International

What was the FBI up to on January 6?

Quick Hit:

President Donald Trump on Saturday called for answers after a report detailed how at least 274 undercover FBI agents were present at the U.S. Capitol on January 6, 2021. He said the finding contradicts Director Christopher Wray’s repeated denials and demanded to know “who each and every one” of the agents were and “what they were up to.”

Key Details:

- The Blaze reported that internal FBI documents revealed the agency had “acknowledged” deploying 274 plainclothes agents in and around the Capitol on January 6, contradicting prior testimony from Director Wray.

- Trump posted on Truth Social that the FBI’s secret deployment violated “all Rules, Regulations, Protocols, and Standards,” and accused the bureau of possibly acting as “Agitators and Insurrectionists, but certainly not as Law Enforcement Officials.”

- The report also referenced complaints from agents who said they were sent into unsafe conditions without protective gear or clear identification, according to documents obtained by Just the News.

President Trump just called out the 274 FBI agents working undercover on J6

Now he’s opening a full investigation

Trump has had thousands of MAGA rallies and they were all peaceful, but the 1 MAGA rally with 274 FBI agents gets crazy?

It was a Fedsurrection pic.twitter.com/AVNPHHAoCQ

— DC_Draino (@DC_Draino) September 27, 2025

Diving Deeper:

President Donald Trump is demanding answers after a report alleged that 274 undercover FBI agents were embedded among the crowd during the January 6 Capitol protest — far more than previously disclosed by the agency.

“It was just revealed that the FBI had secretly placed, against all Rules, Regulations, Protocols, and Standards, 274 FBI Agents into the Crowd just prior to, and during, the January 6th Hoax,” Trump wrote Saturday on Truth Social. “This is different from what Director Christopher Wray stated, over and over again!”

The report from The Blaze cited internal communications and a source confirming the FBI’s acknowledgment of its undercover presence at the Capitol, even as the bureau repeatedly refused to disclose details about its operations that day. Trump argued the revelation vindicates long-standing claims that federal operatives may have played an active role in the chaos.

“That’s right, as it now turns out, FBI Agents were at, and in, the January 6th Protest, probably acting as Agitators and Insurrectionists, but certainly not as ‘Law Enforcement Officials,’” Trump continued. “I want to know who each and every one of these so-called ‘Agents’ are, and what they were up to on that now ‘Historic’ Day.”

The president said Wray “has some major explaining to do,” adding, “That’s two in a row, Comey and Wray, who got caught LYING, with our Great Country at stake. WE CAN NEVER LET THIS HAPPEN TO AMERICA AGAIN!”

Documents obtained by Just the News reportedly show dozens of FBI personnel later filed complaints describing the deployment as unsafe and poorly coordinated. The agents claimed they were sent into the crowd without proper protective gear or clear identification, making it difficult to distinguish them from protesters.

Trump, who has long described the Capitol riot investigations as politically motivated, said Americans who were punished for protesting “for the love of their Country” deserve the truth. “I owe this investigation of ‘Dirty Cops and Crooked Politicians’ to them,” he wrote.

The revelations mark another blow to the credibility of the FBI’s leadership. With renewed calls for accountability, Trump’s demand — “Who were they, and what were they doing there?” — is likely to keep pressure on the FBI as scrutiny intensifies over its conduct that day.

(AP Photo/John Minchillo)

Business

Dominic Barton’s Shadow Over $1-Billion PRC Ferry Deal: An Investigative Op-Ed

Ottawa’s story never added up. When the Canada Infrastructure Bank pushed through a $1-billion loan to BC Ferries for vessels built at a Chinese state-owned shipyard, federal ministers claimed they were “dismayed” and blindsided. Chrystia Freeland even wrote a letter to the BC government citing national security concerns. In hindsight, she and her staff were engaged in political theatre, performing shock to deflect responsibility onto Premier David Eby.

Documents later showed Freeland’s own ministry of transport had been briefed six weeks before the public rollout. In one internal exchange, her staff admitted officials had received “a confidential heads-up” well in advance. Then came testimony from Housing and Infrastructure Minister Gregor Robertson — also responsible for the Infrastructure Bank — acknowledging the loan was already “inked” in March, before he supposedly raised concerns, a claim as hollow as Freeland’s staged outrage.

The $1-billion Canadian Infrastructure Bank loan to BC Ferries flows directly to China Merchants Industry Weihai — a dual-use shipyard central to Beijing’s military-civil fusion strategy. Critics have long warned that such contracts risk entangling Canadian taxpayers with Chinese state enterprises linked to the People’s Liberation Army.

