Economy

Reconciliation means clearing the way for Indigenous leadership

From the Resource Works team.

On Truth and Reconciliation Day, Canadians are asked to honour residential school survivors and to support the families and communities who must live with that history.

It also calls for action, not mere commemoration. The Truth and Reconciliation Commission called for structural change in Canada, and that means clearing the way for Indigenous leadership across this country.

Economic reconciliation is a practical journey that shifts decision-making and ownership towards First Nations and Indigenous people more generally.

Throughout B.C., First Nations are already practicing what that looks like. The Osoyoos Indian Band has built a diverse economy in tourism, wine, and recreation that has sustained steady jobs and revenue.

“I think all Native leadership need to get the economic development focus going on and make the economy the number one issue. It’s the economy that looks after everything,” Chief Clarence Louie has said. That sense of mission, along with assets like Nk’Mip Cellars and Spirit Ridge, has helped to turn Osoyoos into a B.C. success story.

On the coast, the Haisla Nation is leading in innovation in the LNG sector. In 2024, the Cedar LNG facility was granted a positive final investment decision, along with the Haisla’s majority ownership of the $4 billion project.

“Today is about changing the course of history for my Nation and Indigenous peoples,” said Haisla Chief Councillor Crystal Smith during the long approval process. By seeing the project through, Haisla ownership has created the means to fund language, health care, and opportunity for generations that had found all of that out of reach.

In the Lower Mainland, the Squamish Nation’s Sen̓áḵw development is one of the biggest projects in the Vancouver real estate market, and will become an asset for decades to come.

“This project is not just about buildings, it’s about bringing the Squamish People back to the land, making our presence felt once again in the heart of our ancestral territory, and creating long term wealth for the Squamish Nation,” said Council Chairperson Khelsilem.

The Squamish recently restructured the partnership so Squamish holds half of phases one and two and all of phases three and four, while welcoming OPTrust to a 50 percent stake in the early phases. Indigenous leadership is not just transforming the rural resource economy, but the urban one as well.

Chief Ian Campbell of the Squamish Nation, former chair of the Indigenous Partnerships Success Showcase event in Vancouver, has said that economic reconciliation is essential to the future of Canada.

“To move forward and reframe that complex dynamic, and put the lens on economic reconciliation, to me, is the path forward to create mutual benefits and values that benefit all Canadians, which includes Indigenous people,” said Campbell.

For governments and industry, there is a duty to align policy, permitting, and capital flows with Indigenous-led priorities. Beyond benefits agreements, reconciliation requires listening both early and attentively, and ensuring cooperation every step of the way.

The Bank of Canada itself has noted that “tremendous untapped potential exists”, but only when private firms and public agencies commit to economic reconciliation.

Listening also means resisting the temptation to cast Indigenous peoples as either monolithic supporters or opponents of development. Figures like Ellis Ross, former Chief Councillor of the Haisla, and his successor Crystal Smith have challenged these narratives, pointing instead to Haisla and neighbouring Nations’ experience with real jobs, careers, and community services tied to LNG and related infrastructure.

The Haisla message is straightforward: the path to revitalized language and culture runs through sustained opportunity and self-determination.

Truth and Reconciliation Day is a reminder that the past matters, and this is evident in the inequities of the present and in the possibilities now being realized by Nations that are reclaiming jurisdiction and building enterprises on their own terms.

Our task is to ensure public policy and corporate practice do not get in the way. On September 30, we remember, and then on October 1 and every day after, we have work to do.

Alberta

Taxpayers: Alberta must scrap its industrial carbon tax

-

Carney praises carbon taxes on world stage

-

Alberta must block Carney’s industrial carbon tax

The Canadian Taxpayers Federation is calling on the government of Alberta to completely scrap its provincial industrial carbon tax.

“It’s baffling that Alberta is still clinging to its industrial carbon tax even though Saskatchewan has declared itself to be a carbon tax-free zone,” said Kris Sims, CTF Alberta Director. “Prime Minister Mark Carney is cooking up his new industrial carbon tax in Ottawa and Alberta needs to fight that head on.

“Alberta having its own industrial carbon tax invites Carney to barge through our door with his punishing industrial carbon tax.”

On Sept. 16, the Alberta government announced some changes to Alberta’s industrial carbon tax, but the tax remains in effect.

On Friday night at the Global Progress Action Summitt held in London, England, Carney praised carbon taxes while speaking onstage with British Prime Minister Keir Starmer.

“The direct carbon tax which had become a divisive issue, it was a textbook good policy, but a divisive issue,” Carney said.

During the federal election, Carney promised to remove the more visible consumer carbon tax and change it into a bigger hidden industrial carbon tax. He also announced plans to create “border adjustment mechanisms” on imports from countries that do not have national carbon taxes, also known as carbon tax tariffs.

“Carney’s ‘textbook good policy’ comments about carbon taxes shows his government is still cooking up a new industrial carbon tax and it’s also planning on imposing carbon tax tariffs,” Sims said. “Alberta should stand with Saskatchewan and obliterate all carbon taxes in our province, otherwise we are opening the door for Ottawa to keep kicking us.”

Business

New PBO report underscores need for serious fiscal reform in Ottawa

From the Fraser Institute

By Jake Fuss and Grady Munro

The PBO expects total federal debt to reach $2.9 trillion by 2029/30—roughly equivalent to 80 per cent of the entire Canadian economy in that year.

Ahead of this year’s long-awaited federal budget—Prime Minister Carney’s first at the helm—a new report paints a picture of what we might expect federal finances to look like. The picture is not pretty, and the numbers underscore the serious need for the government to change course immediately.

