Business

Canada’s economic pain could be a blessing in disguise

This article supplied by Troy Media.

By Roslyn Kunin

By Roslyn Kunin

Tariffs, inflation, and falling incomes sound bad, but what if they’re forcing us to finally fix what’s broken?

Canada is facing serious economic headwinds—from falling incomes to rising inflation and U.S. trade hostility—but within this turmoil lies an opportunity. If we respond wisely, this crisis could become a turning point, forcing long-overdue reforms and helping us build a stronger, more independent economy.

Rather than reacting out of frustration, we can use these challenges to reassess what’s holding us back and move forward with practical solutions. From

trade policy to labour shortages and energy development, there are encouraging shifts already underway if we stay focused.

A key principle when under pressure is not to make things worse for ourselves. U.S. tariffs on Canadian steel and aluminum, and the chaotic renegotiation of NAFTA/CUSMA, certainly hurt our trade-dependent economy. But retaliatory tariffs don’t work in our favour. Canadian imports make

up a tiny fraction of the U.S. economy, so countermeasures barely register there, while Canadian consumers end up paying more. The federal government’s own countertariffs on items like orange juice and whisky raised costs here without changing American policy.

Fortunately, more Canadians are starting to realize this. Some provinces have reversed bans on U.S. goods. Saskatchewan, for example, recently lifted

restrictions on American alcohol. These decisions reflect a growing recognition that retaliating out of pride often means punishing ourselves.

More constructively, Canada is finally doing what should have happened long ago: diversifying trade. We’ve put too many economic eggs in one

basket, relying on an unpredictable U.S. market. Now, governments and businesses are looking for buyers elsewhere, an essential step toward greater stability.

At the same time, we’re starting to confront domestic barriers that have held us back. For years, it’s been easier for Canadian businesses to trade with the U.S. than to ship goods across provincial borders. These outdated restrictions—whether on wine, trucks or energy—have fractured our internal market. Now, federal and provincial governments are finally taking steps to create a unified national economy.

Labour shortages are another constraint limiting growth. Many Canadian businesses can’t find the skilled workers they need. But here, too, global shifts

are opening doors. The U.S.’s harsh immigration and research policies are pushing talent elsewhere, and Canada is emerging as the preferred alternative.

Scientists, engineers and graduate students, especially in tech and clean energy, are increasingly choosing Canada over the U.S. due to visa uncertainty and political instability. Our universities are already benefiting. If we continue to welcome international students and skilled professionals, we’ll gain a long-term advantage.

Just as global talent is rethinking where to invest their future, Canada has a chance to reassert leadership in one of its foundational industries: energy.

The federal government is now adopting a more balanced climate policy, shifting away from blanket opposition to carbon-based energy and focusing instead on practical innovation. Technologies such as carbon capture and storage are reducing emissions and helping clean up so-called dirty oil. These cleaner energy products are in demand globally.

To seize that opportunity, we need infrastructure: pipelines, refining capacity and delivery systems to get Canadian energy to world markets and across our own country. Projects like the Trans Mountain pipeline expansion, along with east-west grid connections and expanded refining, are critical to reducing dependence on U.S. imports and unlocking Canada’s full potential.

Perhaps the most crucial silver lining of all is a renewed awareness of the value of this country. As we approach July 1, more Canadians are recognizing how fortunate we are. Watching the fragility of democracy in the U.S., and confronting the uncomfortable idea of being reduced to a 51st state, has reminded us that Canada matters. Not just to us, but to the world.

Dr. Roslyn Kunin is a respected Canadian economist known for her extensive work in economic forecasting, public policy, and labour market analysis. She has held various prominent roles, including serving as the regional director for the federal government’s Department of Employment and Immigration in British Columbia and Yukon and as an adjunct professor at the University of British Columbia. Dr. Kunin is also recognized for her contributions to economic development, particularly in Western Canada.

Troy Media empowers Canadian community news outlets by providing independent, insightful analysis and commentary. Our mission is to support local media in helping Canadians stay informed and engaged by delivering reliable content that strengthens community connections and deepens understanding across the country.

Artificial Intelligence

Lawsuit Claims Google Secretly Used Gemini AI to Scan Private Gmail and Chat Data

Whether the claims are true or not, privacy in Google’s universe has long been less a right than a nostalgic illusion.

|

When Google flipped a digital switch in October 2025, few users noticed anything unusual.