Those concerns take on new urgency with fresh revelations from Australia. ABC News reported yesterday on a classified U.S. Defense Intelligence Agency assessment showing that China’s commercial ferry fleet is being militarized for amphibious operations against Taiwan. These are not neutral passenger vessels but dual-use platforms modified to carry tanks and PLA troops. The timing of the four-ship build for BC Ferries, the nature of the shipyard, and the class of vessel all suggest that Canada could be indirectly bolstering Beijing’s invasion platform — and, at the very least, injecting Canadian funds into the industrial ecosystem driving the PLA’s buildup.

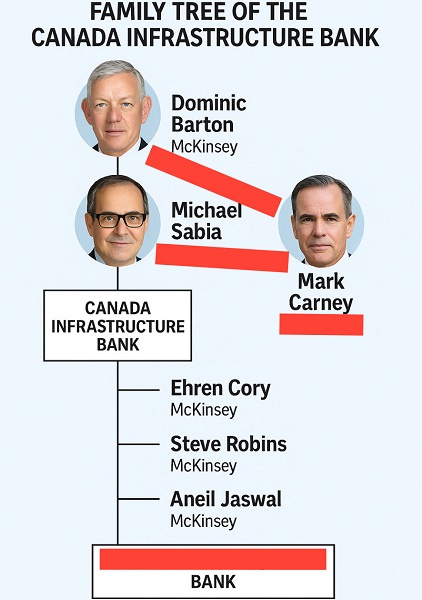

The nature of CIB’s involvement, and Ottawa’s actions that fit the pattern of an emerging cover-up, point to a deeper story that has been bubbling in the capital for nearly a decade: former McKinsey global director and Canadian ambassador to China Dominic Barton, his deep ties to Chinese state-owned and dual-use enterprises, and his founding role in the CIB.

Defensive “talking points” prepared for Gregor Robertson’s August 1, 2025 testimony provide a revealing glimpse. The records, obtained through freedom of information by The Bureau, are mostly boilerplate answers. But two pages on the CIB’s structure show clearly what outside reporting has long established: the Bank carries Barton’s DNA, and the imprint of his McKinsey network continues to this day. That raises a plausible theory — that Canada’s pro-Beijing trade lobby, a circle of business leaders revolving around Barton, Sabia, McKinsey, and now Prime Minister Mark Carney, looks like the hidden hand guiding this supposedly arm’s-length deal.

The records that anchor this OpEd show the Infrastructure Bank’s story can be traced like a family tree. At the top is Dominic Barton. In 2016, while serving as McKinsey’s global managing director, he chaired the federal Advisory Council on Economic Growth. That council produced the blueprint for the Canada Infrastructure Bank — and McKinsey itself was paid as a consultant during its creation. Sitting beside Barton on the council was Michael Sabia, who would later become chair of the Bank in 2020 and today serves as chief of staff to Prime Minister Mark Carney.

As the Bank moved from paper to practice, Sabia’s role became pivotal. When he took over as chair, he pulled Barton back into the fold. In June 2020, Barton joined a “strategic refresh” meeting of the CIB. Emails later revealed that McKinsey staff had arranged the session so that “Dom” could “speak freely,” even though he was then serving as Canada’s ambassador to China.

The pattern deepened as new leadership arrived. In November 2020, Ehren Cory was appointed CEO. Cory, too, had worked at McKinsey. Around him, other alumni filled senior posts: Steve Robins, now head of strategy; Aneil Jaswal, director of strategic sectors; even Cory’s executive assistant came directly from McKinsey, according to notes prepared for Gregor Robertson’s August testimony and obtained by The Bureau.

Running alongside this McKinsey chain is a side branch that loops back into the heart of Ottawa. Sabia, Barton’s colleague from the Advisory Council, now serves as Mark Carney’s right hand in the Prime Minister’s Office.

Seen this way, the CIB is not just a Crown corporation with a neutral mandate. It is an institution shaped from the start by Barton’s hand, nurtured by Sabia, and still run day to day by McKinsey-trained managers. The government’s defensive claim — that McKinsey’s influence ended in 2017, as set out in notes for Robertson’s testimony — is impossible to believe. It is as false as Chrystia Freeland’s June 2025 letter to David Eby’s government.

The continuity of influence is not just structural — it’s personal. On June 23, 2020, while serving as ambassador to China, Barton joined a CIB “strategic refresh” meeting. He says it was at Sabia’s invitation. But emails tabled in committee show McKinsey staff helped arrange the call and even discussed limiting participants so “Dom” could “speak freely.” Pressed in Parliament during May 2023 testimony, Barton initially failed to disclose the meeting. Only after documents surfaced did he confirm it.

That evasiveness set off a bruising clash. Conservative MP Leslyn Lewis told him flatly: “We have testimony that you gave before, and that was false indeed.” She added: “Mr. Sabia, the former chair of the CIB, testified here on Tuesday that you participated in a McKinsey seminar, led by McKinsey, while you were ambassador — and you have now confirmed this information today.”

