Business

Will Trump’s ‘Liberation Day’ Tariffs End In Disaster Or Prosperity?

From the Daily Caller News Foundation

By J.D. Foster

“Liberation Day” has come. So what does it mean? Beats the hell out of me.

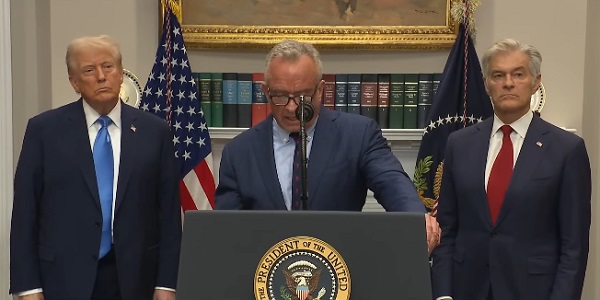

What we know is that President Trump’s avalanche of tariffs was to hit a peak on April 2; not end, mind you; not necessarily “the” peak, as more could be on the way; but a peak.

No Trump policy more completely breaks with America’s past than his “beautiful” tariffs on just about everything coming into the United States from just about anywhere.

Will this new policy liberate American manufacturing from foreign shackles? Will it usher in a new era of prosperity, keeping in mind the United States had for many years the consistently best-performing economy in the industrialized world, even overcoming the many inane obstacles erected by the Biden-Harris Administration?

Or will it leave the United States isolated, friendless, and weakened?

The correct answer at this point is no one knows, not even the bloviating talking heads on TV confidently predicting demise or Shangri-la.

Think of it this way. Suppose you’re a restaurant chef and a woman hands you a new recipe. Her father turns 75 soon and they want to have a party at the restaurant. The recipe is for the father’s favorite dish, one her mother made for years.

The recipe looks old, with odd ingredients and processes you’ve not seen before. Now judge it as a chef.

You can’t. Even as you start chopping and dicing, mixing ingredients as instructed, you’re not too sure how this is going to turn out. You have to wait until the dish is on the plate and taste it.

That’s the case with Trump’s tariffs. How will this all turn out? It’s too soon to tell.

The stock market sure doesn’t like it, but why should it? The investor class doesn’t understand this any better than you do. What they do understand is this new policy has upended assumptions and created enormous new uncertainties. We know that dish as those ingredients are always good for a big pullback.

Much of the confusion arises because we don’t know the underlying policy and likely this uncertainty is intentional. Trump likes keeping his counterparts, in this case our trading partners, guessing. If it means Americans are confused for a bit, Trump’s cool with that. Breaking eggs to make an omelette. It will pass and America will be great again afterward. Bon appetite.

If the core policy is to erect massive and mostly permanent tariff walls behind which American firms can hide, then we know how this will turn out: America, meet the dustbin of history.

If the core policy is to force our trading partners to deal with America fairly by reducing their trade barriers after which Trump will remove his tariffs, then this could turn out very well. Tariffs (and non-tariff barriers) in the U.S. and those of our trading partners would fall, reinvigorating the free trade that has energized prosperity for decades.

Which is it? Walls and doom or freedom and prosperity? Again, too early to tell.

Whatever else Trump does in his second term, these tariffs will define his presidency, akin in consequence to Ronald Reagan’s pro-growth tax cuts and Joe Biden’s inflation.

Trump in his second term clearly lives by the saying, “go bold or go home.” He’s got “bold” down pat. We will see over the next year or so whether he and the Republicans go home. Has he liberated Democrats from any fear of Republicans in the mid-terms or in 2028, or he’s liberated America from any fear of Democratic socialism and wokism returning in our lifetimes. The chips are all-in. Soon we will see the cards. Uncertainty, indeed.

JD Foster is the former chief economist at the Office of Management and Budget and former chief economist and senior vice president at the U.S. Chamber of Commerce. He now resides in relative freedom in the hills of Idaho.