Gmail loaded as usual, Chat messages zipped across screens, and Meet calls continued without interruption.

Yet, according to a new class action lawsuit, something significant had changed beneath the surface.

We obtained a copy of the lawsuit for you here.

Plaintiffs claim that Google silently activated its artificial intelligence system, Gemini, across its communication platforms, turning private conversations into raw material for machine analysis.

The lawsuit, filed by Thomas Thele and Melo Porter, describes a scenario that reads like a breach of trust.

It accuses Google of enabling Gemini to “access and exploit the entire recorded history of its users’ private communications, including literally every email and attachment sent and received.”

The filing argues that the company’s conduct “violates its users’ reasonable expectations of privacy.”

Until early October, Gemini’s data processing was supposedly available only to those who opted in.

Then, the plaintiffs claim, Google “turned it on for everyone by default,” allowing the system to mine the contents of emails, attachments, and conversations across Gmail, Chat, and Meet.

The complaint points to a particular line in Google’s settings, “When you turn this setting on, you agree,” as misleading, since the feature “had already been switched on.”

This, according to the filing, represents a deliberate misdirection designed to create the illusion of consent where none existed.

There is a certain irony woven through the outrage. For all the noise about privacy, most users long ago accepted the quiet trade that powers Google’s empire.

They search, share, and store their digital lives inside Google’s ecosystem, knowing the company thrives on data.

The lawsuit may sound shocking, but for many, it simply exposes what has been implicit all along: if you live in Google’s world, privacy has already been priced into the convenience.

Thele warns that Gemini’s access could expose “financial information and records, employment information and records, religious affiliations and activities, political affiliations and activities, medical care and records, the identities of his family, friends, and other contacts, social habits and activities, eating habits, shopping habits, exercise habits, [and] the extent to which he is involved in the activities of his children.”

In other words, the system’s reach, if the allegations prove true, could extend into nearly every aspect of a user’s personal life.

The plaintiffs argue that Gemini’s analytical capabilities allow Google to “cross-reference and conduct unlimited analysis toward unmerited, improper, and monetizable insights” about users’ private relationships and behaviors.

The complaint brands the company’s actions as “deceptive and unethical,” claiming Google “surreptitiously turned on this AI tracking ‘feature’ without informing or obtaining the consent of Plaintiffs and Class Members.” Such conduct, it says, is “highly offensive” and “defies social norms.”

The case invokes a formidable set of statutes, including the California Invasion of Privacy Act, the California Computer Data Access and Fraud Act, the Stored Communications Act, and California’s constitutional right to privacy.

Google is yet to comment on the filing.

|

|

|

|

Reclaim The Net is reader-supported. Consider becoming a paid subscriber.

|

|

|

|

Business

Nearly One-Quarter of Consumer-Goods Firms Preparing to Exit Canada, Industry CEO Warns Parliament

Standing Committee on Industry and Technology hears stark testimony that rising costs and stalled investment are pushing companies out of the Canadian market.

There’s a number that should stop this country cold: twenty-three percent. That is the share of companies in one of Canada’s essential manufacturing and consumer-goods sectors now preparing to withdraw products from the Canadian market or exit entirely within the next two years. And this wasn’t whispered at a business luncheon or buried in a consultancy memo. It was delivered straight to Parliament, at the House of Commons Standing Committee on Industry and Technology, during its study on Canada’s underlying productivity gaps and capital outflow.

Michael Graydon, the CEO of Food, Health & Consumer Products of Canada, didn’t hedge or soften the message. He told MPs, “23% of our members expect to exit products from the Canadian marketplace within the next two years, because the cost of doing business here has just become unsustainable.”

Unsustainable. That’s the word he used. And when the people who actually make things in this country start using that word, you should pay attention. These aren’t fringe players or hypothetical startups. These are firms that supply the goods Canadians buy every single day, and they’re looking at their balance sheets, their regulatory burdens, the delays in getting anything approved or built, and concluding that Canada simply doesn’t work for them anymore.

