Business

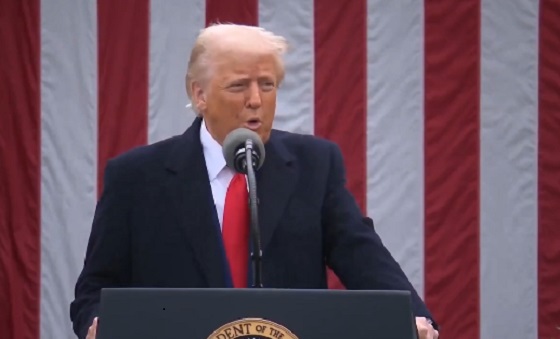

Trump raises China tariffs to 125%, announces 90-day pause for countries who’ve reached out to negotiate

MxM News

MxM News

Quick Hit:

On Wednesday, President Donald Trump announced an immediate increase in tariffs on China to 125%, citing “a lack of respect” toward global markets. At the same time, he approved a 90-day pause and tariff reduction for over 75 countries that have engaged with the U.S. on trade reforms.

Key Details:

-

Trump said the dramatic tariff hike on China is meant to send a clear message: “the days of ripping off the U.S.A., and other Countries, is no longer sustainable or acceptable.”

-

The president added that over 75 countries have reached out to the U.S. Departments of Commerce, Treasury, and the U.S. Trade Representative (USTR) to negotiate on issues including trade barriers, tariffs, and currency manipulation.

-

As a goodwill measure, Trump authorized “a 90 day PAUSE, and a substantially lowered Reciprocal Tariff during this period, of 10%, also effective immediately,” noting that these countries had not retaliated against the U.S. despite strong prior warnings.

Diving Deeper:

President Donald Trump on Wednesday took a major step in reshaping the global trade landscape, announcing via Truth Social that he is raising tariffs on China to 125% effective immediately. Trump attributed the decision to “the lack of respect that China has shown to the World’s Markets,” and said it is time for Beijing to face consequences for its trade practices.

“At some point, hopefully in the near future, China will realize that the days of ripping off the U.S.A., and other Countries, is no longer sustainable or acceptable,” Trump stated.

The president emphasized that this was not a blanket policy toward all trading partners. In contrast to China, Trump said more than 75 countries have reached out to American trade officials to address ongoing issues related to tariffs and trade barriers.

“More than 75 Countries have called Representatives of the United States, including the Departments of Commerce, Treasury, and the USTR, to negotiate a solution to the subjects being discussed relative to Trade, Trade Barriers, Tariffs, Currency Manipulation, and Non Monetary Tariffs,” he wrote.

Citing those discussions and the absence of retaliation against the U.S., Trump approved a temporary reduction in reciprocal tariffs for those countries. “I have authorized a 90 day PAUSE, and a substantially lowered Reciprocal Tariff during this period, of 10%, also effective immediately.”

The move reflects a two-pronged strategy—punishing China for what Trump sees as longstanding economic abuses while rewarding countries that have shown a willingness to work with the U.S. to level the playing field.

The 125% tariff marks one of the most aggressive steps in Trump’s America First trade doctrine, likely signaling to both allies and adversaries that a second Trump administration would continue its hardline economic policies.

Business

What Pelosi “earned” after 37 years in power will shock you

Nancy Pelosi isn’t just walking away from Congress — she’s cashing out of one of the most profitable careers ever built inside it. According to an investigation by the New York Post, the former House Speaker and her husband, venture capitalist Paul Pelosi, turned a modest stock portfolio worth under $800,000 into at least $130 million over her 37 years in office — a staggering 16,900% return that would make even Wall Street’s best blush.

The 85-year-old California Democrat — hailed as the first woman to wield the Speaker’s gavel and infamous for her uncanny market timing — announced this week she will retire when her term ends in January 2027. The Post reported that when Pelosi first entered Congress in 1987, her financial disclosure showed holdings in just a dozen stocks, including Citibank, worth between $610,000 and $785,000. Today, the Pelosis’ net worth is estimated around $280 million — built on trades that have consistently outperformed the Dow, the S&P 500, and even top hedge funds.

The Post found that while the Dow rose roughly 2,300% over those decades, the Pelosis’ reported returns soared nearly seven times higher, averaging 14.5% a year — double the long-term market average. In 2024 alone, their portfolio reportedly gained 54%, more than twice the S&P’s 25% and better than every major hedge fund tracked by Bloomberg.

Pelosi’s latest financial disclosure shows holdings in some two dozen individual stocks, including millions invested in Apple, Nvidia, Salesforce, Netflix, and Palo Alto Networks. Apple remains their single largest position, valued between $25 million and $50 million. The couple also owns a Napa Valley winery worth up to $25 million, a Bay Area restaurant, commercial real estate, and a political data and consulting firm. Their home in San Francisco’s Pacific Heights is valued around $8.7 million, and they maintain a Georgetown townhouse bought in 1999 for $650,000.

The report comes as bipartisan calls grow to ban lawmakers and their spouses from trading individual stocks — a move critics say is long overdue. “What I’ll miss most is how she trades,” said Dan Weiskopf, portfolio manager of an ETF that tracks congressional investments known as “NANC.” He described Pelosi’s trading as “high conviction and aggressive,” noting her frequent use of leveraged options trades. “You only do that if you’ve got confidence — or information,” Weiskopf told the Post.

Among her most striking trades was a late-2023 move that allowed the Pelosis to buy 50,000 shares of Nvidia at just $12 each — less than a tenth of the market price. The $2.4 million investment is now worth more than $7 million. “She’s buying deep in the money and putting up a lot of money doing it,” Weiskopf said. “We don’t see a lot of flip-flopping on her trading activity.”

