Fraser Institute

Atlantic provinces should focus on growth—despite Carney’s transfer policies

From the Fraser Institute

By Alex Whalen

In his election platform, Prime Minister Mark Carney promised there will be no cuts to federal transfers for the duration of the his government’s term. Nowhere is this pledge more relevant than in Atlantic Canada. As of last year, federal transfers represented 33.4 per cent to 38.7 per cent of provincial revenues in the Maritimes (the highest levels in Canada), and 19.0 per cent in Newfoundland and Labrador.

Why? Mainly because of Canada’s equalization program, which (to paraphrase) redistributes federal funds to poorer provinces to help them maintain comparable service levels.

Setting aside the various issues of the equalization program, self-sufficiency and economic growth has been thrust to the forefront in Atlantic Canada recently, due in part to President Trump’s destructive economic policies, and perhaps also due to the prospect of policy change at the federal level. Premier Tim Houston has talked explicitly about the need for Nova Scotia to be more self-reliant, while the Council of Atlantic Premiers has emphasized the need for collaboration, removal of regional barriers and the imperative to strengthen the economy.

In a region with a long history of being dominated by government, there’s a risk that Carney’s policy to maintain federal transfers, or a stabilization in Canada-U.S. relations, may reduce the perceived importance of the newfound emphasis on growth. This would be a mistake.

In fact, creating the policy conditions for stronger growth, and therefore reducing reliance on federal transfers, should be a top priority for all four governments in Atlantic Canada, regardless of Trump or Carney’s policies. So, what can be done?

Nova Scotia’s recent policy shift to emphasize natural resource development—including removing bans on uranium mining and fracking for natural gas—is a good start. New Brunswick’s new government has also emphasized the importance of increased mining activity to grow its economy. Natural resource development attracts much-needed investment and jobs that pay well above average wages. However, the industry faces a large regulatory burden and governments must be laser-focused on improving competitiveness. Secondly, governments in the region should restrain spending and redirect those funds to lower their crushing tax burdens. The four Atlantic provinces have among the highest personal income and business income taxes in North America, both of which hurt growth by making the region relatively less attractive for people and capital.

More government does not work. Some provincial governments such as British Columbia and Ontario have used the economic situation spurred by President Trump to open up provincial spending taps, which is a costly approach. Again, Atlantic Canada is the most government-dominated region in the country, and an extensive body of research has connected excessively large government with slower growth.

The newfound emphasis on growth and self-sufficiency among Atlantic Canada’s premiers is a welcome development. Growing incomes and improving living standards should be a top priority for all governments in the region. Higher levels of economic growth would mean lower federal transfers, which would better position the region for any fluctuations ahead. Carney’s transfer policy must not breed complacency among Atlantic premiers.

Business

New PBO report underscores need for serious fiscal reform in Ottawa

From the Fraser Institute

By Jake Fuss and Grady Munro

The PBO expects total federal debt to reach $2.9 trillion by 2029/30—roughly equivalent to 80 per cent of the entire Canadian economy in that year.

Ahead of this year’s long-awaited federal budget—Prime Minister Carney’s first at the helm—a new report paints a picture of what we might expect federal finances to look like. The picture is not pretty, and the numbers underscore the serious need for the government to change course immediately.

The new report comes from the independent Parliamentary Budgetary Officer (PBO)—Ottawa’s fiscal watchdog. While the PBO’s outlook offers some general insight as to what we can expect from the upcoming November 4 budget, we shouldn’t hang our hat on the exact estimates. Excluded from the report are major new measures including the Carney government’s pledge to raise military spending to 5 per cent of GDP by 2035, the government’s spending review, and the launch of “Build Canada Homes.”

However, the report demonstrates a clear need for serious fiscal reform.

First and foremost, the PBO projects dramatically higher annual budget deficits than were previously projected in last year’s fall economic statement—the last official government fiscal update—which already included a concerning forecast for federal finances. Budget deficits arise when the government spends more than it raises in revenues during the year, and must borrow money to make up the difference. Previously, the government planned to borrow a combined $202.7 billion over the six years from 2024/25 to 2029/30. Now, the PBO estimates combined federal deficits will reach $366.2 billion over that same period.

Put differently, for the six years from 2024/25 to 2029/30, the average deficit is expected to be $61.0 billion—nearly four times the six-year average of $15.8 billion the government ran before the pandemic.

