Alberta

Investigation continues into CPS officer-involved shooting causing death

On Feb. 19, the Alberta Serious Incident Response Team (ASIRT) was directed to investigate the death of a 41-year-old man after an encounter with Calgary Police Service (CPS) officers earlier that day.

At around 3:41 p.m., CPS received 911 calls about a man on 17 Avenue S.E. near 44 Street who was holding a stick and a knife. One caller reported that the man had hit someone with the stick.

At 3:46 p.m., the first officers arrived on scene and located the man, who was still holding the stick and the knife. More officers arrived and surrounded the man from a distance. Video of the incident shows that the man was sitting down on the sidewalk while officers spoke to him. Officers can be heard on the video repeatedly telling the man to drop the knife or throw the knife away.

Video shows that the man started to get up and move at 4:02 p.m. An officer then discharged less-lethal baton rounds at him. The man stood up and began to run in the direction of a group of police officers and police vehicles. A police service dog on a lead was allowed to approach the man as he approached the front of the police vehicles. Video shows that the dog’s handler pulled the dog back, upon which the man advanced in the direction of the dog and the handler. In the ensuing altercation, the man swung the stick and stabbed the knife at the dog while the dog bit the man and officers used conductive energy weapons on him.

Now at the back of the police vehicle and still holding the knife and stick, police officers were near him on many sides. A confrontation occurred between the man and the officers, during which two officers discharged their firearms. The man fell to the ground. Officers approached the man and moved the knife and stick away from him.

Emergency medical services, which had been waiting nearby, and CPS officers provided medical care to the man at the scene. Their efforts were unsuccessful and the man was pronounced dead.

ASIRT’s investigation will examine the circumstances surrounding the use of force. No additional information will be released.

As part of its ongoing investigation, ASIRT is continuing efforts to identify people who may have witnessed aspects of the confrontation between the man and police. ASIRT is asking anyone who may have been in the area and may have witnessed these events and/or may have video to contact investigators at 403-592-4306.

ASIRT’s mandate is to effectively, independently and objectively investigate incidents involving Alberta’s police that have resulted in serious injury or death to any person, as well as serious or sensitive allegations of police misconduct.

This release is distributed by the Government of Alberta on behalf of the Alberta Serious Incident Response Team.

Alberta

ATA Collect $72 Million in Dues But Couldn’t Pay Striking Teachers a Dime

Marco Navarro-Génie

Marco Navarro-Génie

They Built a Sustaining Rainbow Bureaucracy Instead of a Warchest

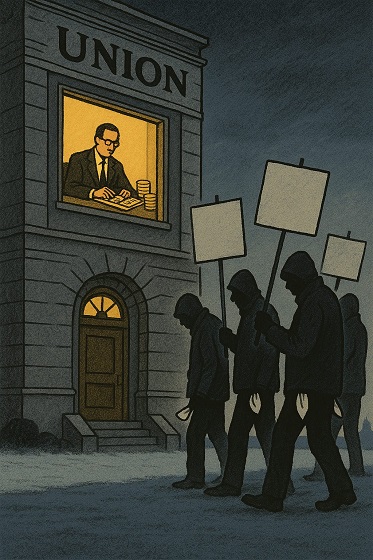

Alberta’s teachers walked off the job twice in a few years, which surprised anyone who still believed the old line that teachers avoid confrontation. A strike strips an organization to its essentials. It reveals whether a union carries real strength or only the appearance of it. When the Alberta Teachers’ Association entered a province-wide strike, it took on the posture of a century-old institution, but it drew on reserves of something far younger and far leaner. One question hangs in the air: How did a union that has existed since 1918 arrive at a major labour showdown with so little capacity to sustain its members?

Haultain’s Substack is a reader-supported publication.

To receive new posts and support our work, please consider becoming a free or paid subscriber.

Try it out.

The answer, it turns out, is that the ATA spent a century perfecting the art of growing and protecting itself, but not the teachers who pay for it.

Early unions understood that withdrawing labour meant stepping into a void. Wages vanished at the factory door. Families survived on whatever the union could provide. From small collections grew one of the essential principles of organized labour: A union prepares for conflict by saving in peacetime. It builds the means to protect its members when negotiations break down.

