Business

Mounting evidence suggests emissions cap will harm Canadians

From the Fraser Institute

By Julio Mejía and Elmira Aliakbari

In a recent interview with CTV, Prime Minister Mark Carney said he may eliminate Bill C-69, which imposes uncertain and onerous review requirements on major energy projects, and eliminate the cap on oil and gas emissions, so energy projects can “move forward.” Of course, actions speak louder than words and Canadians will have to wait and see what the Carney government will actually do. But one thing’s for certain—reform is needed now.

Last year, when the Trudeau government proposed to cap greenhouse gas (GHG) emissions exclusively for the oil and gas sector, it insisted this was essential for fighting climate change and building a strong thriving economy. However, a recent report by the Parliamentary Budget Officer (PBO) suggests this policy—which would require oil and gas producers to reduce their emissions by 35 per cent below 2019 levels by 2030—could lead to significant job losses, reduced production in the sector, and more broadly, less prosperity for Canadians.

The PBO’s findings add to mounting evidence indicating that the emissions cap will harm Canada’s already struggling economy while yielding virtually no measurable environmental benefits.

Oil and gas form the backbone of Canada’s economy and trade. As the country’s main export, the sector contributed nearly $8 billion in income taxes to federal and provincial governments while adding $74.3 billion to the overall economy in 2024. More importantly, the oil and gas sector provides employment for more than 140,000 Canadian families, offering well above-average salaries.

Several studies have assessed the potential impact of the proposed GHG cap. While estimates vary, they all reach the same conclusion: the cap will force the industry to cut oil and gas production and, in turn, negatively affect the entire economy.

The PBO projects that, under the proposed cap, Canadian firms will be required to cut oil and gas production by 4.9 per cent between 2030 and 2032, compared to what production levels would have been without the policy. As a result, an estimated 54,000 fulltime jobs would be lost, and by 2032 Canada’s economy (measured by inflation-adjusted GDP) will be 0.39 per cent smaller than it otherwise would have been.

There’s also a recent report by Deloitte, which found the cap will reduce oil production by 626,000 barrels per day by 2030 and lead to a decline in oil and gas production of 10 per cent and 12 per cent, respectively. Overall, the country will experience an economic loss equivalent to 1.0 per cent of the value of the entire economy (GDP), translating into the loss of nearly 113,000 jobs and a 1.3 per cent reduction in government tax revenues.

Similarly, a study by the Conference Board of Canada and presented by the Government of Alberta, suggests that the cap’s negative effect would ripple across the economy, resulting in the loss of 151,000 jobs by 2030. Between 2030 and 2040, Canada’s GDP losses could total up to $1 trillion, resulting in the loss of up to $151 billion in revenues for the federal government.

Finally, a recent study found that capping oil and gas emissions would result in significant economic loss without generating measurable environmental benefits. Specifically, even if Canada were to shut down its entire energy industry by 2030—thus removing all GHG emissions from the sector—the resulting global reduction in emissions would be a mere four-tenths of one per cent, a figure too small to impact the Earth’s climate.

The available evidence indicates that the proposed GHG cap could come at a high economic cost while delivering limited environmental benefits.

Business

The Digital Services Tax Q&A: “It was going to be complicated and messy”

A tax expert on the departed Digital Services Tax, and the fiscal and policy holes it leaves behind

It’s fun, and fair, arguing whether Mark Carney “caved” in suspending the application of Canada’s Digital Services Tax to revive broader negotiations with the Trump administration. But I figure there are other dimensions to this issue besides tactics. So I got in touch with Allison Christians, a tax law professor at McGill University and the founding director of the Canadian Centre for Tax Policy.

In our talk, Christians discusses the policy landscape that led to the introduction of the DST; the pressure that contributed to its demise; and the ways other countries are addressing a central contradiction of the modern policy landscape: without some kind of digital tax, countries risk having to impose costs on their own digital industry that the overwhelmingly US-based multinationals can avoid.

I spoke to Christians on Friday. Her remarks are edited for length and clarity.

Paul Wells: I noticed in your social media that you express inordinate fondness for tax law.

