Alberta

Canmore attempting to tax its way out of housing crisis

From the Fraser Institute

By Jake Fuss and Austin Thompson

Taxing part-time residency is no substitute for genuine housing reform, and may in fact deter investment in new housing.

A recent court decision has cleared the way for Canmore next year to impose a new “Livability Tax”—a 0.4 per cent property tax surcharge for homes left unoccupied for more than half the year. Mayor Sean Krausert called the ruling a “big win for Canmore.” But without addressing the root cause of Canmore’s housing shortage—too few new homes being built—this new tax is simply a costly distraction.

Canmore is not alone in taxing housing that is supposedly underused. Vancouver, Toronto, Ottawa and the federal government have imposed similar taxes. According to proponents, these taxes encourage part-time residents to sell or rent their properties to full-time residents. However, the evidence for this is underwhelming.

A study of Vancouver’s Empty Homes Tax found that it shifted 5,355 homes from part- to full-time residency between 2016 and 2021. While that may seem like progress, during the same five-year period construction started on more than 240,000 new homes. And despite the tax, home prices and rents continued to rise significantly. Again, because new housing construction has not kept pace with population growth, partly due to policies that discourage homebuilding such as high municipal fees, long permit approval wait times, and restrictive rules on what can be built and where—challenges that are familiar to Canmore’s homebuilders. Taxing part-time residency is no substitute for genuine housing reform, and may in fact deter investment in new housing.

Vacant home taxes are also costly for governments to administer. According to Canmore’s latest budget, it will cost $920,000 in the first year and $820,000 in the second year just to administer the Livability Tax. That amounts to between eight and nine per cent of the projected $10.3 million in annual revenue generated by the tax. By contrast, the administrative cost of ordinary property tax administration in Canada is typically about two per cent of revenue. The Livability Tax will apply to Canmore residents that occupy their housing unit for less than 183 days a year.

Crucially, the stakes of vacant home taxation are unusually high for Canmore. A study commissioned by the municipality estimates that one in four homes are likely not occupied full-time . That may increase the tax’s reach, but also its potential harm.

Why? Because deterring part-time residents is a risky proposition. The underlying assumption of the Livability Tax is that full-time residents are more valuable to the community than part-time residents. But the town council’s arbitrary 183-day threshold does not account for a resident’s contribution to Canmore’s economy or civic life. In many communities in North America, particularly in areas with wide ranges in seasonal temperatures and weather, part-time residents may help comprise the lifeblood of the community. Canmore may not realize the full cost of deterring part-time residents until they are gone.

And the Livability Tax comes on top of a recent hike in property tax rates for so-called “tourist homes,” which now pay roughly triple the standard rate. While these measures may appeal to some permanent residents, they risk deterring homebuilding and undermining Canmore’s appeal as a tourist destination.

Meanwhile, the town’s actual housing supply remains stagnant. Only 321 new homes were started in 2024. Some constraints on housing development are unavoidable given that Canmore is hemmed in by mountains and protected land. But other impediments to new housing—rooted in policy and political will—are not.

Rather than targeting part-time residents, Canmore should remove policy barriers that restrict new housing development. The recently approved Gateway and Palliser Lane projects show that relaxing municipal rules—on building heights, setbacks and parking requirements—can unlock more housing development. Building that kind of flexibility into policy and applying it more widely could go a long way toward easing the housing crunch.

If Canmore wants to improve housing affordability, it needs to build—not tax—its way there.

Alberta

Alberta Next: Alberta Pension Plan

From Premier Danielle Smith and Alberta.ca/Next

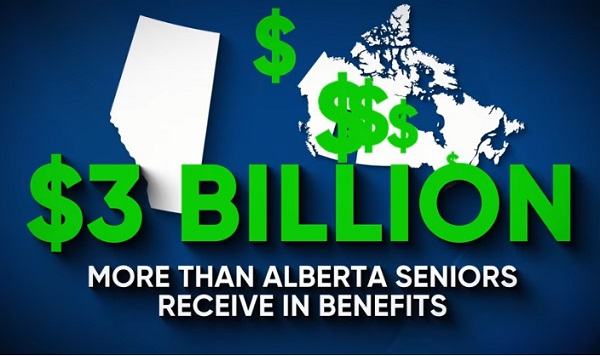

Let’s talk about an Alberta Pension Plan for a minute.