When unions matured, industrial organizations built strike funds large enough to hold firm through prolonged stalemates. These reserves became equalizers. Without them, employers waited for hunger to do the work. With them, a union could bargain in earnest. Strike pay bought time. Time forced movement. Time was power.

Consider what proper unions accomplish. CUPE maintains a national strike fund holding $132.8 million as of 2023. With 650,000 members, that’s about $200 per member in reserve. CUPE pays striking workers $300 per week from day one, rising to $350 after eight weeks. OPSEU maintains a $70 million strike fund, paying $200 per week plus $50 per dependent, increasing to $300 per week at week four.

By contrast, the ATA had $25 million in its Special Emergency Fund when the recent strike began. That money lasted just over two weeks, covering member benefits, not strike pay. For a union with 51,000 members, that’s less than $500 per teacher. After those two weeks, the Association drained its general cash reserves. By the end of the three-week strike, the SEF was depleted. Compare this to CUPE’s $132 million for 650,000 members or OPSEU’s $70 million for 180,000 members, and the ATA’s inadequacy becomes stark.

A century of life gives any organization the chance to build such strength. Over decades it becomes serious. Over a century it becomes formidable. Yet when the association decided to strike on October 6, 2025, it had nothing approaching the reserve needed for a long contest. A union prepared for endurance needs a fund measured in the high tens of millions, not the low twenties. That cushion was missing.

Of course, it was missing. Building a war chest means acknowledging you might actually have to fight a war. Far safer to build a peacetime palace and hope nobody notices when the enemy arrives at the gates.

This weakness grew from the inward turn that overtakes institutions with stable revenue and public status. What begins as a tool for members becomes an organism that primarily protects itself. After the Teaching Profession Act of 1936 entrenched its place in Alberta’s landscape, the ATA expanded like any other public body—without constraint or self-examination. Staff increased. Departments multiplied. New programs became permanent fixtures. Over time, the structure thickened into bureaucracy.

Robert Michels observed more than a century ago that organizations drift toward oligarchy because staff become the custodians of continuity. Members cycle in and out. Staff remain. As this instinct grows, the organization develops a belief that its first duty is to preserve itself. The ATA is no exception. Salaries for staff, internal operations, communication units, legal services, research branches, and advocacy initiatives occupy the foreground of its budget. The association’s annual budget is approximately $50 million, with discretionary programming accounting for less than a quarter. The remainder goes to staff salaries, operations, and fixed expenditures. A strike fund becomes an afterthought. Annual fees for 2025-26 are set at $1,422 per teacher, generating roughly $72 million in yearly revenue. Where did it all go?

The ATA’s books are not open, but there is public evidence of where some spending goes. Much went to campaigns that had precious little to do with wages, benefits, or working conditions. The ATA maintains an elaborate apparatus devoted to social justice advocacy. It supports the Alberta GSA Network, produces extensive resources on sexual and gender minorities, runs a “Walking Together” reconciliation program complete with 25 Indigenous education facilitators, publishes anti-racism materials, maintains Diversity Equity Networks, and employs staff dedicated to promoting SOGI (Sexual Orientation and Gender Identity) inclusion in classrooms. When Premier Danielle Smith announced policies requiring parental notification for name and pronoun changes in schools, the ATA mobilized its complete communications apparatus to oppose the measures, with President Jason Schilling calling them “irresponsible and dangerous” and a “distraction from more important issues.” If that were so, Schilling allowed his organization to be distracted.

I am not passing judgment on whether their causes lack merit or that teachers shouldn’t care about them. That’s their business and their money. But a union exists first and foremost to protect the material interests of its members. When teachers lose a month’s salary because their union spent decades building a rainbow bureaucracy instead of a strike fund, the priorities become clear. The ATA allocated resources to produce toolkits on creating “SOGI-inclusive classrooms” and funded campaigns about transgender policy while its Special Emergency Fund remained woefully inadequate. It hired facilitators to deliver workshops on dismantling anti-Indigenous racism, but couldn’t pay striking teachers a dime. This is ideology dressed up as unionism, performance masquerading as protection.

Haultain’s Substack is a reader-supported publication.

To receive new posts and support our work, please consider becoming a free or paid subscriber.

