Alberta

Housing in Calgary and Edmonton remains expensive but more affordable than other cities

From the Fraser Institute

By Tegan Hill and Austin Thompson

In cities across the country, modest homes have become unaffordable for typical families. Calgary and Edmonton have not been immune to this trend, but they’ve weathered it better than most—largely by making it easier to build homes.

Specifically, faster permit approvals, lower municipal fees and fewer restrictions on homebuilders have helped both cities maintain an affordability edge in an era of runaway prices. To preserve that edge, they must stick with—and strengthen—their pro-growth approach.

First, the bad news. Buying a home remains a formidable challenge for many families in Calgary and Edmonton.

For example, in 2023 (the latest year of available data), a typical family earning the local median after-tax income—$73,420 in Calgary and $70,650 in Edmonton—had to save the equivalent of 17.5 months of income in Calgary ($107,300) or 12.5 months in Edmonton ($73,820) for a 20 per cent down payment on a typical home (single-detached house, semi-detached unit or condominium).

Even after managing such a substantial down payment, the financial strain would continue. Mortgage payments on the remaining 80 per cent of the home’s price would have required a large—and financially risky—share of the family’s after-tax income: 45.1 per cent in Calgary (about $2,757 per month) and 32.2 per cent in Edmonton (about $1,897 per month).

Clearly, unless the typical family already owns property or receives help from family, buying a typical home is extremely challenging. And yet, housing in Calgary and Edmonton remains far more affordable than in most other Canadian cities.

In 2023, out of 36 major Canadian cities, Edmonton and Calgary ranked 8th and 14th, respectively, for housing affordability (relative to the median after-tax family income). That’s a marked improvement from a decade earlier in 2014 when Edmonton ranked 20th and Calgary ranked 30th. And from 2014 to 2023, Edmonton was one of only four Canadian cities where median after-tax family income grew faster than the price of a typical home (in Calgary, home prices rose faster than incomes but by much less than in most Canadian cities). As a result, in 2023 typical homes in Edmonton cost about half as much (again, relative to the local median after-tax family income) as in mid-sized cities such as Windsor and Kelowna—and roughly one-third as much as in Toronto and Vancouver.

To be clear, much of Calgary and Edmonton’s improved rank in affordability is due to other cities becoming less and less affordable. Indeed, mortgage payments (as a share of local after-tax median income) also increased since 2014 in both Calgary and Edmonton.

But the relative success of Alberta’s two largest cities shows what’s possible when you prioritize homebuilding. Their approach—lower municipal fees, faster permit approvals and fewer building restrictions—has made it easier to build homes and helped contain costs for homebuyers. In fact, homebuilding has been accelerating in Calgary and Edmonton, in contrast to a sharp contraction in Vancouver and Toronto. That’s a boon to Albertans who’ve been spared the worst excesses of the national housing crisis. It’s also a demographic and economic boost for the province as residents from across Canada move to Alberta to take advantage of the housing market—in stark contrast to the experience of British Columbia and Ontario, which are hemorrhaging residents.

Alberta’s big cities have shown that when governments let homebuilders build, families benefit. To keep that advantage, policymakers in Calgary and Edmonton must stay the course.

Alberta

Danielle Smith slams Skate Canada for stopping events in Alberta over ban on men in women’s sports

From LifeSiteNews

The Alberta premier has denounced Skate Canada as ‘disgraceful’ for refusing to host events in the province because of a ban on ‘transgender’ men in women’s sports.

Alberta Premier Danielle Smith has demanded an apology after Skate Canada refused to continue holding events in Alberta.

In a December 16 post on X, Smith denounced Skate Canada’s recent decision to stop holding competitions in Alberta due to a provincial law keeping gender-confused men from competing in women’s sports.

“Women and girls have the right to play competitive sports in a safe and fair environment against other biological females,” Smith declared. “This view is held by a vast majority of Albertans and Canadians. It is also common sense and common decency.”

Women and girls have the right to play competitive sports in a safe and fair environment against other biological females.

This view is held by a vast majority of Albertans and Canadians. It is also common sense and common decency.

Skate Canada‘s refusal to hold events in… pic.twitter.com/n4vbkTx6B0

— Danielle Smith (@ABDanielleSmith) December 16, 2025

“Skate Canada‘s refusal to hold events in Alberta because we choose to protect women and girls in sport is disgraceful,” she declared.

“We expect they will apologize and adjust their policies once they realize they are not only compromising the fairness and safety of their athletes, but are also offside with the international community, including the International Olympic Committee, which is moving in the same direction as Alberta,” Smith continued.

Earlier this week, Skate Canada announced their decision in a statement to CBC News, saying, “Following a careful assessment of Alberta’s Fairness and Safety in Sport Act, Skate Canada has determined that we are unable to host events in the province while maintaining our national standards for safe and inclusive sport.”

Under Alberta’s Fairness and Safety in Sport Act, passed last December, biological men who claim to be women are prevented from competing in women’s sports.

Notably, Skate Canada’s statement failed to address safety and fairness concerns for women who are forced to compete against stronger, and sometimes violent, male competitors who claim to be women.

Under their 2023 policy, Skate Canada states “skaters in domestic events sanctioned by Skate Canada who identify as trans are able to participate in the gender category in which they identify.”

While Skate Canada maintains that gender-confused men should compete against women, the International Olympic Committee is reportedly moving to ban gender-confused men from women’s Olympic sports.

The move comes after studies have repeatedly revealed what almost everyone already knew was true, namely that males have a considerable innate advantage over women in athletics.