The new report comes from the independent Parliamentary Budgetary Officer (PBO)—Ottawa’s fiscal watchdog. While the PBO’s outlook offers some general insight as to what we can expect from the upcoming November 4 budget, we shouldn’t hang our hat on the exact estimates. Excluded from the report are major new measures including the Carney government’s pledge to raise military spending to 5 per cent of GDP by 2035, the government’s spending review, and the launch of “Build Canada Homes.”

However, the report demonstrates a clear need for serious fiscal reform.

First and foremost, the PBO projects dramatically higher annual budget deficits than were previously projected in last year’s fall economic statement—the last official government fiscal update—which already included a concerning forecast for federal finances. Budget deficits arise when the government spends more than it raises in revenues during the year, and must borrow money to make up the difference. Previously, the government planned to borrow a combined $202.7 billion over the six years from 2024/25 to 2029/30. Now, the PBO estimates combined federal deficits will reach $366.2 billion over that same period.

Put differently, for the six years from 2024/25 to 2029/30, the average deficit is expected to be $61.0 billion—nearly four times the six-year average of $15.8 billion the government ran before the pandemic.

According to the PBO, this $163.5 billion increase in combined federal deficits is driven by the effects of lower expected revenues, alongside higher expected spending on both government programs and debt interest payments. There are many reasons underlying these changes including the economic impact of U.S. tariffs, increased defence spending to reach 2 per cent of GDP, and the federal personal income tax cut. But this represents an alarming plunge deeper into the red.

The primary consequence of deficits is an increase in the mountain of debt held by the government. Previously, total federal debt was expected to rise from $2.1 trillion in 2023/24—a big number after a substantial run-up in debt from the previous decade—to $2.6 trillion by 2029/30. Now, the PBO expects total federal debt to reach $2.9 trillion by 2029/30—roughly equivalent to 80 per cent of the entire Canadian economy in that year.

Government borrowing and debt costs fall squarely on the backs of Canadians. For instance, similar to a family with a mortgage, the government must pay interest on its debt. As the government continues to accumulate more and more debt, all else equal, the amount it spends on interest will also rise. And each taxpayer dollar spent on interest is a dollar diverted from government programs or potential tax relief for Canadians.

Rising government debt also acts as a drag on the overall economy. Both the government and the private sector compete for scarce resources and it becomes more expensive for everyone to borrow money. Therefore, those in the private sector can be discouraged from borrowing money to invest into Canadian businesses.

New projections on the state of federal finances paint a dire picture of huge deficits and massive debt accumulation. The Carney government should implement major fiscal reform to avoid this future.

-

Business2 days ago

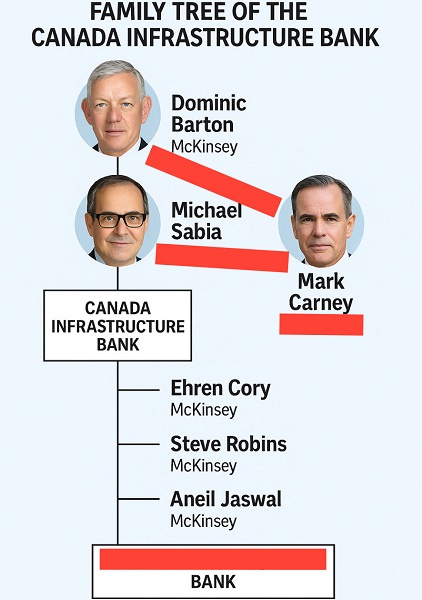

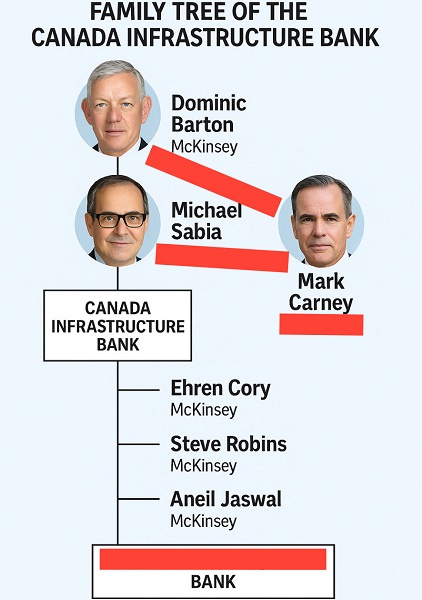

Business2 days agoDominic Barton’s Shadow Over $1-Billion PRC Ferry Deal: An Investigative Op-Ed

-

Censorship Industrial Complex2 days ago

Censorship Industrial Complex2 days agoCanada To Revive Online Censorship Targeting “Harmful” Content, “Hate” Speech, and Deepfakes

-

Alberta2 days ago

Alberta2 days agoAlberta refuses to take part in Canadian government’s gun buyback program

-

Alberta2 days ago

Alberta2 days agoOrthodox church burns to the ground in another suspected arson in Alberta

-

Alberta2 days ago

Alberta2 days agoAlberta puts pressure on the federal government’s euthanasia regime

-

Fraser Institute1 day ago

Fraser Institute1 day agoAboriginal rights now more constitutionally powerful than any Charter right

-

Business1 day ago

Business1 day agoNew PBO report underscores need for serious fiscal reform in Ottawa

-

Alberta1 day ago

Alberta1 day ago$150 a week from the Province to help families with students 12 and under if teachers go on strike next week