Try it out.

And here’s the greater irony: when teachers walked the picket lines, union executives kept drawing their salaries. Strike or no strike, the apparatus hummed along. The people running the ATA never missed a paycheque while the members they represent watched their bank accounts drain. In the 2025 strike, teachers lost a month’s salary. In return for this sacrifice, they gained precisely nothing. The settlement forced upon them by the government’s Back to School Act offered no improvement over what was available before they walked out. In fact, 89.5 per cent of teachers had already rejected this very offer on September 29, before the strike even began. In an era of persistent inflation, that lost income hurts. It hurt while union apparatchiks cashed their cheques on schedule.

The pattern of misplaced priorities extends beyond budgeting. When governments announce reforms, the ATA responds with press conferences, research papers, social media campaigns, and policy briefs. These are the tools of a professional bureaucracy, revolutionary in rhetoric, managerial in practice. They convey activity. They project influence. They cost a fortune. The ATA spent approximately $1.2 million on communications advocacy campaigns. Yet none of these tools matter when the government decides to hold firm during wage negotiations. Only endurance matters. Endurance rests on savings. Discipline has been scarce, but glossy newsletters have been plentiful.

The ATA fashions itself as the vanguard of progressive change, draping its pronouncements in the language of social justice and systemic transformation. It speaks like Che Guevara but budgets like a mid-tier insurance company. This is the defanged wolf: all growl, no bite. When push comes to shove, when teachers actually need material support to withstand a strike and make it count, the revolutionary rhetoric evaporates like morning dew. What remains is a comfortable administrative class that has confused advocacy theatre with actual power.

For a union that seeks to control so much of the province’s educational life, the ATA demonstrated a remarkable inability to control its own strike capacity. When the moment arrived to exercise the most fundamental power a union possesses—the withdrawal of labour—it had nothing. This is not the behaviour of a serious labour organization. This is the behaviour of a professional association that occasionally remembers it is supposed to be a union.

The ATA speaks of solidarity and resolve. It encourages teachers to show unity. It frames strikes as moral moments. It talks tough, pushed by its political branch, the NDP. Yet solidarity without resources is fragile. Resolve without savings falters when the bills arrive. A union that accepts going on strike without the means to sustain its membership hands the employer a strategic advantage from the outset. Employers read the same budgets. A union with a thin reserve can shout but cannot stand long, no matter what assurances Nenshi and their political allies make. The employer knows time will do the work. The people insulated from this reality are the NDP MLAs who cheered them on and the union administrators whose paycheques never depend on winning the fight.

It becomes difficult to tell whether the ATA has become an arm of the NDP or whether the NDP serves as the political branch of the ATA. Either way, the relationship has proven costly and fruitless. Opposition leader Naheed Nenshi stood ready with soundbites throughout the strike, encouraging teachers to hold firm while offering nothing of material value. NDP MLAs treated striking teachers and disrupted students as convenient instruments to embarrass the government, cheering on a labour action that could never succeed without the financial backing to sustain it. The enemy of your employer is not necessarily your friend. An independent union would have recognized this and built its strength accordingly, rather than spending resources and political capital on an alliance that delivers applause but not wages.

But it’s a professional association and not a conventional trade union, many will say. Members chose to strike against the leadership’s recommendations. That only seals the argument: It is an admission that the organization has no business going on strike. And if the membership voted for a strike, the leadership should have resigned. No youth leader would ever accept leading Girl Guides into a battlefield against seasoned warriors.

If the NDP functions as the political arm of the ATA, then the union has wasted considerable time and treasure on a supremely ineffective partner. A union serious about protecting its members would invest in strike capacity, not in subsidizing a moribund political movement that cannot deliver victories.

The institutional incentives explain much of this failure. Once an organization builds programs and layers of administration, cutting them becomes painful. Every department has defenders. Every initiative has champions. A strike fund has no constituency except prudence, and prudence has no allies among radicals. Prudence is no match for the seductive appeal of another communications coordinator or tattoo-covered diversity officer. Virtue-signalling solidarity wants no sacrifice. It is easier still when the people making these decisions know they will be paid regardless of whether the teachers they represent can hold out through week three of a strike.

