Canadian Energy Centre

‘Big vulnerability’: How Ontario and Quebec became reliant on U.S. oil and gas

From the Canadian Energy Centre

ARC Energy Institute leaders highlight the need for a new approach in a new reality

Despite Canada’s status as one of the world’s largest oil and gas producers, more than half of the country’s own population does not have true energy security – uninterrupted, reliable access to the energy they need at an affordable price.

Even though Western Canada produces much of the oil consumed in Ontario and Quebec, in order to get there, it moves on pipelines that run through the United States.

“It’s only energy secure if the Americans are our partners and friends,” leading energy researcher Jackie Forrest said on a recent episode of the ARC Energy Ideas podcast.

Amid rising trade tensions with the United States, energy security is taking on greater importance. But Forrest said the issue is not well understood across Canada.

“The concern is that in the worst-case scenario where the Americans want to really hurt our country, they have the ability to stop all crude oil flows to Ontario,” she said.

That action would also cut off the majority of oil supply to Quebec.

The issue isn’t much better for natural gas, with about half of consumption in Ontario and Quebec supplied by producers in the U.S.

“Tariffs or no tariffs, there is a real vulnerability there,” said Forrest’s co-host Peter Tertzakian, founder of the ARC Energy Research Institute.

The issue won’t go away with increased use of new technology like electric cars, he said.

“This isn’t just about combustion in engines. It’s about securing a vital commodity that is an input into other parts of our manufacturing and sophisticated economy.”

Oil: The Enbridge Mainline

The Enbridge Mainline is the main path for oil from Western Canada to reach refineries in Ontario and Quebec, according to the Canadian Association of Petroleum Producers (CAPP).

Originating in Edmonton, Alberta, the Enbridge Mainline moves crude oil, refined products, and natural gas liquids through a connected pipeline system. At Superior, Wisconsin, the system splits into Line 5, going north of Lake Michigan, and Lines 6, 14, and 61, going around the southern tip of the lake. The two routes then coalesce and terminate in Sarnia, Ontario, where it is interconnected with Line 9, which is terminated in Montreal, Quebec. Source: Canadian Association of Petroleum Producers

Originating in Edmonton, Alberta, the Enbridge Mainline moves crude oil, refined products, and natural gas liquids through a connected pipeline system. At Superior, Wisconsin, the system splits into Line 5, going north of Lake Michigan, and Lines 6, 14, and 61, going around the southern tip of the lake. The two routes then coalesce and terminate in Sarnia, Ontario, where it is interconnected with Line 9, which is terminated in Montreal, Quebec. Source: Canadian Association of Petroleum Producers

Originally built in 1950 from Edmonton to Superior, Wisconsin, in 1953, it was extended to Sarnia, Ontario through a segment known as Line 5.

CAPP said that at the time, politicians had pushed for an all-Canadian path north of the Great Lakes to increase energy security, but routes through the U.S. were chosen because of lower project costs and faster timelines.

In 1979, an extension of the pipeline called Line 9 opened, allowing oil to flow east from Sarnia to Montreal.

“Line 9 was built after the oil crisis and the OPEC embargo as a way to bring western Canadian crude oil into Quebec,” Forrest said.

But by the 1990s – before the massive growth in Alberta’s oil sands – there was a lack of crude coming from Western Canada. It became more economically attractive for refineries in Quebec and Ontario to import oil from overseas via the St. Lawrence River, CAPP said.

A reversal in 1999 allowed crude in Line 9 to flow west from Montreal to Sarnia.

By the 2010s, the situation had changed again, with production from the Alberta oil sands and U.S. shale plays surging. With more of that oil available, the offshore crude was deemed to be more expensive, Forrest said.

In 2015, Line 9 was reversed to send oil east again from Sarnia to Montreal, displacing oil from overseas but not resolving the energy security risk of Canadian pipelines running through the U.S.

CAPP said the case of Line 5 illustrates this risk. In 2020, the Governor of Michigan attempted to shut down the pipeline over concerns about pipeline leak or potential oil spill in a seven-kilometre stretch under the Straits of Mackinac.

Line 5 has been operating in the Straits for 72 years without a single release.

Enbridge is advancing a project to encase the pipeline in a protective tunnel in the rock beneath the lakebed, but the legal battle with the State of Michigan remains ongoing.

Natural gas: The TC Canadian Mainline

The natural gas pipeline now known as TC Energy’s Canadian Mainline from Alberta was first built in 1958.