Allison Christians: You will not find a more passionate adherent to the tax cult than me. Yes, I do. I love tax law. Of course I do. How could you not? How could you not love tax law?

PW: What’s to love about tax law?

Christians: Well, tax law is how we create our country. That’s how we build our society. That’s how we create the communities that we want to live in and the lifestyle that we want to share with our neighbours. That’s how: with tax law.

PW: I guess the goal [of tax policy] is to generate the largest amount of revenue with the smallest amount of grief? And to send social signals while you’re at it. Is that right?

Christians: I don’t think so. Tax is not about raising maximum revenue. Tax is about deciding what society you’re trying to build and what portions of that society need to be made public, and what can be left to private interests which then need to profit. So we have decided in Canada, as a country, that basic minimum healthcare cannot be a for-profit enterprise. It has to be a public enterprise in order to make sure that it works for everybody to a certain basic level. So tax is about making those decisions: are we going to privatize everything and everyone pays for their own health care, security, roads, insurance, fire department etc. And if they can’t pay, then too bad? Or are we going to have a certain minimum, and that minimum is going to be provided in a public way that harmonizes across the communities that we have. And that’s what tax is about. It’s not about extracting revenue at all. It’s about creating revenue. It’s about creating a market. It’s about investing in a community. So I just object to the whole idea that tax is about extracting something from me, because what tax is doing is creating a market for me to be able to thrive. Not just me, but all of my neighbours, as well.

PW: Let’s jump forward to the events of the past couple weeks. Were you surprised when the Prime Minister suspended the Digital Services Tax?

Christians: I think “surprise” is probably too strong of a word, because nothing any political leader does to cope with the volatility of the United States would surprise me. We are dealing with a major threat, a threat that is threatening to annex us, to take our resources, to take our sovereignty, to take our communities and rip them apart and turn them into a different way of being. And that’s a serious threat. So nothing would surprise me in response to that. Disappointed, of course. But not disappointed in our Canadian response. More disappointed in the juggernaut that Trump has been allowed to become by his base, and that they’re pulling the rug out from under everyone that’s cooperated with the US agenda for decades, including us.

PW: What’s your best understanding of what the Digital Services Tax was designed to accomplish? And is it unusual as taxes go?

Christians: So to understand this, you really have to be a policy wonk, which isn’t much fun. So I’m gonna give you an example that might make it clear from the perspective of Canada. Why we might have a Digital Service Tax or might want something like it.

I want to preface this by saying that the Digital Service Tax is by no means the only way to do the underlying things we want to accomplish. Certainly other countries have been collecting DSTs and have been collecting billions of dollars, and US companies have had reserves for paying that Digital Service Tax. So we just left money on the table. But let me try to explain why we want to do the thing without getting too “tax nerdy” on you.

So I’m sure you can come up with the one Canadian company that’s streaming content on television or on digital devices.

PW: Crave?

Christians: Yeah, that’s the one. Crave is owned by Bell Media and is a Canadian company. And Crave pays taxes in Canada. Crave has to compete against Netflix, which does not have to pay tax in Canada. Netflix just simply doesn’t have to pay the same way that Crave does unless we force them to pay. Crave has to compete with US and foreign content streamers. We may get to a point where we can get Netflix to collect some sales tax on the GST, for example. But if Netflix itself stays out of Canada, physically, but it’s still getting all those customers that otherwise Crave would have access to, then Crave is at a structural disadvantage.

Now tell me which Canadian provider competes with Google.

PW: I can’t think of one.

Christians: Exactly. There isn’t one. How are we supposed to get a homegrown competitor when our competition simply does not pay taxes, and any one we would grow here in Canada has to pay tax here? So we have to understand the Digital Service Tax as simply our response to the fact that we normally do not tax a company unless they are physically located in Canada. But now we’ve got to go into this digital space and say: you’re still here, even if we can’t see you and talk to you, you’re still here. You’re doing something in our market. And that’s what the Digital Service Tax was trying to deal with.

This Substack is reader-supported. To receive new posts and support my work, consider becoming a free or paid subscriber.