Business

The richest man alive just got a whole lot richer

Quick Hit:

Elon Musk on Wednesday became the first person in history to hit a $500 billion net worth, according to Forbes. The Tesla, SpaceX, and xAI founder’s fortune now sits roughly $150 billion ahead of Oracle co-founder Larry Ellison, with Tesla’s surging stock and SpaceX’s record valuation driving the leap.

Key Details:

- Forbes reported Musk’s net worth crossed the $500 billion mark around 3:30 p.m. ET, fueled by Tesla’s nearly 4% stock gain Wednesday — adding roughly $9.3 billion to his wealth.

- Musk’s fortune has grown from $24.6 billion in March 2020 to $100 billion by late 2020, $200 billion in 2021, $400 billion in 2024, and now $500 billion.

- Tesla shares have nearly doubled since April, when Musk said he would step back from his role leading President Trump’s Department of Government Efficiency (DOGE) to focus on Tesla. The EV maker’s market cap is now within 10% of its all-time high, with Musk’s 12% stake worth about $191 billion.

Elon Musk achieved yet another major milestone Wednesday, becoming the first ever person worth $500 billion. Musk, who became the first person ever worth $400 billion or more in December, is $150 billion ahead of runner-up Larry Ellison—and half-way to becoming the world’s first… pic.twitter.com/h9LJmAvT7F

— Forbes (@Forbes) October 1, 2025

Diving Deeper:

Elon Musk made history Wednesday as the first individual ever to surpass a $500 billion personal net worth, according to a report from Forbes. The Tesla and SpaceX CEO’s fortune crossed the milestone in mid-afternoon trading, following another surge in Tesla’s share price and continuing investor confidence in Musk’s technology empire.

Tesla stock jumped nearly 4% Wednesday, pushing the company’s valuation closer to its all-time high. Forbes estimates Musk’s 12% stake in Tesla alone is worth about $191 billion. The remainder of his wealth comes from SpaceX — currently valued at around $400 billion — and his artificial intelligence firm xAI, worth roughly $60 billion.

Musk’s rise in wealth has been staggering. In March 2020, he was worth $24.6 billion. By late 2020, he had crossed the $100 billion threshold, reaching $200 billion in 2021 and $400 billion last year. His $500 billion milestone now puts him more than $150 billion ahead of the world’s second-richest person, Oracle co-founder Larry Ellison.

In a post on X last month, Musk said his compensation and influence over Tesla were not about money, but control over the company’s direction: “It’s not about ‘compensation,’ but about me having enough influence over Tesla to ensure safety if we build millions of robots,” he wrote. “If I can just get kicked out in the future by activist shareholder advisory firms who don’t even own Tesla shares themselves, I’m not comfortable with that future.”

According to Forbes, Tesla’s board recently proposed a new compensation plan for Musk worth as much as $1 trillion — the largest package ever offered to a corporate executive. The plan would grant Musk up to 12% of Tesla’s stock if the company hits a $8.5 trillion market cap and other performance milestones over a decade.

At his current trajectory, analysts suggest Musk could become the world’s first trillionaire by 2033 — an outcome that seemed unthinkable just five years ago. As Musk continues to balance his leadership at Tesla, SpaceX, and xAI, his financial empire appears to be expanding as rapidly as the industries he dominates.

Automotive

America’s Troubled EV Industry Loses Its Subsidized Advantage – Now What?

From the Daily Caller News Foundation

The Environmental Protection Agency announced Monday that it has assumed responsibility for what it says is the “Largest Lithium-Ion Battery Cleanup in Agency History” at the Moss Landing facility outside San Francisco.

Crews supervised by the EPA entered the facility this week to begin cleaning out the remains of the fire damaged batteries, which the agency says will be recycled at EPA-approved recycling facilities.

As has happened far too frequently, the retired batteries erupted spontaneously in January, leading authors of MIT’s weekly climate newsletter to speculate about what this latest conflagration would mean for the future of the electric vehicle and stationary battery storage industries going forward.

Dear Readers:

As a nonprofit, we are dependent on the generosity of our readers.

Please consider making a small donation of any amount here.

Thank you!