The TC Canadian Mainline (red dashed line) transports natural gas produced in Western Canada to markets in Eastern Canada. Red lines show pipelines regulated by the Canada Energy Regulator, while black lines show pipelines regulated by the United States. Source: Canadian Association of Petroleum Producers

The TC Canadian Mainline (red dashed line) transports natural gas produced in Western Canada to markets in Eastern Canada. Red lines show pipelines regulated by the Canada Energy Regulator, while black lines show pipelines regulated by the United States. Source: Canadian Association of Petroleum Producers

“This pipeline brought gas into Ontario, and then it was extended to go into Quebec, and that was good for a long time,” Forrest said.

“But over time we built more pipelines into the United States, and it was a better economic path to go through the United States.”

The Mainline started running not at its full capacity, which caused tolls to go up and made it less and less attractive compared to U.S. options.

According to CAPP, between 2006 and 2023 the Mainline’s deliveries of gas from Western Canada to Ontario and Quebec were slashed in half.

“We should have said, ‘We need to find a way for this pipeline, over our own soil, to be competitive with the alternative’. But we didn’t,” Forrest said.

“Instead, we lost market share in Eastern Canada. And today we’re in a big bind, because if the Americans were to cut off our natural gas, we wouldn’t have enough natural gas into Quebec and Ontario.”

A different approach for a new reality

Forrest said the TC Mainline, which continues to operate at about half of its capacity, presents an opportunity to reduce Canada’s reliance on U.S. natural gas while at the same time building energy security for oil.

“Those are the same pipes that were going to be repurposed for oil, for Energy East,” Tertzakian said.

“The beauty of the thing is that actually, I don’t think it would take that long if we had the will… It’s doable that we can be energy secure.”

This could come at a higher cost but provide greater value over the long term.

“That’s always been the issue in Canada, when it comes to energy, we always go with the cheapest option and not the most energy secure,” Forrest said.

“And why? Because we always trusted our American neighbor to never do anything that will impact the flow of that energy. And I think we’re waking up to a new reality.”

Canadian Energy Centre

Canada’s energy leaders send ‘urgent action plan’ to new federal government

From the Canadian Energy Center

38 oil and gas CEOs sign list of shared objectives, opportunities to work together

The CEOs of 38 of Canada’s largest energy companies have a message for the new federal government: after all the discussion on the campaign trail about the need to flex Canada’s role as a global energy superpower, the time is now to take action.

Heads of pipeline majors including Enbridge, TC Energy, Pembina and Inter Pipeline, chiefs of producers such as Canadian Natural Resources, Suncor Energy, Cenovus Energy, Tourmaline and ARC Resources released a joint letter to Prime Minister Mark Carney on April 30 with their “urgent action plan.”

The plan reflects a similar letter sent before the election from 14 heads of industry.

With the list of names more than doubling, the CEOs added their view of opportunities to work together with the federal government “to deliver on our shared objectives.”

“Many of these issues were talked about in your campaign and are of growing interest for Canadians as is evidenced by recent polling,” they wrote.

Here are their five priority areas:

1. Simplify regulation: The federal government’s Impact Assessment Act and West Coast tanker ban are impeding development and need to be overhauled and simplified. Regulatory processes need to be streamlined, and decisions need to withstand judicial challenges.

2. Commit to firm deadlines for project approvals: The federal government needs to reduce regulatory timelines so that major projects are approved within six months of application.

3. Grow production: The federal government’s unlegislated cap on emissions must be eliminated to allow the sector to reach its full potential.

4. Attract investment: The federal carbon levy on large emitters is not globally cost competitive and should be repealed to allow provincial governments to set more suitable carbon regulations.

5. Incent Indigenous co-investment opportunities: The federal government needs to provide Indigenous loan guarantees at scale so industry may create infrastructure ownership opportunities to increase prosperity for communities and to ensure that Indigenous communities benefit from development.

Alberta

‘Existing oil sands projects deliver some of the lowest-breakeven oil in North America’

From the Canadian Energy Centre

By Will Gibson

Alberta oil sands projects poised to grow on lower costs, strong reserves

As geopolitical uncertainty ripples through global energy markets, a new report says Alberta’s oil sands sector is positioned to grow thanks to its lower costs.

Enverus Intelligence Research’s annual Oil Sands Play Fundamentals forecasts producers will boost output by 400,000 barrels per day (bbls/d) by the end of this decade through expansions of current operations.