PW: Now, how are companies likely to respond to this Digital Services Tax? It seems to me the likeliest outcome would be that they would pass those costs on to their customers.

Christians: Yes, that is what companies have said they would do. Google talked about passing those costs on to the customers. And their customers obviously are advertisers. I want to point out that advertisers in Canada used to advertise in local newspapers and media. Now they advertise on Facebook, owned by an American-headquartered Company, Meta. Right now, they advertise on those foreign platforms, so we don’t have those advertising dollars here. Advertisers might have had to pay the Digital Service Tax if Google, or whoever, had passed it on to them. I think it’s fair to say, that Canadians advertising on those foreign platforms would have faced a gross-up to cover that tax.

PW: So, the net effect is that it just becomes more expensive for Canadian consumers. I’ve seen it argued that all this tax would have succeeded in doing is making Netflix more expensive.

Christians: Okay, that’s possible. I mean, that assumes the supply is totally elastic: you can increase the price of Netflix, and people will still pay it indefinitely. Right? So that’s the assumption in the short term. But the long-term assumption is that Crave becomes more competitive — because its competitors are paying the same tax that it is paying. The Crave subscription price may or may not respond, but if you put pressure on the foreign service providers in the same manner that’s on the Canadian providers, it might cost more, but we’re also getting the tax.

PW: I believe the Prime Minister, in an interview with the CBC said that he was thinking of getting rid of this thing, anyway. [The quote I’m reaching for here is: “Look, what we did this week is something that I think we were going to do anyways, in the end, for the deal.” At 1:07 in this video. — pw] Why do you think he would have been leaning in that direction? And do you think that absent a Truth Social post by President Trump, he actually would have gotten rid of the thing?

Christians: I can’t speculate too much about the politics of this, because I’m not talking to many of the people that make policy, but I know the complaints about the DST, and I don’t dispute them. It was going to be a complicated tax to collect and it was going to be messy in terms of compliance. There’s a lot of uncertainty around the tax and I know there’s always an enormous amount of pressure to reduce all taxes. There’s always going to be that segment of society that sees taxes being thrown down the drain and not as an investment in the society that we want to live in.

American companies are famous for investing their money on lobbying and not in taxes. They spend their money convincing us that it would be bad for us to tax them, and they can spend a much smaller percentage of their money on lobbying and get us to believe that narrative. And the narrative is that somehow, if we tax Google, Google will go away and we won’t be able to use it. That Google won’t innovate. It’s nonsense, but it’s a story that resonates nonetheless. Was Prime Minister Carney pressured to get rid of the DST? Undoubtedly. And maybe he personally thinks there’s a better way to tax these companies than with an excise tax. I don’t fault him for thinking that. I have even written that there are better ways for Canada to collect this tax than the Digital Services Tax.

PW: I’m going to want you to tell me about these other ways. But I assume that if a Canadian government attempts any of these other ways, then the companies we’re talking about know that all they have to do is hit the Trump button and the pressure will be right back on.

Christians: That’s correct. There are a couple of [alternatives to the DST]. We could, like some other countries have done, redefine the types of income that we subject to withholding taxes in Canada. It’s a complicated technical idea, but basically any payments that go from our advertisers to Google, we could impose a withholding tax simply by expanding a couple of definitions in the Income Tax Act that would then carry over into our treaty. Now, people will push back on that, and say that you’re changing a deal, and people will object to that. And we can have an argument about that, but that possibility exists. That withholding tax is the most straightforward way to do this and we should probably already be thinking about it.

Another one that’s kind of fun, which I really enjoyed learning about when I came to Canada, is Section 19 in the Income Tax Act. So, Canadian advertisers are paying Google now, instead of a Canadian newspaper. Well, Section 19 basically says that whenever someone makes a payment for advertising to a foreign, non-Canadian media, that payment’s not deductible.

Now that provision seems to violate Free Trade rules because it changes, depending on who you make the payment to. But it’s a provision in law. The US objected to it when we adopted it by imposing a reciprocal tax on US advertisers paying Canadian outlets, which doesn’t seem to bother anybody.

