Business

To Build BIG THINGS Canada Needs to Rid Itself of BIG BARRIERS

From Energy Now

By Deidra Garyk

We find ourselves at the intersection of energy reality and sustainability. The convergence means the way we do business globally is morphing. Some see opportunity in the most unlikely of places, while others only see obstacles.

A new report by the Public Policy Forum entitled Build Big Things: A playbook to turbocharge investment in major energy, critical minerals and infrastructure projects makes a case for why Canada should find the opportunities and how we can do that.

Analysis done by Calgary’s own economist and professor Trevor Tombe identified that Canada’s real GDP per capita growth from 2015 to 2024 was 1.4 percent. This puts us in second-last position among OECD countries.

Canada also took the penultimate spot among OECD countries for the time it takes to get a construction permit. As the graph shows, this isn’t a partisan problem; therefore, it can’t be corrected with a partisan solution. Although, noticeably, we have slipped further over the last few years. For multinational corporations that can invest anywhere, Canada’s ease of doing business appeal is not attractive, and that hampers our ability to build big things.

Fortunately, some jurisdictions are doing something about unnecessarily burdensome regulations. Alberta’s Red Tape Reduction initiative has removed over 200,000 regulations for net savings of $3 billion, a number tallied by the businesses impacted, not government. These are duplicative or archaic rules that added limited to no protections and removing them has not exacerbated risks. Work is still ongoing to ensure the balance is right.

BC is also fast-tracking projects, recognizing the need to build to remain a modern society. By shifting energy development permitting to the BC Energy Regulator, project timelines have improved.

The regulatory barriers affect more than traditional energy development. A new mining project in Canada can take anywhere from 15 to 25 years from application to operation. Energy, mining and infrastructure projects go through three to six years of federal regulatory review processes, in addition to provincial reviews. This is unacceptable if Canada is to meet the resource demands of the future.

The Report makes the case that, “[p]rioritizing nation-building projects such as ports, rail and roads is essential to strengthening internal economic linkages, enhancing export competitiveness and ensuring supply chains remain resilient and globally competitive.”

It goes on to cite, “barriers to success that include: burdensome regulatory processes and permitting procedures; insufficient financial supports and difficulty accessing capital, particularly in the crucial, high-risk development stages before getting to FID; inadequate infrastructure such as roads, bridges and ports; and a persistent lack of capacity and capital among Indigenous groups to participate fully as partners in new projects.”

There’s waning interest from the public in shrill anti-resource activism that puts their current lives and livelihoods at risk. Average weekly earnings in Alberta haven’t changed over the last ten years. Canada is one of the most indebted countries in the world, including subnational and consumer debt. This means that we are not as easily able to strategically act to deal with issues or embrace opportunities.

The report offers four strategic pillars for action:

- Co-ordinated financing: Align public and private funding sources to support priority projects and close investment gaps. Governments should not always aim to be the first or primary source of funding. The most effective role for public financing is often in de-risking projects,

- Efficient and effective regulations: Reconfigure regulatory and permitting processes to get to “yes” much more quickly, providing clearer timelines, improved efficiency and effectiveness, greater certainty, enhanced environmental performance, and a more strategic role for economic regulators across jurisdictions.

- Enabling critical infrastructure: Take a systems-level approach to planning to ensure that foundational infrastructure and skilled labour are in place to support future growth.

- Increasing Indigenous economic participation: Strengthen partnerships between project proponents, government institutions and Indigenous rights-holders to support meaningful Indigenous involvement in major projects, including through improved access to capital, stronger ownership opportunities and continuous capacity building.

Canadians must define who we are and who we want to be, on our own terms. We must change the mindset from fear to opportunity and be proud to be producers of primary materials. We need a kick in the pants to move towards taking calculated risks rather than running away, hoping for security because of our fears. We must build big things.

Deidra Garyk is the Founder and President of Equipois:ability Advisory, a consulting firm specializing in sustainability solutions. Over 20 years in the Canadian energy sector, Deidra held key roles, where she focused on a broad range of initiatives, from sustainability reporting to fostering collaboration among industry stakeholders through her work in joint venture contracts.

Outside of her professional commitments, Deidra is an energy advocate and a recognized thought leader. She is passionate about promoting balanced, fact-based discussions on energy policy, and sustainability. Through her research, writing, and public speaking, Deidra seeks to advance a more informed and pragmatic dialogue on the future of energy.

