Business

Canadians Will Pay For The Federal Budget Delay

From the Frontier Centre for Public Policy

In his latest commentary, Lee Harding slams the Carney government for skipping the federal budget while plowing ahead with tax cuts and spending sprees. With no clear plan and ballooning deficits, Canadians wonder how these promises will be paid for—hint: more debt. Harding warns that Ottawa’s “figure it out later” approach is reckless, echoing past fiscal blunders that still haunt taxpayers today. Brace yourselves—this bill is coming.

The Carney government skipped the budget, but not the spending. And you’re on the hook

What’s better?

To spend and save without a plan, or to do so with accurate information and a focused strategy? The federal government has chosen the former, and one thing is certain: Canadians are going to pay.

Finance Minister François-Philippe Champagne announced on May 14 that the newly elected Carney government wouldn’t table a spring budget, opting instead to take things “step-by-step.” Parliament will sit until June 20, but aside from the throne speech, the only stated priority is to lower the first income tax bracket from 15 per cent to 14. That would slightly lower federal income taxes for most working Canadians by reducing the rate on the first $55,000 of income, saving up to about $550 a year.

That sounds good—until you ask how it’s being paid for. Without a budget, Canadians have no clear picture of the trade-offs or long-term costs.

Tabling a budget is the government’s formal presentation of its financial plan to Parliament. It outlines spending priorities, revenue forecasts and deficit projections for the year ahead. Skipping this step is no small matter.

“Cut taxes first, figure out how to pay later” isn’t the worst way to roll the dice, but it is far from the best. And we already know how Ottawa will cover the shortfall: more deficit spending. Canada hasn’t seen a balanced federal budget in nearly 20 years, and there’s no sign of one on the horizon.

Canadians will repay this tax cut with interest, sacrificing tomorrow’s services for today’s soundbites. This approach lacks fiscal prudence; doing it without a budget only compounds the recklessness.

Ottawa rarely fails to table a budget. The last time was during the height of the COVID pandemic in 2020. The results were disastrous: public debt surged and remains with us today. That was an unprecedented global crisis. There is no such emergency in 2025—only political calculation.

Carney claimed during the election campaign that proposed U.S. tariffs placed Canadians in “the greatest crisis of our lifetimes.” Yet, days later, he stood alongside U.S. President Donald Trump at the White House, smiling for photos and flashing a thumbs-up. For perspective, imagine Volodymyr Zelenskyy flying to Moscow to do the same with Vladimir Putin.

Some may argue the spring election left too little time before summer to draft a budget. But that doesn’t hold water. The Harper Conservatives won a majority on May 2, 2011, and still tabled a budget that spring. Carney’s cabinet includes many Trudeau-era veterans, and the Department of Finance remains staffed by experienced civil servants. The Liberals can and should produce a budget.

Parliament has even sat in July to pass urgent legislation. In 2020, MPs returned on July 20 to approve the Canada Emergency Wage Subsidy. In 1988, they stayed until July 7 to pass the Canada–U.S. Free Trade Agreement Implementation Act. There is precedent—and there is time.

Even when the Liberals do present budgets, they’ve only deepened Canada’s fiscal hole. On Dec. 31, 2015, the net federal debt stood at $693.8 billion. By the end of 2024, it had climbed to $953.9 billion—an increase of 37.4 per cent in just nine years. These debts will likely never be repaid.

A 2022 Fraser Institute study estimated that a 16-year-old Canadian will pay $29,663 in income taxes over her lifetime just to cover interest on the federal debt—money that won’t fund services but simply keep creditors happy.

The Liberals’ current platform is thin on discipline. It includes income tax cuts worth $4.2 billion and a GST exemption on first-time home purchases, costing $383 million. But these are overshadowed by broader spending.

Last year’s budget outlined $538 billion in spending, with $40 billion funded through borrowing. By fall, that deficit had grown past $60 billion. This year’s platform will make matters worse by $46.8 billion, even after factoring in $20 billion in retaliatory tariff revenues.

If the government struggles to follow its own budget when it sets one, how much damage might it do without one? Plenty.

Parliament must still approve any new spending through supplementary estimates—requests for additional funds beyond what’s already authorized. But without the context of a full budget, MPs will be asked to approve billions in spending without a clear picture of what’s affordable.