Garnett Genuis drove the point home: “Mr. Barton is clearly lying to this committee. We have the emails in black and white. It seems McKinsey was able to infiltrate the government and shape decision making. Your presence and close relationship with the government allowed that to happen.”

Three years earlier, Barton had faced an even higher-profile grilling before the Canada–China Committee — testimony with direct geographical and geopolitical relevance to the CIB’s mysterious $1-billion loan to CMC Weihai.

Back in 2020, Genuis pressed him on McKinsey’s advisory work for Chinese state-owned enterprises, including the China Communications Construction Company — sanctioned by the World Bank for corruption and implicated in Beijing’s militarized islands in the South China Sea. Barton ducked, dissembled, and insisted he was unaware.

“At the time you were in charge of McKinsey, from 2009, it’s my understanding that you advised almost two dozen Chinese state-owned companies. According to The New York Times, one of those companies was the China Communications Construction Company,” Genuis prodded. “When you signed the China Communications Construction Company as a client in 2015, they were still under World Bank sanctions because of the corruption and bid-rigging they engaged in in the Philippines.”

Next, the Conservative MP asked directly: “McKinsey was advising a company that was carrying out the Chinese government’s policy of building militarized islands in the South China Sea. Was it your position that those islands are a violation of international law?”

“What I would say is that I am not familiar at all with our being involved in designing the islands in the South China Sea,” Barton answered. “If you want to talk to someone at McKinsey to find out more information, I’m sure we’d be happy to get someone to talk to you about it.”

McKinsey did not return with information on China’s military action in the South China Sea — the very same theater where Beijing now threatens Taiwan with its civilian ferry buildup plan.

Genuis also asked: “Would you be prepared to submit to this committee a list of all of the Chinese state-owned companies that you did work for at McKinsey?”

“McKinsey’s pretty careful about client confidentialities,” Barton answered. “I’d be happy if there were some mechanism so that it isn’t in the public domain but that some people could look at it. I’m open to that.”

That list was never provided, based on The Bureau’s follow-up in Ottawa. Given the questions surrounding the CIB’s loan to fund CMC Weihai ferries, this lack of transparency takes on a more ominous colour.

The historical record of testimony, going back to the Genuis–Barton stand-off, now casts a long shadow. There is a clear through line to the questioning still to come for Carney’s responsible ministers in the BC Ferries deal — Chrystia Freeland and Gregor Robertson. After revelations that Freeland and her staff staged their supposed shock at the deal with a Chinese military-linked shipbuilder, Freeland has been recalled.

Savvy questioners will likely look beyond her — and above her — in their probing. The CIB, seeded by Barton, staffed by McKinsey alumni, and previously steered by Mark Carney’s chief of staff Michael Sabia, has financed a project that objectively strengthens Beijing’s naval-industrial complex. Who really profits, in conjunction with Beijing? Certainly not Canadian workers, shipbuilders, or citizens, who are left carrying the burden of their government’s deals with China.

This is not just about procurement missteps or potential conflicts of interest. It is the culmination of a decade of weak, negligent thinking on China’s military aggression — stretching from the South China Sea to Canada’s Pacific, Atlantic, and Arctic coasts. Until Canadians confront Barton’s enduring imprint on the CIB, they will continue to discover — too late — that their money is underwriting Beijing’s rise.

The Bureau is a reader-supported publication.

To receive new posts and support my work, consider becoming a free or paid subscriber.

Economy

Oil prices fall under pressure as global supply surges

This article supplied by Troy Media.

OPEC output, weak demand and global politics are flooding the market. Experts warn an oil supply glut could hit by 2026

Global oil markets are bracing for a long-term downturn, driven by rising supply, softening demand and mounting economic headwinds.

Brent crude closed Friday at US$66.68 per barrel, down 76 cents or 1.1 per cent. West Texas Intermediate dropped 89 cents to US$62.68, a 1.4

per cent decline. While markets initially hoped an interest rate cut by the U.S. Federal Reserve might boost consumption, oversupply concerns have taken the wheel.

The International Energy Agency now projects a market surplus of 3.3 million barrels per day (bpd) by 2026 if current policies remain in place. Global supply is expected to rise by 2.7 million bpd in 2025 and another 2.1 million in 2026, while demand will grow by just 700,000 bpd annually.

The U.S. Energy Information Administration echoes the concern. Its latest ShortTerm Energy Outlook forecasts global petroleum and other liquid fuels production to average 105.5 million bpd in 2025, climbing to 106.6 million bpd in 2026. Consumption will lag at 103.8 million and 105.1 million bpd, respectively.

Adding to the unease, U.S. distillate stockpiles—diesel, jet fuel and other products held in storage— unexpectedly rose by four million barrels,

suggesting that more fuel is going unused and demand is starting to stall.

