEC+ tried to calm the chaos by announcing a modest increase in output this December, with a pause on future hikes. But the move didn’t move markets. Then Saudi Arabia cut its selling prices to Asia, a clear signal that the kingdom sees weak demand ahead.

In short, it’s messy out there. But not everywhere.

Amid this global downturn, Canada’s energy sector stands out for one rare quality: resilience. While other producers are scaling back or scrambling to adapt, Canada’s oilpatch is quietly outperforming.

A recent CBC News report highlighted the sector’s staying power and why it’s better positioned than its U.S. counterparts. “The companies that have survived here are the companies that have been able to adapt,” said Patrick O’Rourke, managing director at ATB Capital Markets. “It’s effectively Darwinism.”

It’s also smart design. Canada’s oilsands—primarily in Alberta—are expensive to build but cheap to run. Once the upfront costs are covered, producers can keep pumping for decades with relatively low reinvestment. That means even in a

downturn, output stays strong.

Dane Gregoris of Enverus says Canada’s conventional sector is holding up better than the U.S. shale patch. Why? Canadian oil producers operate more efficiently, with fewer legal and logistical barriers tied to land access and ownership than their U.S. shale counterparts. They also benefit from lower operating costs and are less dependent on relentless drilling just to maintain output.

And now, they finally have a way to get more oil out.

The long-delayed Trans Mountain pipeline expansion is finally complete. It delivers Alberta crude to B.C.’s tidewater and, from there, to Asian markets. That access, once a significant limitation for Canadian producers, is now a strategic advantage. It’s already helping offset lower global prices.

Canada’s energy sector also benefits from long-life assets, slow decline rates and political stability. We have a reputation for responsible regulation, but that same system can slow development and limit how quickly we respond to shifting global demand. We can offer a stable, secure supply but only if infrastructure and regulatory hurdles don’t block access to it.

And for Canadians, that matters. Oil prices don’t just fuel industry headlines; they shape provincial and national budgets, drive investment and underpin jobs across the country. Most producers around the world are bracing for pain but Canada may be bracing for opportunity to expand its presence in Asian markets, secure long-term export contracts and position itself as a reliable supplier in a turbulent global landscape.

None of this means Canada is immune. If demand collapses or sanctions lift, prices could sink further. But in a volatile global landscape, Canada isn’t scrambling—it’s competing.

While others slash forecasts, shut wells or hope for an OPEC rescue, Canada’s energy producers are doing something rare in today’s oil market: holding the line.

Toronto-based Rashid Husain Syed is a highly regarded analyst specializing in energy and politics, particularly in the Middle East. In addition to his contributions to local and international newspapers, Rashid frequently lends his expertise as a speaker at global conferences. Organizations such as the Department of Energy in Washington and the International Energy Agency in Paris have sought his insights on global energy matters.

Troy Media empowers Canadian community news outlets by providing independent, insightful analysis and commentary. Our mission is to support local media in helping Canadians stay informed and engaged by delivering reliable content that strengthens community connections and deepens understanding across the country

-

Frontier Centre for Public Policy2 days ago

Frontier Centre for Public Policy2 days agoRichmond Mayor Warns Property Owners That The Cowichan Case Puts Their Titles At Risk

-

COVID-191 day ago

COVID-191 day agoMajor new studies link COVID shots to kidney disease, respiratory problems

-

Business2 days ago

Business2 days agoSluggish homebuilding will have far-reaching effects on Canada’s economy

-

Business2 days ago

Business2 days agoMark Carney Seeks to Replace Fiscal Watchdog with Loyal Lapdog

-

Business2 days ago

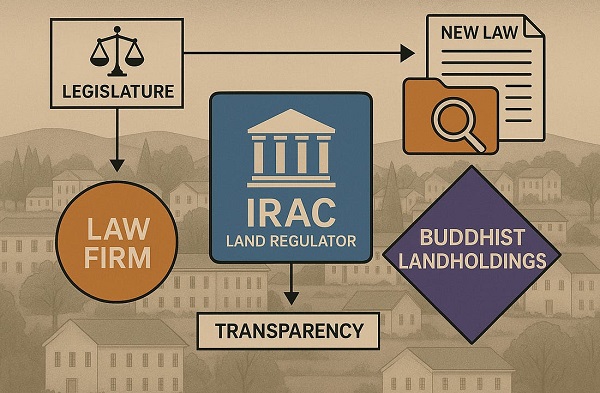

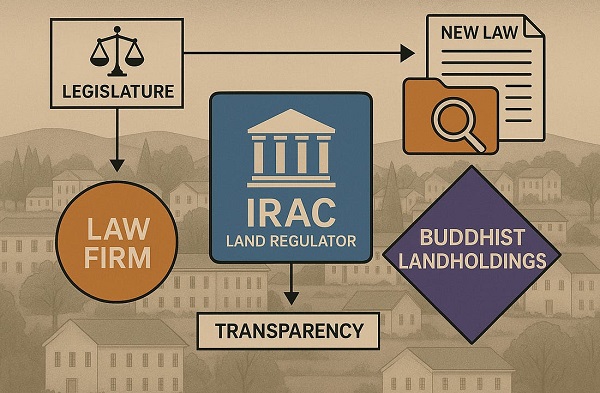

Business2 days agoP.E.I. Moves to Open IRAC Files, Forcing Land Regulator to Publish Reports After The Bureau’s Investigation

-

Energy2 days ago

Energy2 days agoCanada’s oilpatch shows strength amid global oil shakeup

-

International1 day ago

International1 day agoBondi and Patel deliver explosive “Clinton Corruption Files” to Congress

-

International1 day ago

International1 day agoState Department designates European Antifa groups foreign terror organizations