According to the PBO, this $163.5 billion increase in combined federal deficits is driven by the effects of lower expected revenues, alongside higher expected spending on both government programs and debt interest payments. There are many reasons underlying these changes including the economic impact of U.S. tariffs, increased defence spending to reach 2 per cent of GDP, and the federal personal income tax cut. But this represents an alarming plunge deeper into the red.

The primary consequence of deficits is an increase in the mountain of debt held by the government. Previously, total federal debt was expected to rise from $2.1 trillion in 2023/24—a big number after a substantial run-up in debt from the previous decade—to $2.6 trillion by 2029/30. Now, the PBO expects total federal debt to reach $2.9 trillion by 2029/30—roughly equivalent to 80 per cent of the entire Canadian economy in that year.

Government borrowing and debt costs fall squarely on the backs of Canadians. For instance, similar to a family with a mortgage, the government must pay interest on its debt. As the government continues to accumulate more and more debt, all else equal, the amount it spends on interest will also rise. And each taxpayer dollar spent on interest is a dollar diverted from government programs or potential tax relief for Canadians.

Rising government debt also acts as a drag on the overall economy. Both the government and the private sector compete for scarce resources and it becomes more expensive for everyone to borrow money. Therefore, those in the private sector can be discouraged from borrowing money to invest into Canadian businesses.

New projections on the state of federal finances paint a dire picture of huge deficits and massive debt accumulation. The Carney government should implement major fiscal reform to avoid this future.

Fraser Institute

Aboriginal rights now more constitutionally powerful than any Charter right

From the Fraser Institute

By Bruce Pardy

A judge of the British Columbia Supreme Court recently found that the Cowichan First Nation holds Aboriginal title over 800 acres of government land in Richmond, British Columbia. Wherever Aboriginal title is found to exist, said the court, it’s a “prior and senior right” to fee simple title, whether public or private. That means it trumps the property that Canadians hold in their houses, farms and factories.

In Canada, property rights do not have constitutional status. No right to property is included in the Charter of Rights and Freedoms. Fee simple title is merely a gloss on the state’s constitutional authority to tax, regulate and expropriate private property as it sees fit. But Aboriginal rights are different. They have become more constitutionally powerful than any Charter right.

In 1968, then-Justice Minister Pierre Trudeau released a consultation paper that proposed a constitutional charter of human rights. It was the first iteration of what would become the Charter. In the paper, Trudeau proposed to guarantee a right to property. So did drafts that followed. But some provincial governments were dead set against entrenching property rights. By 1980, property had been dropped from proposals. The final version of the Charter, adopted in 1982, does not mention it. Canada’s Constitution does not protect property rights.

Except for Aboriginal property. Trudeau’s 1968 paper made no mention of Aboriginal rights, nor did drafts leading up to the 1980 proposal. Aboriginal groups and their supporters launched a campaign to have Aboriginal rights recognized. They succeeded just in time. Section 35, essentially an afterthought, recognized and affirmed the “existing aboriginal and treaty rights of the aboriginal peoples of Canada.” That section was put into the Constitution but not as part of the Charter. That might sound like section 35 is weaker than a Charter right, but it’s the opposite.

Section 35 affirms Aboriginal rights that existed as of 1982. But since 1982, the Supreme Court of Canada has used section 35 to champion, enlarge and reimagine Aboriginal rights. The Court has “discovered” rights never recognized in the law before 1982. In 1997, it articulated a new vision of Aboriginal title. In 2004, it established the Crown’s “duty to consult.” In 2014, it recognized Aboriginal title over a tract of Crown land. In 2021, it gave Aboriginal rights under section 35 to an American Indigenous group.

Now the B.C. court in the Cowichan decision has said that Aboriginal title takes precedence over private property. Last November, a judge of the New Brunswick King’s Bench suggested similarly. Where a claim of Aboriginal title succeeds over land held in fee simple, she said, the court may instruct the government to expropriate the private property and hand it over to the Aboriginal group.

Governments and legislatures have shown little inclination to turn back these developments. But even if they wanted to, the Constitution stands in the way.