With our young Alberta workforce paying billions more into the CPP each year than our seniors get back in benefits, it’s time to ask whether we stay with the status quo or create our own Alberta Pension Plan that would guarantee as good or better benefits for seniors and lower premiums for workers.

I want to hear your perspective on this idea and please check out the video. Get the facts. Join the conversation.

Visit Alberta.ca/next

Alberta

COVID mandates protester in Canada released on bail after over 2 years in jail

Chris Carbert (right) and Anthony Olienick, two of the Coutts Four were jailed for over two years for mischief and unlawful possession of a firearm for a dangerous purpose.

From LifeSiteNews

The “Coutts Four” were painted as dangerous terrorists and their arrest was used as justification for the invocation of the Emergencies Act by the Trudeau government, which allowed it to use draconian measures to end both the Coutts blockade and the much larger Freedom Convoy

COVID protestor Chris Carbert has been granted bail pending his appeal after spending over two years in prison.

On June 30, Alberta Court of Appeal Justice Jo-Anne Strekaf ordered the release of Chris Carbert pending his appeal of charges of mischief and weapons offenses stemming from the Coutts border blockade, which protested COVID mandates in 2022.

“[Carbert] has demonstrated that there is no substantial likelihood that he will commit a criminal offence or interfere with the administration of justice if released from detention pending the hearing of his appeals,” Strekaf ruled.

“If the applicant and the Crown are able to agree upon a release plan and draft order to propose to the court, that is to be submitted by July 14,” she continued.

Carbert’s appeal is expected to be heard in September. So far, Carbert has spent over two years in prison, when he was charged with conspiracy to commit murder during the protest in Coutts, which ran parallel to but was not officially affiliated with the Freedom Convoy taking place in Ottawa.

Later, he was acquitted of the conspiracy to commit murder charge but still found guilty of the lesser charges of unlawful possession of a firearm for a dangerous purpose and mischief over $5,000.

In September 2024, Chris Carbert was sentenced to six and a half years for his role in the protest. However, he is not expected to serve his full sentence, as he was issued four years of credit for time already served. Carbert is also prohibited from owning firearms for life and required to provide a DNA sample.

Carbert was arrested alongside Anthony Olienick, Christopher Lysak and Jerry Morin, with the latter two pleading guilty to lesser charges to avoid trial. At the time, the “Coutts Four” were painted as dangerous terrorists and their arrest was used as justification for the invocation of the Emergencies Act by the Trudeau government, which allowed it to use draconian measures to end both the Coutts blockade and the much larger Freedom Convoy occurring thousands of kilometers away in Ottawa.

Under the Emergency Act (EA), the Liberal government froze the bank accounts of Canadians who donated to the Freedom Convoy. Trudeau revoked the EA on February 23 after the protesters had been cleared out. At the time, seven of Canada’s 10 provinces opposed Trudeau’s use of the EA.

Since then, Federal Court Justice Richard Mosley ruled that Trudeau was “not justified” in invoking the Emergencies Act, a decision that the federal government is appealing.

-

International2 days ago

International2 days agoWoman wins settlement after YMCA banned her for complaining about man in girls’ locker room

-

Alberta1 day ago

Alberta1 day agoAlberta government records $8.3 billion surplus—but the good times may soon end