Beyond market fundamentals, some of the bearish pressure is also political. OPEC, the Organization of the Petroleum Exporting Countries, is increasing production—partly shielded by U.S. President Donald Trump’s push for lower domestic fuel prices, a priority that influences how much pressure Washington applies to oil-producing nations.

The White House has made clear it wants energy affordability, giving oil producers the political cover to keep pumping without fear of retaliation.

Geopolitical dynamics are compounding the supply picture. A recent thaw in U.S.–China relations reduced the likelihood of secondary sanctions over Chinese imports of Russian crude. Trump and Chinese President Xi Jinping are expected to meet at the upcoming Asia-Pacific Economic Cooperation summit at the end of October.

Markets took comfort in Trump’s silence on Chinese oil purchases, seeing it as a signal that confrontation is off the table, at least for now.

India continues to buy Russian oil, and the European Union’s latest sanctions package lacks the strength to provoke a firmer U.S. response. Together, these factors are helping keep Russian barrels in global circulation.

Elsewhere, Iraq appears close to resuming crude exports from its Kurdistan region to Turkey, adding yet another stream of supply to an already saturated market.

On top of all this, the upcoming refinery turnaround season—a routine drop in crude demand as refineries shut down for maintenance—will temporarily reduce consumption even further.

In short, all the major levers are pulling in the same direction: lower prices.

And while that may seem like good news for consumers, the ripple effects are far more serious. Canadians may welcome cheaper gas in the near term, but the implications go far beyond the pump.

A prolonged downturn could hit investment in Alberta’s oil sands, Newfoundland and Labrador’s offshore sector, and Saskatchewan’s oil-producing regions—each of them key drivers of provincial revenue and the Canadian economy. Lower prices mean reduced royalties, which fund everything from health care to infrastructure.

Non-renewable resource revenues—primarily from oil and gas—remain a significant source of income for these provinces. In Alberta, they are forecast to account for roughly 21.5 per cent of total government revenue in 2025–26. In Newfoundland and Labrador, oil royalties alone are projected to contribute about 15 per cent of the province’s revenue. Even in Saskatchewan, where potash and uranium also play a role, oil and gas revenues make up a substantial share of the 12.8 per cent of income tied to non-renewable resources.

These figures underscore just how exposed provincial finances remain to global oil price movements.

That pullback in investment could also slow hiring and capital spending, with ripple effects across energy-dependent regions. Pension funds and institutional investors with heavy exposure to oil and gas may feel the sting as well.

At the national level, the consequences could be far-reaching. Canada’s oil and gas extraction sector alone accounts for about 3.2 per cent of GDP, according to the Canadian Association of Petroleum Producers. Broader estimates that include investment, supply chains and related industries place the sector’s total contribution at around 6.4 per cent, based on previous Canadian Energy Centre analysis.

Lower crude prices tend to weaken the Canadian dollar, slow investment in big projects, and cut into export earnings. That can drag down GDP growth, shrink government revenues, and affect job markets even outside the oil patch.

In a country where energy exports still drive much of the economy, a prolonged slump could have wide-reaching fiscal and economic consequences.

Investors, governments and energy workers alike should brace for impact—the oil market isn’t just cooling, it’s being flooded.

Toronto-based Rashid Husain Syed is a highly regarded analyst specializing in energy and politics, particularly in the Middle East. In addition to his contributions to local and international newspapers, Rashid frequently lends his expertise as a speaker at global conferences. Organizations such as the Department of Energy in Washington and the International Energy Agency in Paris have sought his insights on global energy matters.

Troy Media empowers Canadian community news outlets by providing independent, insightful analysis and commentary. Our mission is to support local media in helping Canadians stay informed and engaged by delivering reliable content that strengthens community connections and deepens understanding across the country

-

Business8 hours ago

Business8 hours agoOver $2B California Solar Plant Built To Last, Now Closing Over Inefficiency

-

Alberta2 days ago

Alberta2 days agoFederal policies continue to block oil pipelines

-

Autism2 days ago

Autism2 days agoAutism – what we know

-

espionage1 day ago

espionage1 day agoCanada Under Siege: Sparking a National Dialogue on Security and Corruption

-

Business7 hours ago

Business7 hours agoWEF has a plan to overhaul the global financial system by monetizing nature

-

Business1 day ago

Business1 day agoGoogle Admits Biden White House Pressured Content Removal, Promises to Restore Banned YouTube Accounts

-

Business9 hours ago

Business9 hours agoThe Leaked Conversation at the heart of the federal Gun Buyback Boondoggle

-

Opinion8 hours ago

Opinion8 hours agoThe City of Red Deer’s financial mess – KPMG report outlines failure of council to control spending