Banks

Royal Bank of Canada closes Freedom Convoy lawyer’s accounts over ‘risk concerns’

From LifeSiteNews

The Royal Bank of Canada terminated Freedom Convoy lawyer Eva Chipiuk’s accounts, saying her activity is outside its ‘client risk appetite’ and prompting accusations of political targeting.

The Royal Bank of Canada is shutting down a Freedom Convoy lawyer’s accounts over “risk concerns.”

In a July 23 post on X, Freedom Convoy layer Eva Chipiuk revealed that the Royal Bank of Canada (RBC) terminated its banking relationship with her, citing “risk-related concerns” due to “recent activity” being outside their “client risk appetite.”

“As a federally regulated financial institution, RBC is required by law to comply with applicable legislation,” the letter, posted on X, read. “These laws require that we implement certain processes and procedures which directly support the formulation of RBC’s positions with respect to risk.”

“After careful consideration, we regretfully advise you that the recent activity in your accounts is outside of RBC’s client risk appetite, and consequently we are no longer in a position to continue our banking relationship with you,” it continued.

Well, I wasn’t expecting this, @RBC.

Welcome to Canada, where tyranny has great customer service. pic.twitter.com/yQI8QUs8pj

— Eva Chipiuk, BSc, LLB, LLM (@echipiuk) July 23, 2025

The decision followed a flagged Bitcoin transaction, after which RBC froze her account and asked her questions about her crypto activities, which she described to the Western Standard as “strange and demeaning.”

The bank gave her until August 18, 2025, to find a new financial institution, cryptically referencing compliance with federal regulations but providing no specific law or detailed explanation.

Chipiuk, who has been vocal about her criticism of Canadian institutions, suggested the debanking might be linked to her involvement in the Freedom Convoy or her public stance.

Many Canadians responded to the news online, calling out tyrannical government behavior and advocating for Canadians to invest their money in bitcoin and crypto currency.

“This is brazen and astonishing behavior by @RBC towards @echipiuk,” Ontario member of provincial parliament (MPP) Randy Hillier wrote on X.

“Eva is a well-known lawyer in Canada and has been debanked apparently because she is a ‘risk,’” he continued. “It appears that because she uses crypto and is a well known vocal advocate for freedom, she can’t have a bank account.”

“Please note! Everyone of the 5 Canadian bank owns a major stake in each other,” he warned. “Banks are becoming unsafe for Canadians and Credit unions are a safe and better alternative.”

This is brazen and astonishing behavior by @RBC towards @echipiuk.

Eva is a well-known lawyer in Canada and has been debanked apparently because she is a "risk."It appears that because she uses crypto and is a well known vocal advocate for freedom, she can't have a bank… https://t.co/Z5JsShDkoI

— Randy Hillier (@randyhillier) July 23, 2025

The move is reminiscent of major Canadian banks freezing funds of those who donated to the 2022 Freedom Convoy, under the direction of former Prime Minister Justin Trudeau.

Under his invocation of the Emergencies Act, which was later ruled to be unjustified, the Trudeau government took the unprecedented step of freezing the bank accounts of hundreds who donated to and sympathized with the truckers to the tune of almost $8 million.

Banks

Debanking Is Real, And It’s Coming For You

From the Frontier Centre for Public Policy

Marco Navarro-Genie warns that debanking is turning into Ottawa’s weapon of choice to silence dissent, and only the provinces can step in to protect Canadians.

Disagree with the establishment and you risk losing your bank account

What looked like a narrow, post-convoy overreach has morphed into something much broader—and far more disturbing. Debanking isn’t a policy misfire. It’s turning into a systemic method of silencing dissent—not just in Canada, but across the Western world.

Across Canada, the U.S. and the U.K., people are being cut off from basic financial services not because they’ve broken any laws, but because they hold views or support causes the establishment disfavors. When I contacted Eva Chipiuk after RBC quietly shut down her account, she confirmed what others had only whispered: this is happening to a lot of people.

This abusive form of financial blacklisting is deep, deliberate and dangerous. In the U.K., Nigel Farage, leader of Reform UK and no stranger to controversy, was debanked under the fig leaf of financial justification. Internal memos later revealed the real reason: he was deemed a reputational risk. Cue the backlash, and by 2025, the bank was forced into a settlement complete with an apology and compensation. But the message had already been sent.

That message didn’t stay confined to Britain. And let’s not pretend it’s just private institutions playing favourites. Even in Alberta—where one might hope for a little more institutional backbone—Tamara Lich was denied an appointment to open an account at ATB Financial. That’s Alberta’s own Crown bank. If you think provincial ownership protects citizens from political interference, think again.