Indeed, a recent study published in Sports Medicine found that a year of “transgender” hormone drugs results in “very modest changes” in the inherent strength advantages of men.

Additionally, male athletes competing in women’s sports are known to be violent, especially toward female athletes who oppose their dominance in women’s sports.

Last August, Albertan male powerlifter “Anne” Andres was suspended for six months after a slew of death threats and harassments against his female competitors.

In February, Andres ranted about why men should be able to compete in women’s competitions, calling for “the Ontario lifter” who opposes this, apparently referring to powerlifter April Hutchinson, to “die painfully.”

Interestingly, while Andres was suspended for six months for issuing death threats, Hutchinson was suspended for two years after publicly condemning him for stealing victories from women and then mocking his female competitors on social media. Her suspension was later reduced to a year.

Alberta

Alberta’s huge oil sands reserves dwarf U.S. shale

From the Canadian Energy Centre

By Will Gibson

Oil sands could maintain current production rates for more than 140 years

Investor interest in Canadian oil producers, primarily in the Alberta oil sands, has picked up, and not only because of expanded export capacity from the Trans Mountain pipeline.

Enverus Intelligence Research says the real draw — and a major factor behind oil sands equities outperforming U.S. peers by about 40 per cent since January 2024 — is the resource Trans Mountain helps unlock.

Alberta’s oil sands contain 167 billion barrels of reserves, nearly four times the volume in the United States.

Today’s oil sands operators hold more than twice the available high-quality resources compared to U.S. shale producers, Enverus reports.

“It’s a huge number — 167 billion barrels — when Alberta only produces about three million barrels a day right now,” said Mike Verney, executive vice-president at McDaniel & Associates, which earlier this year updated the province’s oil and gas reserves on behalf of the Alberta Energy Regulator.

Already fourth in the world, the assessment found Alberta’s oil reserves increased by seven billion barrels.

Verney said the rise in reserves despite record production is in part a result of improved processes and technology.

“Oil sands companies can produce for decades at the same economic threshold as they do today. That’s a great place to be,” said Michael Berger, a senior analyst with Enverus.

BMO Capital Markets estimates that Alberta’s oil sands reserves could maintain current production rates for more than 140 years.

The long-term picture looks different south of the border.

The U.S. Energy Information Administration projects that American production will peak before 2030 and enter a long period of decline.

Having a lasting stable source of supply is important as world oil demand is expected to remain strong for decades to come.

This is particularly true in Asia, the target market for oil exports off Canada’s West Coast.

The International Energy Agency (IEA) projects oil demand in the Asia-Pacific region will go from 35 million barrels per day in 2024 to 41 million barrels per day in 2050.

The growing appeal of Alberta oil in Asian markets shows up not only in expanded Trans Mountain shipments, but also in Canadian crude being “re-exported” from U.S. Gulf Coast terminals.

According to RBN Energy, Asian buyers – primarily in China – are now the main non-U.S. buyers from Trans Mountain, while India dominates purchases of re-exports from the U.S. Gulf Coast. .

BMO said the oil sands offers advantages both in steady supply and lower overall environmental impacts.

“Not only is the resulting stability ideally suited to backfill anticipated declines in world oil supply, but the long-term physical footprint may also be meaningfully lower given large-scale concentrated emissions, high water recycling rates and low well declines,” BMO analysts said.

-

International1 day ago

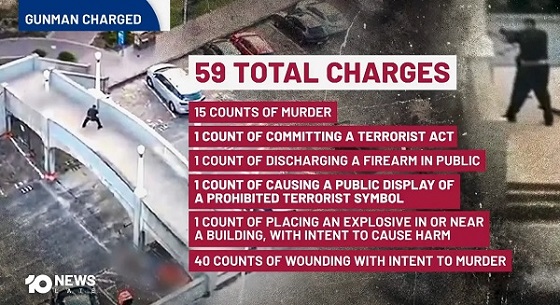

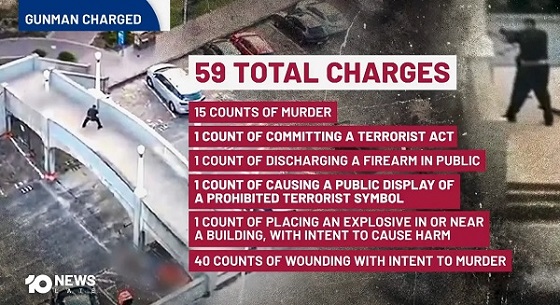

International1 day agoBondi Beach Shows Why Self-Defense Is a Vital Right

-

Business2 days ago

Business2 days agoOttawa Pretends To Pivot But Keeps Spending Like Trudeau

-

Crime1 day ago

Crime1 day agoBondi Beach Survivor Says Cops Prevented Her From Fighting Back Against Terrorists

-

Automotive1 day ago

Automotive1 day agoFord’s EV Fiasco Fallout Hits Hard

-

Energy2 days ago

Energy2 days agoLiberals Twisted Themselves Into Pretzels Over Their Own Pipeline MOU

-

Censorship Industrial Complex1 day ago

Censorship Industrial Complex1 day agoHow Wikipedia Got Captured: Leftist Editors & Foreign Influence On Internet’s Biggest Source of Info

-

Crime1 day ago

Crime1 day agoThe Uncomfortable Demographics of Islamist Bloodshed—and Why “Islamophobia” Deflection Increases the Threat

-

Frontier Centre for Public Policy14 hours ago

Frontier Centre for Public Policy14 hours agoCanada Lets Child-Porn Offenders Off Easy While Targeting Bible Believers