What would be refreshing, though unlikely, is for non-Liberal MPs to approve only measures that strengthen the Canadian economy, military and policing. They could reject everything else and argue that responsible spending can’t occur without a formal financial plan.

Governments should manage national finances like a responsible household: with a clear budget and the discipline to live within their means. Unfortunately, the Carney government appears unwilling—or unable—to do either.

Lee Harding is a research fellow with the Frontier Centre for Public Policy.

Automotive

EV fantasy losing charge on taxpayer time

From the Fraser Institute

By Kenneth P. Green

The vision of an all-electric transportation sector, shared by policymakers from various governments in Canada, may be fading fast.

The latest failure to charge is a recent announcement by Honda, which will postpone a $15 billion electric vehicle (EV) project in Ontario for two years, citing market demand—or lack thereof. Adding insult to injury, Honda will move some of its EV production to the United States, partially in response to the Trump Tariff Wars. But any focus on tariffs is misdirection to conceal reality; failures in the electrification agenda have appeared for years, long before Trump’s tariffs.

In 2023, the Quebec government pledged $2.9 billion in financing to secure a deal with Swedish EV manufacturer NorthVolt. Ottawa committed $1.34 billion to build the plant and another $3 billion worth of incentives. So far, per the CBC, the Quebec government “ invested $270 million in the project and the provincial pension investor, the Caisse de dépôt et placement du Québec (CDPQ), has also invested $200 million.” In 2024, NorthVolt declared bankruptcy in Sweden, throwing the Canadian plans into limbo.

Last month, the same Quebec government announced it will not rescue the Lion Electric company from its fiscal woes, which became obvious in December 2024 when the company filed for creditor protection (again, long before the tariff war). According to the Financial Post, “Lion thrived during the electric vehicle boom, reaching a market capitalization of US$4.2 billion in 2021 and growing to 1,400 employees the next year. Then the market for electric vehicles went through a tough period, and it became far more difficult for manufacturers to raise capital.” The Quebec government had already lost $177 million on investments in Lion, while the federal government lost $30 million, by the time the company filed for creditor protection.

Last year, Ford Motor Co. delayed production of an electric SUV at its Oakville, Ont., plant and Umicore halted spending on a $2.8 billion battery materials plant in eastern Ontario. In April 2025, General Motors announced it will soon close the CAMI electric van assembly plant in Ontario, with plans to reopen in the fall at half capacity, to “align production schedules with current demand.” And GM temporarily laid off hundreds of workers at its Ingersoll, Ontario, plant that produces an electric delivery vehicle because it isn’t selling as well as hoped.

There are still more examples of EV fizzle—again, all pre-tariff war. Government “investments” to Stellantis and LG Energy Solution and Ford Motor Company have fallen flat and dissolved, been paused or remain in limbo. And projects for Canada’s EV supply chain remain years away from production. “Of the four multibillion-dollar battery cell manufacturing plants announced for Canada,” wrote automotive reporter Gabriel Friedman, “only one—a joint venture known as NextStar Energy Inc. between South Korea’s LG Energy Solution Ltd. and European automaker Stellantis NV—progressed into even the construction phase.”

What’s the moral of the story?

Once again, the fevered dreams of government planners who seek to pick winning technologies in a major economic sector have proven to be just that, fevered dreams. In 2025, some 125 years since consumers first had a choice of electric vehicles or internal combustion vehicles (ICE), the ICE vehicles are still winning in economically-free markets. Without massive government subsidies to EVs, in fact, there would be no contest at all. It’d be ICE by a landslide.

In the face of this reality, the new Carney government should terminate any programs that try to force EV technologies into the marketplace, and rescind plans to have all new light-duty vehicle sales be EVs by 2035. It’s just not going to happen, and planning for a fantasy is not sound government policy nor sound use of taxpayer money. Governments in Ontario, Quebec and any other province looking to spend big on EVs should also rethink their plans forthwith.