PW: But the application of that will be very asymmetrical, right?

Christians: Yes, for sure. And I’ll tell you what the Canadian media noticed when we started paying for digital newspapers online: that they’re not subject to Section 19 — only print and traditional media are subject to this denial of deduction — and Canadian media advocated for this denial of deduction for online publications as well.

All you have to do is look at the wording of Section 19 — and you don’t even have to change the words — and all of a sudden all those payments to Google are not deductible. But if the payments were to Crave, they would be deductible, and if they are to the Globe and Mail, or other Canadian companies, they would be deductible. That is a different kind of advantage for the Canadian competitor that’s a little less susceptible to Trump’s understanding, and a little less susceptible to the politics that surround the Digital Services Tax. But it’s technical. You have to explain it to people, and they don’t believe you. It’s hard to understand it.

PW: Theoretically a two-time central-bank governor could wrap his head around it.

Christians: Yes, I think he could fully understand it, for sure. You’re absolutely right. Will he want to do it, though? I just don’t know.

PW: You said that there are other jurisdictions that continue, today, to successfully tax the web giants. Who are you thinking of?

Christians: Well, Austria’s been doing the Digital Service Tax since the beginning. The UK has the Diverted Profits Tax that they’ve been using. Australia has one that’s been enforced. Austria stands out because I think it was 2017, in Trump’s 1st term, and it was part of a group that Trump threatened to retaliate against, but they just quietly kept going and they’re still collecting it. Part of the narrative is that we, Canada, came too late to the DST party. We just weren’t part of that initial negotiation. We came in too late, and then it was too obvious, and people were able to isolate us from the pack.

PW: My understanding is we’re looking at a hypothetical $7.2 billion in revenue over 5 years. And that represents a shortfall that’s going to have to be found either in other revenue sources or in spending cuts, or in greater debt. Aside from the DST, do you think Canada could use a general overhaul of its tax code?

Christians: Always. Yes, absolutely! Taxes are funny, right? Because they come into every single political battle, and what ends up happening is that politicians treat the Tax Act and the tax system as a present-giving machinery, and not as a clear policy deliverance system.

I am, every day, surprised at how complicated the Canadian tax system is. It’s way too complicated. You can’t even fill out your own tax return in this country. You’re going to make mistakes because it’s just too ridiculously written. It’s too confusing. It’s too messy. So it’s time to take another look. But you need a commission [like the 1962 Carter royal commission on taxation]. You need to be bipartisan. You need to spend money on that. You need to think that the things that you do have long-term effects, and this takes political courage. And basically it requires upsetting a bunch of people and resetting things, and we just might not be at the right time politically to be doing that because people feel vulnerable to volatility from abroad. So it may not be the time to push that.

Invite your friends and earn rewards

Business

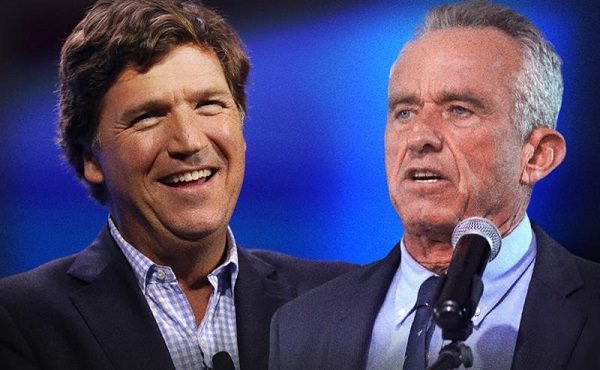

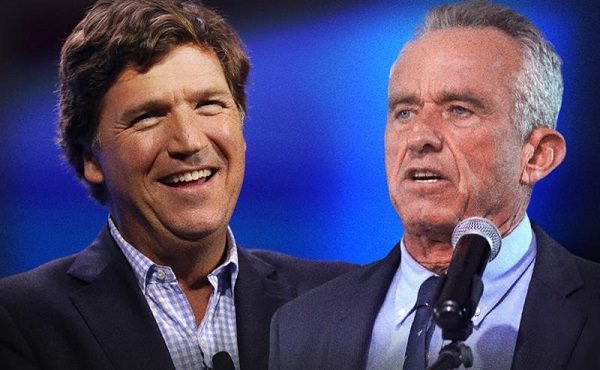

RFK Jr. says Hep B vaccine is linked to 1,135% higher autism rate

From LifeSiteNews

By Matt Lamb

They got rid of all the older children essentially and just had younger children who were too young to be diagnosed and they stratified that, stratified the data