Alberta teachers should demand clarity. They have paid dues for generations. They are told the association exists to protect them. Protection cannot be rhetorical. It must take the form of financial strength when the moment demands it. If the ATA built a bureaucracy instead of a war chest, if it prioritized the comfort of its administrative class over the security of its members, then teachers deserve that truth without varnish. They deserve to know why their union leadership never missed a meal while asking them to tighten their belts for the cause.

The defanged wolf is hurt now. It lashes out with its claws, backing recall campaigns against elected officials and organizing petitions to defund non-ATA school instruction. A Calgary high school teacher and ATA governing council representative wants to end public funding for Alberta’s independent schools, where roughly 2,000 teachers work outside ATA membership, costing the association approximately $2.84 million in foregone dues revenue annually. The petition to defund independent schools masquerades as concern for public education but reeks of institutional self-interest. Those 2,000 teachers represent nearly $3 million in annual dues that never reach ATA coffers. The defunding campaign is not about protecting students. It is about eliminating competition and conscripting teachers into membership. This is the Borg logic of an assimilating monopoly, not solidarity.

Wolves can be declawed, too. A union that cannot win at the bargaining table but insists on fighting everywhere else will find itself further diminished, further isolated, and ultimately less able to serve the teachers who still pay its bills. Vindictiveness is not a substitute for competence, and performative rage cannot replace the strength that comes from prudent preparation.

A century of dues offered the ATA a chance to build real power for its members. That chance slipped away into offices, programs, campaigns, and the salaries of people who never had to worry about surviving a strike because they were never actually on strike. The next century should begin with a different understanding of duty, rooted in prudence rather than performance, in stewardship rather than self-preservation, and in the recognition that a union leadership that doesn’t share the risks of its members has no business sending them into battle.

A defanged wolf can howl all it wants. Until it grows its teeth back, no one needs to take it seriously.

To receive new posts and support our work, please consider becoming a free or paid subscriber.

Try it out.

Alberta

Federal budget: It’s not easy being green

From Resource Works

Canada’s climate rethink signals shift from green idealism to pragmatic prosperity.

Bill Gates raised some eyebrows last week – and probably the blood pressure of climate activists – when he published a memo calling for a “strategic pivot” on climate change.

In his memo, the Microsoft founder, whose philanthropy and impact investments have focused heavily on fighting climate change, argues that, while global warming is still a long-term threat to humanity, it’s not the only one.

There are other, more urgent challenges, like poverty and disease, that also need attention, he argues, and that the solution to climate change is technology and innovation, not unaffordable and unachievable near-term net zero policies.

“Unfortunately, the doomsday outlook is causing much of the climate community to focus too much on near-term emissions goals, and it’s diverting resources from the most effective things we should be doing to improve life in a warming world,” he writes.

Gates’ memo is timely, given that world leaders are currently gathered in Brazil for the COP30 climate summit. Canada may not be the only country reconsidering things like energy policy and near-term net zero targets, if only because they are unrealistic and unaffordable.

It could give some cover for Canadian COP30 delegates, who will be at Brazil summit at a time when Prime Minister Mark Carney is renegotiating his predecessor’s platinum climate action plan for a silver one – a plan that contains fewer carbon taxes and more fossil fuels.

It is telling that Carney is not at COP30 this week, but rather holding a summit with Alberta Premier Danielle Smith.

The federal budget handed down last week contains kernels of the Carney government’s new Climate Competitiveness Strategy. It places greater emphasis on industrial strategy, investment, energy and resource development, including critical minerals mining and LNG.

Despite his Davos credentials, Carney is clearly alive to the fact it’s a different ballgame now. Canada cannot afford a hyper-focus on net zero and the green economy. It’s going to need some high octane fuel – oil, natural gas and mining – to prime Canada’s stuttering economic engine.

The prosperity promised from the green economy has not quite lived up to its billing, as a recent Fraser Institute study reveals.

Spending and tax incentives totaling $150 billion over a decade by Ottawa, B.C, Ontario, Alberta and Quebec created a meagre 68,000 jobs, the report found.

“It’s simply not big enough to make a huge difference to the overall performance of the economy,” said Jock Finlayson, chief economist for the Independent Contractors and Business Association and co-author of the report.