“Existing oil sands projects deliver some of the lowest-breakeven oil in North America at WTI prices lower than $50 U.S. dollars,” said Trevor Rix, a director with the Calgary-based research firm, a subsidiary of Enverus which is headquartered in Texas with operations in Europe and Asia.

Alberta’s oil sands currently produce about 3.4 million bbls/d. Individual companies have disclosed combined proven reserves of about 30 billion barrels, or more than 20 years of current production.

A recent sector-wide reserves analysis by McDaniel & Associates found the oil sands holds about 167 billion barrels of reserves, compared to about 20 billion barrels in Texas.

While trade tensions and sustained oil price declines may marginally slow oil sands growth in the short term, most projects have already had significant capital invested and can withstand some volatility.

“While it takes a large amount of out-of-pocket capital to start an oil sands operation, they are very cost effective after that initial investment,” said veteran S&P Global analyst Kevin Birn.

“Optimization,” where companies tweak existing operations for more efficient output, has dominated oil sands growth for the past eight years, he said. These efforts have also resulted in lower cost structures.

“That’s largely shielded the oil sands from some of the inflationary costs we’ve seen in other upstream production,” Birn said.

Added pipeline capacity through expansion of the Trans Mountain system and Enbridge’s Mainline have added an incentive to expand production, Rix said.

The increased production will also spur growth in regions of western Canada, including the Montney and Duvernay, which Enverus analysts previously highlighted as increasingly crucial to meet rising worldwide energy demand.

“Increased oil sands production will see demand increase for condensate, which is used as diluent to ship bitumen by pipeline, which has positive implications for growth in drilling in liquids-rich regions such as the Montney and Duvernay,” Rix said.

-

COVID-192 days ago

COVID-192 days agoFormer Australian state premier accused of lying about justification for COVID lockdowns

-

Business1 day ago

Business1 day agoOttawa’s Plastics Registry A Waste Of Time And Money

-

Addictions1 day ago

Addictions1 day agoFour new studies show link between heavy cannabis use, serious health risks

-

COVID-192 days ago

COVID-192 days agoCanada’s health department warns COVID vaccine injury payouts to exceed $75 million budget

-

COVID-192 days ago

COVID-192 days agoStudy finds Pfizer COVID vaccine poses 37% greater mortality risk than Moderna

-

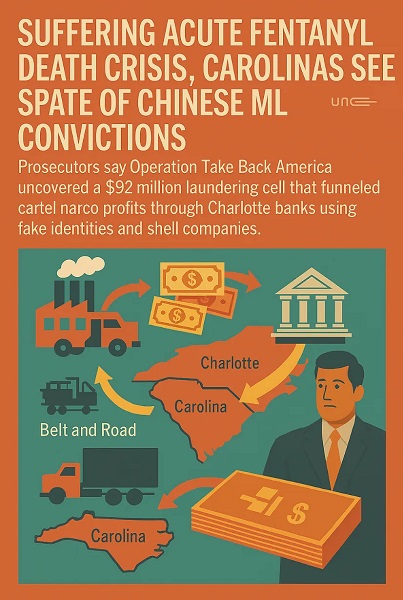

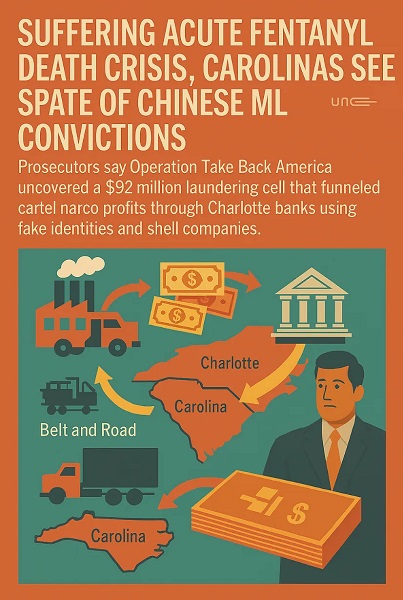

Crime1 day ago

Crime1 day agoOperation Take Back America Strikes Chinese Money Launderers in Charlotte Cartel Case

-

Business1 day ago

Business1 day agoBUILD CANADA NOW: An Open Letter to the Prime Minister of Canada from Energy Leaders

-

Canadian Energy Centre1 day ago

Canadian Energy Centre1 day agoCanada’s energy leaders send ‘urgent action plan’ to new federal government