Section 33 of the Charter, the “Notwithstanding clause” (NWC), allows provincial legislatures and the federal Parliament to enact legislation notwithstanding the Charter rights guaranteed in sections 2 and 7 to 15. That means that they can pass statutes that might infringe these Charter rights. Use of the NWC clause prevents courts from striking down the statute as unconstitutional. The main part of the NWC reads:

33. (1) Parliament or the legislature of a province may expressly declare in an Act of Parliament or of the legislature, as the case may be, that the Act or a provision thereof shall operate notwithstanding a provision included in section 2 or sections 7 to 15 of this Charter.

Section 35 is not part of the Charter. It is not subject to the NWC. Legislatures cannot ignore it, legislate around it, or change its meaning. Barring a constitutional amendment, courts have exclusive domain over the scope and application of section 35. In the constitutional hierarchy, Aboriginal rights rest above the “fundamental freedoms” and rights of the Charter.

Lest there was any doubt about that status, section 25 of the Charter spells it out. Charter rights and freedoms, the section says, “shall not be construed so as to abrogate or derogate from any aboriginal, treaty or other rights or freedoms that pertain to the aboriginal peoples of Canada.”

That does not mean that Aboriginal rights are absolute. Legislation or government action may sometimes infringe Aboriginal rights. But courts, not legislatures, control when, where, and under what circumstances that can happen. The Supreme Court of Canada has established the process and criteria by which governments must justify infringements of section 35 to the courts’ satisfaction.

Section 35, like much of the rest of the Constitution, is subject to an onerous amending formula. It cannot be easily changed or repealed.

-

Business2 days ago

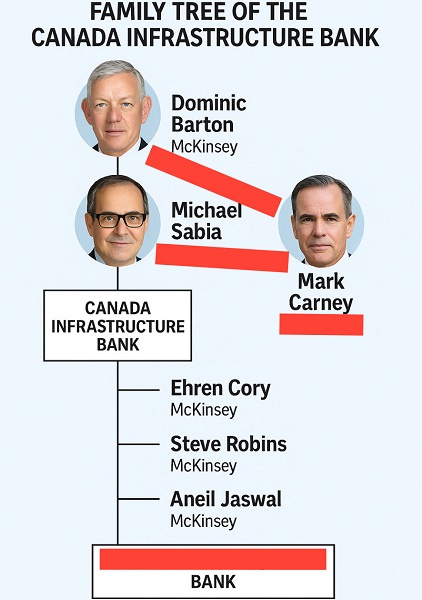

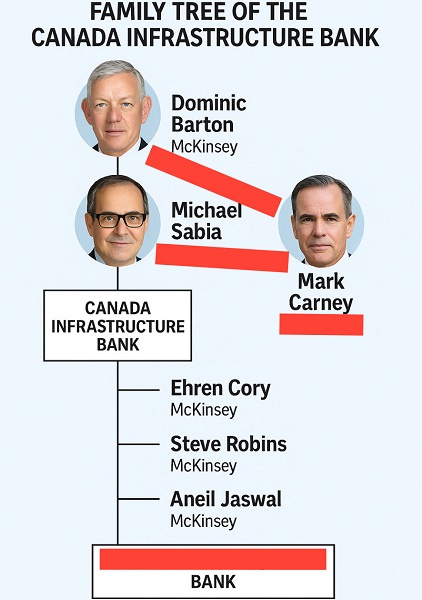

Business2 days agoDominic Barton’s Shadow Over $1-Billion PRC Ferry Deal: An Investigative Op-Ed

-

Alberta2 days ago

Alberta2 days agoAlberta refuses to take part in Canadian government’s gun buyback program

-

Censorship Industrial Complex2 days ago

Censorship Industrial Complex2 days agoCanada To Revive Online Censorship Targeting “Harmful” Content, “Hate” Speech, and Deepfakes

-

Alberta2 days ago

Alberta2 days agoOrthodox church burns to the ground in another suspected arson in Alberta

-

Fraser Institute1 day ago

Fraser Institute1 day agoAboriginal rights now more constitutionally powerful than any Charter right

-

Alberta1 day ago

Alberta1 day ago$150 a week from the Province to help families with students 12 and under if teachers go on strike next week

-

Business1 day ago

Business1 day agoNew PBO report underscores need for serious fiscal reform in Ottawa

-

Agriculture1 day ago

Agriculture1 day agoCarney’s nation-building plan forgets food