The Centers for Disease Control and Prevention (CDC) found newborn babies who received the Hepatitis B vaccine had 1,135-percent higher autism rates than those who did not or received it later in life, Robert F. Kennedy Jr. told Tucker Carlson recently. However, the CDC practiced “trickery” in its studies on autism so as not to implicate vaccines, Kennedy said.

RFK Jr., who is the current Secretary of Health and Human Services, said the CDC buried the results by manipulating the data. Kennedy has pledged to find the causes of autism, with a particular focus on the role vaccines may play in the rise in rates in the past decades.

The Hepatitis B shot is required by nearly every state in the U.S. for children to attend school, day care, or both. The CDC recommends the jab for all babies at birth, regardless of whether their mother has Hep B, which is easily diagnosable and commonly spread through sexual activity, piercings, and tattoos.

“They kept the study secret and then they manipulated it through five different iterations to try to bury the link and we know how they did it – they got rid of all the older children essentially and just had younger children who were too young to be diagnosed and they stratified that, stratified the data,” Kennedy told Carlson for an episode of the commentator’s podcast. “And they did a lot of other tricks and all of those studies were the subject of those kind of that kind of trickery.”

But now, Kennedy said, the CDC will be conducting real and honest scientific research that follows the highest standards of evidence.

“We’re going to do real science,” Kennedy said. “We’re going to make the databases public for the first time.”

He said the CDC will be compiling records from variety of sources to allow researchers to do better studies on vaccines.

“We’re going to make this data available for independent scientists so everybody can look at it,” the HHS secretary said.

— Matt Lamb (@MattLamb22) July 1, 2025

Health and Human Services also said it has put out grant requests for scientists who want to study the issue further.

Kennedy reiterated that by September there will be some initial insights and further information will come within the next six months.

Carlson asked if the answers would “differ from status quo kind of thinking.”

“I think they will,” Kennedy said. He continued on to say that people “need to stop trusting the experts.”

“We were told at the beginning of COVID ‘don’t look at any data yourself, don’t do any investigation yourself, just trust the experts,”‘ he said.

In a democracy, Kennedy said, we have the “obligation” to “do our own research.”

“That’s the way it should be done,” Kennedy said.

He also reiterated that HHS will return to “gold standard science” and publish the results so everyone can review them.

-

Business14 hours ago

Business14 hours agoRFK Jr. says Hep B vaccine is linked to 1,135% higher autism rate

-

Alberta1 day ago

Alberta1 day agoAlberta Independence Seekers Take First Step: Citizen Initiative Application Approved, Notice of Initiative Petition Issued

-

Crime1 day ago

Crime1 day agoNational Health Care Fraud Takedown Results in 324 Defendants Charged in Connection with Over $14.6 Billion in Alleged Fraud

-

Censorship Industrial Complex21 hours ago

Censorship Industrial Complex21 hours agoGlobal media alliance colluded with foreign nations to crush free speech in America: House report

-

Health1 day ago

Health1 day agoRFK Jr. Unloads Disturbing Vaccine Secrets on Tucker—And Surprises Everyone on Trump

-

Bruce Dowbiggin1 day ago

Bruce Dowbiggin1 day agoThe Game That Let Canadians Forgive The Liberals — Again

-

International20 hours ago

International20 hours agoRFK Jr. tells Tucker how Big Pharma uses ‘perverse incentives’ to get vaccines approved

-

Business2 days ago

Business2 days agoCanada’s loyalty to globalism is bleeding our economy dry