Business

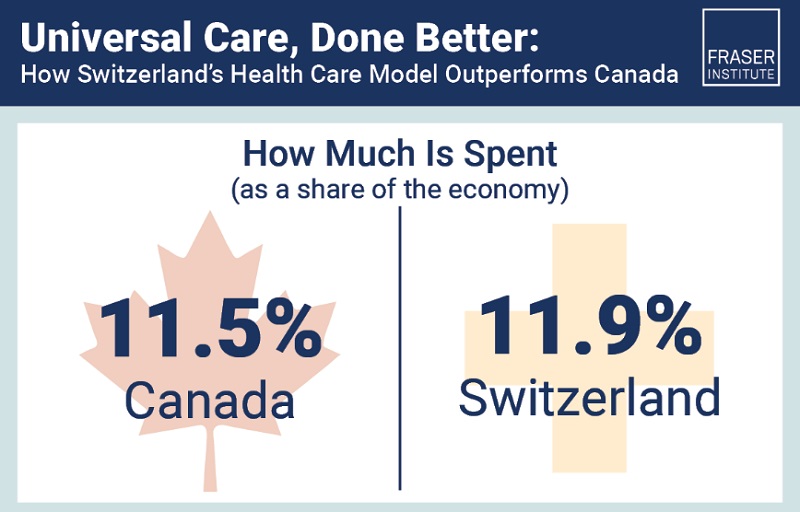

Switzerland has nearly 65% more doctors and much shorter wait times than Canada, despite spending roughly same amount on health care

From the Fraser Institute

Switzerland’s universal health-care system delivers significantly better results than Canada’s in terms of wait times, access to health professionals like doctors and nurses, and patient satisfaction finds a new study published by the Fraser Institute, an independent, non-partisan Canadian policy think-tank.

“Despite its massive price tag, Canada’s health-care system lags behind many other countries with universal health care,” said Yanick Labrie, senior fellow at the Fraser Institute and author of Building Responsive and Adaptive Health-Care Systems in Canada: Lessons from Switzerland.

The study highlights how Switzerland’s universal health-care system consistently outperforms Canada on most metrics tracked by the OECD.

In 2022, the latest year of available data, despite Canada (11.5 per cent of GDP) and Switzerland (11.9 per cent) spending close to the same amount on health care, Switzerland had 4.6 doctors per thousand people compared to 2.8 in Canada. In other words, Switzerland had 64.3 per cent more doctors than Canada (on a per-thousand people basis).

Switzerland also had 4.4 hospital beds per thousand people compared to 2.5 for Canada—Switzerland (8th) outranked Canada (36th) on this metric out of 38 OECD countries with universal health care.

Likewise, 85.3 per cent of Swiss people surveyed by the CWF (Commonwealth Fund) reported being able to obtain a consultation with a specialist within 2 months. By comparison, only 48.3 per cent of Canadians experienced a similar wait time. Beyond medical resources and workforce, patient satisfaction diverges sharply between the two countries, as 94 per cent of Swiss patients report being satisfied with their health-care system compared to just 56 per cent in Canada.

“Switzerland shows that a universal health care system can reconcile efficiency and equity – all while being more accessible and responsive to patients’ needs and preferences,” Labrie said.

“Policymakers in Canada who hope to improve Canada’s broken health-care system should look to more successful universal health-care countries like Switzerland.”

Building Responsive and Adaptive Health Care Systems in Canada: Lessons from Switzerland

- Canada’s health-care system is increasingly unable to meet patient needs, with wait times reaching record lengths—over 30 weeks for planned care in 2024—despite significantly rising public spending and growing dissatisfaction among patients and providers nationwide.

- Swiss health care outperforms Canada in nearly all OECD performance indicators: more doctors and nurses per capita, better access to care, shorter wait times, lower unmet needs, and higher patient satisfaction (94% vs. Canada’s 56%).

- Switzerland ensures universal coverage through 44 competing private, not-for-profit insurers. Citizens are required to enroll but have the freedom to choose insurers and tailor coverage to their needs and preferences, promoting both access and autonomy.

- Swiss basic insurance coverage is broader than Canada’s, including outpatient care, mental health, prescribed medications, home care, and long-term care—with modest, capped cost-sharing, and exemptions for vulnerable groups, including children, low-income individuals, and the chronically ill.