“With the growing number of electric vehicles and batteries for energy storage on the grid,” the authors wrote, “more high-profile fires have hit the news, like last year’s truck fire in LA, the spate of e-bike battery fires in New York City, or one at a French recycling plant last year.”

The parade of troubling incidents related to these batteries has continued throughout 2025. In June, for example, a large container ship called the Morning Midas, operated by Zodiac Maritime, sank into the Pacific Ocean after batteries in EVs it was carrying to Alaska spontaneously combusted, forcing the crew to abandon ship. A month later, U.S.-based shipper Matson announced it would no longer transport EV cargoes due to the obvious dangers involved. Three weeks later, Alaska Marine Lines put a similar policy in place.

All of these inconvenient news stories come at an already troubling time for the U.S. EV industry, given that its huge $7,500 per car federal subsidy expired at midnight, Sept. 30. That subsidy was enacted in the Orwellian-named Inflation Reduction Act of 2022 and subsequently repealed in the One Big Beautiful Bill Act signed into law by President Donald Trump on July 4 of this year.

Sales have spiked in the run-up to the subsidy expiration, to no one’s real surprise. But EV makers now face the troubling prospect of having to compete in the U.S. market absent that significant price advantage, leading many to anticipate a significant drop-off in sales.

Some carmakers have already begun to scale back operations. Stellantis announced the cancellation of a planned all-electric Dodge Ram pickup model on Sept.12, citing slowing demand for such trucks in a field already dominated by the Ford F-150 Lightning and the Tesla Cyber Truck. The fact that sales of those competing models are already coming in well below projections this year was another obvious motivating factor.

Ford, meanwhile, said in August it would delay the introduction of what it refers to as “next generation” updates to its Lightning pickup and full-sized electric van for two years due to the same challenging market conditions. “F-150 Lightning, America’s best-selling electric truck, and E-Transit continue to meet today’s customer needs,” the company said in what can only be described as an understatement.

Competitor GM announced it would take similar action on Sept. 4, saying it was suspending production of a pair of Cadillac SUVs – the mid-size Lyriq and the full-size Vistiq – at its assembly plant in Spring Hill, Tenn., effective in December. The company also said it would indefinitely delay the start of a second shift at an assembly plant near Kansas City.

Amid the frequent big fire events involving EV batteries and the industry’s fallout from the loss of a federal subsidy, it must be repeated here that the electric vehicle industry is not “new” or even a young one. It is in fact well over a century old, with the first electric cars introduced in the U.S. in the 1890s, during the same period when gas-powered cars started to come onto the market. In those early years, in fact, many experts insisted that electric cars would ultimately render gas-powered cars obsolete and become the dominant force in American transportation.

But makers of EVs then found themselves suffering from the same set of limitations that plague the industry well over a century later: Range anxiety, lack of infrastructure, and persistent unreliability.

The fact that an industry this old has still not solved for the same set of issues after so much time makes it reasonable to question whether it ever will.

David Blackmon is an energy writer and consultant based in Texas. He spent 40 years in the oil and gas business, where he specialized in public policy and communications.

-

Fraser Institute2 days ago

Fraser Institute2 days agoAboriginal rights now more constitutionally powerful than any Charter right

-

Alberta1 day ago

Alberta1 day ago$150 a week from the Province to help families with students 12 and under if teachers go on strike next week

-

Agriculture2 days ago

Agriculture2 days agoCarney’s nation-building plan forgets food

-

Business2 days ago

Business2 days agoNew PBO report underscores need for serious fiscal reform in Ottawa

-

International2 days ago

International2 days agoArab and Muslim nations rally behind Trump’s Gaza peace plan

-

Business1 day ago

Business1 day agoPfizer Bows to Trump in ‘Historic’ Drug Price-Cutting Deal

-

National1 day ago

National1 day agoCanada’s birth rate plummets to an all-time low

-

Also Interesting2 days ago

Also Interesting2 days agoCan Sugar Rush 1000 Satisfy Your Sweet Tooth for Wins?