Business

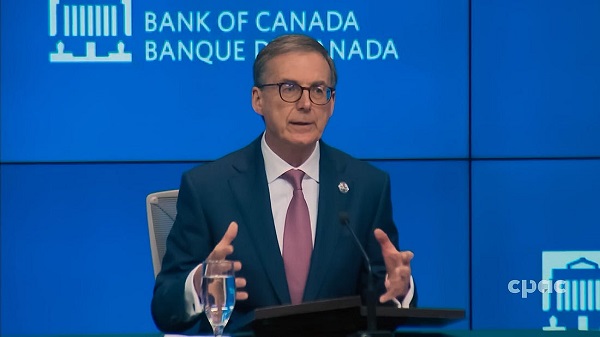

Bank of Canada Flags Challenges Amid Absence of Federal Budget

Dan Knight

Dan Knight

Governor Tiff Macklem signals the central bank is flying blind as Mark Carney’s Liberal government withholds fiscal plans, leaving Canadians to face rising prices and economic uncertainty.

The Bank of Canada—yes, the people in charge of stabilizing your currency, protecting your savings, and guiding the economy through the storm—held a press conference. The takeaway? They have no idea what’s going on.

If you missed it, Governor Tiff Macklem stood at the podium and told Canadians, with a straight face, that the Bank is keeping interest rates unchanged at 2.75%. Now, if you’re expecting that decision to come with some clarity, a plan, maybe even a roadmap for the months ahead—don’t hold your breath.

Why? Because Macklem said the Bank’s navigating ‘unusual uncertainty’ from U.S. trade moves, and they’re too unsure to pin down a forecast. Instead, they’re waiting for more numbers to make sense of the mess.

Just pause and think about that for a second. The central bank of one of the wealthiest nations on Earth—tasked with steering the economy—is flying blind.

But don’t worry, we were told. A rate cut might come in July. Maybe. Depending on how inflation behaves. Depending on how the economy holds up. Depending on a whole list of things no one can actually predict right now. Macklem says it depends on inflation being “contained.” But look around—consumer spending is falling, housing is slowing down, and people are losing jobs in sectors tied to trade. And he knows it.

He said, “The second quarter is expected to be much weaker.” Why? Because the growth we saw earlier this year was a mirage. Canadian companies rushed to export goods before U.S. tariffs hit. That inflated Q1 GDP to 2.2%. Now the adrenaline is gone and reality is setting in.

He didn’t say we’re in trouble. But he didn’t need to. When your central banker says growth was “pulled forward” and Q2 will be “much weaker,” he’s telling you the economy is already running on fumes.

And then there’s inflation. Now, according to the headlines, inflation dropped to 1.7% in April. Sounds good, right? Until you look at why. The reason inflation dropped is because the federal government eliminated the carbon tax, which temporarily lowered gas prices. That policy change alone knocked 0.6 percentage points off inflation. Not because goods got cheaper—because the tax man backed off for once.

Meanwhile, core inflation—the kind that actually matters—went up. Higher food prices, rising goods prices, supply chain costs—it’s all hitting Canadian businesses and families right now. Macklem even said it himself: “Underlying inflation could be firmer than we thought.”

So what does the Bank do when prices are rising for the wrong reasons and growth is falling for the right ones? Apparently, they wait. They gather “intel” from business owners and talk about “soft data.” That’s the technical term now: soft data.

But the real kicker—what’s actually driving a lot of this chaos—is U.S. trade policy. Tariffs are back. Yes, tariffs on Canadian steel and aluminum were doubled again. And Macklem admitted that unpredictability is the biggest threat we’re facing. He said: “The trade conflict initiated by the United States remains the biggest headwind facing the Canadian economy.”

And what has Canada done to protect itself from that risk? Absolutely nothing.

In fact, Macklem came right out and admitted it. He said Canada’s overdependence on U.S. trade has been obvious for years. Here’s the quote:

“Canada’s trade is very concentrated with the United States. Look, it’s always going to be concentrated with the United States… but that doesn’t mean we can’t diversify our trade.”

So the solution has been obvious for decades. Diversify our exports. Strengthen our own internal market. Get serious about reducing interprovincial trade barriers—yes, those still exist in this country. But none of it happened. None of it. Not under Trudeau. Not under Chrystia Freeland. And certainly not under the new “caretaker” prime minister, Mark Carney—Trudeau’s old global finance buddy.

The Deafening Silence from Ottawa: No Budget, No Plan, No Leadership

Now, let’s talk about what Tiff Macklem didn’t say—but might as well have.