Fortunately, not every institution has lost its nerve. Bow Valley Credit Union, a smaller but principled operation, has taken a clear stance: it won’t debank Albertans over their political views or affiliations. In an era of bureaucratic cowardice, Bow Valley is acting like a credit union should: protective of its members and refreshingly unapologetic about it.

South of the border, things are shifting. On Aug. 7, 2025, U.S. President Donald Trump signed an executive order titled “Guaranteeing Fair Banking for All Americans.” The order prohibits financial institutions from denying service based on political affiliation, religion or other lawful activity. It also instructs U.S. regulators to scrap the squishy concept of “reputational risk”—the bureaucratic smoke screen used to justify debanking—and mandates a review of past decisions. Cases involving ideological bias must now be referred to the Department of Justice.

This isn’t just paperwork. It’s a blunt declaration: access to banking is a civil right. From now on, in the U.S., politically motivated debanking comes with consequences.

Of course, it’s not perfect. Critics were quick to notice that the order conveniently omits platforms like PayPal and other payment processors—companies that have been quietly normalizing debanking for over a decade. These are the folks who love vague “acceptable use” policies and ideological red lines that shift with the political winds. Their absence from the order raises more than a few eyebrows.

And the same goes for another set of financial gatekeepers hiding in plain sight. Credit card networks like Visa, American Express and Mastercard have become powerful, unaccountable referees, denying service to individuals and organizations labelled “controversial” for reasons that often boil down to politics.

If these players aren’t explicitly reined in, banks might play by the new rules while the rest of the financial ecosystem keeps enforcing ideological conformity by other means.

If access to money is a civil right, then that right must be protected across the entire payments system—not just at your local branch.

While the U.S. is attempting to shield its citizens from ideological discrimination, there is a noticeable silence in Canada. Not a word of concern from the government benches—or the opposition. The political class is united, apparently, in its indifference.

If Ottawa won’t act, provinces must. That makes things especially urgent for Alberta and Saskatchewan. These are the provinces where dissent from Ottawa’s policies is most common—and where citizens are most likely to face politically motivated financial retaliation.

But they’re not powerless. Both provinces boast robust credit union systems. Alberta even owns ATB Financial, a Crown bank originally created to protect Albertans from central Canadian interference. But ownership without political will is just branding.

If Alberta and Saskatchewan are serious about defending civil liberties, they should act now. They can legislate protections that prohibit financial blacklisting based on political affiliation or lawful advocacy. They can require due process before any account is frozen. They can strip “reputational risk” from the rulebooks and make it clear to Ottawa: using banks to punish dissenters won’t fly here.

Because once governments—or corporations doing their bidding—can cut off your access to money for holding the wrong opinion, democracy isn’t just threatened.

It’s already broken.

Marco Navarro-Genie is vice-president of research at the Frontier Centre for Public Policy and co-author, with Barry Cooper, of Canada’s COVID: The Story of a Pandemic Moral Panic (2023).

Banks

Debanking is Ottawa’s quiet tool to crush dissent

This article supplied by Troy Media.

By Lee Harding

By Lee Harding

The rise of debanking threatens free speech and financial rights. Canadians have a right to be worried

If you thought bank account freezes ended after the 2022 convoy, think again. “Debanking”—the practice of banks abruptly closing accounts, often without a clear explanation—is on the rise in Canada and the U.S., and it’s fast becoming a tool to silence dissent.

Alberta lawyer Eva Chipiuk is a recent debanking victim. On July 17, the Royal Bank of Canada (RBC) sent her a letter saying she could no longer have an account there. She posted RBC’s letter, which offered little explanation beyond stating her recent account activity was “outside of RBC’s client risk appetite,” on X. She was told to transfer her funds to another financial institution within 31 days.

In an interview with the Financial Post, Chipiuk said she had made two $1,000 transfers to cryptocurrency platform Shakepay Inc. over two consecutive days to buy Bitcoin. The second transfer was blocked by the bank and triggered an account freeze. She went to the bank to have her account restored. A few days after succeeding, she received the letter saying her accounts would again be closed until mid-August.

While banks often flag cryptocurrency transactions for review because of antimoney-laundering regulations, such activity is lawful.

If that alone were grounds for debanking, more than four million Canadians would be at risk. According to the Triple A Global Cryptocurrency

Report, about 10.1 per cent of Canadians own cryptocurrency.

However, buying crypto does not appear to be the real reason. Chipiuk represented protesters from the Freedom Convoy, which began in

opposition to COVID-19 vaccine mandates and sweeping pandemic restrictions, and cross-examined then-prime minister Justin Trudeau

in 2022 at the Public Order Emergency Commission hearings in Ottawa.

