Business

Switzerland has nearly 65% more doctors and much shorter wait times than Canada, despite spending roughly same amount on health care

From the Fraser Institute

Switzerland’s universal health-care system delivers significantly better results than Canada’s in terms of wait times, access to health professionals like doctors and nurses, and patient satisfaction finds a new study published by the Fraser Institute, an independent, non-partisan Canadian policy think-tank.

“Despite its massive price tag, Canada’s health-care system lags behind many other countries with universal health care,” said Yanick Labrie, senior fellow at the Fraser Institute and author of Building Responsive and Adaptive Health-Care Systems in Canada: Lessons from Switzerland.

The study highlights how Switzerland’s universal health-care system consistently outperforms Canada on most metrics tracked by the OECD.

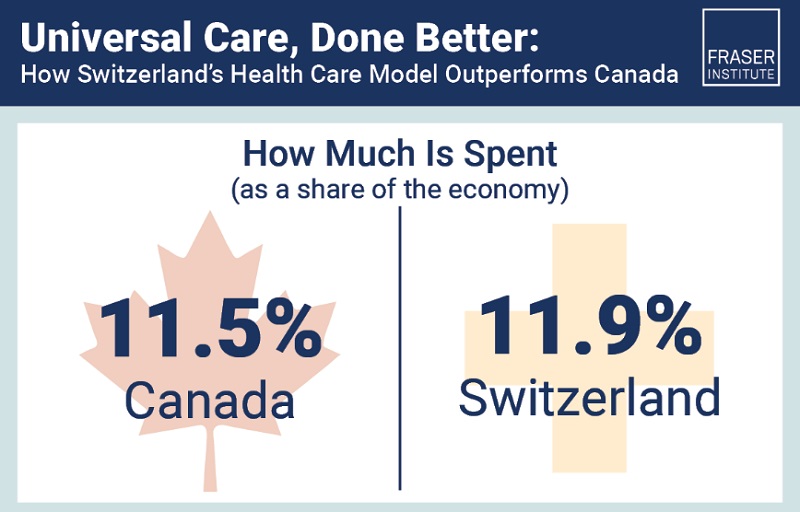

In 2022, the latest year of available data, despite Canada (11.5 per cent of GDP) and Switzerland (11.9 per cent) spending close to the same amount on health care, Switzerland had 4.6 doctors per thousand people compared to 2.8 in Canada. In other words, Switzerland had 64.3 per cent more doctors than Canada (on a per-thousand people basis).

Switzerland also had 4.4 hospital beds per thousand people compared to 2.5 for Canada—Switzerland (8th) outranked Canada (36th) on this metric out of 38 OECD countries with universal health care.

Likewise, 85.3 per cent of Swiss people surveyed by the CWF (Commonwealth Fund) reported being able to obtain a consultation with a specialist within 2 months. By comparison, only 48.3 per cent of Canadians experienced a similar wait time. Beyond medical resources and workforce, patient satisfaction diverges sharply between the two countries, as 94 per cent of Swiss patients report being satisfied with their health-care system compared to just 56 per cent in Canada.

“Switzerland shows that a universal health care system can reconcile efficiency and equity – all while being more accessible and responsive to patients’ needs and preferences,” Labrie said.

“Policymakers in Canada who hope to improve Canada’s broken health-care system should look to more successful universal health-care countries like Switzerland.”

Building Responsive and Adaptive Health Care Systems in Canada: Lessons from Switzerland

- Canada’s health-care system is increasingly unable to meet patient needs, with wait times reaching record lengths—over 30 weeks for planned care in 2024—despite significantly rising public spending and growing dissatisfaction among patients and providers nationwide.

- Swiss health care outperforms Canada in nearly all OECD performance indicators: more doctors and nurses per capita, better access to care, shorter wait times, lower unmet needs, and higher patient satisfaction (94% vs. Canada’s 56%).

- Switzerland ensures universal coverage through 44 competing private, not-for-profit insurers. Citizens are required to enroll but have the freedom to choose insurers and tailor coverage to their needs and preferences, promoting both access and autonomy.

- Swiss basic insurance coverage is broader than Canada’s, including outpatient care, mental health, prescribed medications, home care, and long-term care—with modest, capped cost-sharing, and exemptions for vulnerable groups, including children, low-income individuals, and the chronically ill.

- Patient cost participation (deductibles/co-payments) exists, but the system includes robust financial protection: 27.5% of the population receives direct subsidies, ensuring affordability and equity.

- Risk equalization mechanisms prevent risk selection and guarantee insurer fairness, promoting solidarity across demographic and health groups.

- Decentralized governance enhances responsiveness; cantons manage service planning, ensuring care adapts to local realities and population needs.

- Managed competition drives innovation and efficiency: over 75% of the Swiss now choose alternative models (e.g., HMOs, telemedicine, gatekeeping).

- The Swiss model proves that a universal, pluralistic, and competitive system can reconcile efficiency, equity, access, and patient satisfaction—offering powerful insights for Canada’s stalled health reform agenda.

Business

Federal government’s ‘very different approach’ will further erode Ottawa’s finances

From the Fraser Institute

By Jake Fuss and Grady Munro

This week, after five months off and one federal election, Parliament will start a new session in Ottawa. And federal finances should be a top priority.

Too much of anything can be harmful. In recent years, both the size of government in Canada and the government debt burden have grown too large, harming economic growth and living standards. Why? Because when government grows too large, it begins taking over functions and resources that are better left to the private sector.