“If they want to turn around what I would describe as a moribund Canadian economy…they’re not going to be successful if they focus on these clean, green industries because they’re just not big enough.”

There are tentative moves in the federal budget and Climate Competitiveness Strategy to recalibrate Canada’s climate action policies, though the strategy is still very much in draft form.

Carney’s budget acknowledges that the world has changed, thanks to deglobalization and trade strife with the U.S.

“Industrial policy, once seen as secondary to market forces, is returning to the forefront,” the budget states.

Last week’s budget signals a shift from regulations towards more investment-based measures.

These measures aim to “catalyse” $500 billion in investment over five years through “strengthened industrial carbon pricing, a streamlined regulatory environment and aggressive tax incentives.”

There is, as-yet, no commitment to improve the investment landscape for Alberta’s oil industry with the three reforms that Alberta has called for: scrapping Bill C-69, a looming oil and gas emissions cap and a West Coast oil tanker moratorium, which is needed if Alberta is to get a new oil pipeline to the West Coast.

“I do think, if the Carney government is serious about Canada’s role, potentially, as an global energy superpower, and trying to increase our exports of all types of energy to offshore markets, they’re going to have to revisit those three policy files,” Finlayson said.

Heather Exner-Pirot, director of energy, natural resources and environment at the Macdonald-Laurier Institute, said she thinks the emissions cap at least will be scrapped.

“The markets don’t lie,” she said, pointing to a post-budget boost to major Canadian energy stocks. “The energy index got a boost. The markets liked it. I don’t think the markets think there is going to be an emissions cap.”

Some key measures in the budget for unlocking investments in energy, mining and decarbonization include:

- incentives to leverage $1 trillion in investment over the next five years in nuclear and wind power, energy storage and grid infrastructure;

- an expansion of critical minerals eligible for a 30% clean technology manufacturing investment tax credit;

- $2 billion over five years to accelerate critical mineral production;

- tax credits for turquoise hydrogen (i.e. hydrogen made from natural gas through methane pyrolysis); and

- an extension of an investment tax credit for carbon capture utilization and storage through to 2035.

As for carbon taxes, the budget promises “strengthened industrial carbon pricing.”

This might suggest the government’s plan is to simply simply shift the burden for carbon pricing from the consumer entirely onto industry. If that’s the case, it could put Canadian resource industries at a disadvantage.

“How do we keep pushing up the carbon price — which means the price of energy — for these industries at a time when the United States has no carbon pricing at all?” Finlayson wonders.

Overall, Carney does seem to be moving in the right direction in terms of realigning Canada’s energy and climate policies.

“I think this version of a Liberal government is going to be more focused on investment and competitiveness and less focused around the virtue-signaling on climate change, even though Carney personally has a reputation as somebody who cares a lot about climate change,” Finlayson said.

“It’s an awkward dance for them. I think they are trying to set out a different direction relative to the Trudeau years, but they’re still trying to hold on to the Trudeau climate narrative.”

Pictured is Mark Carney at COP26 as UN Special Envoy on Climate Action and Finance. He is not at COP30 this week. UNRIC/Miranda Alexander-Webber

Resource Works News

-

espionage2 days ago

espionage2 days agoChinese-Owned Trailer Park Beside U.S. Stealth Bomber Base Linked to Alleged Vancouver Repression Case

-

Daily Caller2 days ago

Daily Caller2 days agoLaura Ingraham Presses Trump On Allowing Flood Of Chinese Students Into US

-

Crime19 hours ago

Crime19 hours agoCBSA Bust Uncovers Mexican Cartel Network in Montreal High-Rise, Moving Hundreds Across Canada-U.S. Border

-

Environment20 hours ago

Environment20 hours agoThe Myths We’re Told About Climate Change | Michael Shellenberger

-

Energy1 day ago

Energy1 day agoIt should not take a crisis for Canada to develop the resources that make people and communities thrive.

-

Dr John Campbell1 day ago

Dr John Campbell1 day agoCures for Cancer? A new study shows incredible results from cheap generic drug Fenbendazole

-

Alberta2 days ago

Alberta2 days agoFederal budget: It’s not easy being green

-

Business2 days ago

Business2 days agoWill Paramount turn the tide of legacy media and entertainment?