What makes this more troubling is the timing. Canada’s investment levels have been falling for years, even as the United States and other competitors race ahead. Businesses aren’t reinvesting in machinery or technology at the rate they once did. They’re not modernizing their operations here. They’re putting expansion plans on hold or shifting them to jurisdictions that move faster, cost less and offer clearer rules. That’s not ideology; it’s arithmetic. If it costs more to operate here, if it takes longer to get a permit, and if supply chains back up because ports and rail lines are jammed, investors will choose the place that doesn’t make growth a bureaucratic mountain climb.

Graydon raised another point that ought to concern anyone who cares about domestic production. Canada’s agrifood sector recorded a sixty-billion-dollar trade surplus last year, one of the brightest spots in the national economy, but according to him that potential is being “diluted by fragmented interprovincial trade and logistics bottlenecks.” The ports, the rail corridors, the entire transport network—choke points everywhere. And you can’t build a productive economy on choke points. Companies can’t scale, can’t guarantee delivery, can’t justify the costs. So they leave.

This twenty-three percent figure is the clearest evidence yet that the problem isn’t theoretical. It’s not something for think-tank panels or academic papers. It is happening at the level that matters most: the decision whether to continue doing business in Canada or move operations somewhere more predictable. And once those decisions are made, they’re very hard to reverse. Capital doesn’t boomerang back out of patriotism. It goes where it can earn a return.

For years, Canadian policymakers have talked about productivity as if it were a moral failing of workers or a mystical national characteristic. It’s neither. Productivity comes from investment—real money poured into equipment, technology, training and expansion. When investment stalls, productivity collapses. And when a quarter of firms in a major sector are already planning their exit, you are not looking at a temporary dip. You are looking at a structural rejection of the business environment itself.

The fact that executives are now openly warning Parliament that they cannot afford to stay is a moment of clarity. It is also a test. Either this country becomes a place where people can build things again—quickly, affordably, competitively—or it continues down the path that leads to empty factories, hollowed-out supply chains and consumers who wonder why the shelves look thinner every year.

Twenty-three percent is not just a statistic. It’s the sound of a warning bell ringing at full volume. The only question now is whether anyone in charge hears it.

-

Carbon Tax1 day ago

Carbon Tax1 day agoCarney fails to undo Trudeau’s devastating energy policies

-

Daily Caller2 days ago

Daily Caller2 days ago‘Holy Sh*t!’: Podcaster Aghast As Charlie Kirk’s Security Leader Reads Texts He Allegedly Sent University Police

-

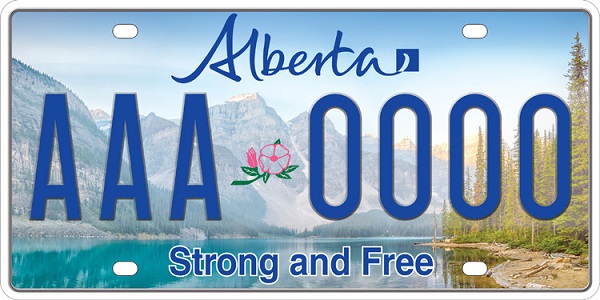

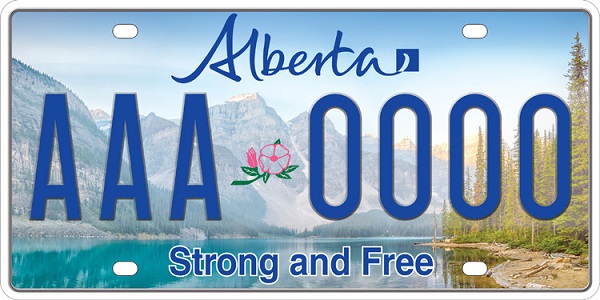

Alberta1 day ago

Alberta1 day agoAlbertans choose new licence plate design with the “Strong and Free” motto

-

Agriculture2 days ago

Agriculture2 days agoFederal cabinet calls for Canadian bank used primarily by white farmers to be more diverse

-

Business2 days ago

Business2 days agoThe UN Pushing Carbon Taxes, Punishing Prosperity, And Promoting Poverty

-

Great Reset2 days ago

Great Reset2 days agoCanadian government forcing doctors to promote euthanasia to patients: report

-

Alberta1 day ago

Alberta1 day agoEdmonton and Red Deer to Host 2027 IIHF World Junior Hockey Championship

-

Health1 day ago

Health1 day agoNEW STUDY: Infant Vaccine “Intensity” Strongly Predicts Autism Rates Worldwide