Consider this. From 2014 to 2024, total government spending in Canada (federal, provincial and local) increased from 38.4 per cent (as a share of GDP) to 44.7 per cent—the second-fastest increase among 40 advanced countries worldwide. Consequently, the total size of government in Canada increased from 25th highest to 17th highest (out of the same 40 countries). Again, this means that government now essentially controls a significantly larger share of our economy.

During the same 10-year period, Canada’s gross government debt (federal, provincial and local) increased from 85.5 per cent (as a share of GDP) to 110.8 per cent—the third-fastest increase among the 40 countries. As such, Canada’s debt ranking among the 40 countries increased from 14th highest to 7th highest.

Why should Canadians care?

A large government debt burden lands squarely on the backs of Canadians. For example, governments and the private sector compete for the limited pool of savings available for borrowing. As governments increase the amount they borrow, there are fewer savings available for the private sector. All else equal, this drives up interest costs and makes it more expensive for families to take out a mortgage or businesses to attract investment.

Moreover, debt accumulation today will likely mean higher taxes in the future. Indeed, a 16-year old Canadian in 2025 will pay an estimated $29,663 over their lifetime in additional personal income taxes (that they otherwise wouldn’t pay) due to ballooning federal debt. In other words, by accumulating debt today, the government is disproportionately burdening younger generations with higher taxes in the future.

Of course, when talking about Canada’s overall debt load, the federal government plays a big role. The Carney government says it will “build Canada into the strongest economy in the G7” by employing a “very different approach” to federal fiscal policy than its predecessor. Yet the Carney campaign platform promises to add to Ottawa’s mountain of debt (which currently stands at a projected $2.2 trillion) by running huge annual deficits until at least 2028/29, even outspending the Trudeau government’s previous plan. This is not a “very different approach.”

The Carney government plans to table its first budget in the fall. As Parliament resumes, let’s hope the new prime minister shows real leadership by charting a clear path towards fiscal sustainability and stronger economic growth.

Business

Bureaucracy balloons while less than 50 per cent of government performance targets are consistently met

The federal government added 98,986 employees since 2016, bringing the number of federal bureaucrats to 357,965, according to data from the Treasury Board of Canada Secretariat.

“The last thing Canadians need is a bloated government full of highly paid paper pushers,” said Franco Terrazzano, CTF Federal Director. “If politicians want to provide tax relief and start paying down the federal debt, they need to shrink government bureaucracy.”

The federal government reduced its payroll by 9,807 employees over the last year. However, the federal government still has 98,986 more employees than it did in 2016 – a 38 per cent increase.

The average annual compensation for full-time federal bureaucrats is $125,300, when pay, pension, and other perks are accounted for, according to the Parliamentary Budget Officer.

Taxpayers would save about $7 billion annually had the federal bureaucracy grew in line with population growth over the last 10 years.

There are seven federal departments and agencies that have more than doubled their number of employees since 2016, including:

- Infrastructure Canada (375 per cent)

- Women and Gender Equality Canada (334 per cent)

- RCMP External Review Committee (229 per cent)

- Elections Canada (173 per cent)

- Immigration and Refugee Board of Canada (158 per cent)

- Financial Consumer Agency of Canada (154 per cent)

- Impact Assessment Agency of Canada (127 per cent)

Employment and Social Development Canada added the greatest number of employees since 2016. The department added 16,842 employees since 2016 – a 75 per cent increase.

The Canada Revenue Agency added the second greatest number of employees over the decade. The CRA added 13,015 employees since 2016 – a 33 per cent increase.

“It’s good to see the bureaucracy shrinking a little bit, but it’s still too bloated and too expensive,” Terrazzano said.

It isn’t just the size of the federal bureaucracy that’s ballooning – the cost is too.

The PBO estimates the federal bureaucracy cost taxpayers $69.5 billion in 2023-24. In 2016-17, the cost of the bureaucracy was $40.2 billion. That’s an increase of 72.9 per cent.

The federal government handed out more than one million pay raises between 2020 and 2023, according to government records obtained by the CTF. The federal government also rubberstamped more than $1.5 billion in bonuses for bureaucrats since 2015.

Given the rash of bonuses and pay raises, on top of new hires, Canadians might wonder: how well are things running in Ottawa?

Less than 50 per cent of the government’s own performance targets are consistently met by federal departments within each year, according to a March 2023 report from the PBO.

“We are also committed to capping, not cutting, public service employment,” according to the Liberal Party’s 2025 election platform.

“Prime Minister Mark Carney’s promise to cap the bureaucracy doesn’t go nearly far enough and just entrenches the Trudeau government’s costly bureaucrat hiring spree,” Terrazzano said. “Taxpayers need politicians to cut the bloated bureaucracy and make pay and perks more affordable.”

-

Addictions2 days ago

Addictions2 days agoMan jailed for trafficking diverted safer supply drugs, sparking fresh debate over B.C. drug policies

-

Fraser Institute2 hours ago

Fraser Institute2 hours agoFederal government’s ‘affordable housing’ strategy doomed without strong income growth

-

Alberta2 days ago

Alberta2 days agoHow Trump and Alberta might just save Canada

-

Carbon Tax3 hours ago

Carbon Tax3 hours agoCarney picks up Trudeau’s net-zero wrecking ball

-

Business2 days ago

Business2 days agoThe Liberals Finally Show Up to Work in 2025

-

Alberta2 days ago

Alberta2 days agoJann Arden’s Rant Will Only Fuel Alberta’s Separation Fire

-

Bruce Dowbiggin2 days ago

Bruce Dowbiggin2 days agoCaitlin Clark Has Been The Real Deal. So Her WNBA Rivals Hate Her

-

Banks2 days ago

Banks2 days agoCanada Pension Plan becomes latest institution to drop carbon ‘net zero’ target