At a time when Canadians are facing real economic stress—on housing, food, jobs, and savings—the Liberal government under Mark Carney has failed to table a federal budget. Let that sink in. We’re halfway through 2025, inflation is shifting, trade policy is in turmoil, and the federal government has not provided a single fiscal blueprint.

This isn’t just a minor oversight. In a presser filled with caution, hedging, and uncertainty, Macklem was asked point-blank how the lack of a spring budget is affecting the Bank’s ability to do its job. His answer? Chilling in its understatement:

“Whatever announcements come out of the government that are… concrete, clear plans with numbers on them—we will take those on board.”

But here’s the thing: there are no numbers. There are no “concrete” plans. There is no spring budget. Which means the Bank of Canada is operating without a fiscal anchor.

And that’s not a partisan jab. That’s a direct acknowledgment from the central bank governor. Monetary policy doesn’t exist in a vacuum. It relies on fiscal policy—how much Ottawa plans to spend, what kind of debt it’s taking on, whether it’s injecting or withdrawing demand from the economy. Without that information, the Bank is effectively being asked to navigate blindfolded.

Macklem was careful, as central bankers always are, but he sent a signal to anyone paying attention: the absence of fiscal clarity is a problem. In his words, it “complicates monetary policy planning.” That’s about as blunt as a central banker gets.

Yet in a moment of unintended honesty, he added this:

“To be frank, the budget is not the biggest source of uncertainty… It’s U.S. tariffs.”

Well, sure. America’s economic unpredictability is real. But what Macklem didn’t say—but we all know—is this: Canada’s lack of internal leadership is a close second. And that’s the part Ottawa doesn’t want to talk about.

And here’s the part that’s impossible to ignore, even if every outlet in this country refuses to say it: Mark Carney knows better.

He used to run central banks. That’s his entire résumé. He understands, better than anyone, that monetary policy doesn’t function in a fiscal vacuum. He knows the Bank of Canada requires a federal budget to plan ahead. He knows you can’t forecast inflation or economic activity if the federal government won’t even tell you how much it plans to spend, borrow, or tax. That’s not some fringe economic theory, that’s Monetary Policy 101.

And yet, despite knowing all of this, Carney is choosing not to deliver a budget. He’s actively keeping the Bank of Canada in the dark. Why?

Well, maybe it’s because he doesn’t want to show you the numbers. Because the numbers are bad. Because the spending is out of control. Because the debt is spiraling. Because if he puts it all on paper, if he gives us the hard data, then suddenly, the opposition can do what it’s supposed to do: hold his government to account.

And maybe, just maybe, Carney doesn’t want that. Not yet. Not so early in his reign as Trudeau’s heir. He doesn’t want the Conservative Party pulling apart his economic plan, and he certainly doesn’t want the Canadian people realizing that we are not collecting retaliatory tariffs on U.S. goods, even as the Americans hammer us again with steel and aluminum levies.

He doesn’t want you to see the imbalance. Because if you did, if the average Canadian saw how weak and passive this country has become in the face of American economic aggression, you’d be furious. You’d demand answers. You’d demand change.

But instead, its all, “elbows down.” Quietly filtered out of the official narrative. No plan, no numbers, no debate—just vague promises, half-hearted reassurances, and a press conference where your central banker admits he’s guessing.

And you, the ordinary Canadian, are stuck with the consequences. You feel it every time you go to the grocery store. Food prices are still climbing. The latest inflation data shows that even as headline numbers tick down, your groceries are getting more expensive. Your paycheque isn’t going as far. And nobody in power seems to care enough to fix it.

So here’s the truth: the system is rigged. Not in some conspiratorial way, but in the most obvious, bureaucratic, cowardly way imaginable. Those in charge know the damage they’re causing. They just don’t want to be blamed for it.

And as always, it’s the people who work, save, and pay taxes—the people who still believe in this country—who get left holding the bag.

So the next time they tell you “everything is under control,” ask yourself: whose hands are on the wheel?

Because right now, it sure doesn’t look like anyone is driving.

Good-day, Canada.

Subscribe to The Opposition with Dan Knight .

For the full experience, upgrade your subscription.

Business

This Sunday, June 8, is Tax Freedom Day, when Canadians finally start working for themselves

From the Fraser Institute

By Milagros Palacios, Jake Fuss and Nathaniel Li

This Sunday, June 8, Canadians will celebrate Tax Freedom Day, the day in the year when they start working for themselves and not government, finds a new study published by the Fraser Institute, an independent, non-partisan Canadian public policy think-tank.