In 2022, Canadian banks froze $7.8 million from 200 accounts related to the convoy. A single mother in B.C. complained to her MP, Mark Strahl, that her bank account was frozen after giving a $50 donation to the convoy, which was legal at the time. In response, the prime minister and deputy prime minister said financial measures were meant only to target convoy leaders.

The convoy is over, but debanking is not. The Ombudsman for Banking Services and Investments opened 94 cases related to debanking in 2024 and 105 in 2023. A spokesperson for the organization told the Financial Post: “We are not able to challenge or change a bank’s decision. We are also generally not able to tell the consumer the bank’s reason for account closure.”

Debanking has also emerged as an issue in the United States. U.S. President Donald Trump complained about it in his Jan. 20 video conference with the World Economic Forum. He told Brian T. Moynihan, chair, president and CEO of Bank of America: “I hope you start opening your bank to conservatives because many conservatives complain that the banks are not allowing them to do business.”

Democratic Senator Elizabeth Warren agreed. At a Senate committee hearing on Feb. 8 entitled “Investigating the Real Impacts of Debanking in America,” she said: “Donald Trump was onto a real problem when he criticized Bank of America for its de-banking practices.”

Warren said de-banked U.S. customers “all reported common themes,” namely: “No warning. No explanation. No chance to dispute or appeal. They described how one day, all of a sudden, they lost their place in the banking system.” The Consumer Financial Protection Bureau has received 12,000 debanking complaints over the past three years. Georgia, Florida and Tennessee have introduced laws to curb debanking.

A completely de-banked person is left with only cash, but in Canada, Bill C-2 could significantly worsen their predicament. If passed, federal law will ban cash transactions of $10,000 or more to a business or non-profit for any given thing, whether that amount is in a lump sum or a series of payments.

Encroachments on free speech and financial rights are paving the way for a dystopian future, where those who refuse to bow to government diktat or bankfavoured ideologies are shut out of the financial system.

Canadians and Americans must defend their freedoms now, before a digital technocracy emerges to cancel and crush dissent.

Lee Harding is a research fellow for the Frontier Centre for Public Policy

Troy Media empowers Canadian community news outlets by providing independent, insightful analysis and commentary. Our mission is to support local media in helping Canadians stay informed and engaged by delivering reliable content that strengthens community connections and deepens understanding across the country.

-

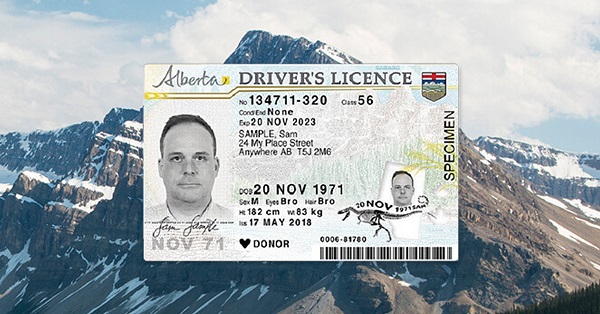

Alberta5 hours ago

Alberta5 hours agoAlberta first to add citizenship to licenses

-

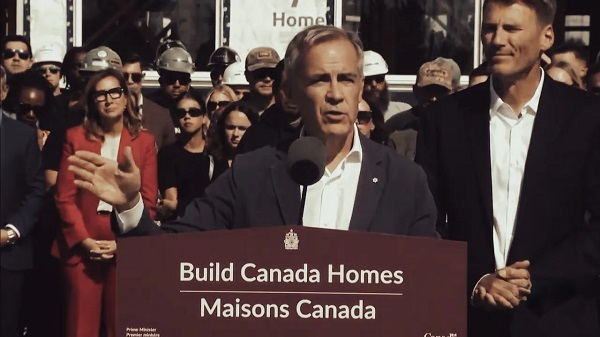

Business8 hours ago

Business8 hours agoCarney Admits Deficit Will Top $61.9 Billion, Unveils New Housing Bureaucracy

-

Business7 hours ago

Business7 hours agoCarney’s Ethics Test: Opposition MP’s To Challenge Prime Minister’s Financial Ties to China

-

Business6 hours ago

Business6 hours agoAttrition doesn’t go far enough, taxpayers need real cuts

-

Addictions2 days ago

Addictions2 days agoNo, Addicts Shouldn’t Make Drug Policy

-

Censorship Industrial Complex2 days ago

Censorship Industrial Complex2 days agoThe FCC Should Let Jimmy Kimmel Be

-

Alberta2 days ago

Alberta2 days agoEducation negotiations update: Minister Horner

-

COVID-192 days ago

COVID-192 days agoNew Study Obliterates the “Millions Saved” COVID Shot Myth