Republicans blasted Pelosi’s record as proof of Washington’s double standard. “Nancy Pelosi’s true legacy is becoming the most successful insider trader in American history,” said RNC spokesperson Kiersten Pels. “If anyone else had turned $785,000 into $133 million with better returns than Warren Buffett, they’d be retiring behind bars.”

Business

Ottawa should stop using misleading debt measure to justify deficits

From the Fraser Institute

By Jake Fuss and Grady Munro

Based on the rhetoric, the Carney government’s first budget was a “transformative” new plan that will meet and overcome the “generational” challenges facing Canada. Of course, in reality this budget is nothing new, and delivers the same approach to fiscal and economic policy that has been tried and failed for the last decade.

First, let’s dispel the idea that the Carney government plans to manage its finances any differently than its predecessor. According to the budget, the Carney government plans to spend more, borrow more, and accumulate more debt than the Trudeau government had planned. Keep in mind, the Trudeau government was known for its recklessly high spending, borrowing and debt accumulation.

While the Carney government has tried to use different rhetoric and a new accounting framework to obscure this continued fiscal mismanagement, it’s also relied on an overused and misleading talking point about Canada’s debt as justification for higher spending and continued deficits. The talking point goes something like, “Canada has the lowest net debt-to-GDP ratio in the G7” and this “strong fiscal position” gives the government the “space” to spend more and run larger deficits.

Technically, the government is correct—Canada’s net debt (total debt minus financial assets) is the lowest among G7 countries (which include France, Germany, Italy, Japan, the United Kingdom and the United States) when measured as a share of the overall economy (GDP). The latest estimates put Canada’s net debt at 13 per cent of GDP, while net debt in the next lowest country (Germany) is 49 per cent of GDP.

But here’s the problem. This measure assumes Canada can use all of its financial assets to offset debt—which is not the case.

When economists measure Canada’s net debt, they include the assets of the Canada Pension Plan (CPP) and the Quebec Pension Plan (QPP), which were valued at a combined $890 billion as of mid-2025. But obviously Canada cannot use CPP and QPP assets to pay off government debt without compromising the benefits of current and future pensioners. And we’re one of the only industrialized countries where pension assets are accounted in such a way that it reduces net debt. Simply put, by falsely assuming CPP and QPP assets could pay off debt, Canada appears to have a stronger fiscal position than is actually the case.

A more accurate measure of Canada’s indebtedness is to look at the total level of debt.

Based on the latest estimates, Canada’s total debt (as a share of the economy) ranked 5th-highest among G7 countries at 113 per cent of GDP. That’s higher than the total debt burden in the U.K. (103 per cent) and Germany (64 per cent), and close behind France (117 per cent). And over the last decade Canada’s total debt burden has grown faster than any other G7 country, rising by 25 percentage points. Next closest, France, grew by 17 percentage points. Keep in mind, G7 countries are already among the most indebted, and continue to take on some of the most debt, in the industrialized world.

In other words, looking at Canada’s total debt burden reveals a much weaker fiscal position than the government claims, and one that will likely only get worse under the Carney government.

Prior to the budget, Prime Minister Mark Carney promised Canadians he will “always be straight about the challenges we face and the choices that we must make.” If he wants to keep that promise, his government must stop using a misleading measure of Canada’s indebtedness to justify high spending and persistent deficits.

-

Crime22 hours ago

Crime22 hours agoPublic Execution of Anti-Cartel Mayor in Michoacán Prompts U.S. Offer to Intervene Against Cartels

-

Alberta21 hours ago

Alberta21 hours agoCanada’s heavy oil finds new fans as global demand rises

-

Bruce Dowbiggin19 hours ago

Bruce Dowbiggin19 hours agoA Story So Good Not Even The Elbows Up Crew Could Ruin It

-

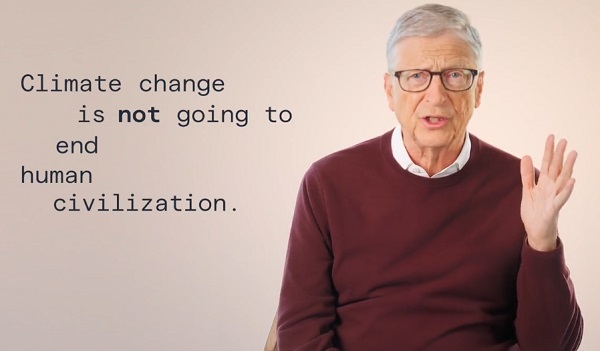

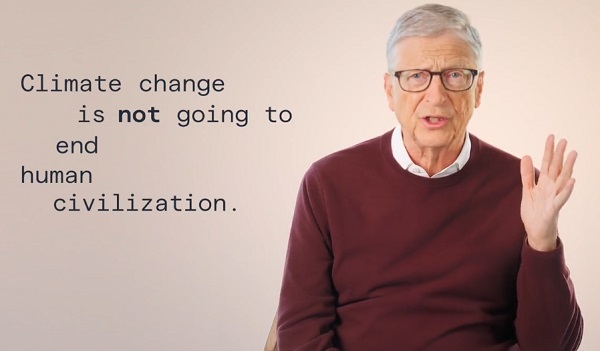

Environment23 hours ago

Environment23 hours agoThe era of Climate Change Alarmism is over

-

Addictions20 hours ago

Addictions20 hours agoThe War on Commonsense Nicotine Regulation

-

Alberta2 days ago

Alberta2 days agoAlberta Announces Members of Class Size and Complexity Committee

-

armed forces2 days ago

armed forces2 days agoIt’s time for Canada to remember, the heroes of Kapyong

-

Alberta2 days ago

Alberta2 days agoTell the Province what you think about 120 km/h speed limit on divided highways