-

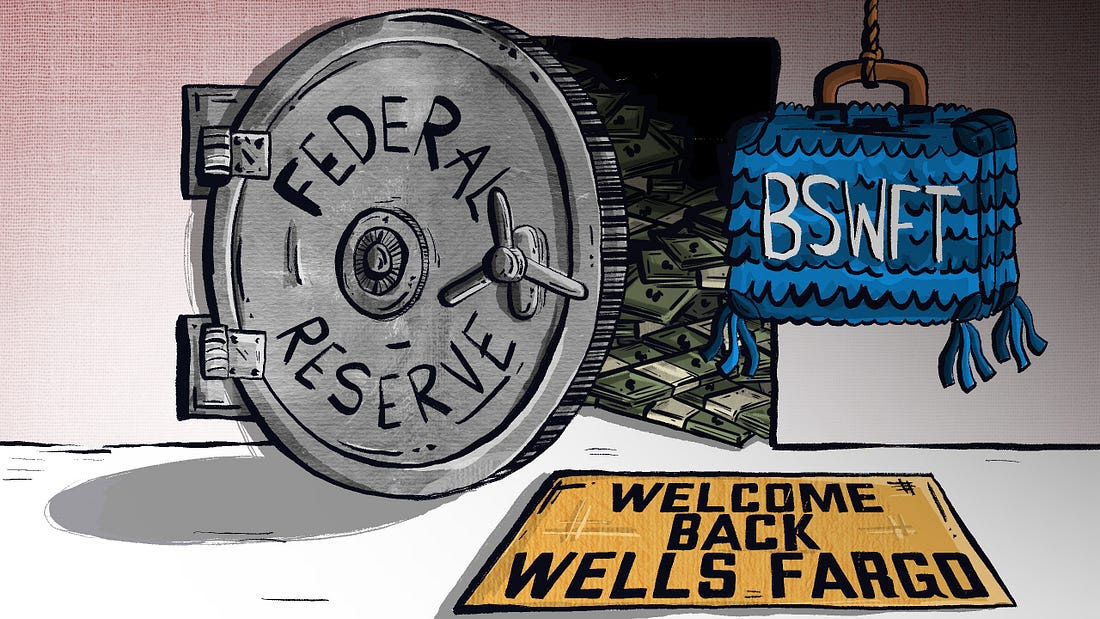

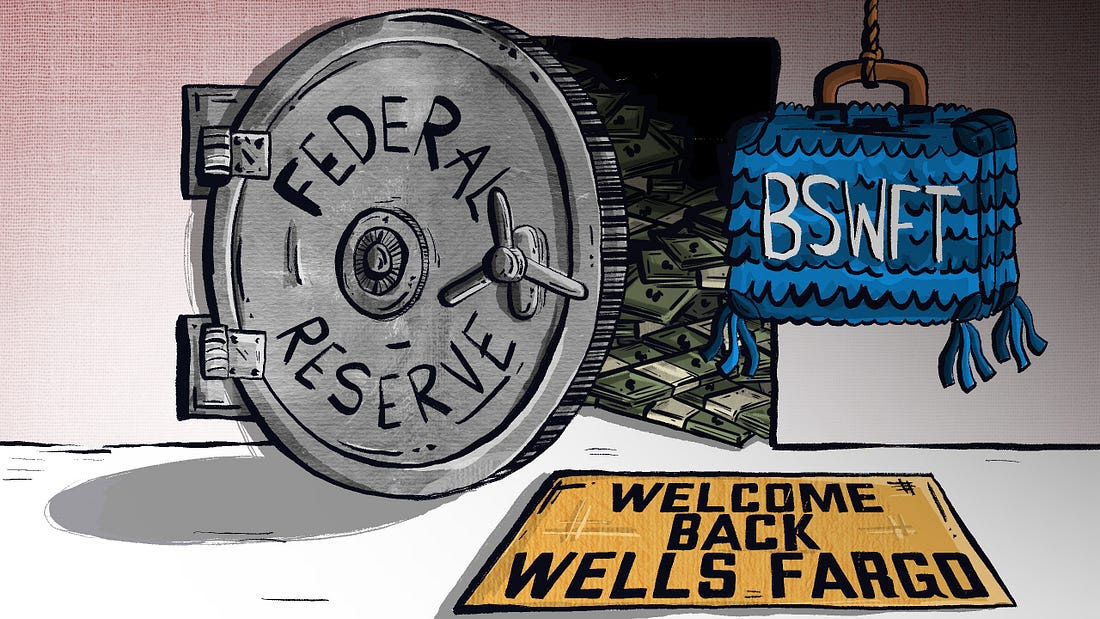

Banks2 days ago

Banks2 days agoWelcome Back, Wells Fargo!

-

MxM News1 day ago

MxM News1 day agoDiddy found not guilty of trafficking, faces prison on lesser charge

-

Bruce Dowbiggin1 day ago

Bruce Dowbiggin1 day agoCanada Day 2025: It’s Time For Boomers To Let The Kids Lead

-

Also Interesting1 day ago

Also Interesting1 day agoEndorphina Slots: High-Quality Games Now at Zoome Casino Canada

-

Business1 day ago

Business1 day agoPrairie provinces and Newfoundland and Labrador see largest increases in size of government

-

Canadian Energy Centre1 day ago

Canadian Energy Centre1 day agoAlberta oil sands legacy tailings down 40 per cent since 2015