“If Canadians paid all their taxes up front, they would work the first 158 days of this year before bringing any money home for themselves and their families,” said Jake Fuss, director of fiscal studies at the Fraser Institute.

Tax Freedom Day measures the total annual tax burden imposed on Canadian families by federal, provincial, and municipal governments.

In 2025, the average Canadian family (with two or more people) will pay $68,266 in total taxes. That’s 43.1 per cent of its annual income ($158,533) going to income taxes, payrolltaxes (including the Canada Pension Plan), health taxes, sales taxes (like the GST), property taxes, fuel taxes, “sin” taxes and more.

Represented as days on the calendar, the total tax burden comprises more than five months of income—from January 1 to June 7. On June 8th—Tax Freedom Day—Canadians finally start working for themselves, and not government.

But Canadians should also be worried about the nearly $90 billion in deficits the federal and provincial governments are forecasting this year, because they will have substantial tax implications in future years.

To better illustrate this point, the study also calculates a Balanced Budget Tax Freedom Day—the day of the year when the average Canadian finally would finally start working for themselves if governments paid for all of this year’s spending with taxes collected this year.

In 2025, the Balanced Budget Tax Freedom Day won’t arrive until June 21. “Tax Freedom Day helps put the total tax burden in perspective, and helps Canadians understand just how much of their money they pay in taxes every year,” Fuss said. “Canadians need to decide for themselves whether they are getting their money’s worth when it comes to how governments are spending their tax dollars.”

Tax Freedom Day for each province varies according to the extent of the provincially and locally levied tax burden.

2025 Provincial Tax Freedom Days

Manitoba May 17

Saskatchewan May 31

British Columbia May 31

Alberta May 31

Prince Edward Island June 2

New Brunswick June 4

Ontario June 7

Nova Scotia June 10

Newfoundland & Labrador June 19

Quebec June 21

CANADA June 8

Canadians Celebrate Tax Freedom Day on June 8, 2025

- In 2025, the average Canadian family will earn $158,533 in income and pay an estimated $68,266 in total taxes (43.1%).

- If the average Canadian family had to pay its taxes up front, it would have worked until June 7 to pay the total tax bill imposed on it by all three levels of government (federal, provincial, and local).

- This means that Tax Freedom Day, the day in the year when the average Canadian family has earned enough money to pay the taxes imposed on it, falls on June 8.

- Tax Freedom Day in 2025 comes one day earlier than in 2024, when it fell on June 9. This change is due to the expectation that the total tax revenues forecasted by Canadian governments will increase slower than the incomes of Canadians.

- Tax Freedom Day for each province varies according to the extent of the provincially levied tax burden. The earliest provincial Tax Freedom Day falls on May 17 in Manitoba, while the latest falls on June 21 in Quebec.

- Canadians are right to be thinking about the tax implications of the $89.4 billion in projected federal and provincial government deficits in 2025. For this reason, we calculated a Balanced Budget Tax Freedom Day, the day on which average Canadians would start working for themselves if governments were obliged to cover current expenditures with current taxation. In 2025, the Balanced Budget Tax Freedom Day arrives on June 21.

-

Business2 days ago

Business2 days agoCarney’s Energy Mirage: Why the Prospects of Economic Recovery Remain Bleak

-

National2 days ago

National2 days agoCensured doctor who’s now a Conservative MP calls COVID mandates ‘full Communism’

-

Censorship Industrial Complex2 days ago

Censorship Industrial Complex2 days agoBC nurse faces $163k legal bill for co-sponsored a billboard reading, “I [heart] JK Rowling.”

-

Censorship Industrial Complex1 day ago

Censorship Industrial Complex1 day agoLegal warning sent to Ontario school board for suspending elected school council member

-

Daily Caller2 days ago

Daily Caller2 days agoLiberals Embrace Islamic Extremism In Canada

-

Business1 day ago

Business1 day agoThis Sunday, June 8, is Tax Freedom Day, when Canadians finally start working for themselves

-

Fraser Institute1 day ago

Fraser Institute1 day agoHealth-care lessons from Switzerland for a Canada ready for reform

-

Bruce Dowbiggin1 day ago

Bruce Dowbiggin1 day agoI’m A Victim, You’re A Victim, Wouldn’t You Like To Be A Victim, Too?