- Patient cost participation (deductibles/co-payments) exists, but the system includes robust financial protection: 27.5% of the population receives direct subsidies, ensuring affordability and equity.

- Risk equalization mechanisms prevent risk selection and guarantee insurer fairness, promoting solidarity across demographic and health groups.

- Decentralized governance enhances responsiveness; cantons manage service planning, ensuring care adapts to local realities and population needs.

- Managed competition drives innovation and efficiency: over 75% of the Swiss now choose alternative models (e.g., HMOs, telemedicine, gatekeeping).

- The Swiss model proves that a universal, pluralistic, and competitive system can reconcile efficiency, equity, access, and patient satisfaction—offering powerful insights for Canada’s stalled health reform agenda.

-

Business2 days ago

Business2 days agoU.S. to deny visas to foreign censorship enforcers under new Rubio-led policy

-

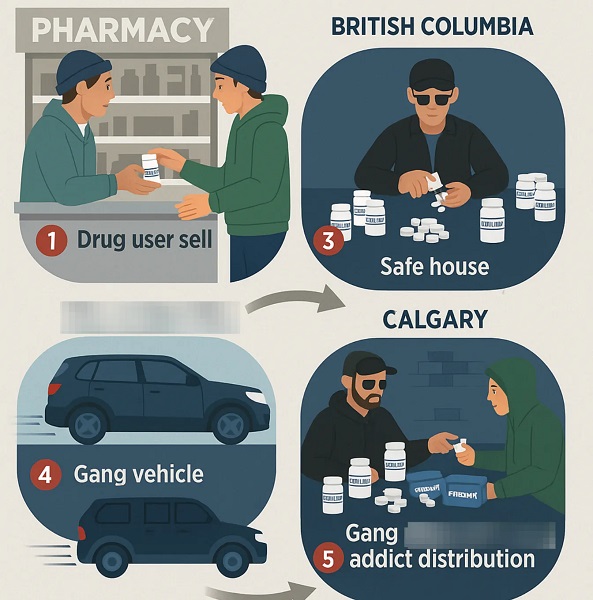

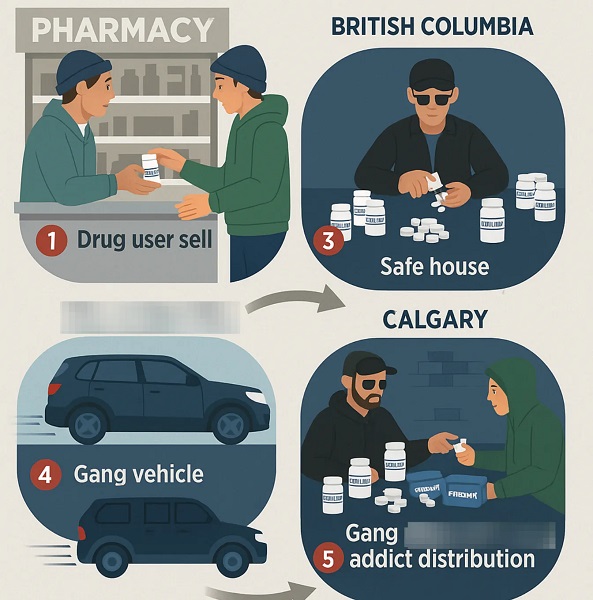

Crime1 day ago

Crime1 day ago“A Dangerous Experiment”: Doctor Says Ideological Canadian Governments Ignored Evidence as Safer Supply Exacerbated Fentanyl Death Surge

-

Business2 days ago

Business2 days agoElon Musk’s Time At DOGE Comes To End

-

Alberta1 day ago

Alberta1 day agoCanadian doctors claim ‘Charter right’ to mutilate gender-confused children in Alberta

-

Business1 day ago

Business1 day agoBig grocers rigged bread prices and most walked away free

-

National1 day ago

National1 day agoQuestion Period : Barrett vs. Carney Clash Over Offshore Investments

-

Economy1 day ago

Economy1 day agoCanada’s housing crisis deepens as landuse policies push prices beyond reach

-

Health1 day ago

Health1 day agoRFK Jr. cancels $700 million mRNA bird flu ‘vaccine’ contract with Moderna over safety concerns